In This Edition

U.S. Real Estate Market Cooling Trends

Multifamily Demand Reaches 24-Year High

Real Estate Deals Cancelling at Last Minute

and more inside

Regional: $3.36 Billion in Sales

Mortgage & REITS

30-Yr Fixed RM | 6.62% | - 0.08% |

15-Yr Fixed RM | 6.15% | - 0.07% |

30-Yr FHA | 6.13% | - 0.16% |

30-Yr Jumbo | 6.80% | - 0.10% |

7/6 SOFR ARM | 6.33% | - 0.07% |

30-Yr VA | 6.15% | - 0.15% |

Average going rates as of Aug 1st 2024 closing

S&P 500 | 5,446.68 | - 1.37% |

S&P REIT | 355.10 | + 1.12% |

FTSE NAREIT | 789.06 | + 1.33% |

Numbers as of Aug 1st 2024 closing

New? Join our newsletter – no cost!

Key Trends

U.S. Real Estate Market Cooling Trends and Regional Hot spots. Click for full list

The U.S. real estate market experienced a significant cooldown in 2023 after a nearly 50% surge in home prices during the pandemic. Higher interest rates and inflation have limited buying power, with home prices declining by 4.1% in April 2023 before rebounding by 4.0% by December 2023.

The Northeast and California remain hot markets, with Rhode Island and cities like San Jose leading the charge. Despite high costs, tight housing supply and regulatory challenges drive demand. Conversely, Texas and Mountain West cities have cooled off, with cities like Austin and Denver dropping in market activity rankings.

Home sales saw a roller coaster ride, with a record high increase of 49.8% in May 2021 followed by a sharp decline of 35.2% by the end of 2022. As of December 2023, sales volumes were still down 8.8% year-over-year, reflecting ongoing market instability.

Happening Now

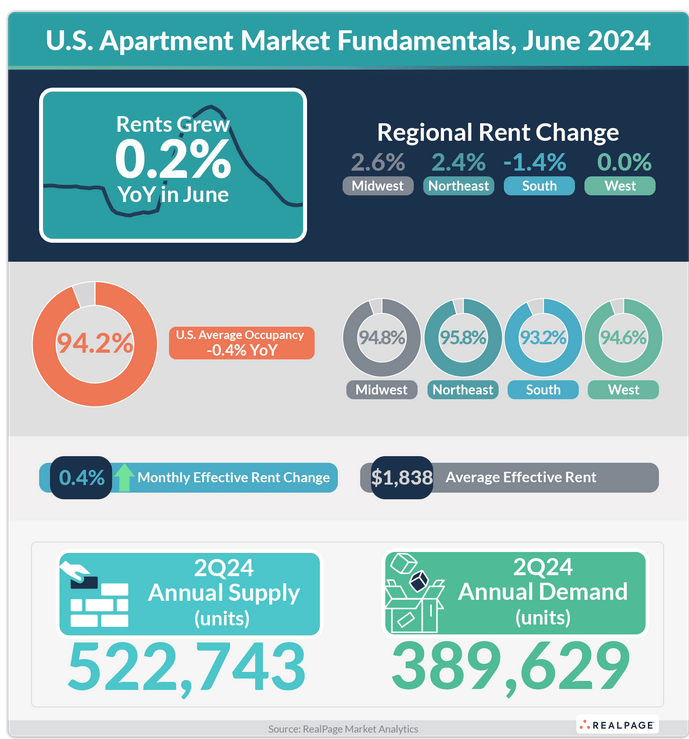

Multifamily Demand Reaches 24-Year High. Read More Stats

Despite an imbalance in multifamily demand and supply leading to increased vacancies and downward pressure on rents, the multifamily sector has seen record absorption rates. In the year-ending Q2 2024, 390,000 net units were leased, the eighth-highest annual figure since 2000, reflecting a robust demand driven by demographic shifts and business relocations to the south and west.

The first two quarters of 2024 saw 257,000 units absorbed, nearly matching the pandemic-era peak of 270,000 units in early 2021. This surge in demand, highlighted by a Cushman & Wakefield report, led to a 10 basis points drop in multifamily vacancies, showcasing the resilience of the sector even in a challenging landscape.

RealPage Market Analytics emphasized the unprecedented demand levels, with the past six months demonstrating one of the highest absorption rates in 24 years. This strong performance underscores the multifamily market's ability to adapt and thrive amid shifting demographic trends and economic conditions.

Real estate deals in America are getting canceled full story here

Nearly 15% of home purchases fell through last June, with over 56,000 deals collapsing, highlighting a major shift in buyer behavior and market conditions.

The median home sale price surged 4% to $442,525, and mortgage rates hit 6.92%, causing many buyers to reconsider their purchases due to affordability issues.

A 13% increase in active listings and a record 19% of homes experiencing price cuts indicate a transition from a seller’s market to a buyer’s market, affecting strategies for both buyers and sellers.

Please Note: We send our editions on most week days at 8am ET,if you don’t see us in your inbox,please check your spam and move to primary.

Regional Zone - Brooklyn, New York

Commercial $3.36 Billion in Investment Sales in 1H 2024. Read Full Report

Brooklyn’s multifamily market surged with $1.8 billion in sales, a 103% increase from 2H 2023 and a 38% increase from 1H 2023, driven by high-profile transactions like Silverstein Capital Partners’ $672 million acquisition of 9 Dekalb Avenue.

Despite a 21% decline from 1H 2023, Brooklyn's development market saw $585 million in transactions, with Williamsburg leading the activity. The average price per buildable square foot dropped to $231, the lowest since 2014, reflecting a challenging market without tax abatement’s.

Industrial/warehouse/storage assets saw 57 transactions totaling $512.1 million, the second-highest transaction volume in six years. The average price per square foot reached a record $510, with notable deals like Carlyle Group’s $60.1 million self-storage portfolio purchase. more data inside

Special Topic - Warehouse & Data Center Sector

Prologis Bullish on Logistics and Data Center Space Link

In its Q2 2024 earnings call, Prologis reported strong demand for logistics and data center space, driven by the continuous expansion of e-commerce. The company highlighted that ongoing growth in online retail is a key factor in the increased need for logistics facilities, as businesses seek to optimize their supply chains to meet consumer demand more efficiently.

Prologis emphasized the importance of supply chain optimization in driving demand for their spaces. Companies are investing in more advanced logistics and data center infrastructure to improve operational efficiency and resilience. This trend is expected to sustain the high demand for Prologis' offerings throughout the year.

Looking ahead, Prologis remains optimistic about the remainder of 2024. The company anticipates continued strong demand for both logistics and data center space, supported by the growth in e-commerce and the strategic need for better supply chain management. This positive outlook is bolstered by current market trends and customer feedback, indicating sustained interest and investment in these sectors.

Dwelling’s on Market

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.