Mortgage & REITS

30-Yr Fixed RM | 6.46% | - 0.03% |

15-Yr Fixed RM | 5.98% | - 0.02% |

30-Yr FHA | 5.90% | - 0.08% |

30-Yr Jumbo | 6.67% | - 0.01% |

7/6 SOFR ARM | 6.39% | - 0.03% |

30-Yr VA | 5.92% | - 0.08% |

Average going rates as of Aug 21 2024

S&P 500 | 5,620.85 | + 0.42% |

S&P REIT | 362.07 | + 0.52% |

FTSE NAREIT | 797.77 | + 0.42% |

Numbers as of Aug 21 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic Rundown

Why a Weakening U.S Dollar Can Help The Consumer

The dollar fell to its lowest level since December on Wednesday as investors anticipate Federal Reserve Chair Jerome Powell’s speech to the Jackson Hole economic conference in Wyoming.

A strong U.S. dollar increases Americans’ purchasing power abroad but can lead to economic consequences such as job losses in key industries domestically.

Tariffs and global trade policies influence the dollar’s value, with past presidential actions impacting both the economy and job stability in manufacturing.

🎢 Stock Health

S&P 500, Nasdaq Rise as Fed Signal 'likely' September Rate Cut

Stock Market Uptick: The S&P 500 rose by 0.4% and the Nasdaq Composite by 0.6% on Wednesday, as investors reacted to Federal Reserve minutes hinting at a potential rate cut in September.

Fed's Rate Cut Anticipation: The "vast majority" of Fed officials favored easing policy if inflation continues to cool, raising expectations for a September rate cut, with markets closely watching Jerome Powell's upcoming Jackson Hole speech.

Labor Market Update: Revised data showed 818,000 fewer jobs than initially reported as of March 2024, indicating a softening labor market that may influence the Fed's policy decisions.

🎙️ RE Spotlight

Homebuilders Face Rising Competition as Housing Inventory Surges

Increased Competition: Homebuilders, long benefiting from low resale housing inventory, are now facing competition as both new and existing home inventories rise.

Meritage Homes & Toll Brothers: Meritage Homes saw a 14% rise in total home orders, while Toll Brothers reported an 11% increase in purchase contracts, both missing analyst expectations.

Price Adjustments: Builders like Meritage have started cutting prices to move inventory, with a 6% drop in average sales price compared to last year.

Shift in Market Dynamics: The SPDR S&P Homebuilders ETF is up 19% this year, but declining mortgage rates and increased housing inventory are slowly shifting the market from favoring sellers to buyers.

Future Outlook: Despite the competition, homebuilders remain cautiously optimistic, citing long-term undersupply issues due to years of underproduction, even as more sellers re-enter the market.

Why a Growing Number of Homeowners Choose To Forgo Home Insurance—and the Nail-Biting Gamble

Rising Home Insurance Costs: In Florida, average homeowners insurance costs have tripled in the past four years, with the average annual premium now at $2,230—a 23% increase from the previous year, pushing some homeowners to opt out of insurance altogether.

Increasing Uninsured Homeowners: A 2024 study found that 7.4% of U.S. homeowners, or around 6 million, lack homeowners insurance, up from 5% in 2019, largely due to the rising costs associated with extreme weather risks and insurers pulling out of high-risk areas.

Economic and Racial Impact: Homeowners without insurance disproportionately include disadvantaged minorities—22% of Native Americans, 14% of Hispanics, and 11% of Black homeowners lack coverage—leaving $1.6 trillion in property vulnerable to disasters and deepening economic inequality.

🏰 RE State Zone

High Supply Meets Strong Job Growth in Small Texas Markets

Sherman-Denison's Apartment Growth Potential: With a 9% population increase over five years and 5,000 new jobs projected from Texas Instruments and GlobiTech in 2025, Sherman-Denison's apartment market is poised for significant expansion. With less than 7,000 units currently, even modest development could shift fundamentals.

Lubbock's Steady Expansion: Lubbock's apartment inventory grew by 8% in the last five years, driven by Texas Tech University's 40,000 students and strong job gains in Education, Health Services, and Leisure sectors. A moderate volume of new units is underway as of Q2 2024, reinforcing its role as a hub in West Texas.

Killeen-Temple's Strategic Location: Population growth in Killeen-Temple topped 10% in the five years ending in 2022. With 34,000 active-duty military personnel at Fort Cavazos and 446 new units underway in the Temple/Belton submarket, this area is well-positioned between fast-growing Waco and Austin.

🏕️ Niche-RE

Federal Land Sales: A Bipartisan Solution to Address the Affordable Housing Crisis?

“Imagine having a county where over 90 percent of the land can’t have housing ... all because it’s federally managed,” said Rep. John Curtis.

Federal Land Ownership & Housing Potential: The U.S. federal government owns roughly 28% of the country's land, with significant holdings in states like Nevada (80%) and Utah (63%), sparking bipartisan interest in using this land to address the housing shortage, particularly in high-demand areas.

Affordable Housing Demand: The U.S. is short nearly 4 million housing units, with home prices reaching record highs in May 2024. Rising construction on surplus federal land could potentially alleviate some of this shortage, particularly in urban areas facing severe affordability issues.

Voter Concerns & Economic Impact: Approximately 90% of Gen Z and millennials cite housing affordability as a key voting issue, and 64% of homeowners and renters report negative feelings about the economy due to housing costs, underscoring the urgent need for effective policy solutions.

👉 More Stories

6 Best Rental Markets for Vacation Homes on the East Coast

Affordable housing developers can apply to receive financial assistance from the $1.4 billion pool within Amazon’s total $3.6 billion Housing Equity Fund.

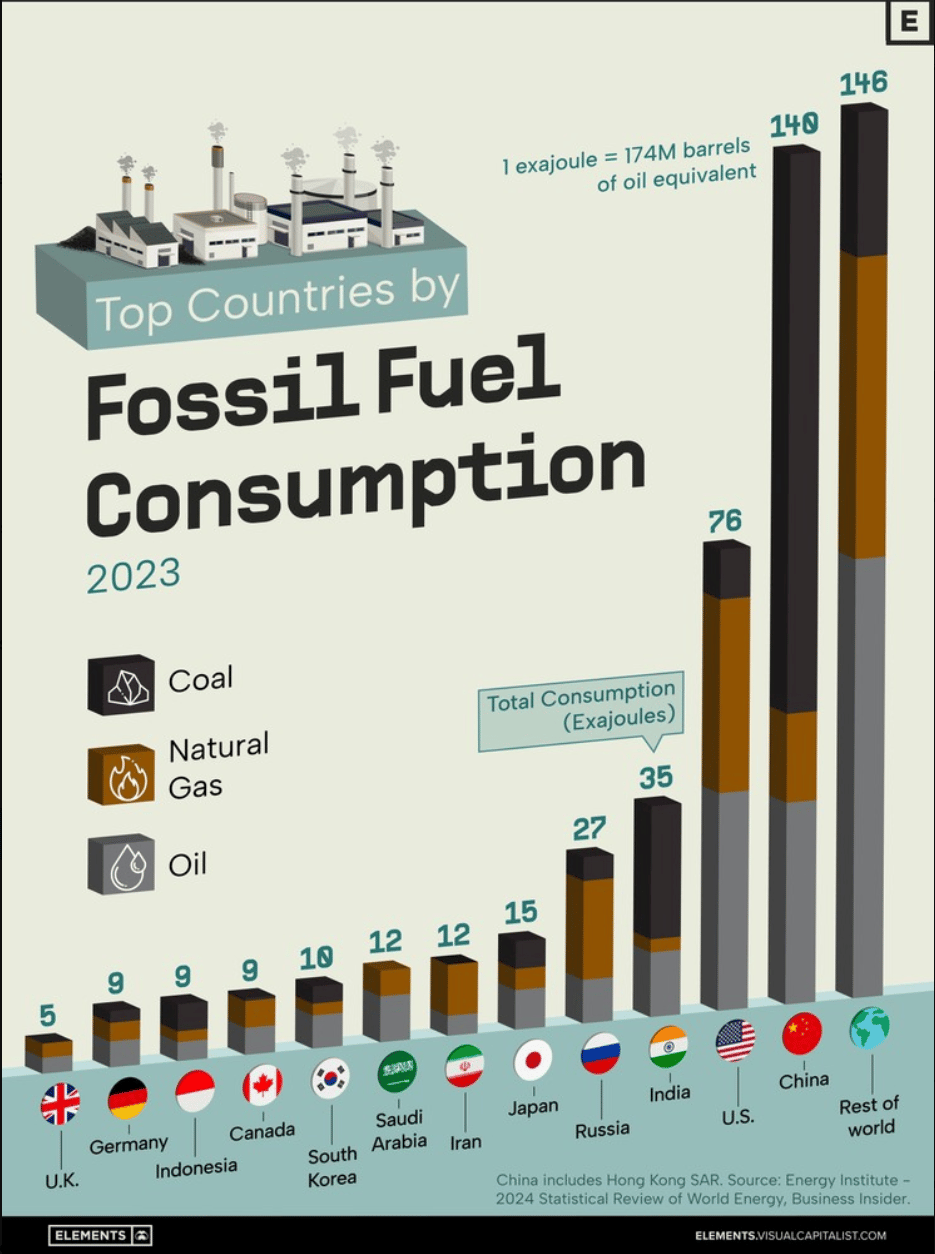

🖼️ Chart-Tastic

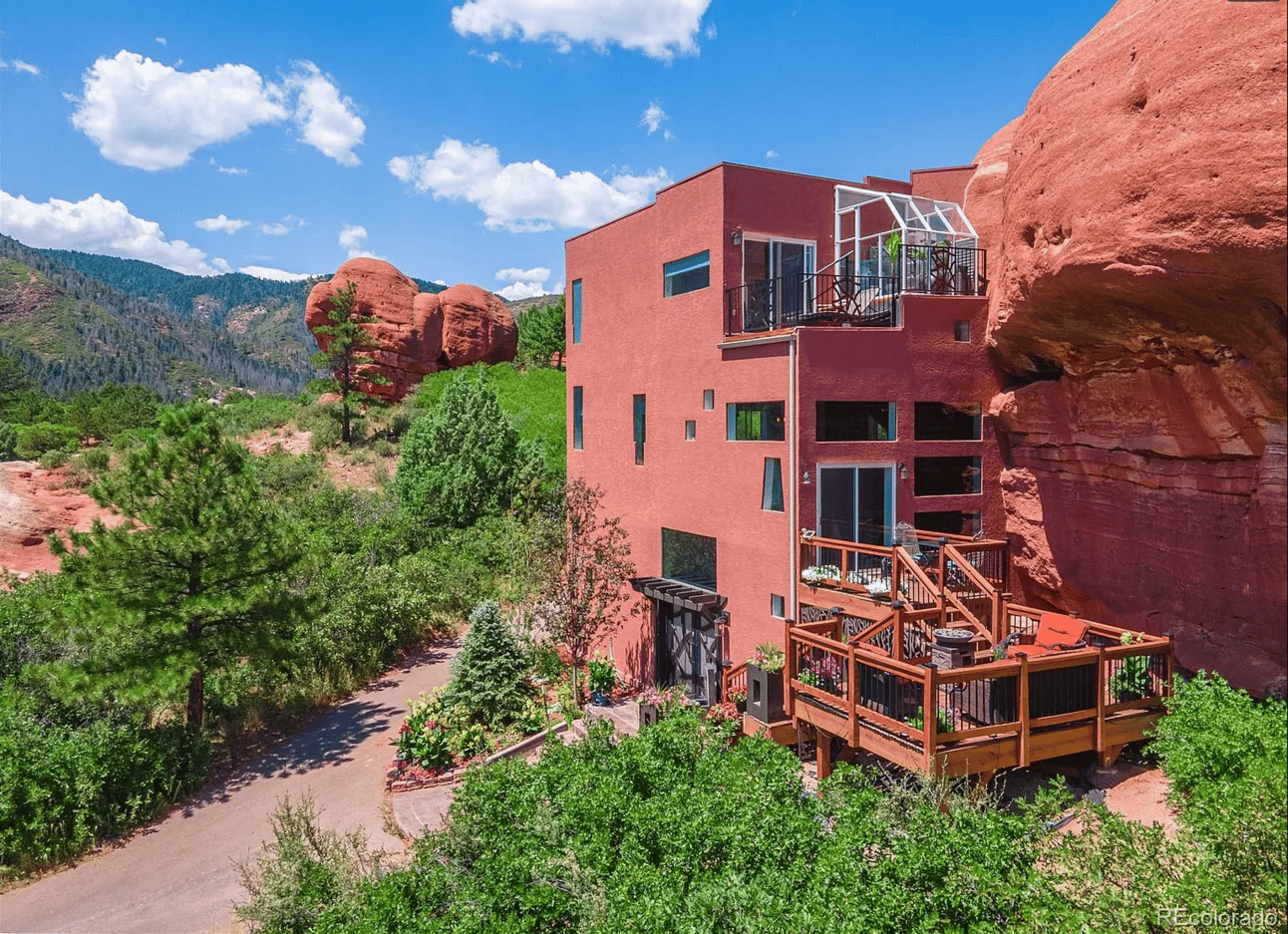

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.