Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “From rising rents to resilient student housing, today’s real estate challenges remind us: the key to opportunity lies in adapting to shifting foundations”

In today’s edition - Dive into the December CPI report, which signals persistent inflation as the Fed navigates 2025 rate challenges. Explore the transformative impact of new housing laws on affordability, the cooling rental markets in Sun Belt cities, and the rising demand for data centers in real estate. Plus, discover why Urbana-Champaign is a student housing hotspot and how strategic transactions are reshaping this resilient asset class. Finally, examine how the national median rent is shifting amid these evolving market dynamics.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.25% | - 0.01% |

15-Yr Fixed RM | 6.58% | - 0.01% |

30-Yr Jumbo | 7.44% | - |

7/6 SOFR ARM | 7.14% | + 0.01% |

30-Yr FHA | 6.59% | + 0.02% |

30-Yr VA | 6.60% | + 0.01% |

Average going rates as of Jan 14 2024

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

December CPI Signals Stubborn Inflation as Fed Navigates 2025 Rate Path

December CPI to Reflect Persistent Inflation Pressures:

Core inflation, expected at 3.3% YoY, continues to be driven by shelter and services costs, with no significant moderation yet.

Federal Reserve's Dilemma Amid Economic Signals:

Inflation remains above the Fed's 2% target, limiting scope for rate cuts.

Economists are divided on 2025 rate actions; predictions range from three cuts to no cuts, with a potential for hikes if core inflation stays above 3%.

Political and Market Uncertainties Add Complexity:

Policies proposed by President-elect Trump, including tariffs and corporate tax cuts, may reignite inflation risks.

Markets currently price a 40% chance of rate cuts starting in June, highlighting uncertainty in the Fed's approach to economic cooling.

🎢 Impact on Real Estate

New Housing Laws Transforming Affordability & Development in 2025

Diverse Legislative Focus Across States:

States are addressing housing crises through varied approaches like tenant protections, ADU facilitation, and zoning reform.

Illinois and Minnesota outlaw landlord retaliation; Idaho seals certain eviction records; California expedites ADU approvals near transit zones.

Accessory Dwelling Units (ADUs) as a Housing Solution:

Bipartisan support for ADU-friendly laws, with states like Arizona, Nebraska, and California leading.

Legislation focuses on removing permitting barriers and integrating ADUs into coastal zones and multifamily properties.

The Challenge of Affordability:

New bills aim to align housing supply with affordability, such as Hawaii's plan to optimize rental housing funds and Oregon's proposed rent control for mobile home parks.

A slew of new housing laws take effect this month to streamline building, protect tenants. Accessory dwelling units, or ADUs, are finding bipartisan support.

🎙️ RE Spotlight

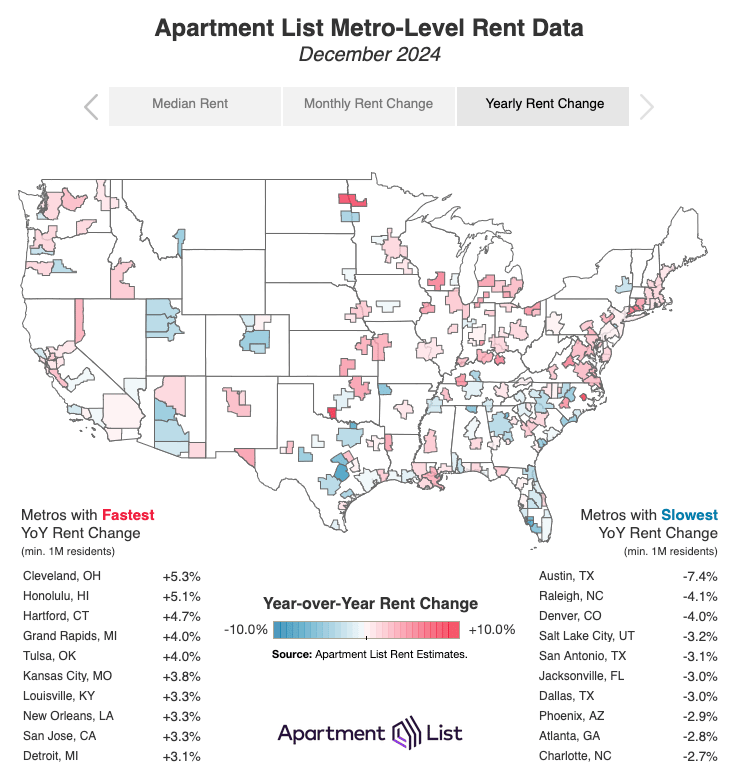

Apartment construction cools rents in some regions

Historic Apartment Boom Impact: With a record 67,000 units completed in August 2024 alone, Sun Belt cities like Austin and Atlanta have seen rent drops of 7–13% since 2022. Yet, national rents remain high, with a median of $1,373, only 2% below the 2022 peak.

Regional Disparities Persist: Despite declines in Sun Belt states, rents in the Northeast and Midwest have risen sharply, with states like North Dakota (+14%) and Alaska (+13%) leading. Limited new construction—under 1 unit per 1,000 residents—fuels these increases.

Affordability vs. Location: Experts debate the shortage’s scope (1.5M–5.5M homes) and its resolution. While Freddie Mac cites a 3.7M gap, some argue targeted urban development and wage growth are critical for addressing affordability where demand is highest.

For affordability to improve, housing has to be built in the places people want to live.

Our Take:

The sharp rent declines in Sun Belt metros underscore the power of supply, yet the broader picture is a tale of two housing markets. For real estate stakeholders, the focus must shift toward strategic, targeted developments in high-demand urban areas to balance supply and affordability while addressing wage disparities for low- and middle-income renters.

🏰 RE State Zone

Surprising Illinois City Becomes the Hottest Housing Market for the First Time - Check out Top 20

🏕️ Niche-RE

Global data center demand surges despite supply and power constraints

Unprecedented Growth Forecast: The global data center sector is projected to grow at a 15-20% CAGR through 2027, with 10 GW breaking ground in 2025. This expansion is creating high-value opportunities for real estate developers near tech hubs.

Energy and Sustainability Challenges: AI workloads requiring up to 250 kW per rack are reshaping site selection, with proximity to alternative energy sources like SMRs and liquid cooling infrastructure driving real estate demand in specific regions.

Investment and Real Estate Synergy: Record financing in 2025 will amplify demand for data center-ready properties, especially in metros like Northern Virginia and London. Joint ventures between real estate firms and tech players will thrive in emerging markets, capitalizing on location-driven value.

Data center capacity (gigawatts) 2023-2027

Student housing complex near University of Illinois Urbana-Champaign trades hands

High-Occupancy Market: Urbana-Champaign’s student housing boasts a 95% occupancy rate, with UIUC enrollment reaching 56,000 students, signaling robust demand for purpose-built accommodations.

Prime Location Advantage: Campus Circle, located 0.10 miles from campus, capitalizes on proximity to key university facilities, ensuring consistent tenant demand and strong market positioning.

Strategic Transaction: JLL facilitated the sale and secured a five-year fixed-rate Freddie Mac loan, showcasing the appeal of high-quality student housing assets to institutional investors in growth markets.

Our Take:

The sale of Campus Circle underscores the rising interest in student housing as a resilient asset class. With UIUC’s growing enrollment and unmet housing demand, opportunities abound for real estate investors to develop or reposition assets near thriving campuses. Strategic partnerships, like those enabled by JLL, will be key to navigating financing and capturing value in high-demand markets.

🖼️ Chart-Tastic

The national median monthly rent closed out 2024 at $1,373 in December, after declining by 0.6 percent, or $8, from the prior month. Year-over-year rent growth nationally also currently stands at -0.6 percent, meaning that the typical apartment is currently renting for slightly less than it was one year ago.

🌍 Dwelling of the Day

New Jersey Luxury Timeless Masterpiece in Moorestown, New Jersey

6 Bed, 11 Bath, 11,250sqft

Asking $5.5M

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.