Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Success is the sum of small efforts repeated daily”

In today’s edition - Despite job cut speculations, D.C.'s housing market shows stability, with no surge in listings. Florida and Texas continue to dominate with strong population growth, while smaller states like New Jersey are also on the rise. Tariffs on Chinese imports are raising construction costs, impacting homebuilders and affordability. "In real estate, location and timing are everything—make them count." Stay informed on national trends, inventory shifts, and the growing influence of tariffs on the housing market to guide your next investment.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.96% | - 0.08% |

15-Yr Fixed RM | 6.41% | - 0.07% |

30-Yr Jumbo | 7.32% | - 0.07% |

7/6 SOFR ARM | 6.85% | - 0.10% |

30-Yr FHA | 6.33% | - 0.12% |

30-Yr VA | 6.35% | - 0.12% |

Average going rates as of Feb 14 2025

S&P 500 | 6,137.00 | + 0.11% |

Gold | 2,906.40 | + 0.20% |

10 Yr T-Note | 109.19 | - 0.11% |

Numbers as of Feb 14 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Americans owe $1.21 trillion in credit card debt, a record high

Credit Card Debt Climbs to $1.21 Trillion: U.S. credit card debt increased by $45 billion in Q4 2024, marking a 7.3% year-over-year jump as inflation pressures force consumers to rely more on credit.

Delinquencies on the Rise: Over 7% of credit card debt became seriously delinquent (90+ days overdue) in Q4 2024, with total U.S. debt delinquencies reaching 3.6%, highlighting growing financial strain.

Mortgage Debt Leads Total Borrowing Surge: Mortgage debt hit $12.6 trillion in Q4 2024, up $353 billion YoY, accounting for the largest share of America’s $18 trillion total debt burden

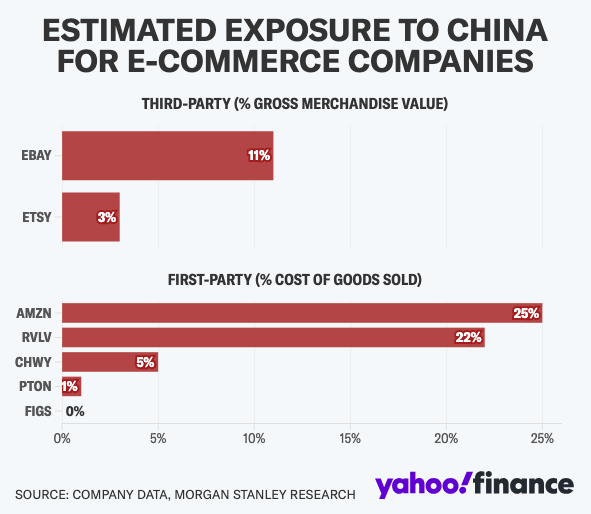

Why Trump reciprocal tariffs should terrify bulls in Apple, Amazon, and other tech plays

Amazon Faces 40% China Supply Exposure: With two-thirds of its merchandise being non-grocery and 40% tied to Chinese imports, Amazon (AMZN) may see profits erode under prolonged tariffs—despite a 35x forward earnings valuation vs. the S&P 500's 22x.

Apple’s 90% China Manufacturing Dependency: Evercore estimates Apple (AAPL) could see a 3%-4% EPS impact if 10% tariffs remain. Nearly 90% of Apple's production is tied to China, adding major exposure to trade war volatility.

Tech Giants’ Wide Moats Under Threat: Nvidia (NVDA), Amazon, and Microsoft (MSFT) may boast unstoppable business models, but tariffs and rising import costs could chip away at premiums investors pay for their stocks.

🎢 Impact on Real Estate

From return-to-office to federal layoffs,The impact of job cuts on the DC housing market

D.C. Housing Market Holds Steady Amid Job Cuts Speculation: Despite alarming social media claims, Altos Research data shows no significant inventory surge in the D.C. Metro housing market. Active listings remain near pandemic-era lows, debunking fears of a sudden crash.

National Inventory Trends Reflect Recovery, Not Crisis: National inventory rose to 637,991 homes last week, well above the 2022 low of 240,497, signaling gradual normalization. By contrast, D.C.’s housing inventory remains stable, with no explosive growth detected.

Price Cuts and Federal Job Cuts Under Scrutiny: Nationally, 33% of homes saw price cuts in early 2025, aligning with long-term averages. In D.C., price-cut percentages remain below the national level, with no immediate stress visible—though job cuts could change this dynamic.

Key Data Highlights for Contextual Understanding:

Weekly Inventory (Feb 7-14, 2025): Rose from 632,367 to 637,991 nationally.

Price Cuts (2025 vs. 2024): 33% of homes saw cuts nationally, slightly higher than 2024’s 30%.

New Listings (D.C. vs. National): D.C.'s data mirrors prior years, contrasting claims of an influx.

🎙️ RE Spotlight

Top 15 States With the Fastest-Growing Populations

Washington, D.C. Leads with 2.2% Population Growth: Despite being a district, D.C. saw the fastest growth in 2024. Its 2.2% increase highlights the area’s ongoing attractiveness, driven by employment and cultural factors.

Florida and Texas Continue to Dominate: Florida grew 2%, and Texas expanded by 1.8%, continuing their post-pandemic magnet status. With 31.3M residents, Texas remains the second-most populous state and is projected to overtake California by 2045.

Surprise Growth in Smaller Coastal States: New Jersey and Washington state each grew by 1.3%, with Massachusetts rounding out the top 15 at 1%. New Jersey now ranks as the 11th-most populous state with 9.5M residents, highlighting its robust appeal.

Home Builders Say Trump Tariffs Are Raising Construction Costs

Material Costs Soar Amid Tariffs: Developers like Bentley Zhao report a 10% price hike on Chinese-imported goods, adding $375,000 to condo budgets. Escalation clauses and unpredictable supply chains are forcing builders to pass costs onto homebuyers.

Housing Affordability at Risk: Rising construction costs could further tighten the already strained housing market. With new home builds threatened and inflation risks looming, buyers face even higher barriers to entry.

Supply Chain Uncertainty Intensifies: Builders like Spencer Levine and Chris Morrison are locking in bids as suppliers shorten price quote periods. A lack of clarity in tariff policies adds unpredictability to long-term planning.

🏰 Pro Tip - Home Buyers/Sellers

Ask a Realtor: What home improvements should I bother making before selling my house?

Brighten with New Light Bulbs

Swap out warm bulbs for cool white or daylight bulbs to make your home feel larger, brighter, and modern. This simple change can enhance listing photos and open house impressions without breaking the bank.Minor Kitchen Updates Matter

Freshen up your kitchen with new curtains, hand towels, and refaced or painted cabinets. Neutrals like white or gray are crowd-pleasers, making the space more inviting without a full renovation.Deep Clean for a Lasting First Impression

A spotless home sends the message that it’s well-maintained. Clean windows, scrub appliances, and refresh bathroom caulking to give your home that move-in-ready feel buyers love.Front Door & Curb Appeal Boost

A fresh coat of paint and a modern handle for your front door can transform your home’s exterior. Add basic landscaping for a polished look that sets a positive tone the moment buyers arrive.Staging for a Competitive Edge

Decluttering and staging your home with clean, simple decor helps buyers envision living there. Every detail—down to new towels—makes a difference in selling fast.

Pro Tip: Focus on updates that make your home more functional and visually appealing to the broadest audience. Simple, budget-friendly changes can leave a lasting impression!

Do you want me to include More Pro Tips in future editions, Reply to let me know.

🏕️ Niche-RE

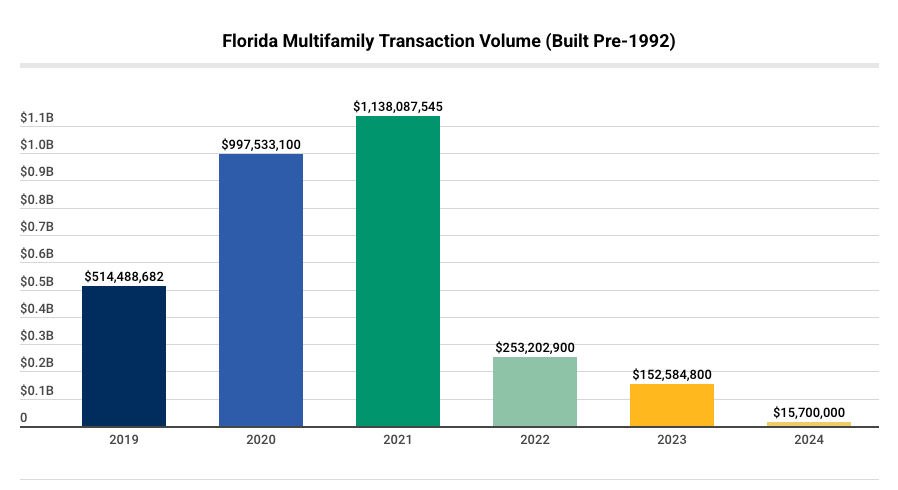

Sales of older multifamily complexes in Florida have fallen

Stricter Codes for Hurricane Resilience: Florida's building codes, strengthened after Hurricane Andrew in 1992 and the Surfside collapse of 2021, have led to improved safety for multifamily properties, requiring enhancements like wind resistance and flood mitigation. Older buildings are increasingly facing challenges due to deferred maintenance and compliance costs.

Aging Multifamily Stock Faces Financial Strain: Properties built before 1992 are at risk of declining values and higher maintenance costs due to outdated designs and tougher inspection regulations. Investors are capitalizing on the opportunity to redevelop these properties, contributing to a market shift.

Post-2002 Properties Show Greater Resilience: Multifamily buildings built after the Florida Building Code (FBC) was enacted benefit from better resilience to hurricanes and flooding. These properties offer a relatively safer investment, with lower repair costs and reduced insurance premiums, though they still face financial pressures from rising costs.

🖼️ Chart-Tastic

👾 Interesting in Social

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.