where real property meets real data, every day

In This Edition

$28B Digital Revolution in Rentals

Americans Tapping into HELOC’s

Structuring Pre-Stabilization Finances

and more inside

Regional: Veterans, Half Century of Grievances

Economic: Fed's Dual Mandate Under Pressure

New? Join our newsletter – no cost!

Mortgage & REITS

30-Yr Fixed RM | 6.58% | + 0.06% |

15-Yr Fixed RM | 6.03% | + 0.10% |

30-Yr FHA | 6.15% | + 0.03% |

30-Yr Jumbo | 6.72% | + 0.04% |

7/6 SOFR ARM | 6.30% | + 0.15% |

30-Yr VA | 6.17% | + 0.04% |

Average going rates as of Aug 7th 2024

S&P 500 | 5,199.50 | - 0.77% |

S&P REIT | 350.19 | - 0.70% |

FTSE NAREIT | 777.65 | - 0.79% |

Numbers as of Aug 7th 2024 closing

Key Trends

Online Home Rentals, The $28B Digital Revolution. Read Full Stats

$28B boom: Online rentals surge 14.72% yearly through 2028

Market size increasing by $28.01 billion

CAGR of 14.72% between 2023 and 2028

Driven by high real estate prices and urban population growth

Flats dominate: $9.86B segment leads 36% North American market growth

Flat rentals valued at $9.86 billion in 2018

North America contributes 36% to global market growth

E-commerce and digital innovations fuel millennial demand

11% urban demand spike: Renting outpaces buying in U.S. cities

11% increase in rental apartment demand in U.S. cities (2022 vs 2021)

Freddie Mac survey shows consumer preference for renting over buying

Driven by migration to cities for economic opportunities

Happening Now

Americans Tapping Home Equity Credit Lines. More Details Inside

Home Equity Lines of Credit are making a comeback, with balances increasing 20% since late 2021 to reach $380 billion. This trend reflects homeowners' growing desire to access their property's value without giving up favorable mortgage rates.

Interestingly, older homeowners are driving this HELOC trend. About 1.8 million new HELOCs were originated in 2023 and early 2024, with a significant portion going to long-time homeowners who've accumulated substantial equity.

New mortgage originations have plummeted from an average of $900 billion in 2021-2022 to just $374 billion in Q2 2024. While HELOCs gain popularity, mortgage originations have dropped sharply, highlighting significant shifts in consumer behavior and market dynamics.

How Different Lenders Structure Pre-Stabilization Financing. Guide

As high interest rates persist, multifamily developers are increasingly seeking "pre-stab" or "lease-up" loans to exit costly construction loans before full property stabilization.

Construction take-out loans before stabilization can significantly reduce borrowing costs for developers. These loans can also eliminate the need for bridge financing when facing loan maturities prior to reaching stabilization.

While pre-stab loans offer advantages, many lenders require properties to be at least 50% leased or occupied before considering such financing. The timing, sizing, and pricing of these products vary among lenders, highlighting the importance of understanding individual lender criteria in this evolving market landscape.

Regional Zone

Half a Century of Grievances, Veterans Housing Demands on West L.A

In May, U.S. District Judge David O. Carter ruled that the VA discriminates against homeless veterans whose disability compensation makes them ineligible for housing on the West Los Angeles campus. The court’s upcoming non-jury trial will address potential remedies, including the addition of 4,000 permanent supportive housing units and 1,000 shelter beds.

The lawsuit, a class action initiated by 14 veterans, revisits ongoing grievances dating back to the Vietnam War era. The VA’s 2015 settlement, which promised a significant increase in housing units, has seen delays and unmet targets, leading to renewed legal action.

The plaintiffs argue that current leases with UCLA and Brentwood School, as well as oil and parking operations, are invalid and hinder the development of veteran-focused housing. The government contends that additional demands are impractical and may lead to undue burdens. This case has broader implications for national VA housing policies and developer contracts.

Special Topic

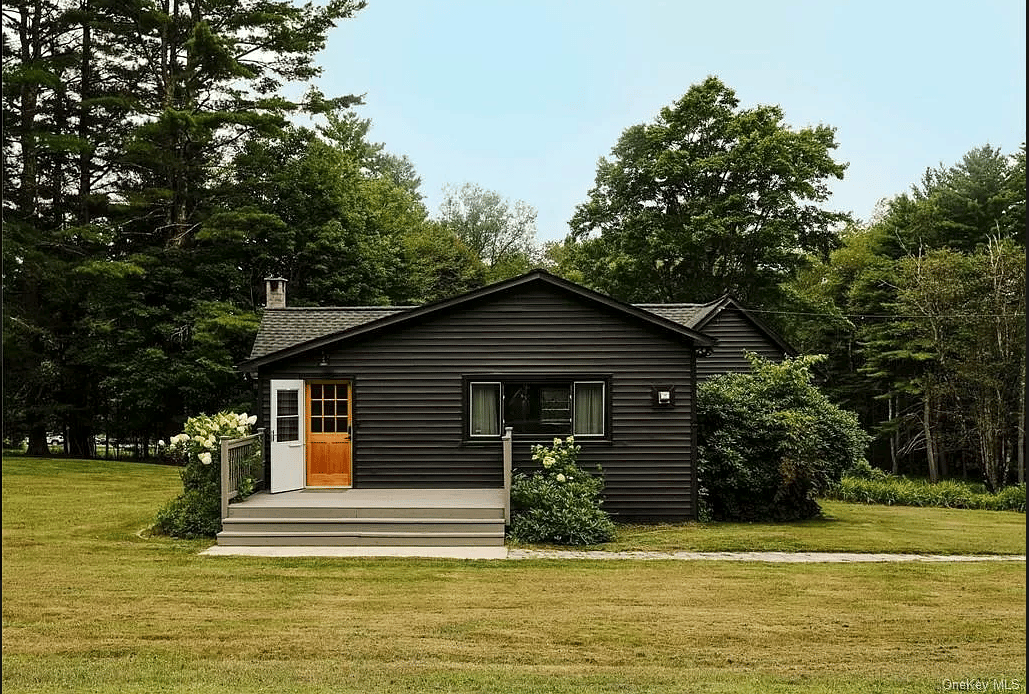

40 Beach House Decor Ideas That Will Make Major Waves

Crafting the perfect beach house ambiance doesn't require oceanfront property. By embracing coastal decor trends, homeowners can transform any space into a serene seaside retreat. Key elements include light-reflecting white walls, natural textures like wicker and jute, and a soothing color palette dominated by blues and sandy neutrals. Incorporate nautical accents such as driftwood art, seashell collections, and maritime-inspired lighting fixtures to evoke a subtle coastal charm. Remember, the goal is to create a relaxed, airy atmosphere that captures the essence of beachside living without overdoing the theme. With these beach house decorating ideas, you can bring the calming spirit of the coast into your home, no matter its location. Get the Look

Economic Indicator -

Fed's Dual Mandate Under Pressure. Read More

Market Turbulence: U.S. and global markets have been volatile this week, with a significant sell-off on Monday heightening concerns about the Federal Reserve’s timing for rate cuts.

Fed's Challenge: Economists urge the Fed to lower interest rates despite inflation remaining above 2%. Balancing low inflation with strong employment is complex and shifting.

Historical Trends: The Fed has occasionally achieved both goals in the past, but maintaining this balance is difficult and often temporary.

“That’s not a number, that’s a concept,” said Ann Owen, an economics professor at Hamilton College.

Dwelling’s in Market

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.