- Dwelling's Digest

- Posts

- CRE Market Set for Revival in 2025: Economic Growth and REIT Strategies Lead the Way

CRE Market Set for Revival in 2025: Economic Growth and REIT Strategies Lead the Way

While the commercial real estate market faces hurdles, the alignment of valuations and economic stability signal a promising path to growth in 2025

Welcome Dwellers! A realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topic.

Quote of the day - “Real estate is cyclical, but with strategic investments and market shifts, the future of CRE looks brighter in 2025”

Dwellings Digest: In-Depth - Despite strong economic conditions, the commercial real estate (CRE) market faces persistent challenges. However, promising signs are emerging as valuation gaps close, and REITs show resilience. Key trends include economic stability, valuation realignment between public and private markets, and revitalized property transaction momentum. As the CRE sector looks ahead to 2025, REITs are poised for growth, leveraging strong occupancy rates, low leverage, and strategic capital management. Keep an eye on these dynamics to navigate the evolving market.

Don’t miss the final part of our in-depth analysis on credit trends, published. Read it now!

If you missed yesterday’s newsletter, click here

New? Join our newsletter – no cost!

🏛️ U.S Commercial Real Estate and REITs for 2025

Key Takeaways - Nareit

CRE Challenges Persist Amid Strong Economic Conditions:

Despite Q3 GDP growth of 2.8% and unemployment at 4.2% in November 2024, CRE struggles with supply-demand imbalances and an 86.1% office occupancy rate, driven by remote work and oversupply.

REITs Shine With Higher Occupancy Rates and Strategic Capital Management:

Retail REITs maintain a 95.9% occupancy rate, outperforming private counterparts by 122 basis points.

Low leverage (30.7% debt-to-market assets) and strong unsecured debt issuance ($40.8 billion YTD) enable REITs to weather economic volatility.

Economic Soft Landing Fuels Optimism for CRE Growth in 2025:

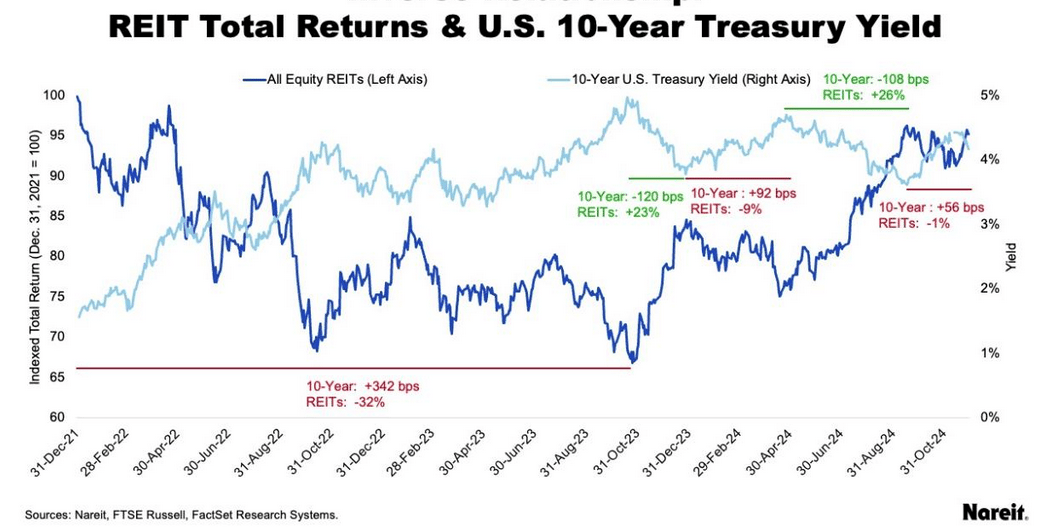

Fed rate cuts in 2024 have reduced recession risks to 25%, and narrowing cap rate spreads (down 69 basis points in Q3) signal a potential revival of property transactions and CRE valuation alignment.

Unlocking the Stifled CRE Market - Nareit

The U.S. economy is currently stable, characterized by healthy growth, steady unemployment rates, moderating inflation, and diminished recession fears. However, the commercial real estate (CRE) market remains stagnant, impacted by a combination of supply-demand imbalances, softening fundamentals, a valuation disconnect between public and private real estate, and muted transaction activity.

Despite these headwinds, signs suggest that CRE’s trajectory could shift positively. Here are the three primary catalysts expected to unlock the market's potential:

An Economic Soft Landing: The Federal Reserve is showing promising signs of engineering another soft landing, with inflation cooling and unemployment staying relatively low. Such conditions create a favorable backdrop for CRE investments.

Key Metrics:

U.S. real GDP grew by 2.8% in Q3 2024.

Nonfarm employment added 227,000 jobs in November 2024, with unemployment at 4.2%.

CPI inflation moderated to 2.7% annually through November 2024.

These metrics highlight a strong economic foundation that could reinvigorate CRE activity in 2025.

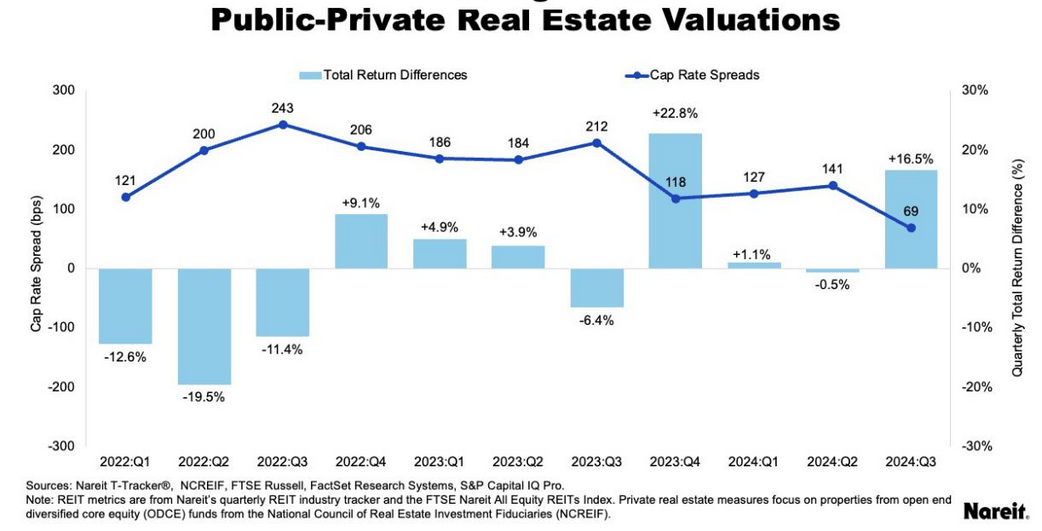

Valuation Realignment Between Public and Private Real Estate: A persistent gap between REIT-implied cap rates and private appraisal cap rates has stalled transactions. However, as interest rates decline, monetary easing is expected to bridge this valuation gap, boosting both REITs and broader CRE activity.

Supporting Data:

The public-private cap rate spread dropped to 69 bps in Q3 2024, signaling progress.

REITs outperformed private markets with a 16.5% total return in Q3 2024, further aligning valuations.

Revitalized Property Transaction Market: Convergence in valuation metrics between public and private markets could restore transaction momentum. This would benefit REITs and private investors alike.

Current Challenges in Property Fundamentals

While macroeconomic conditions are promising, some CRE sectors face fundamental challenges:

Office Sector: Office occupancy rates remain low (86.1% as of Q3 2024) due to shifting workplace dynamics and remote work trends.

Apartment Sector: Supply has surged, leading to declining occupancy (92.1%) and moderating rent growth.

Retail Sector: Although stable at 95.9% occupancy, growth has plateaued in many markets.

Industrial Sector: A flood of new supply has softened previously strong demand, with occupancy at 93.4%.

REIT Fundamentals Offer a More Optimistic Picture

REITs have demonstrated resilience compared to their private counterparts:

Higher Occupancy Rates: Average REIT occupancy rates across key sectors exceed private market equivalents, with a 346 bps advantage in the apartment sector alone.

Sector Shifts: REITs have actively pivoted toward modern economy sectors like data centers, telecommunications, and health care, all supported by strong demand fundamentals:

Data Centers: AI advancements drive sustained demand, outpacing supply.

Health Care: Senior housing benefits from demographic shifts and limited supply.

Telecommunications: Cell tower demand rebounds with expanded 5G deployment.

The Road to Transaction Recovery

A significant impediment to CRE growth has been the disconnect between public and private valuations. Historical data suggests that valuation convergence is a precursor to transaction recovery.

Notable Trends:

During Q3 2024, REITs executed $15.4 billion in senior debt deals, signaling increased activity in higher-aligned markets.

REITs’ ability to secure cost-effective capital, with 91.3% of debt fixed-rate, positions them advantageously for future acquisitions.

As public and private valuation metrics realign, transaction volumes are expected to rise, fostering a more robust CRE ecosystem.

REITs Poised for Growth in 2025

With disciplined balance sheets and diversified capital access, REITs remain uniquely positioned to capitalize on a revitalized CRE market.

Financial Strength:

Average REIT leverage ratios stood at a low 30.7%, with weighted average debt maturity extending to 6.5 years.

Aggregate REIT capital raising reached $40.8 billion through Q3 2024, underscoring strong market confidence.

Strategic Moves:

Notable 2024 deals include Lineage’s $5.1 billion IPO and Equinix’s $15 billion JV for AI-driven data centers.

Looking Ahead to 2025

The CRE market faces risks, including fiscal uncertainty, potential trade conflicts, and fluctuating interest rates. However, the following developments could catalyze a brighter 2025:

Macroeconomic Stability: Continued GDP growth, job creation, and inflation moderation will support investor confidence.

Valuation Convergence: Public and private markets closing the cap rate gap will unlock capital flows.

REIT Advantage: With their operational expertise and financial discipline, REITs are well-positioned for growth in a revitalized market.

Investors should monitor market dynamics closely while preparing for potential disruptions, ensuring alignment with both short-term trends and long-term opportunities.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.

Reply