Mortgage & REITS

30-Yr Fixed RM | 6.49% | - 0.04$ |

15-Yr Fixed RM | 6.00% | - 0.13% |

30-Yr FHA | 5.98% | - 0.07% |

30-Yr Jumbo | 6.68% | - 0.04% |

7/6 SOFR ARM | 6.42% | - 0.03% |

30-Yr VA | 6.00% | - 0.07% |

Average going rates as of Aug 20 2024

New? Join our newsletter – no cost!

🏛️ Economic Rundown

SCE Labor Market Survey Shows Sharp Increase in Job Seekers.

The expected likelihood of moving to a new employer increased to 11.6% from 10.6% in July 2023, while the average expected likelihood of becoming unemployed rose to 4.4% from 3.9% in July 2023. The current reading is the highest since the series started in July 2014.

The average expected likelihood of receiving at least one job offer in the next four months increased to 22.2% from 18.7% in July 2023. The average expected likelihood of receiving multiple offers in the next four months rose to 25.4% from 20.6% in July 2023.

Conditional on expecting an offer, the average expected annual salary of job offers in the next four months declined to $65,272 from $67,416 in July 2023, though it remains significantly higher than pre-pandemic levels. The decline was broad-based across age and education groups.

🎢 Stock Exchange

S&P 500 wobbles as Wall Street struggles to maintain comeback’s momentum

Market Pullback: After eight consecutive gains, the S&P 500 and Nasdaq Composite paused, with the S&P 500 down 0.2% and Nasdaq shedding 0.4%. The Dow dipped 61 points.

Volatility Drop: The CBOE Volatility Index (VIX) dropped from 65 on August 5th to around 15, marking a sharp decline in market fear since the S&P 500's worst session of 2022.

Fed Focus: Investors await the Federal Reserve's Jackson Hole Symposium, where Chair Jerome Powell's remarks may provide clues on the next interest rate decision, amidst a strong market recovery.

🎙️ RE Spotlight

Apartments Out of Reach for Many Teachers, Miami Is Hardest

Housing Affordability Crisis for Teachers: On average, teachers can only afford 14.3% of homes within commuting distance of their schools, a slight dip from 14.4% last year and a significant decline from 39.1% in 2019.

Rent Affordability Shows Minimal Improvement: Teachers can afford 47.9% of rental apartments near their schools, up from 40.7% last year, but this still leaves many struggling to find affordable housing options.

Miami Among the Worst for Teachers: In Miami, teachers can afford only 0.2% of apartments within commuting distance, making it one of the least affordable cities for educators.

Renting Now Beats Buying in All Major US Cities, Some Areas Diminishing

Renting Surpasses Buying in All Major Metros: As of July, renting a starter home is more financially advantageous than buying across all 50 largest U.S. metropolitan areas, marking a significant shift from last year when only 47 metros favored renting.

High Costs of Homeownership: On average, buying a starter home costs $1,067 more per month than renting, with cities like Austin, Texas leading the way, where buying is 144.4% more expensive than renting.

Narrowing Rent-Buy Gap: The financial gap between renting and buying has narrowed by two percentage points this year, from 63.3% in 2023 to 61.3% in 2024, driven by a slight decrease in home prices and an increase in affordable listings.

🏰 State Zone

A Record 60,000 home buyers backed out of deals in July. Here’s why.

July Cancellations Surge: Approximately 59,000 home-purchase agreements, or 16%, were canceled in July, marking the highest share of cancellations for any July on record since 2017.

Market Impact: Cancellations were most prevalent in Tampa, Fort Lauderdale, and San Antonio, where new home inventory has surged, prompting sellers to cut prices.

Buyers Hesitate: Despite falling mortgage rates, high home prices and political uncertainty are causing many potential buyers to delay their purchases, awaiting clarity on future market conditions.

🏕️ Niche-RE

“I Treat Houses Like Hospitals. You Get In, You Get Out”: Grant Cardone Says

Renting Over Buying: Despite a $4 billion net worth, Grant Cardone prefers renting over homeownership, viewing a house as a financial liability rather than an asset.

Income Over Ownership: Cardone emphasizes cash flow and passive income, investing in income-generating properties instead of owning a home, which he likens to a "financial prison."

Contrarian Investment Approach: Cardone predicts a future where ownership declines across various sectors, reinforcing his belief that real estate should generate income, not just be a place to live.

👉 More Stories

High supply is an issue in the multifamily market – but The Beach Company isn't necessarily sinking in it.

American Real Estate Association ready to collect dues, lays out road map offering basic @ $20 and founding member @ $1500 fees.

Home Team Vacation Rentals Expands Nationwide, Elevating Short-Term Rental Management Across Key U.S. Markets

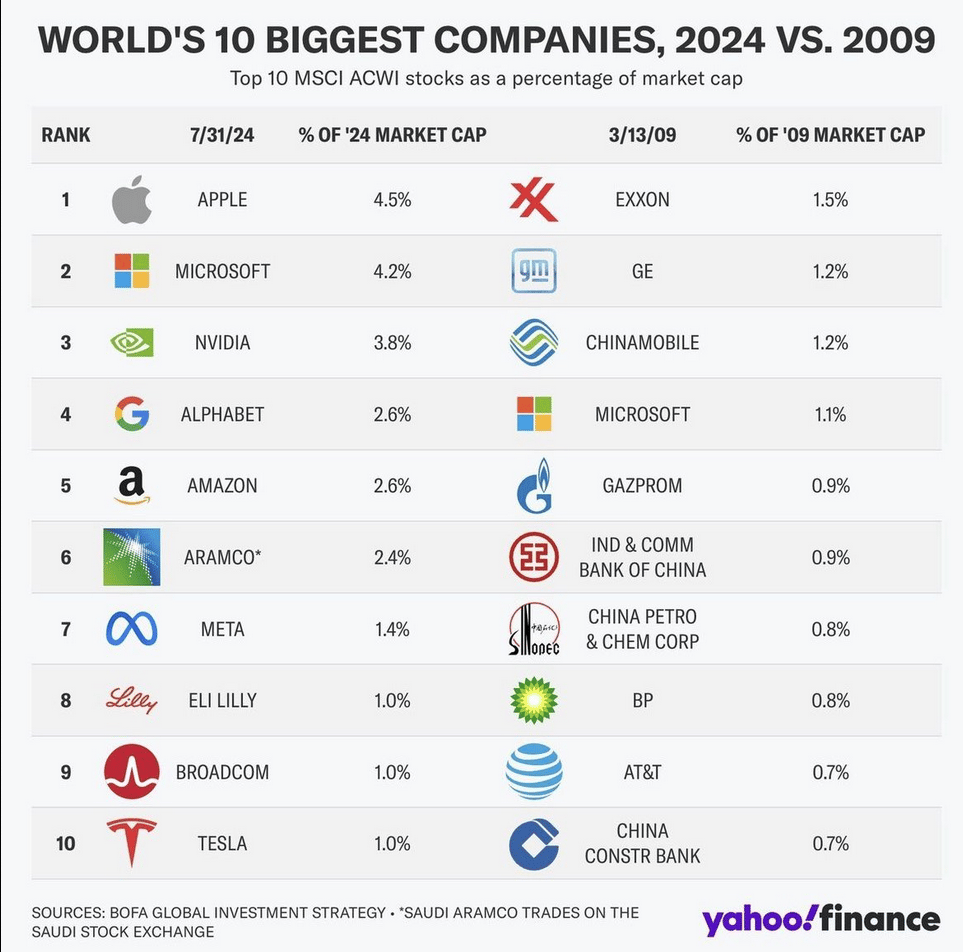

🖼️ Chart-Tastic

👾 Interesting in Social

🌍 Dwelling of the Day

1,624-square-foot multi-unit house built in 1961 has changed hands on July 19 2024 for $2.4M

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.