Mortgage & REITS

30-Yr Fixed RM | 6.56% | - 0.02% |

15-Yr Fixed RM | 6.14% | - 0.01% |

30-Yr FHA | 6.10% | - 0.02% |

30-Yr Jumbo | 6.73% | - 0.01% |

7/6 SOFR ARM | 6.38% | - 0.02% |

30-Yr VA | 6.12% | - 0.02% |

Average going rates as of Aug 16 2024

S&P 500 | 5,554.25 | + 0.20% |

S&P REIT | 357.26 | - 0.20% |

FTSE NAREIT | 788.77 | - 0.058% |

Numbers as of Aug 16 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic Rundown

July Housing Starts and Fed Rate Cuts: Key Drivers for Real Estate Market Growth

Markets now anticipate a quarter-point rate cut from the Federal Reserve in September, signaling the start of an easing cycle as inflation edges closer to the target.

Despite some weakness in manufacturing and housing, strong retail sales and positive updates from major companies like Walmart are helping to ward off recession fears.

U.S. and global stocks are on track for their best week in months, bolstered by resilient economic data and easing inflation concerns, with Japan’s Nikkei and European markets leading the charge.

🎢 Stock Exchange

Stock Futures Rise Slightly after S&P 500 Notches Best Week of the Year.

S&P 500 Futures Rise: Stock futures ticked up, with S&P 500 futures climbing 0.1% after the index posted its best week of 2024, gaining 3.9% as market optimism rebounded.

Market Recovery Driven by Positive Data: Last week’s rally was fueled by strong retail sales and jobless claims data, which helped ease recession fears and supported hopes for a soft landing in the economy.

🎙️ RE - Spotlight

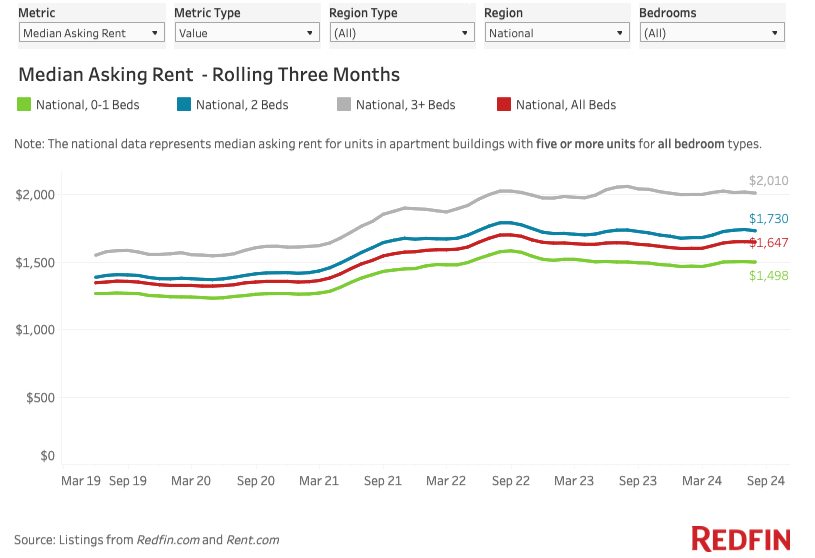

US Rent Prices Fall Amid Apartment Boom: Trends, Regional Variations, and What Renters Should Know

Rent Decline After Construction Boom: U.S. asking rents dropped for all apartment sizes in July, with a 2.4% decrease for three-bedroom units, reflecting the impact of the recent surge in apartment construction.

Regional Variations in Rent Trends: Florida and Texas led rent declines, with Austin and Jacksonville seeing significant drops, while regions like Virginia Beach experienced rent hikes, up 13.7% year-over-year.

Renters' Window of Opportunity: Despite the current dip, construction slowdown hints at potential rent increases within the next year or two, making now a favorable time for renters to secure deals.

Housing Inventory Recovery: 41 Major Markets Exceed Pre-Pandemic Levels as 'Reset' Unfolds

Housing Inventory Rebounds: July 2024 active listings hit 884,273, up 62% from pandemic low but still 29% below 2019 levels

Market Shift: 41 of 200 largest U.S. housing markets now exceed pre-pandemic inventory, up from just 8 in July 2023

Price-Inventory Correlation: Markets with recovered inventory see weaker price growth, while low-inventory areas experience stronger gains

🏰 State Zone

Luxury Meets Controversy: 360-Unit Livana Complex Brings First Apartments to Wealthy Colts Neck, NJ

Luxury living in Colts Neck: 360 high-end apartments coming to NJ's wealthiest town (median income: $187,969), featuring 15 buildings on 30 acres along Route 537, completion expected by February 2027

Controversial $500M+ development: 30-acre Livana complex sparks debate over wastewater treatment, with concerns about thousands of gallons pumped daily into local wells; NJDEP granted permit despite opposition from NJ Sierra Club and 2020 lawsuit against Freehold Township

Affordable housing meets affluence: 72 units (20% of total) designated for lower-income residents in $1M+ average property value community; amenities include fitness center, yoga studio, pools, and work-from-home spaces, located 2 miles from Trump National Golf Club Colts Neck

🏕️ Niche-RE

US Hotel Occupancy, Average Daily Rate Climb Steadily

U.S. hotel industry shows resilience: RevPAR up 1.9% to $109.51, ADR rises 1.4% to $159.49, occupancy increases 0.5% to 68.7% (August 4-10, 2024 vs 2023), reflecting steady growth despite economic uncertainties

Houston leads Top 25 Markets in recovery: 31.1% occupancy surge to 76.3%, RevPAR skyrockets 47.2% to $93.89 year-over-year, signaling strong rebound in travel demand for the Texas metropolis

Market divergence highlights regional trends: Chicago's ADR jumps 13.8% to $188.95, while Los Angeles sees 12.2% RevPAR decline to $161.66 and Dallas drops 11.3% to $66.30, indicating varied performance across major U.S. cities

👉 More Stories

Google To Spend Over $1 Billion in Texas This Year To Meet Demand for Its Data Centers.

Overlooked by Developers, Small-Bay Warehouses Drive Philadelphia’s Industrial Sales. Deals Reflect Strong Leasing Demand Across Smaller Warehouses

Travel spending reflects consumer confidence and the broader economic outlook. Now, notably, travelers are prioritizing value and becoming more selective in their bookings. Cruise lines, with their all-inclusive pricing, are benefiting, while some domestic hotels are struggling

🖼️ Chart-Tastic

👾 Interesting in Social

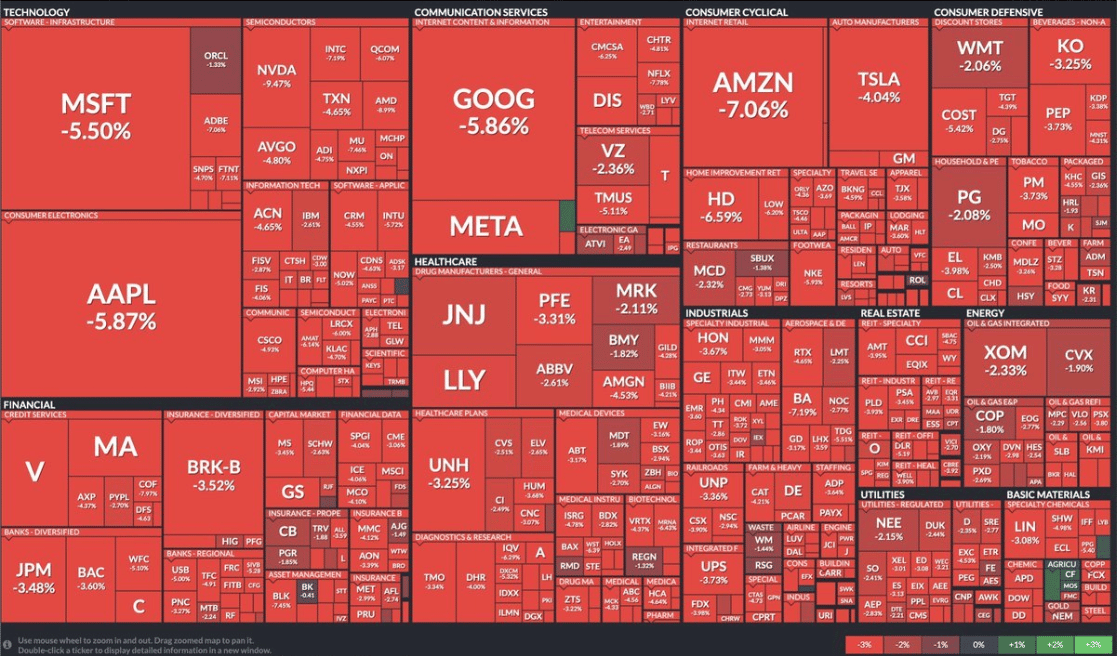

Throwback to September 13th, 2022 the 5th largest daily point loss in S&P 500 history

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.