Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - Egg prices soar by 41% due to bird flu, and the housing market weakens as pending home sales hit record lows. Mortgage rates and rising insurance premiums are creating affordability challenges. Ultra-wealthy investors shift focus to real estate, while rising insurance costs threaten homeownership, especially in disaster-prone areas. Interest in second homes remains high, and adaptive reuse projects are reshaping urban spaces for economic and environmental benefits. 11 social housing apartments in Mallorca, Spain. Stay informed with the latest trends!

Quote of the day - "Real estate adapts to the times—whether through market shifts or sustainable innovation."

If you missed yesterday’s newsletter, click here

The Economic Blackout—How Homeowners Can Shop on February 28

Mortgage & Stocks

30-Yr Fixed RM | 6.79% | + 0.01% |

15-Yr Fixed RM | 6.25% | + 0.01% |

30-Yr Jumbo | 7.09% | - |

7/6 SOFR ARM | 6.59% | - 0.06% |

30-Yr FHA | 6.15% | + 0.02% |

30-Yr VA | 6.17% | + 0.02% |

Average going rates as of Feb 27 2025

S&P 500 | 5,861.57 | - 1.59% |

Dow 30 | 43,239.50 | - 0.45% |

Bitcoin USD | 84,230.23 | - 0.55% |

Numbers as of Feb 27 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Egg Prices Surge 41% as Bird Flu Devastates Supply—Housing & Job Markets Weaken

Egg Prices Skyrocket – The USDA revised its 2024 egg price forecast to a 41% increase, up from 20%, as 19M hens were culled due to the worst bird flu outbreak since 2022. Retail prices are 53% higher YoY, with some areas exceeding $1 per egg.

Housing Market at Record Lows – Pending home sales plunged 4.6% MoM in January, hitting their lowest level since 2001, as high mortgage rates and new tariffs on steel and aluminum drive affordability concerns. YoY sales dropped 5.2%, signaling a deepening slowdown.

Job Market Shows Cracks – Initial jobless claims surged to 242K, exceeding forecasts of 225K, while Q4 GDP slowed to 2.3% from 3.1% in Q3. Analysts warn that economic uncertainty, inflation, and trade policies could prolong financial strain for households.

🎢 Impact on Real Estate

Home Prices Cool as Buyers and Sellers Step Back—2025 Housing Market Faces Uncertain Spring

Housing Market Ends 2024 on a Cooler Note – December saw a surge in de-listings to post-Great Financial Crisis levels, while time on the market hit its highest point since the pandemic's onset. Pending home sales dropped 4.6% MoM, signaling ongoing buyer hesitation.

Home Prices Dip for Fifth Straight Month – The CoreLogic S&P Case-Shiller Index recorded a 0.15% month-over-month decline in December, marking five consecutive months of price drops. However, annual appreciation edged up to 3.9%, slightly above November’s 3.7% gain.

2025 Spring Market Looks Uncertain – Early indicators suggest a spring season similar to 2024, with inventory growth helping buyers but economic and policy uncertainties keeping them cautious. Home price gains are forecasted to slow to 1.3% by April, with 2025 appreciation projected to average 2.8% nationally.

🎙️ RE Spotlight

Interest in Second Homes and Rentals Continues To Rise Among the Wealthy

Ultra-Wealthy Shift to Real Estate Amid Economic Confidence – A WSJ & Barron’s survey shows rising interest in real estate, with 43% of ultra-high-net-worth individuals favoring vacation homes—an 8-point jump—while demand for art, jewelry, and watches declines.

Investor Confidence in Economy Nearly Doubles – 47% of surveyed investors expect the economy to improve in 2025, up from 24% in September, driven by expectations of tax and regulatory policies under the new administration.

Luxury Property Demand Outpaces Other Passion Assets – Interest in secondary homes and rental properties is climbing, while collectibles like jewelry (-5 pts) and art (-2 pts) see declining demand, signaling a preference for tangible, appreciating assets.

Rising insurance costs will continue to put a strain on homeownership

Rising Disaster Costs & Home Insurance Impact – The U.S. recorded 27 weather disasters exceeding $1 billion in 2024, marking the 14th consecutive year with 10+ billion-dollar disasters. This surge is driving up homeowners insurance costs, making affordability a growing concern.

Home Insurance Costs Outpacing Mortgage Payments – CoreLogic data reveals that nearly 10% of mortgage borrowers now pay more for property taxes and insurance than for principal and interest, up from 2% a decade ago. Home insurance costs have risen over 50% in the past five years, with increases as high as 62% in Arizona.

Rising Premiums Affecting Home Values – Insurability challenges are leading to declining home prices in high-risk areas. In Cape Coral and Florida’s Gulf Coast, home values are already impacted. If national home prices drop 10%, 2.4% of mortgages could become underwater, rising to 6% with a 20% price decline.

CoreLogic’s Selma Hepp believes that rising insurance costs will continue to stretch homebuyers and impact prices in some hard-hit markets

🏰 RE State Zone

The 5 Cities Where Homeowners Are Taking Advantage of Lower Mortgage Rates

Refinance Surge as Mortgage Rates Dip to 6.76% – Q4 2024 saw 641,918 refinance loans, up from 603,324 in Q3, signaling homeowners seizing opportunities before potential rate hikes.

Cities Leading the Refinance Boom – Hilton Head, SC (+56.4%), Wilmington, NC (+48.9%), and San Jose, CA (+43.8%) saw the largest refinance activity increases, driven by favorable rate conditions.

Most Homeowners Still Locked into Lower Rates – With 83% of mortgages below 6%, refinancing remains unattractive for most. However, those who bought when rates peaked near 8% in 2023 may benefit from today’s lower levels.

Refinance Activity Up Again During Fourth Quarter Despite Broader U.S. Downturn in Home Mortgages

🏕️ Niche-RE

Revitalizing Urban Spaces: The Rise of Adaptive Reuse in Architecture

Adaptive Reuse is Reshaping Urban Landscapes – With 50% of office buildings in some cities sitting vacant, repurposing outdated structures into mixed-use spaces, hotels, and housing is becoming a high-ROI strategy for investors.

Sustainability Meets Economic Efficiency – Converting existing buildings reduces construction costs, preserves embodied energy, and accelerates project timelines—offering developers a cost-effective, eco-friendly alternative to new builds.

Historic Conversions Enhance Community Value – Projects like 20 Mass in D.C. and The Victor in St. Louis revitalize city centers, integrating modern amenities while maintaining cultural and architectural heritage.

From Historic Warehouses to Modern Hubs—How Adaptive Reuse is Transforming Real Estate

The Future Demand for Industrial Is Decarbonized

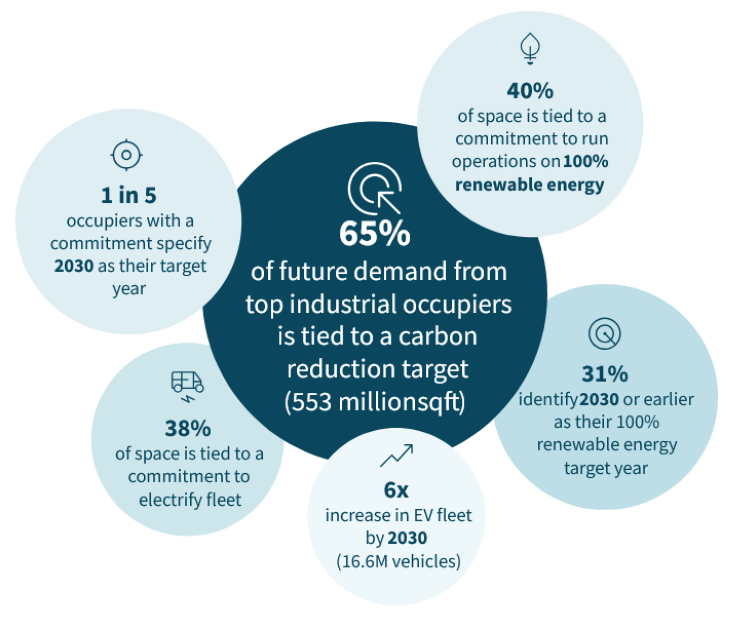

65% of Future Industrial Space Needs Tied to Carbon Goals – A JLL report reveals that most industrial and logistics tenants will require decarbonization-enabling sites by 2030, driven by energy upgrades, fleet electrification, and clean energy adoption.

Aging Industrial Stock Creates Urgent Retrofit Demand – With 76% of U.S. industrial properties over a decade old, landlords must modernize warehouses to attract tenants and mitigate obsolescence risks in a rapidly evolving market.

Supply Shortages Could Leave 41% of Demand Unmet – Despite growing interest in low-carbon spaces, the industrial sector may struggle to keep pace, highlighting a major opportunity for landlords investing in energy-efficient upgrades.

Leasing decisions will be increasingly linked to carbon reduction targets, according to JLL’s latest study.

Commericail Real Estate Decarbonization Strategy - 4 Strategies for Reaching Net Zero

🖼️ Chart-Tastic

👾 Interesting in Social

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.