Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - "In times of economic complexity, real estate remains a mirror to broader trends— It's not just about market conditions but about how people adapt and redefine stability”

In today’s edition - As 2025 unfolds, the U.S. real estate market shows signs of resilience with increased homebuyer demand and rising mortgage rates. Meanwhile, China faces deepening deflationary pressures, signaling potential global risks. "In uncertain times, real estate remains a solid investment, but adaptability is key," says market expert John Doe. Stay informed with the latest on mortgage rates, home price growth, and economic trends shaping the housing market today.

If you missed yesterday’s newsletter, click here

Rates

30-Yr Fixed RM | 7.15% | - 0.02% |

15-Yr Fixed RM | 6.51% | - 0.03% |

30-Yr Jumbo | 7.38% | - 0.01% |

7/6 SOFR ARM | 6.99% | - 0.02% |

30-Yr FHA | 6.48% | - 0.02% |

30-Yr VA | 6.50% | - 0.02% |

Average going rates as of Jan 9 2024

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

China’s Zero-Inflation Troubles Getting Harder to Ignore: A Critical 2025 Outlook

Deflation Deepens as Factory Prices Drop: China reported its 27th consecutive month of falling factory prices in December, with a 2.3% year-on-year decline and near-zero consumer price inflation (0.1%), intensifying concerns about "Japanification" in the world's second-largest economy.

Bond Yields Highlight Pessimism: The spread between Chinese and U.S. 10-year bond yields widened to 300 basis points, reflecting investor doubts about Beijing's ability to counter deflation despite recent stimulus measures.

Global Risks Mount Amid U.S.-China Tensions: President-elect Trump's tariff threats, alongside a weakening yuan and persistent property and employment crises, compound uncertainty for China's economy in 2025, risking further capital outflows and economic instability.

Stock Market : Wall Street slumps as good news for the economy is once again bad for stocks

Rising Yields Trigger Stock Market Decline: The S&P 500 fell 1.1%, the Dow dropped 178 points, and the Nasdaq tumbled 1.9%, as strong job market and business activity reports pushed the 10-year Treasury yield to 4.69%, making bonds more attractive than equities.

Big Tech Faces Pressure Amid AI Frenzy: Nvidia's 6.2% loss led a tech sell-off, pulling down other heavyweights like Amazon, Tesla, Apple, and Microsoft, as high yields hurt valuations of growth stocks.

Corporate Moves in Focus: Cintas rose 2% on its acquisition offer for UniFirst, while Getty Images and Shutterstock gained 24.1% and 14.8%, respectively, after announcing a $3.7 billion merger to expand visual content offerings.

Our Take:

Better-than-expected U.S. economic reports drove bond yields higher, reigniting Wall Street's "good news is bad news" dynamic. Investors are cautious ahead of Friday's jobs report, with Fed rate policy and inflation concerns in focus. Meanwhile, corporate deals added some positivity amid broader market losses.

🎢 Impact on Real Estate

Home Tours Rise Modestly to Start 2025, But That Hasn’t Translated to More Sales

Homebuyer Demand Inches Up: Redfin’s Homebuyer Demand Index rose 2% month-over-month and year-over-year, signaling renewed buyer interest as the new year begins, despite daily mortgage rates hitting a seven-month high.

Sellers Step Back: New listings dropped 2.5%, marking the sharpest decline in over a year, while pending home sales fell 3.1% compared to the same period last year, reflecting the market's hesitation to fully rebound.

Buyers Compete Despite Challenges: High-demand areas are seeing multiple offers within 24 hours, with buyers waiving contingencies to stay competitive. Some buyers are motivated by fear of rising home prices or optimism about future rate declines.

Our Take:

As 2025 kicks off, more house hunters are hitting the market, adapting to 7% mortgage rates and taking advantage of increased inventory compared to prior years. However, new listings and pending sales remain subdued, highlighting continued uncertainty. Experts suggest serious buyers act now, as competition for desirable listings could intensify in the coming months.

🎙️ RE Spotlight

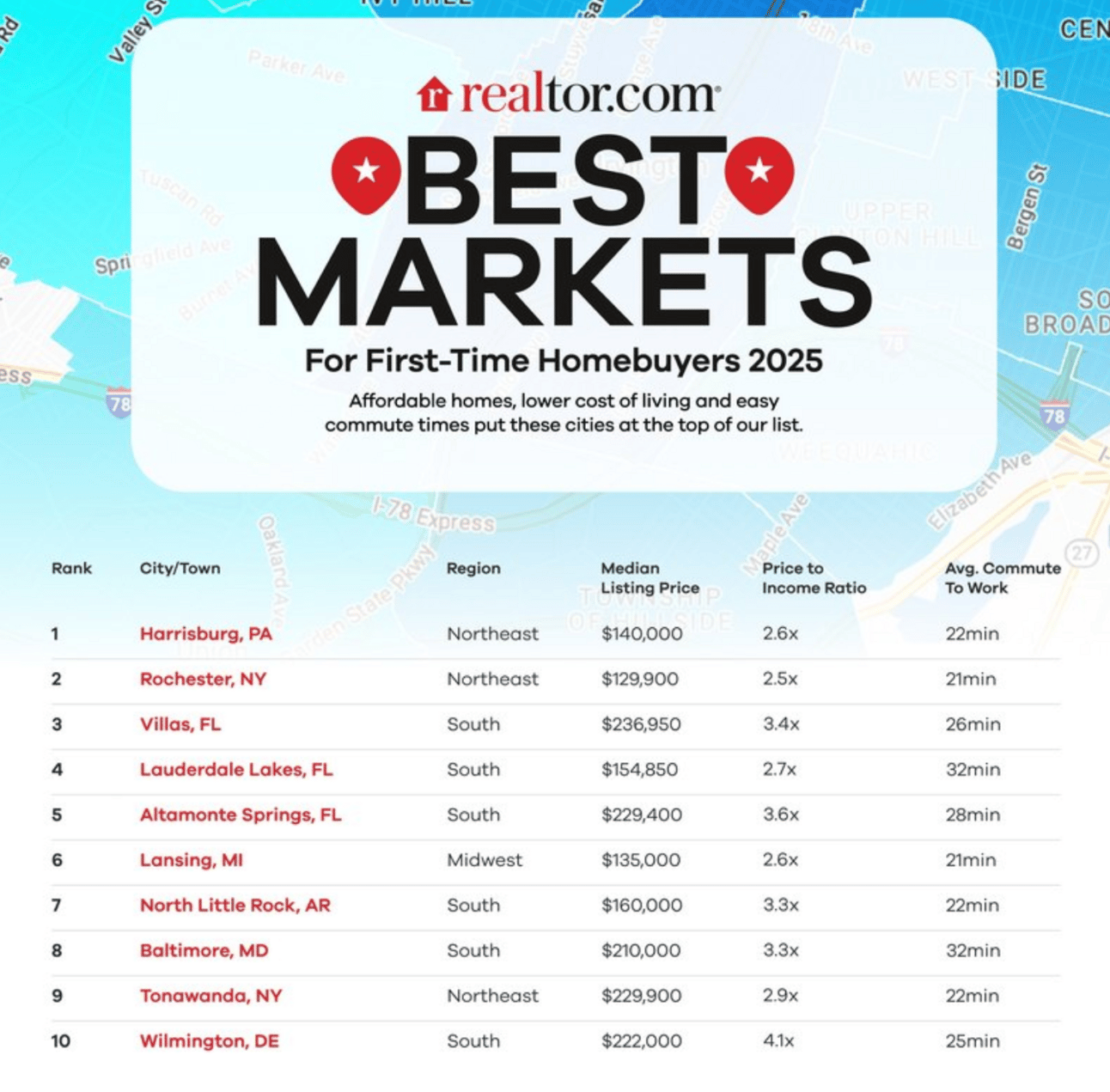

The Best Markets for First-Time Homebuyers in 2025 Revealed

Harrisburg, PA, Leads the Pack: With a median home price of $140,000, Harrisburg offers first-time buyers affordability, a strong economy, and accessible townhomes. Buyers often find owning cheaper than renting here.

Rochester, NY, Offers Budget-Friendly Living: The lowest median home price on the list at $129,900 and government grant programs make Rochester a standout choice, though limited housing supply slightly dampens its appeal.

Florida Dominates with Three Cities: Villas, Lauderdale Lakes, and Altamonte Springs offer home prices below the national median and are poised for 9%+ home price growth, making them hotspots for affordability and future gains.

Our Take:

First-time homebuyers in 2025 face steep challenges, but cities like Harrisburg, PA, and Rochester, NY, offer hope with affordable home prices, robust economies, and supportive programs. Florida, with its trio of budget-friendly hotspots, rounds out the best options. Despite high mortgage rates, easing inventory and price growth slowdown bring optimism for new buyers navigating today’s tough market.

Mortgage Rates Rise Again, to 6.93%—but Economists Predict Housing Market Conditions Will Improve

Mortgage Rates Hit a Six-Month High: Average 30-year fixed rates climbed to 6.93%, driven by strong economic performance and a rising 10-year Treasury yield. Rates are projected to average 6.3% across 2025, potentially easing affordability pressures.

Inventory and Sales to Rise: An 11.7% increase in for-sale inventory and a 1.5% uptick in home sales are expected in 2025, offering buyers more choices, particularly in spring and summer.

Home Prices to Increase Moderately: Realtor.com forecasts a 3.7% rise in home prices, spurred by slightly lower rates and improved inventory, signaling a more balanced housing market ahead.

Our Take:

The 2025 housing market is poised for gradual recovery, with mortgage rates expected to dip slightly, home sales to grow by 1.5%, and inventory levels improving. While affordability challenges remain, the forecasted 3.7% price growth and 11.7% rise in listings indicate better opportunities for buyers. As economic and job data continue to influence the Federal Reserve's policies, rate stability will be key to market momentum.

🏰 RE State Zone

Northeastern, New England States Continue to Lead US for Annual Home Price Growth in November

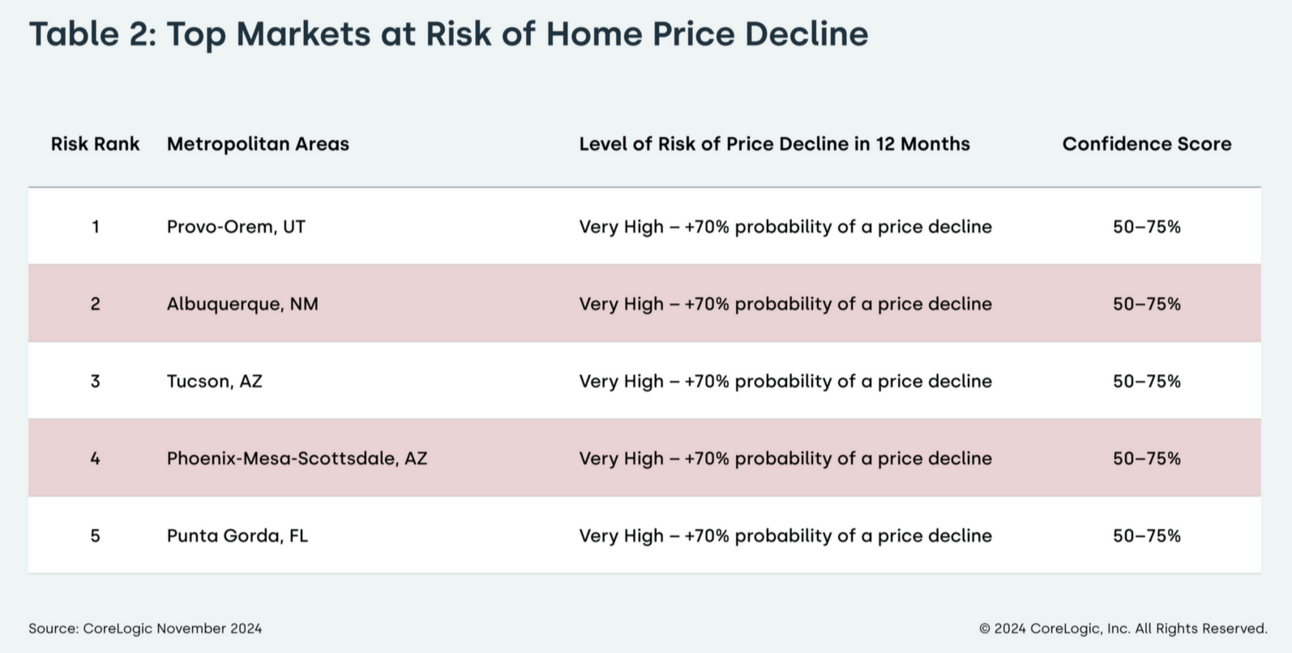

Northeast Leads in Home Price Growth: New Jersey (+7.8%), Rhode Island (+7.3%), and New Hampshire (+6.9%) topped the charts for annual price appreciation in November 2024. No state saw a price decline.

Nationwide Growth Moderates: U.S. home prices rose 3.4% year-over-year in November 2024, down from 5.2% in 2023. Annual appreciation is projected to climb to 3.8% by November 2025, with a new national price peak expected this spring.

Regional and Property Type Trends: Detached homes appreciated faster (+3.7% YoY) compared to attached properties (+1.7%). Cities like Chicago (+5.8%) and Miami (+5.6%) led gains among the top 10 metro areas.

Our Take:

CoreLogic's November 2024 Home Price Index reveals a shift in U.S. home price growth, with the Northeast outperforming other regions. While national appreciation has moderated, 17 states hit new price peaks. Detached homes and budget-friendly Midwest metros remain strong, with 3.8% growth forecasted for 2025. The market awaits new highs in spring as elevated mortgage rates persist.

🏕️ Niche-RE

Buy the House First, Get Married Later: Couples’ New Math

Unmarried Homeownership Is Rising: In 2023, 555,000 unmarried couples bought homes, a 46% increase from a decade earlier. They now represent over 11% of U.S. home sales, a threefold increase since the 1980s.

Homeownership Trumps Big Weddings: Couples are delaying or downsizing weddings, redirecting funds toward home purchases. From 2019 to 2023, median home prices rose 44%, while wedding costs increased 25%, further tipping the scales in favor of real estate.

Financial Foundation Over Legal Ties: Many couples view owning a home as a stronger commitment than marriage, citing equity-building and financial stability. Yet legal protections, like cohabitation agreements, are often overlooked, exposing them to risks during potential splits.

Our Take:

A growing number of couples are reshuffling life milestones, prioritizing homeownership over traditional weddings. With housing costs rising faster than wedding expenses, financial stability is taking precedence. While this trend aligns with changing societal norms, experts caution that skipping legal safeguards could lead to complications down the road.

New Oakland Multifamily Tower Trades for Half of Assessed Value

Post-Pandemic Reset: Multifamily rents in Oakland fell 9% from 2019 to 2024, averaging $2,500 per unit in 2024 compared to $2,750 in 2019. Oakland rents, historically 15% lower than San Francisco’s, are now 20% below their neighbor's.

Developer Challenges: Multifamily deliveries peaked in 2019 with 2,617 units, but as rents declined, new construction slowed. Only 533 units were delivered in 2023, with fewer than 400 units in the 2024 pipeline. Developers like oWow are delaying projects, citing unfavorable market conditions.

Occupancy Stability Amid Valuation Drops: Despite falling rents, occupancy rates remain strong at 92%. A notable example of value erosion: the 34-story luxury tower at 17th and Broadway sold in 2024 for $99M, a 53% discount from its earlier valuation.

Our Take:

Oakland's multifamily market has shifted from a booming "supercycle" (2018–2022) to a challenging downturn, marked by falling rents and declining building valuations. However, stable occupancy rates and reduced new supply signal a foundation for potential recovery. Developers are adopting a wait-and-see approach, poised for a rebound when market conditions improve.

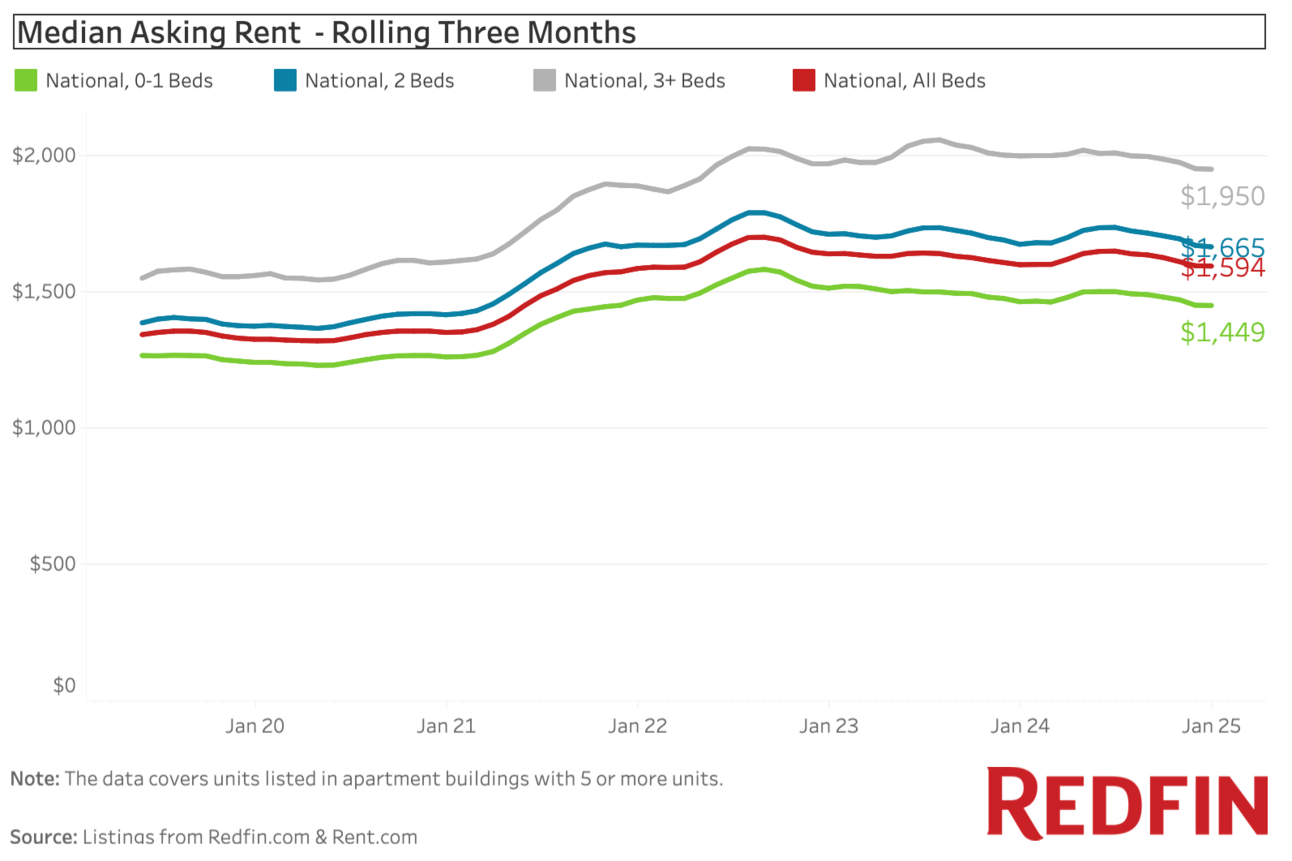

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.