Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Investing in property is not just about owning a space, but about building a legacy.

In today’s edition - October’s economic highlights, including resilient consumer spending and persistent inflation. Discover why contract signings are climbing, rents are falling, and Montana’s housing market is booming. Explore grassroots efforts advocating for affordability and property rights, plus expert strategies for navigating shifting markets.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.88% | - 0.04% |

15-Yr Fixed RM | 6.09% | - 0.03% |

30-Yr Jumbo | 7.05% | - 0.05% |

7/6 SOFR ARM | 6.82% | - 0.08% |

30-Yr FHA | 6.22% | - 0.03% |

30-Yr VA | 6.24% | - 0.01% |

Average going rates as of Nov 29th 2024

S&P 500 | 6,032.38 | + 0.56% |

USD/JPY | 149.6520 | - 1.24% |

10-Yr Bond | 4.1780 | - 1.51% |

Bitcoin USD (As of Dec 1st 2024) | 97,459.58 | + 0.65% |

Numbers as of Nov 29th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

October 2024 Economic Insights: Consumer Spending Rises, Inflation Remains Stubborn

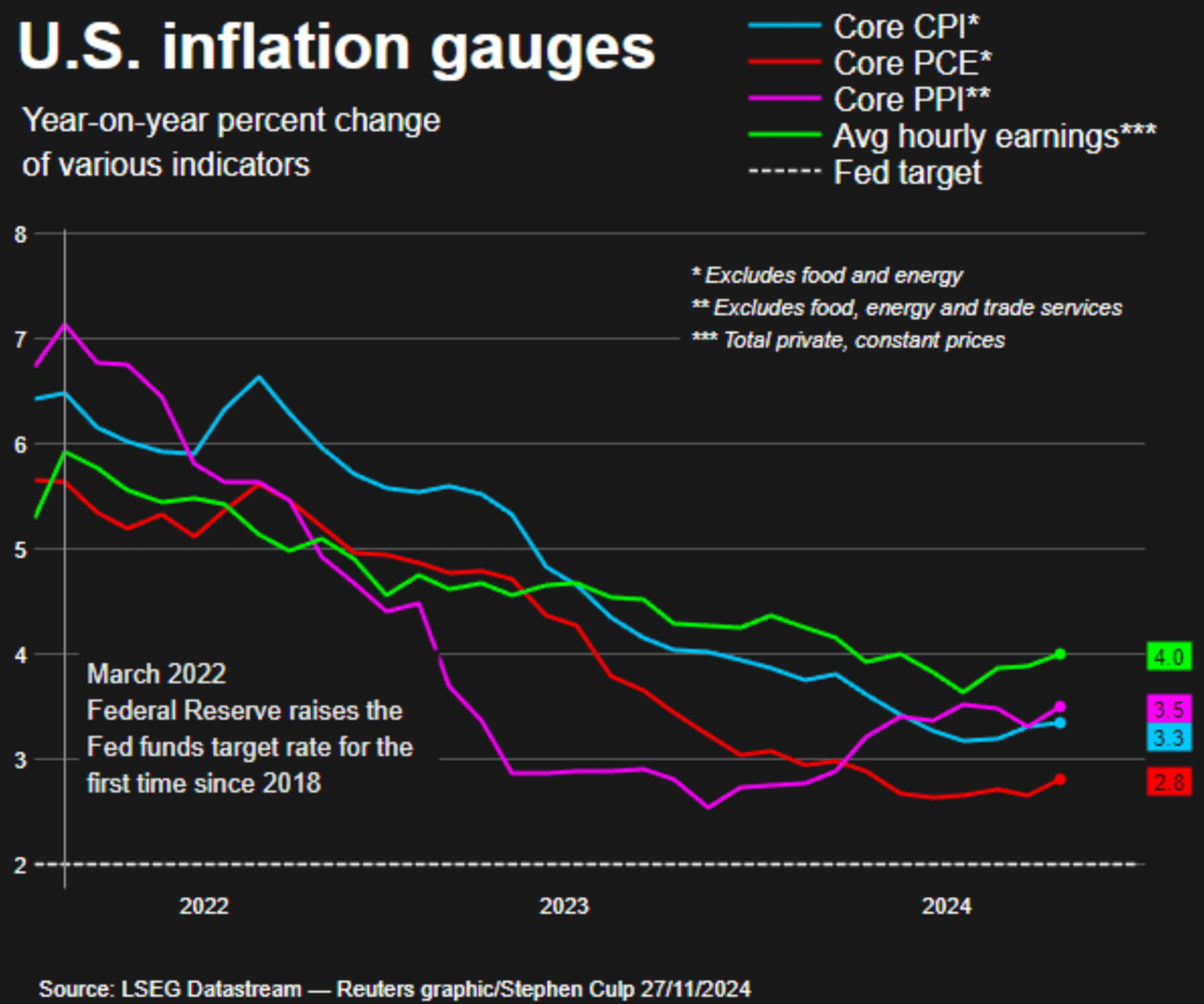

Consumer Spending Grows While Inflation Stays Persistent: U.S. consumer spending rose by 0.4% in October, outperforming forecasts. Despite steady economic momentum, core PCE inflation remains high at 2.8% YoY, complicating the Fed's path to its 2% inflation target.

Labor Market Stability Amid Policy Shifts: Weekly jobless claims fell to 213,000, the lowest since April, showcasing labor market resilience. However, continuing claims climbed to 1.907 million, hinting at challenges for long-term unemployed workers in a tight market.

Core Capital Goods Orders Signal Slower Business Investment: Non-defense capital goods orders (excluding aircraft) dropped by 0.2% in October, following a modest 0.3% gain in September, reflecting cautious business spending as economic uncertainties loom.

2024 Portfolio Gains: Expert Insights for a Balanced Investment Strategy in 2025

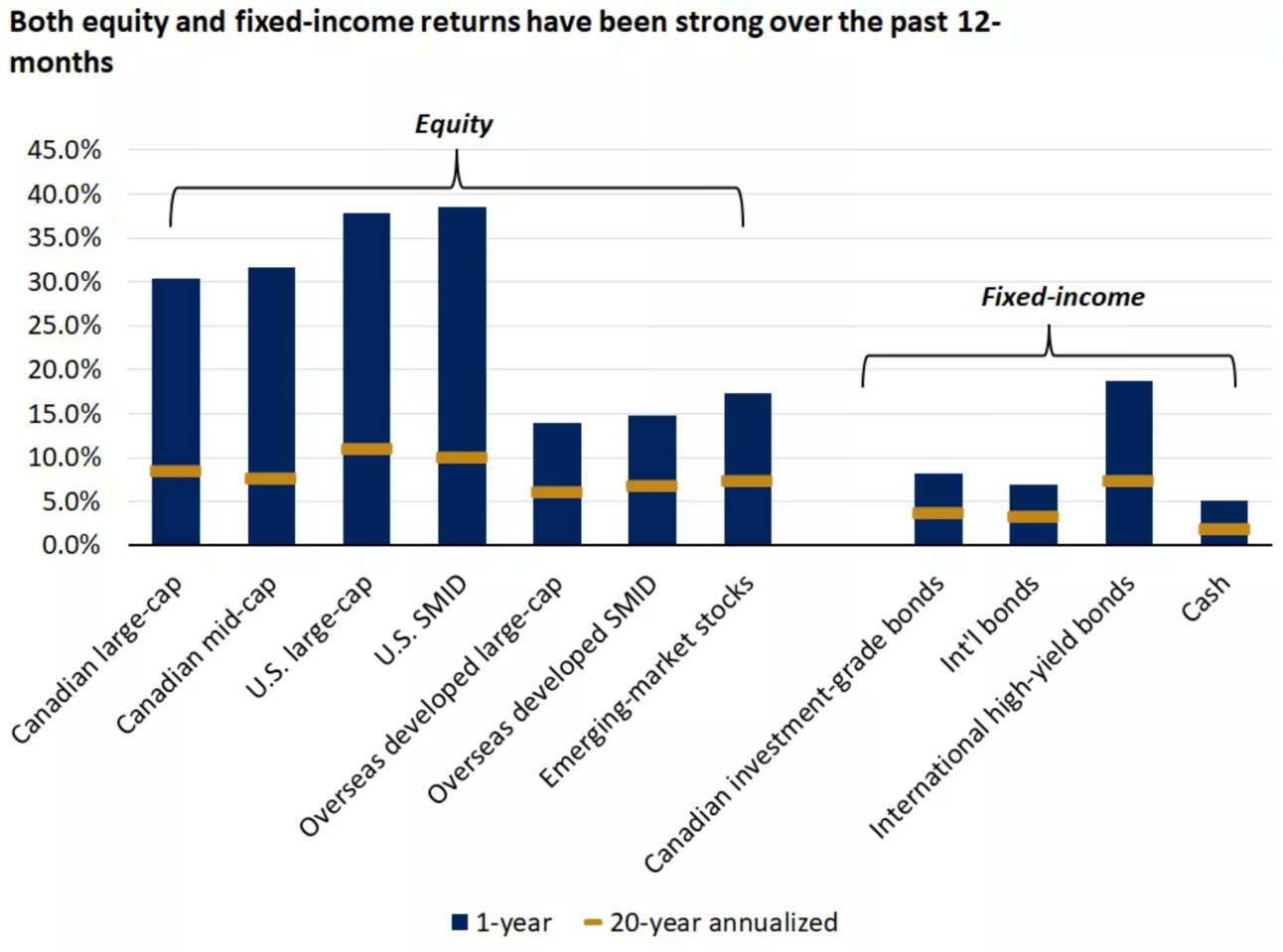

Diversified Portfolios Shine: All 11 major asset classes posted above-average gains in 2024, with U.S. equities soaring over 35% and Canadian large-cap stocks trailing closely. Balanced allocations smoothed investor returns despite global volatility.

Economic Resilience Powers Growth: U.S. GDP expanded by 2.8% in Q3 2024, supported by a robust 3.5% increase in household spending, highlighting strong consumer confidence and labor market health.

Strategic Rebalancing Pays Off: Overweight U.S. stocks outperformed Canadian and international equities, while long-term bonds mitigated reinvestment risks. Investors reducing cash holdings by 10% reported higher portfolio stability in Q4.

🎢 Impact on Real Estate

October 2024 Rental Market Trends: 15th Consecutive Month of Rent Declines with Growing Multifamily Supply

Fifteenth Straight Month of Rent Declines: The U.S. median rent fell by $14 (-0.8%) year-over-year in October 2024, with 0-2 bedroom units averaging $1,720 across the 50 largest metros—$40 below the August 2022 peak but 18.8% higher than pre-pandemic levels.

Rental Supply Surges as Multifamily Completions Rise: Multifamily completions jumped to a seasonally adjusted 606,000 units between January and September 2024, marking a 36% increase year-over-year and a 69% surge compared to pre-pandemic levels, creating downward pressure on rents.

Regional Trends Favor the South and West: The South leads with a projected 1.5% rental stock increase by fall 2025, fueled by a 49.1% growth in completions. Cities like Memphis (-5.4%) and Denver (-5.6%) saw the largest rent declines, highlighting the uneven impact of new supply across regions.

🎙️ RE Spotlight

Contract Signings Jump, Signaling Housing Momentum

Home Sales Gain Momentum

October marked the third consecutive month of increased home sales, with contract signings up 5.4% year-over-year, signaling a growing buyer presence despite elevated mortgage rates.

Existing-home sales recorded their first annual gain in over three years, rising nearly 3% annually.

Regional Growth Across the Board

Pending sales rose in all U.S. regions: Northeast (+5%), Midwest (+4%), South (+0.9%), and West (+0.2%).

The West leads year-over-year with a 17% increase, reflecting a revival in higher-priced markets.

Drivers Behind the Recovery

Housing inventory surged 19% year-over-year, providing buyers with more options, while buyer traffic increased 7%, per SentriLock data.

Buyers are adjusting to mortgage rates stabilizing in the 6% range, with job growth and a record-high stock market supporting upper-end purchases.

🏰 RE State Zone

Montana’s Population Boom Fuels Higher Home Prices and Sends Young, Longtime Residents Packing

Population Growth Outpaces Housing Supply

From 2010 to 2020, Montana’s population grew by nearly 10%, while housing units increased by only 7%. Between 2020 and 2023, the state saw an additional 5% growth, exacerbating housing demand.

This surge, driven by remote workers and cash buyers from high-cost coastal states, highlights a widening supply-demand gap.

Home Prices Skyrocket Across the State

Over the past five years, Montana’s median home listing price soared 85%, the steepest rise in the U.S., reaching $646,975 in October 2024.

Notable metro areas like Missoula (66%), Kalispell (85%), Helena (91%), and Butte (92%) experienced dramatic price hikes, pushing affordability further out of reach.

Affordability Crisis Hits Local Residents

Montana ranks as the least affordable state when comparing local incomes to home prices.

Many younger residents, even with family support, find homeownership unattainable, prompting some to relocate for better affordability.

🏕️ Niche-RE

APOA: Advocating for Housing Affordability and Property Rights

Driving Grassroots Advocacy

APOA has engaged over 45,000 advocates to influence housing policy, sending 5,000 letters to Congress in support of the Neighborhood Homes Investment Act last month.

With a network of 10 million homeowners, the organization amplifies voices across the U.S. to address affordability, insurance costs, and tax reforms.

Bipartisan Solutions for Housing Challenges

APOA bridges political divides to advance policies like the Neighborhood Homes Investment Act and reauthorize the 2017 Tax Cuts and Jobs Act.

Grants and coalitions support grassroots organizations like the National Black Empowerment Council to promote generational wealth and close racial homeownership gaps.

Educating and Empowering Communities

Nationwide events, such as the upcoming Dec. 14 event in Little Rock, AR, equip homeowners with tools for navigating the housing market.

APOA’s partnerships provide resources for first-time buyers and communities disproportionately impacted by affordability crises.

🖼️ Chart-Tastic

10 Affordable Cities Poised To Become Million-Dollar Markets in a Decade

🌍 Dwelling of the Day

The ‘Yellowstone’ Ranch Is Real—and Guests Can Pay To Stay There for Under $2,000 a Night When Filming Wraps

Reservations Here

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.