Welcome Dwellers! A realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Understanding today’s credit trends is key to unlocking tomorrow’s real estate opportunities.”

Dwellings Digest: In-Depth - Credit Trends Signal a New Normal for Consumers and Real Estate Markets

The Q3 2024 TransUnion Credit Industry Insights Report highlights stabilizing credit patterns, with slower growth in credit card balances (+6.9% YoY) and easing delinquency rates (+1.9% YoY). Mortgage origination’s fell 15.9% YoY, while auto loans showed resilience, stabilizing at $729/month. These shifts reflect cautious consumer behavior amid high rates and inflation. Whether you're a realtor, investor, or first-time buyer, these trends offer a glimpse into the evolving dynamics of affordability and demand in today's economy. Ready to decode the impact on your next move? Let’s dive in.

💡 Real Estate Insight: Stabilizing credit improves buyer readiness for FHA loans, while elevated rates support multi-family investment demand.

If you missed yesterday’s newsletter, click here

Click on the graphs to read full reports below.

New? Join our newsletter – no cost!

🏛️ U.S Credit Industry Report Q3 2024

Q3 2024 Credit Trends Signal Stabilization Amid Shifting Consumer Behaviors

The Q3 2024 TransUnion Credit Industry Insights Report reveals key trends signaling a shift toward stabilization in the U.S. consumer credit landscape. After years of rapid growth in balances and delinquencies, the market appears to be transitioning to more normalized patterns. Below, we break down the insights across various credit products and analyze these trends, their implications, and the potential road ahead for stakeholders in real estate, investment, and economic markets.

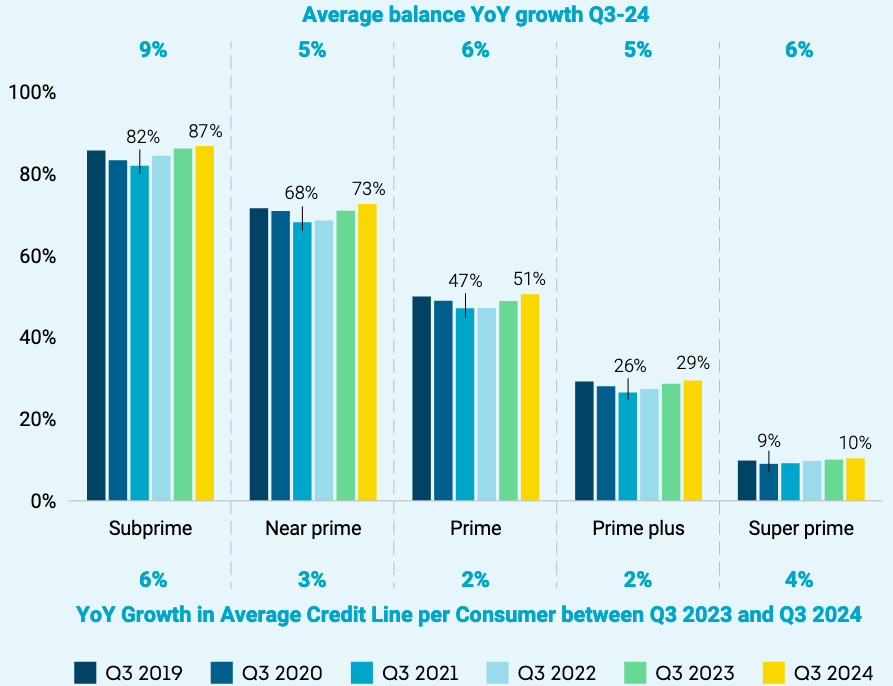

Credit Card Trends: Slower Growth Reflects Changing Consumer Habits

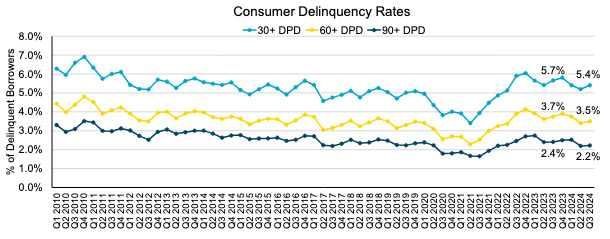

Total credit card balances reached $935 billion in Q3 2024, a modest 6.9% year-over-year (YoY) increase compared to last year’s double-digit surges. While balances grew, the average card utilization rate stabilized at 20.6%, signaling a shift in consumer spending patterns.

Delinquency Rates: Credit card delinquency rates slowed significantly, with a YoY growth of just 1.9%. This marks a considerable improvement compared to prior quarters, driven by a resilient labor market and consumers adopting more cautious spending behaviors.

Key Driver: Michele Raneri, VP of U.S. Research at TransUnion, highlighted, “The stabilization in delinquency growth reflects both consumer resilience and ongoing economic adjustments. It demonstrates a balancing act between leveraging credit and staying current on payments.”

Metrics to Note

Total Balances: $935 billion (+6.9% YoY), reflecting moderated growth from 2023’s double-digit surges.

Utilization Rate: Stabilized at 20.6%, indicating a shift toward cautious spending.

Delinquency Rates: Grew by 1.9% YoY, a slowdown compared to earlier quarters.

Analysis & Implications

Spending Shifts: Moderating credit card growth suggests consumers are adapting to higher interest rates by prioritizing essential expenditures over discretionary spending.

Debt Management: Lower delinquency growth reflects consumer efforts to maintain payment discipline amid uncertain economic conditions.

Impact for Stakeholders

Real Estate Professionals: Stabilizing delinquency rates may improve buyer creditworthiness, especially among first-time homebuyers leveraging FHA loans.

Investors: Slower credit card growth signals a cautious consumer sentiment, potentially tempering retail and hospitality real estate demand.

📊 Quick Stat: Consumers in the top risk tiers maintained average balances of $5,821, while subprime borrowers saw higher rates of balance increases, averaging $3,111.

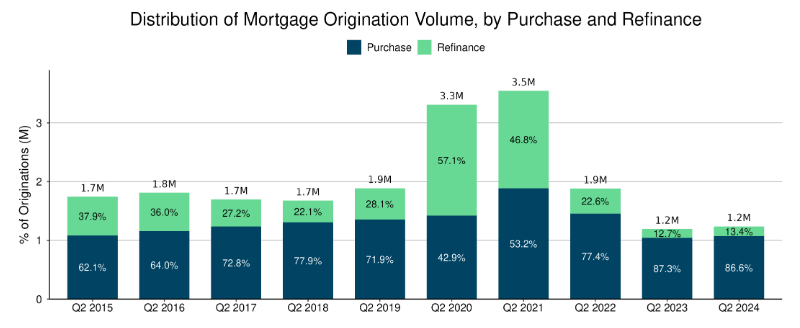

Mortgage Market Outlook: Can Fed Rate Cuts Spur Activity?

The mortgage sector continues to grapple with high interest rates, limiting new originations and refinancing activity. According to TransUnion, new mortgage originations dropped to 1.85 million, down from 2.2 million in Q3 2023—a decline of 15.9%.

Delinquency Trends: Mortgage delinquencies remained relatively flat at 0.86% for Q3, with no significant YoY increases. This stability indicates consumers’ prioritization of housing payments amid other economic pressures.

Market Predictions: As Raneri pointed out, “It remains to be seen if the Fed's interest rate reductions help spur the mortgage market. A stabilization or decline in rates could provide the boost needed.”

Metrics to Note

New Originations: Dropped to 1.85 million (-15.9% YoY).

Delinquency Rates: Flat at 0.86%, showing continued prioritization of housing payments.

Interest Rates: Averaging 7.5% for 30-year fixed mortgages, up from 6.8% in Q3 2023.

Analysis & Implications

Higher Barriers to Entry: Elevated rates and low affordability continue to sideline many buyers, particularly in markets with rapid home price appreciation.

Potential Fed Moves: A forecasted rate cut in 2025 could spur refinancing activity and moderate new buyer enthusiasm.

Impact for Stakeholders

Real Estate Professionals: High rates create opportunities in the rental market as more buyers delay purchases, increasing demand for multi-family investments.

Investors: Watch for declining cap rates in single-family rentals (SFRs) and opportunities in underperforming luxury markets with stagnant inventory.

💡 Takeaway: A lower interest rate environment could reignite demand for home loans, especially in areas with steady home price appreciation, like Central Jersey.

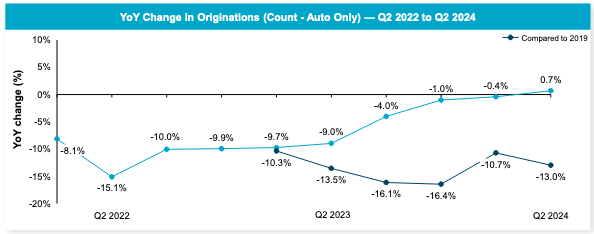

Auto Loans: Stabilizing Payments and Positive Momentum

The auto loan market displayed positive momentum, with average monthly payments for new vehicles stabilizing at $729—an improvement after years of steep increases. Used vehicle loans also showed signs of relief, with average payments decreasing to $548.

Delinquency Growth: The auto loan delinquency rate edged higher to 1.87% but at a decelerated pace compared to earlier quarters. This points to improving borrower repayment capacity, possibly linked to a stronger job market.

Lending Shifts: Subprime lending saw a slight rebound, contributing to higher origination volumes YoY. However, lenders remain cautious, focusing on risk-adjusted growth strategies.

Metrics to Note

Total Debt: Surpassed $1.5 trillion (+3.2% YoY).

Delinquency Rates: Rose to 1.87% but grew slower than prior quarters.

Monthly Payments: Stabilized at $729 for new vehicles and declined to $548 for used vehicles.

Analysis & Implications

Demand Dynamics: Stabilized payments suggest relief for consumers, potentially enabling increased discretionary spending.

Subprime Lending Uptick: Growth in subprime originations indicates easing lender restrictions, a sign of market confidence.

Impact for Stakeholders

Real Estate Professionals: A stable auto market could support growth in suburban and commuter-centric real estate, as buyers maintain vehicle affordability.

Investors: Subprime lending growth may correlate with higher risk-adjusted opportunities in adjacent financial products like lease-to-own agreements.

📉 Data Highlight: The total outstanding auto loan debt surpassed $1.5 trillion, marking a YoY growth of 3.2%.

Personal Loans: A Mixed Bag

Personal loans continued to grow in popularity, especially among younger consumers. Origination volumes reached record highs, with average balances exceeding $10,800—a 9.3% YoY increase.

Delinquency Rates: Despite rising originations, delinquency rates held steady at 3.52%, indicating a sustainable growth trajectory.

Economic Context: Younger borrowers contributed to most of this growth, leveraging personal loans for debt consolidation and large purchases amid inflationary pressures.

Metrics to Note

Average Balances: Surged to $10,800 (+9.3% YoY).

Origination Volumes: Set a record high, driven by younger consumers.

Delinquency Rates: Held steady at 3.52%, indicating controlled risk.

Analysis & Implications

Younger Borrower Influence: Millennials and Gen Z are increasingly using personal loans for debt consolidation, major purchases, and education expenses.

Economic Resilience: Stable delinquencies reflect cautious optimism despite high borrowing costs.

Impact for Stakeholders

Real Estate Professionals: Personal loan growth among younger borrowers could support demand for first-time home purchases or rental upgrades.

Investors: Growing balances suggest opportunities in fintech lending platforms and debt securities tied to personal loans.

💡 Trend Watch: Expect personal loan growth to continue as consumers seek flexible borrowing options to navigate economic uncertainty.

What These Trends Mean for Real Estate & Economic Markets

As the economy evolves, these credit trends reflect a delicate balance between consumer resilience and economic pressures. Whether you’re managing credit cards, considering a mortgage, or shopping for an auto loan, understanding these dynamics can help you make informed financial decisions.

Key Considerations

Credit Tightness Impacts Residential Demand: Slower credit growth may constrain first-time buyers and increase competition for rental properties, supporting multi-family investments.

Consumer Behavior Signals: Modest growth in credit utilization and stabilized auto loan payments suggest consumers are adapting, which could lead to steady but cautious spending in retail and residential sectors.

Interest Rate Watch: The Federal Reserve’s rate trajectory will be crucial for unlocking latent demand in mortgages and large capital investments.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.