Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “A home is more than an address—it's the story of who you are”

In today’s edition - Moody’s downgraded Israel’s credit rating amid geopolitical risks and a projected $66 billion war cost, while China’s bold stimulus measures aim to stabilize its slowing economy. U.S. stocks ended the week higher, driven by optimism for Federal Reserve rate cuts. In real estate, nearly half of home listings have gone stale after 60 days on the market, and single-family housing starts surged in August. Philadelphia’s Center City retail thrives post-pandemic, fueled by resident-driven demand and multifamily development.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.20% | - 0.01% |

15-Yr Fixed RM | 5.57% | - 0.01% |

30-Yr Jumbo | 6.40% | - 0.01% |

7/6 SOFR ARM | 6.12% | - 0.02% |

30-Yr FHA | 5.79% | - 0.01% |

30-Yr VA | 5.80% | - 0.02% |

Average going rates as of Sep 28 2024

S&P 500 | 5,738.17 | - 0.13% |

Gold | 2,680.80 | - 0.52% |

10 Yr T-Note | 114.72 | + 0.27% |

Numbers as of Sep 28 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Moody’s Downgrades Israel Amid Growing Geopolitical Risks

Moody’s warned that Israel’s economy is unlikely to recover swiftly, with war costs projected to exceed $66 billion, or over 12% of GDP. As government borrowing surges and sectors like tourism and agriculture slump, Israel’s fiscal outlook remains strained, compounded by a record-high budget deficit and stalled growth projections. Despite the Israeli government’s pushback, Moody’s maintains a negative outlook, signaling continued economic uncertainty.

China's Bold Economic Reset: Can Stimulus Save the Day?

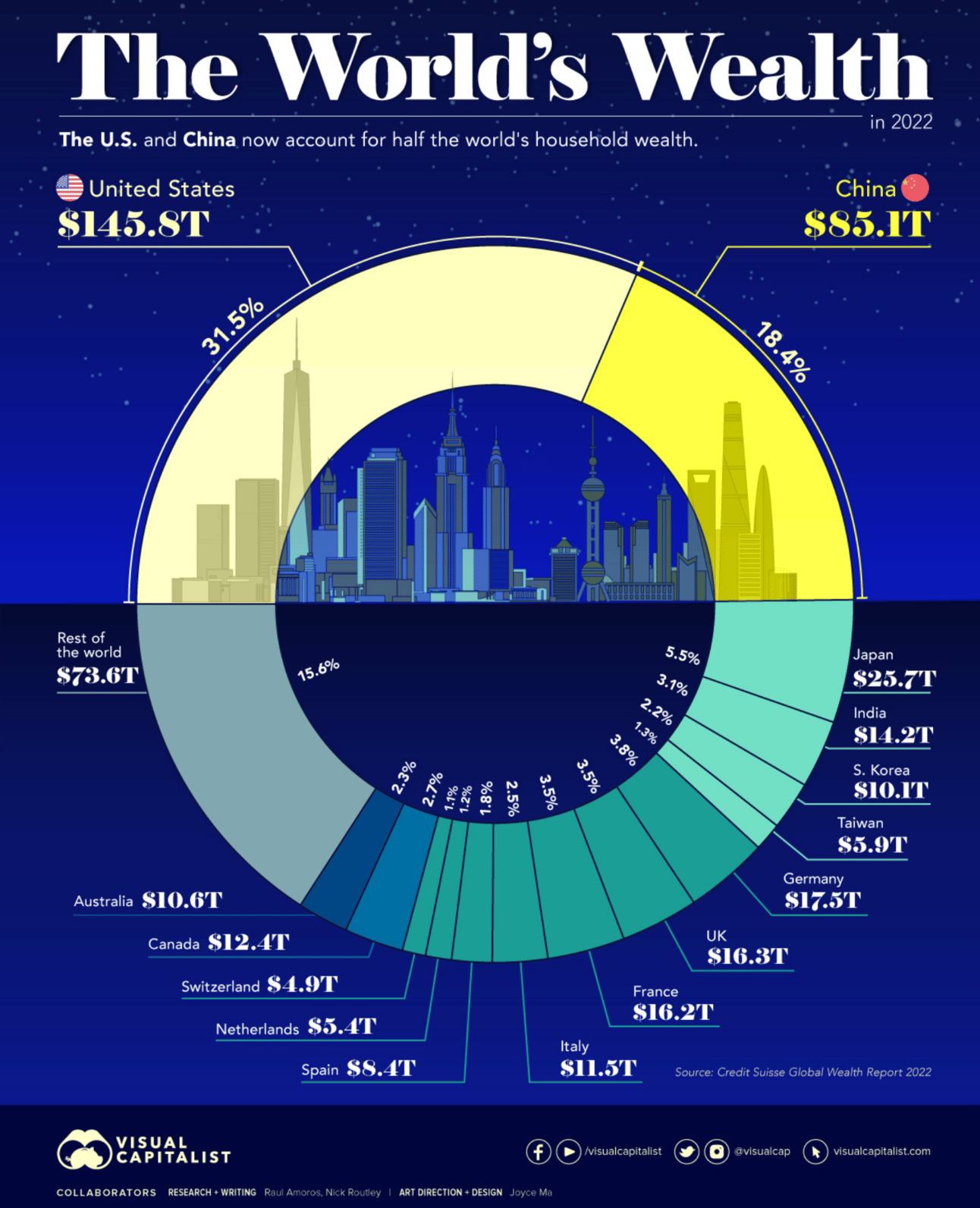

China has launched sweeping stimulus measures to jumpstart its slowing economy, slashing interest rates, easing home-buying rules, and rolling out cash subsidies. The People’s Bank of China’s largest-ever rate cut on one-year loans, paired with relaxed policies on second-home purchases, aims to reverse the downturn in the property market and boost consumer spending. With a focus on fiscal spending, these bold moves are designed to prevent the world’s second-largest economy from slipping into deflation. As global markets react positively, China buys precious time to navigate rising debt, trade tensions, and long-term economic risks. Whether these measures will deliver sustained growth or only provide temporary relief remains to be seen.

Stocks End Week on a High Amid Optimism for Fed Rate Cuts

Stocks closed the week with gains, buoyed by investor optimism following a key inflation report. The Dow Jones added 0.3%, reaching a new record high, while the S&P 500 edged down by 0.1% after hitting a previous record. The Nasdaq dropped 0.4%, yet all three indices recorded weekly gains as market confidence in the economy strengthened. A strong GDP report and a cooling August PCE inflation reading have bolstered expectations that the Federal Reserve may execute a significant rate cut next month, with 52% of traders now betting on a 50 basis point reduction.

🎢 Impact on Real Estate

Half of All Home Listings Have Gone Extra Stale, Unsold After 60 Days on Market

Nearly 48% of homes for sale in August sat on the market for at least 60 days, marking the highest share since 2019, as home sales dropped to pandemic lows and buyer hesitation grew amidst fluctuating interest rates.

Seattle leads the nation with the fastest home sales, with a median of just 12 days on the market, while Florida metros like West Palm Beach and Fort Lauderdale saw homes linger for over 75 days, reflecting stark regional contrasts.

With 68.5% of homes sitting for at least 30 days, rising insurance costs and a post-pandemic slowdown in migration have contributed to slower sales, particularly in Florida and Texas, where homebuyers are more cautious.

Nearly seven out of every 10 homes (68.5%) on the market last month had been sitting for at least 30 days, up from 63.9% a year ago.

🎙️ RE Spotlight

Single-Family Starts Up in August but Supply-Side Issues Linger

Single-family housing starts jumped 15.8% in August, driven by robust demand and easing mortgage rates, marking a 10.4% year-to-date increase despite ongoing supply challenges like labor shortages and high material costs.

The Federal Reserve’s expected rate cuts could provide a boost to homebuilders, reducing construction loan rates and fueling more housing starts, as single-family permits rose 2.8% in August, signaling strong future growth.

While overall housing starts increased 9.6% in August, multifamily starts dropped 4.2%, reflecting a shift in market focus toward single-family homes, especially in regions like the Midwest and Northeast where permits are on the rise.

Overall permits increased 4.9% to a 1.48 million unit annualized rate in August. Single-family permits increased 2.8% to a 967,000 unit rate. Multifamily permits increased 9.2% to an annualized 508,000 pace.

🏕️ Niche-RE

Resident-Driven Retail Center City in Philadelphia Post-Pandemic Shift

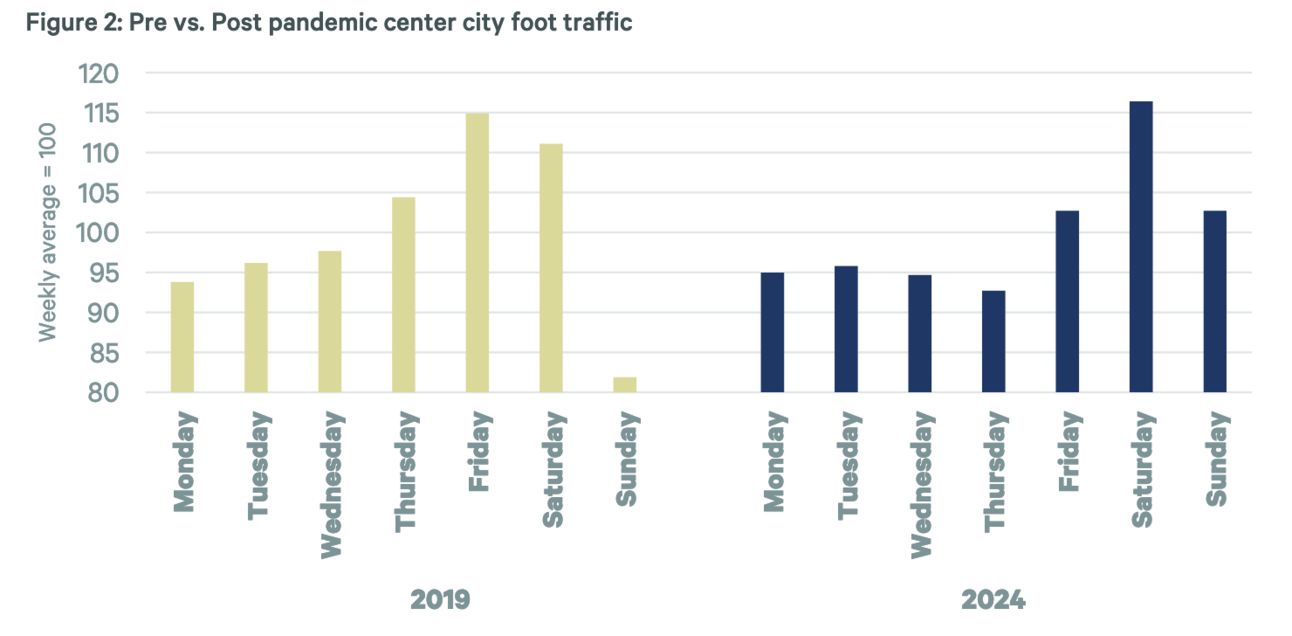

Resident-driven retail is thriving in Center City as multifamily development booms, with 83.6% of storefronts occupied in 2024, a steady rise from 2021. Local residents now support businesses more than office workers, reshaping retail demand and foot traffic patterns.

Population growth fuels retail resilience as Center City's population jumped 27.8% since 2010, creating demand for new developments like The Josephine and 1909 Rittenhouse, which are reshaping the shopping corridors of Walnut and Chestnut Streets.

Experiential retail dominates Center City’s landscape, with entertainment venues such as Puttshack, F1 Arcade, and World of Flight tapping into the demand from a growing residential base, making weekends the busiest shopping days.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.