Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - The U.S. faces a severe affordable housing shortage, with 3.7–4.5 million homes needed, exacerbated by rising mortgage rates, material costs, and labor shortages. Private equity's growing share of affordable homes further limits supply. Meanwhile, luxury home sales increased 9% YoY in 2024, with affluent buyers opting for cash payments in markets like Los Angeles and Colorado Springs. Climate resiliency features are influencing home values, as homes with storm-proof features can see a 1.5% price premium. The senior housing market also faces challenges, with aging boomers demanding more premium housing options.

Quote of the day - “Navigating these shifts is key to future market success.”

If you missed yesterday’s newsletter, click here

Mortgage & Stocks

30-Yr Fixed RM | 6.96% | - 0.06% |

15-Yr Fixed RM | 6.41% | - 0.03% |

30-Yr Jumbo | 7.30% | - 0.05% |

7/6 SOFR ARM | 6.89% | - 0.05% |

30-Yr FHA | 6.32% | - 0.07% |

30-Yr VA | 6.35% | - 0.06% |

Average going rates as of Feb 20 2025

S&P 500 | 6,117.52 | - 0.43% |

Gold | 2,952.70 | + 0.57% |

Bitcoin USD | 98,358.88 | + 2.21% |

Numbers as of Feb 20 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Affordable Housing Is A Credit Market Problem—For Builders And Buyers

Severe Housing Shortfall: The U.S. is facing a supply gap of 3.7–4.5 million homes, with millennials forming new households at record rates. Private equity firms bought 26% of affordable homes in 2023, potentially increasing to 40% by 2030, fueling supply scarcity.

Credit Market Dynamics: Affordable housing availability remains impacted by rising fixed mortgage rates (currently 6.94%) and mortgage insurance costs. Median home prices are 160% higher than in 2000, and homeowners are holding onto low-interest mortgages, limiting inventory turnover.

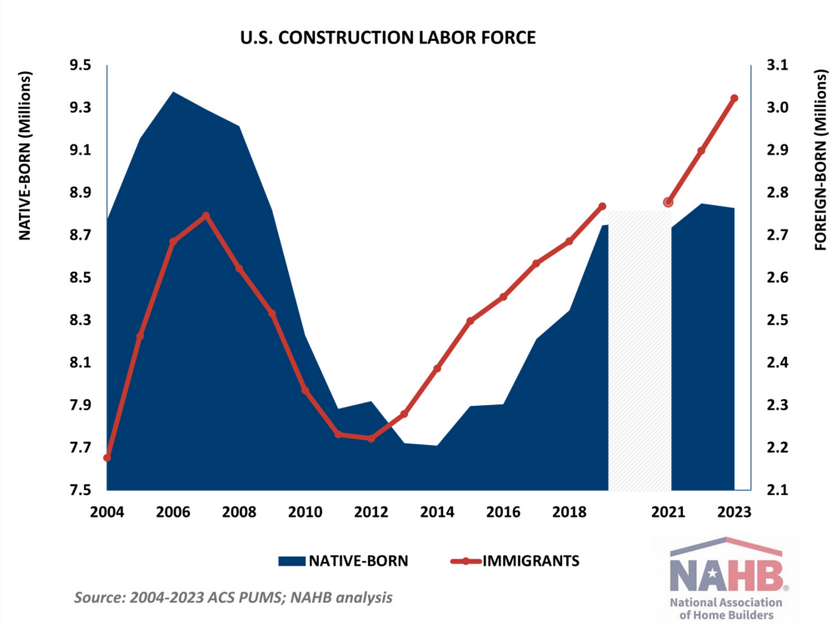

Labor and Material Constraints: Rising land and material costs, labor shortages, and policy uncertainty—such as potential tariffs and deportations—are hindering new construction. The NAHB-Wells Fargo Housing Market Index plummeted in January 2025, reflecting strained credit conditions and rising economic pressures.

Affordable housing remains in crisis, driven by tight credit conditions and structural supply issues.

🎢 Impact on Real Estate

Climate Resiliency Flips The Housing Market Upside Down

Post-Wildfire Housing Shortages Deepen Affordability Crisis: Zillow’s latest data reveals that LA’s ongoing housing shortage—already at 337,000 units—combined with wildfire displacement has left just 1.6% of listings affordable for median-income buyers. Rental affordability remains dire, with renters spending 36.5% of income—6th highest in the nation at $2,954/month.

Insurance Hikes Spark Migration Trends & Regional Shifts: In high-risk areas, insurance premiums surged from 8% to 20% of mortgage costs (2013-2022), with cities like Miami seeing a 322% increase. First Street’s projections estimate that over 5.2 million Americans will begin relocating to safer regions by 2025, with 55 million expected by 2055. This climate-driven migration could create new regional housing trends and impact property values nationwide.

Resiliency Features Drive Buyer Demand & Price Premiums: Homes with climate-resilient features—such as backup generators and fire protection—can boost sale prices by 1.5%, according to Zillow data. Yet, buyers weigh risk factors, as certain features (e.g., tornado-safe rooms) may lengthen the time on market due to perceived climate vulnerability. Communities like Babcock Ranch, FL, are emerging as models for storm-proof housing innovations, setting new market standards for climate preparedness.

🎙️ RE Spotlight

Million-Dollar Home Sales Are Growing—and Affluent Buyers Are Paying in Cash

National luxury home sales up 9% YoY: Nearly 300,000 homes sold above $1 million in 2024, driven by tech wealth, military hubs, and biotech sectors in cities like Seattle, Colorado Springs, and Durham-Chapel Hill.

California’s coastal markets lead the charge: San Luis Obispo recorded a 38.6% surge in million-dollar home sales, while Los Angeles saw nearly 50% of luxury purchases paid in cash, insulating buyers from rising mortgage rates.

Colorado Springs’ tech boom fuels luxury growth: With a 20% rise in tech wages over five years and major firms expanding operations, 14.2% of homes sold in 2024 surpassed $1 million, a 6.3 percentage-point jump YoY.

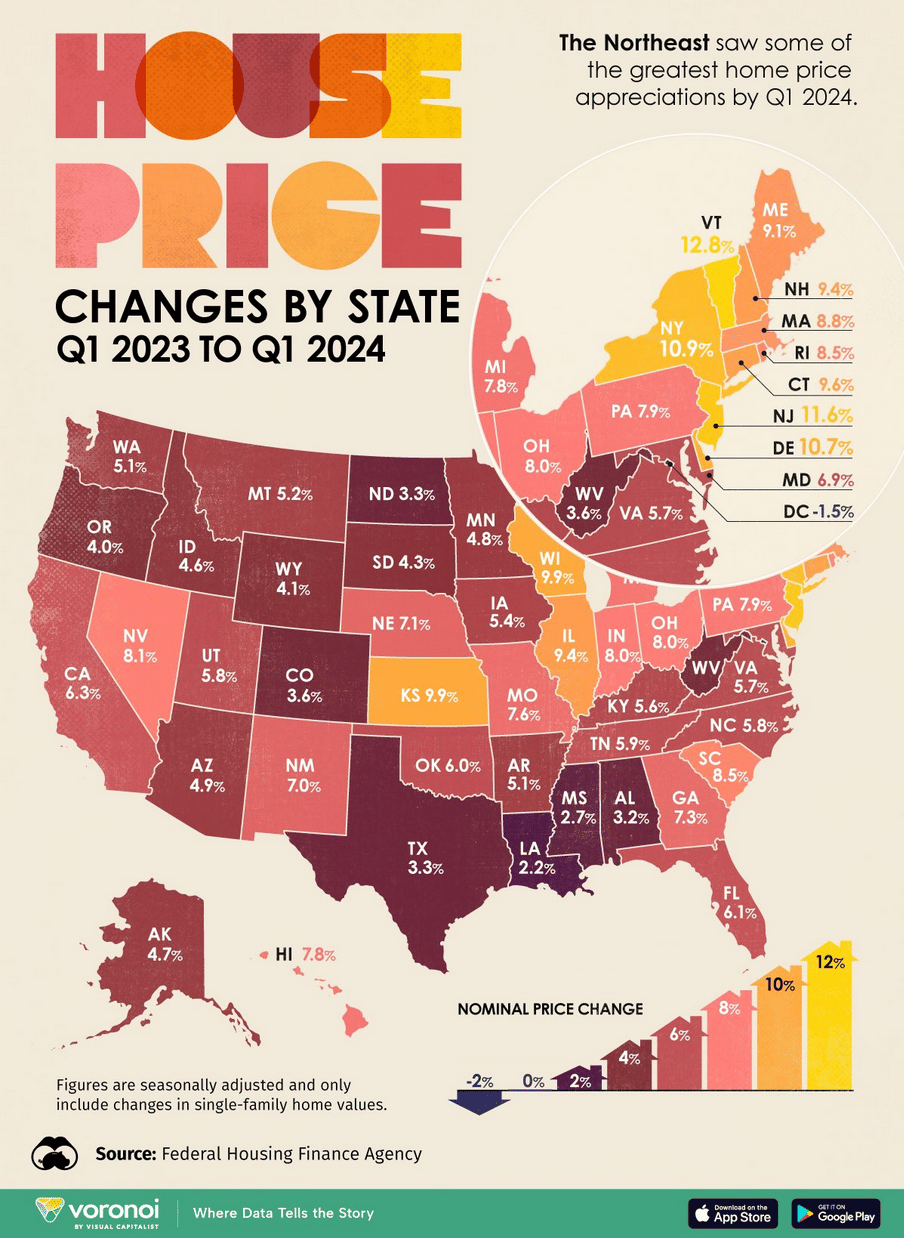

U.S. Housing Market Gained $2.5 Trillion in Value in 2024

Trillion-Dollar Club: Top 10 Metros By Aggregate Home Value (2024)

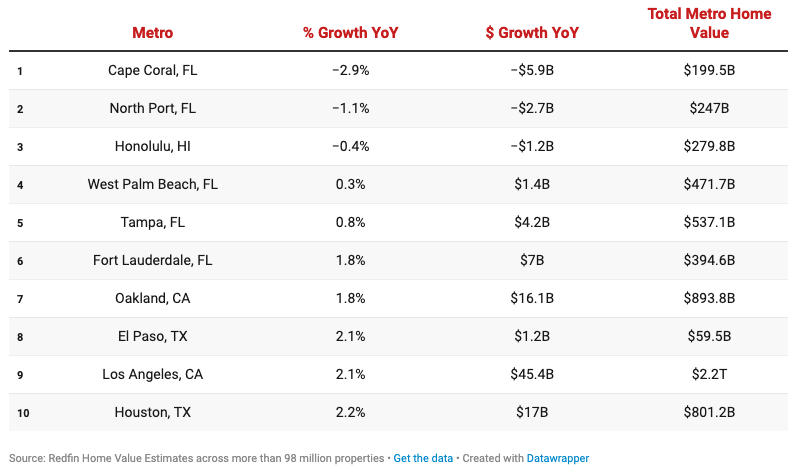

Metros With Slowest Growing Total Home Value (2024)

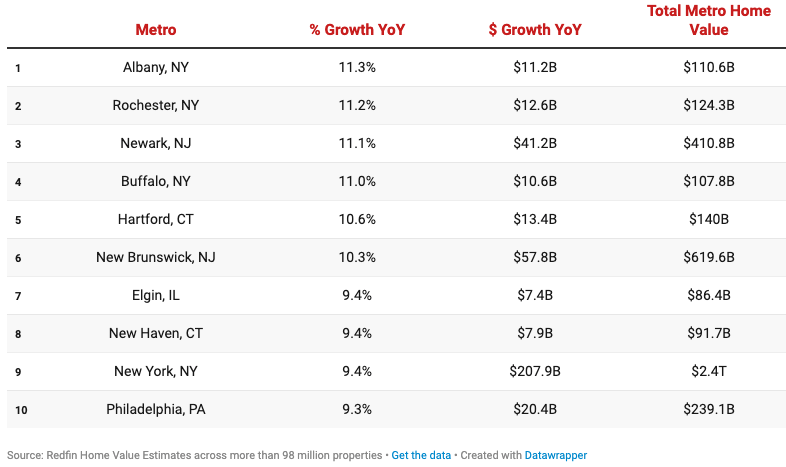

Metros With Fastest Growing Total Home Value (2024)

🏰 RE State Zone

NC’s real estate market: Key trends shaping 2025 and beyond

North Carolina faces a 2.2M job opportunity tied to housing needs: Addressing the state’s housing inventory gap could drive $489B in economic activity as population and job growth surge.

Office-to-housing conversions offer a 40% vacancy solution: Cities like Winston-Salem are seeing historic office vacancies, opening doors for cost-efficient residential conversions, pending public incentives.

Rising rents expected to increase by 10-15% in 2025: Land and construction costs are limiting new development, intensifying the squeeze on middle-income households amid record demand for housing.

🏕️ Niche-RE

Aging Boomers Are About to Rekindle the Senior-Housing Market

Booming Demand vs. Short Supply: By 2030, the U.S. population aged 80+ is expected to rise by over 4 million, but senior housing development rates will leave a 369,000-unit shortfall, NIC MAP reports.

Shift from Development to Acquisitions: Developers like Welltower spent $6.2 billion on acquisitions in 2024, a 5% increase from 2023, as construction costs and high interest rates make new builds less viable.

Luxury Leads the Way: Wealthier baby boomers, with 40% able to afford private senior housing, drive demand for premium projects featuring golf cart paths, private wine rooms, and high-end amenities.

Government Downsizings Create Challenges for Senior Housing

Funding Freeze and Staff Cuts: The Trump administration's freeze on funding and rumors of layoffs at the Department of Housing and Urban Development (HUD) threaten the senior housing sector's ability to close deals and expand.

Rising Demand vs. Slowing Growth: With 50% of Americans aged 80+ expected to increase in the next decade, delays in deal closures could worsen the ongoing shortage of senior housing.

Industry Resilience Amid Crisis: Despite challenges, the senior housing industry remains adaptable, with industry leaders like Steve Ervin confident that the sector will ultimately overcome political disruptions.

Senior Housing Industry Struggles Amid Political Turmoil: Funding Cuts and Workforce Reductions Impact Growth

Virginia’s housing market sees increase in closed sales activity in October

Surge in Closed Sales: Virginia's housing market saw 9,408 closed sales in October 2024, a 12.5% increase compared to the previous year, driven by a rise in new contracts in September when mortgage rates dropped to the low 6% range.

Rising Inventory: Active listings increased by 16% from last year, with 20,042 homes on the market at the end of October, a trend seen across 74% of Virginia’s local markets.

Price Growth Continues: The statewide median sales price rose by $25,000 to $415,000, as tight supply and high demand keep upward pressure on prices despite longer days on market.

October 2024 Virginia Home Sales Report, click here

🖼️ Chart-Tastic

👾 Interesting in Social

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.