It’s Tuesday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - "Every property you pass on today is someone else's opportunity tomorrow."

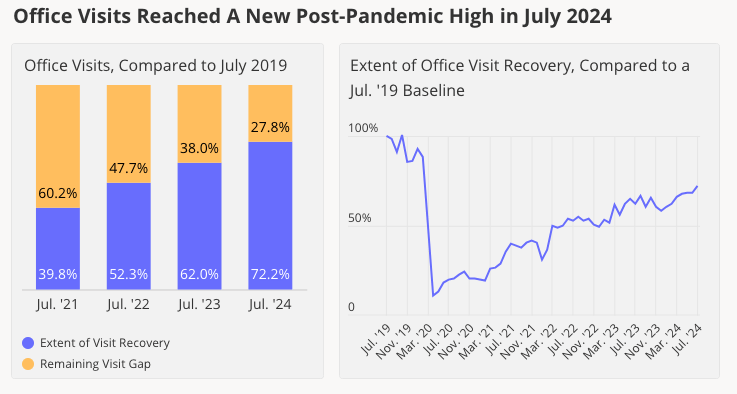

In today’s edition - Office visits soared to 72.2% of pre-pandemic levels in July, with Miami and NYC leading. Housing markets in California, New Jersey, and Illinois face high risks, while condo sales decline sharply compared to single-family homes. A significant credit crunch for homebuilders could reduce housing starts by 16% and keep prices high. Discover how 3D printing in commercial real estate is evolving with Walmart’s latest project, despite initial setbacks.

Stay informed and make smarter real estate decisions with our latest insights!

If you missed yesterday’s newsletter, click here

Mortgage & REITS

30-Yr Fixed RM | 6.27% | - 0.08% |

15-Yr Fixed RM | 5.65% | - 0.20% |

30-Yr Jumbo | 6.49% | - 0.06% |

7/6 SOFR ARM | 6.05% | - 0.16% |

30-Yr FHA | 5.67% | - 0.05% |

30-Yr VA | 5.69% | - 0.06% |

Average going rates as of Sep 9th 2024 |

New? Join our newsletter – no cost!

🎢 Impact on Real Estate

Americans Are Heading Back to the Office at Record Levels

July 2024 Office Visits Surge: Nationwide, office visits in July 2024 reached 72.2% of July 2019 levels, surpassing June 2024’s record recovery.

Miami and New York Lead Recovery: Office visits in Miami and New York City rebounded to around 90% of July 2019 levels, making them top performers among major U.S. cities.

Year-over-Year Growth Across All Cities: All analyzed cities saw year-over-year (YoY) growth in office visits, with Miami leading at 22.8% YoY growth.

Nationwide recovery accelerates as Miami and New York near full pre-pandemic levels, with all major cities showing year-over-year growth.

🎙️ RE Stats

Vulnerable U.S. Housing Markets in Q2 2024: California, New Jersey, and Illinois Dominate the Risk Spectrum

California, New Jersey, Illinois Lead in Risk: The highest concentration of at-risk housing markets in Q2 2024 is in California, New Jersey, and Illinois, driven by affordability issues and underwater mortgages.

Worst-Affected Counties and Cities: Brooklyn (NY), Riverside (CA), and Chicago (IL) are among the counties with the worst levels of affordability, foreclosures, and unemployment.

Economic Disparities Highlighted: Vulnerable counties show stark contrasts, with housing costs consuming over 70% of local wages and foreclosure rates significantly higher than the national average.

County-level housing markets reveal sharp contrasts in risk exposure across the U.S., with California, New Jersey, and Illinois leading in vulnerability.

🏢 Undefeated Single-Family

Condo Market Faces Steep Decline Compared to Single-Family Homes

Condo Sales Decline Sharply: Condo sales dropped by 12% nationwide in July 2024 compared to the previous year, while single-family home sales saw only a 1% decline, highlighting the growing preference for single-family homes.

Regional Disparities: The Midwest and South saw the steepest declines in condo sales, down 17% and 15%, respectively, over the past year, while the Northeast remained stable. This contrasts with single-family homes, which showed more resilience across regions.

Pricing Pressures: Despite condos being a more affordable option, their price per square foot remains 35.8% higher than single-family homes, adding pressure on buyers. Meanwhile, single-family homes continue to hold their value better, making them a more attractive investment option.

“Condo inventory reached its highest level in four years in July as supply outpaced demand,” says Realtor.com senior economic research analyst Hannah Jones.

🏕️ Niche-RE

Credit Crunch Hits Homebuilders: What It Means for Housing Supply and Prices

Significant Credit Cut for Home builders: Banks have reduced lending for residential construction by over 10% in the past year, from $102 billion to $92 billion. This represents the largest decline in more than a decade, signaling a severe credit crunch in the housing sector.

Impact on Housing Supply: With construction lending down for five consecutive quarters, housing starts are projected to drop by 16% this year. Despite the current supply not being affected, the long-term constraint on credit may lead to a tighter housing market, potentially driving up prices.

High Prices Likely to Persist: As construction credit remains limited and housing supply tightens, high home prices are expected to persist. The combination of reduced lending and weak demand could exacerbate affordability challenges for homebuyers.

This represents the biggest credit crunch for home builders in more than a decade.

👷 New Frontier RE 3D Print

Could 3D Printing Revolutionize Commercial Real Estate? Walmart’s Latest Project Reveals Surprises

Walmart's Bold Move in 3-D Printing: Walmart's new 8,000-square-foot expansion in Athens, TN, marks one of the largest 3-D printed commercial projects in the U.S. Despite the ambitious goal to speed up construction and reduce costs, the project faced delays and cost challenges, highlighting the technology’s growing pains.

Technological Challenges and Learning Curves: The 3-D printing process encountered issues with material consistency, heat management, and equipment compatibility, leading to a delay of several weeks. These hurdles underscore the technology's current limitations compared to traditional construction methods.

Future Potential and Ongoing Innovations: Despite the setbacks, Walmart is continuing to explore 3-D printing technology, with plans for over 200 similar projects. As the technology evolves, lessons learned from these initial projects may pave the way for more efficient and cost-effective applications in the commercial real estate sector.

3-D printing, also known as additive manufacturing, builds things by layering material via a computer-programmed robotic arm. Traditional manufacturing, by contrast, whittles away from raw materials, such as a sheet of metal.

“There’s a number of things that we’ve learned,” said Patrick Callahan, chief executive of the four-year-old company Alquist 3D, which was hired by Walmart for the project.

🖼️ Chart-Tastic

Below is a look at home price changes in 10 select large U.S. metros from June 2023 to June 2024, with Miami posting the highest gain at 10% year over year.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.