- Dwelling's Digest

- Posts

- 1.25B SQFT Office to Residential Conversation

1.25B SQFT Office to Residential Conversation

Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Dream big, but start small in real estate”

In today’s edition - Mortgage rates have dropped to their lowest level since January, with the median U.S. housing payment falling to $2,558, down 1.3% year-over-year. However, high home prices and limited inventory keep payments elevated, stalling pending home sales, which are down 7.8% annually. Many buyers are waiting for clarity on NAR rules and potential rate cuts from the Federal Reserve, expected next week. The real estate market remains on edge, as both buyers and sellers anticipate further rate shifts and economic developments to guide their decisions.

If you missed yesterday’s newsletter, click here

Mortgage & REITS

30-Yr Fixed RM | 6.15% | + 0.04% |

15-Yr Fixed RM | 5.67% | + 0.05% |

30-Yr Jumbo | 6.40% | + 0.03% |

7/6 SOFR ARM | 6.15% | + 0.02% |

30-Yr FHA | 5.69% | + 0.04% |

30-Yr VA | 5.70% | + 0.03% |

Average going rates as of Sep 12 2024 |

New? Join our newsletter – no cost!

🏛️ Weekly Housing Report

Mortgage Rates Fall, But Will It Be Enough to Revive Sales?

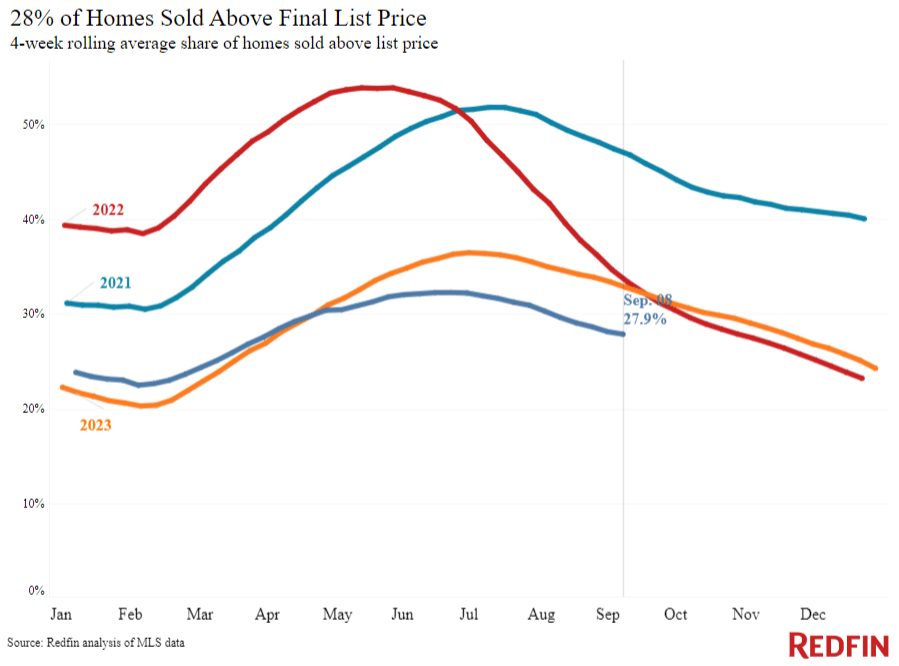

Falling Payments: The median U.S. housing payment dropped to $2,558, down 1.3% year-over-year, as mortgage rates fell to their lowest level since January. However, high home prices and limited inventory are keeping payments elevated.

Pending Sales Stall: Despite lower housing payments, pending home sales are down 7.8% annually, with many buyers holding off due to confusion over new NAR rules and hopes for further rate cuts.

Fed's Impact: With the Fed expected to cut rates next week, the potential for larger cuts could influence mortgage rates further, keeping buyers and sellers on edge.

As mortgage payments drop, buyers wait for more clarity on rates and NAR rules.

🎢 Impact on Real Estate

🤝 Trump-Harris Debate - Housing

The debate between Vice President Kamala Harris and former President Donald Trump highlighted stark differences in their approach to housing, though the conversation lacked depth on this critical issue. Harris put forth ideas to tackle the housing crisis, focusing on increasing home construction and providing down payment assistance to first-time buyers. She also emphasized the need for regulatory reforms to streamline homebuilding and addressed rising property insurance costs linked to climate change.

In contrast, Trump sidestepped Harris' housing proposals and refrained from offering detailed solutions, focusing instead on broader economic issues and identity politics. His housing policies, while not discussed in the debate, have previously centered on deregulation, opening federal land for construction, and addressing immigration to reduce housing demand.

Ralph McLaughlin, senior economist at Realtor.com®, laments that the debate “had the potential to show nuanced differences in their approach to addressing contemporary problems in the U.S. housing market, but fell short on any significant discussion on the matter.

🎙️ RE Headlines

🗳 Election-Year Trends

What Buyers and Investors Should Know Amid Election-Year

Election-Year Jitters: Shifting Buyer Behavior

With many buyers adopting a "wait-and-see" approach due to political uncertainty, housing demand may dip temporarily, creating opportunities for strategic investors to capitalize on less competitive markets.Mortgage Rates in Focus: The Fed’s Next Move

As mortgage rates fluctuate, potential Federal Reserve rate cuts on the horizon could significantly alter affordability, making now a pivotal time for buyers to monitor interest rate trends closely.Economic Sentiment Driving Market Hesitation

Concerns over inflation, rising home prices, and economic policies are keeping many buyers on the sidelines, but historically, election cycles have shown minimal long-term impact on housing market stability.

“I don’t have the pressure to sell a house, I’m not losing equity and I don’t have the pressure to move — I can move whenever I want,” said Carlson, who is currently renting from some friends. “So why not wait?”

🏕️ Deep Dive

✍ New Era of Adaptive Reuse

Top Office Buildings for Residential Conversions in 2024

Rising Demand for Adaptive Reuse: With 228.3 million square feet of office space identified as prime candidates for conversion, urban cores are leading the shift toward residential reuse. Conversion initiatives, backed by government incentives, offer a promising solution to the vacant office crisis.

Economic Feasibility is Key: Despite 1 billion square feet of potential Tier II office space, the financial viability of conversions remains a challenge. Local programs, like New York City’s Office Conversion Accelerator, are stepping in to expedite zoning, offering a lifeline to unlock greater value.

Impact on Major Markets: Manhattan leads the way with over 16.8% of its office stock primed for conversion. As office sales continue to show declining prices, cities like San Francisco, Chicago, and Miami are rapidly positioning office-to-residential conversions as an essential urban strategy.

Explore how 1.25 billion square feet of office space could be transformed into residential opportunities.

The push to convert underutilized office buildings into housing in Washington has gained momentum with a new state tax break aimed at developers. The recently passed law allows cities to offer sales and use tax deferrals for commercial-to-residential conversions, specifically if 10% of the units are affordable to low-income households. This initiative has been widely supported by housing advocates and local governments, though challenges remain with the complexity and cost of conversions.

Key points from the initiative:

Developers can defer taxes if they convert commercial buildings into multifamily housing with a minimum of 10% affordable units.

The incentive remains if the units meet affordability criteria for at least 10 years.

The Department of Revenue is finalizing rules on how this incentive will be applied, and cities like Spokane and Seattle are eager to implement the program.

By 2032, a state audit will assess whether the program has increased affordable housing. If it hasn't, the deferral may be repealed.

This program is seen as a creative response to Washington’s housing crisis, but success will depend on the financial feasibility of conversions and the outcome of state and local implementation.

👾 General Topic

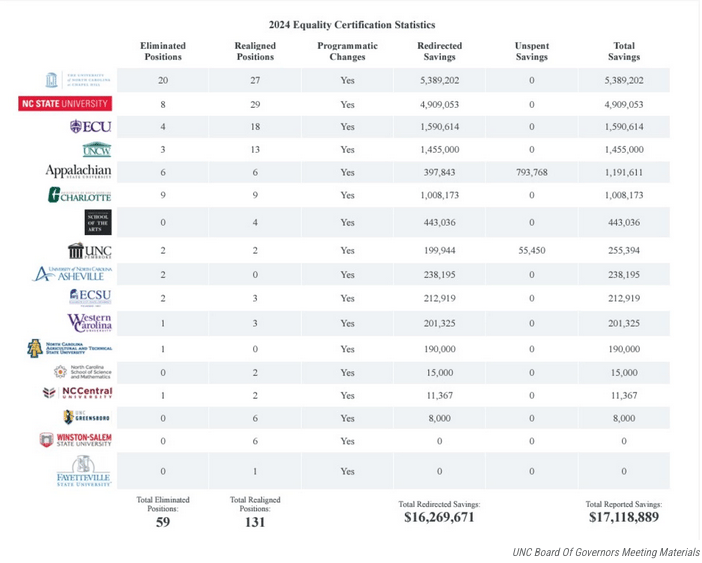

North Carolina public universities are eliminating 59 diversity, equity, and inclusion (DEI) positions, along with other changes, as required under a recent UNC Board of Governor’s mandate.

Collectively the campuses will save just over $17 million by removing DEI initiatives.

🤪 Fun for the Road

Real estate is serious business, but that doesn’t mean we can’t have some fun along the way! Let’s celebrate the wins and enjoy a little humor!

Here is One -

Me: 'This house has great bones.'

Client: 'But I don’t want to live with ghosts!

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.

Reply