where real property meets real data, every day

In This Edition

Office Leasing Highlight a Demand for Quality

10-Point Plan to Address Housing Affordability

KPG Funds Predicts a 50-60% Increase in NYC CRE

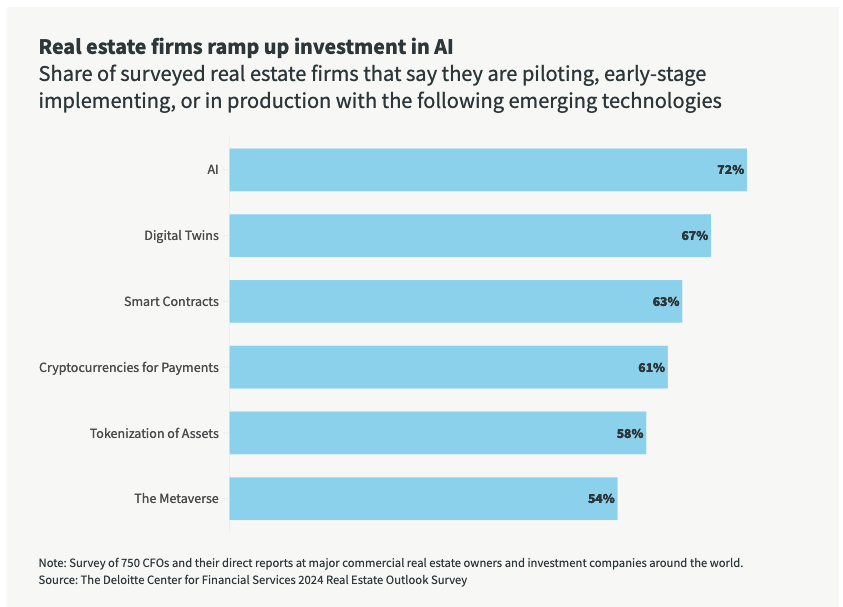

Real Estate Firms Embracing AI

Regional: Housing Price Forecasts, Illinois and Chicago PMSA

Economic: Six Reasons a Recession is Unlikely

New? Join our newsletter – no cost!

Mortgage & REITS

30-Yr Fixed RM | 6.52% | + 0.18% |

15-Yr Fixed RM | 5.93% | + 0.05% |

30-Yr FHA | 6.12% | + 0.37% |

30-Yr Jumbo | 6.68% | + 0.07% |

7/6 SOFR ARM | 6.15% | + 0.20% |

30-Yr VA | 6.13% | + 0.34% |

Average going rates as of Aug 6th 2024

S&P 500 | 5,240.03 | + 1.04% |

S&P REIT | 352.67 | + 2.51% |

FTSE NAREIT | 783.83 | + 2.28% |

Numbers as of Aug 6th 2024 closing

Key Trends

Office Leasing Highlight a Demand for Quality. Link

Prime Office Space Premiums: Savills reports that prime office rents are 31.4% higher globally than Grade A office rents, with North America leading at a 62.5% premium. This trend signifies the high demand for top-tier office spaces despite economic uncertainties, making it crucial for investors and businesses to stay informed about the evolving market dynamics.

Market Resilience and Growth: Despite rising costs, 94% of major office deals in the first half of 2024 involved expansion or renewal. This resilience highlights a robust commitment to maintaining quality office environments, especially in leading cities like London, Hong Kong, and New York. Subscribe now to receive exclusive insights on how businesses are navigating these market conditions.

Regional Variations and Opportunities: The Asia-Pacific region shows a significant variation in prime office space premiums, with Sydney at 13.5% and Shenzhen and Beijing exceeding 70%. Europe, the Middle East, and Africa have a lower regional premium of 17.9%. Understanding these regional differences can offer strategic advantages. Sign up for our newsletter to get detailed reports and expert analyses tailored to your investment needs.

Happening Now

NAHB Unveils 10-Point Plan to Address Housing Affordability Crisis

New Strategies to Tackle Shelter Inflation: The National Association of Home Builders (NAHB) has launched a comprehensive 10-point plan aimed at combating the ongoing housing affordability crisis, which is exacerbated by a shortage of 1.5 million housing units. The plan focuses on reducing excessive regulations, improving building material supply chains, and increasing the availability of affordable housing through federal tax incentives and zoning reforms.

Boosting Construction and Workforce: Key initiatives include promoting careers in the skilled trades, addressing permitting delays, and updating building codes to balance cost and energy efficiency. The plan also advocates for reducing local impact fees and simplifying financing for new housing projects to ensure that more homes are built and made accessible to American families.

KPG Funds Predicts a 50-60% Increase in NYC Commercial Real Estate. Read More

Market Forecast and Economic Context: KPG Funds predicts a 50-60% rise in New York City's commercial real estate values as interest rates decline. This growth is driven by sustained demand for high-quality office spaces and a trend towards residential-to-office conversions. The broader economic backdrop features an anticipated reduction in interest rates, stimulating investment and development activities.

Strategic Positioning and Trends: KPG Funds, led by CEO Gregory Kraut, has been transforming undervalued properties into premium office spaces, catering to modern business needs. The company's strategy of investing in prime locations and enhancing properties with state-of-the-art amenities has consistently added value to their assets. The market is experiencing a "flight to quality," with businesses preferring upscale properties in high-demand areas, further supporting the anticipated rise in pricing.

Future Outlook and Company Insights: KPG Funds' portfolio includes some of the most sought-after properties in Manhattan, positioning the company to capitalize on the expected market upswing. Gregory Kraut emphasized that the company's strategy will meet evolving tenant demands and generate substantial returns for investors. KPG Funds remains committed to transforming underutilized spaces into vibrant, high-performance workplaces, exploring new opportunities, and investing in projects that align with their vision.

Regional Zone

Housing Price Forecasts, Illinois and Chicago PMSA, July 2024. Click For Report

Sales Down, Prices Up: In June 2024, Illinois and the Chicago PMSA experienced significant declines in home sales compared to the previous year—Illinois saw a 16.7% drop to 12,400 homes sold, while the Chicago PMSA had a 15.3% decrease to 8,700 homes sold. Despite these decreases, median home prices surged, with Illinois reaching $315,050 (up 8.6%) and the Chicago PMSA at $375,000 (up 7.1%).

Forecast and Market Insights: Forecasts indicate a continued decline in sales for the next three months, with Illinois and the Chicago PMSA both expected to see annual decreases of 10.4% to 14.1% and 8.5% to 11.4%, respectively. However, median prices are projected to grow positively, with Illinois prices increasing by 8.4% to 9.1% and Chicago PMSA prices rising by 7.0% to 7.1%. The pending home sales index shows a slight annual increase, suggesting a mixed market outlook.

Special Topic

Economic Indicator - Six Reasons a Recession is Unlikely

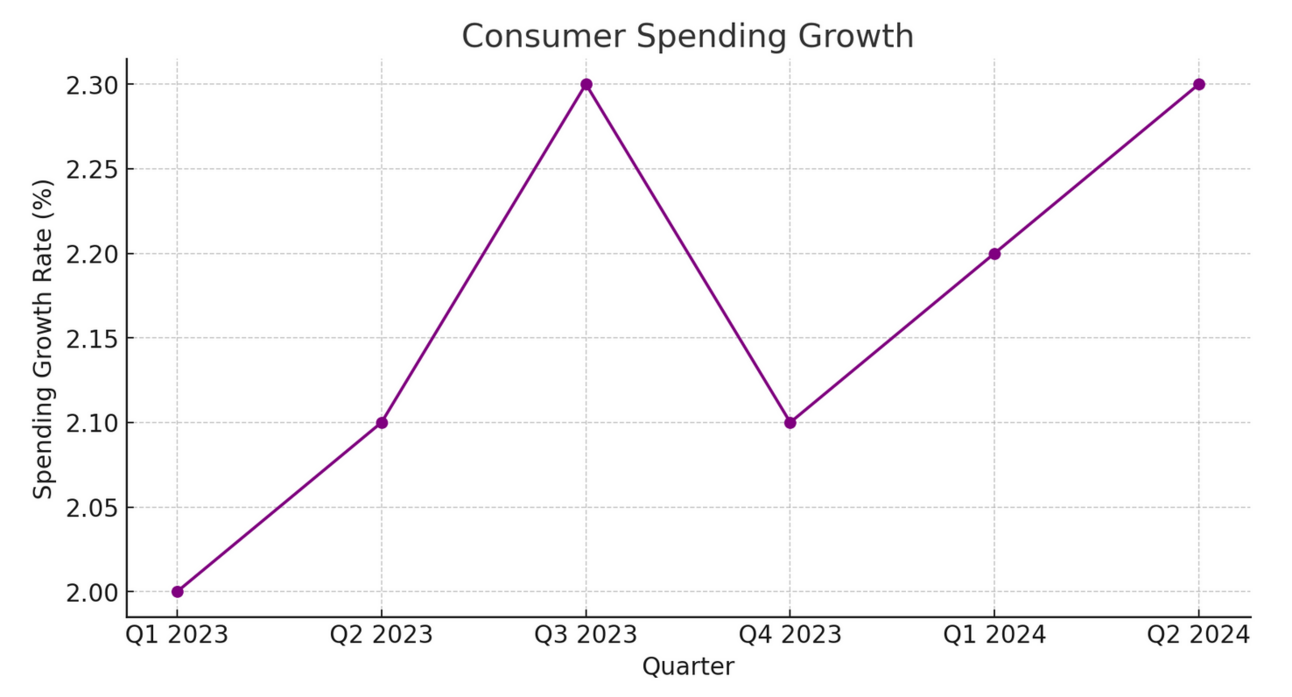

The current economic landscape, despite some challenges, shows signs of stability and potential growth. The 30-year mortgage rates have hovered around 7%, impacting housing affordability, yet the labor market remains relatively strong with a rise in labor force participation. GDP growth surged to 2.8% in Q2 2024, and consumer spending continues to support economic activity with a 2.3% growth rate. While job creation has slowed and job openings have declined, corporate profit margins are set to reach their highest level since 2021, indicating resilience in the business sector. As the Federal Reserve prepares to cut interest rates, the outlook remains cautiously optimistic. Few reasons below

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.