Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - The Fed holds rates steady at 4.25%–4.5% as inflation eases but remains above target, with trade policies adding uncertainty. Housing inventory hit a 5-month supply as new listings rose 7.4%, while pending sales declined. Wage growth lags behind home price surges, pushing mortgage payments to 91% above average rent. January home prices grew 0.6% MoM, with Tampa seeing declines but cities like Pittsburgh posting gains. San Diego rents exceeded $2,500/month, while hotels like Hyatt and Wyndham adapt vacation rental-style amenities. Lodgify’s innovations boost vacation rental management for hosts in 100+ countries.

Quote of the day - “Adapt to market shifts to seize new opportunities.”

If you missed yesterday’s newsletter, click here

Rates & Stocks

30-Yr Fixed RM | 7.02% | + 0.06% |

15-Yr Fixed RM | 6.46% | + 0.05% |

30-Yr Jumbo | 7.36% | + 0.04% |

7/6 SOFR ARM | 6.93% | + 0.08% |

30-Yr FHA | 6.38% | + 0.05% |

30-Yr VA | 6.40% | + 0.05% |

Average going rates as of Feb 18 2025

S&P 500 | 6,129.58 | + 0.24% |

10 Yr T-Note | 108.77 | - 0.50% |

USD/JPY | 152.0780 | + 0.37% |

Numbers as of Feb 18 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Fed's Bowman: Greater confidence in falling inflation needed before more cuts

Rates on Hold for Now: The Federal Reserve is maintaining the benchmark rate at 4.25%–4.5%, allowing time to monitor evolving inflation trends and the economic impact of new trade and tariff policies under the Trump administration.

Inflation Slowing, But Above Target: The Fed’s preferred inflation measure, the core PCE price index, is expected to drop to 2.6% in January, down from 2.8% in December, but still above the Fed's 2% goal. Upside risks to inflation remain, particularly with wage growth outpacing inflation targets and unemployment at 4%.

Trade Policy Adds Uncertainty: Bowman highlighted the need for clarity on how new tariffs and trade policies will shape the economy. The Fed will carefully assess these developments before considering further rate changes.

With inflation moderating but lingering risks, the Fed remains focused on stability while evaluating external policy shifts.

🎢 Impact on Real Estate

Housing Supply Is Piling Up As Home Sellers Enter the Market But Buyers Stay on Sidelines.

Inventory Hits 5-Month Supply: Nationwide for-sale supply rose to 5 months—the highest since early 2019—as new listings increased 7.4% year over year. Pending sales are down 6%, with homes taking 57 days to go under contract, the longest since March 2020.

Rising Buyer Activity Amid Uncertainty: Redfin’s Homebuyer Demand Index is ticking up after hitting a six-month low in January. In markets like Washington, D.C., government job uncertainty and return-to-office mandates are reshaping buyer and seller plans.

Pending Sales Up in Los Angeles: Los Angeles saw a 3.4% increase in pending sales year over year after wildfires displaced affluent homeowners. Continued monitoring will show if this is an anomaly or a lasting trend.

Despite high mortgage rates and prices, slight demand upticks may signal a shifting market dynamic.

🎙️ RE Spotlight

Wages vs. Home Prices: Cost to Own Skyrockets Above Average Rent

Home Prices Far Outpace Wage Growth: Between 2010 and 2024, median home prices grew at an average annual rate of 6.7%, more than double the 3.1% growth in average hourly earnings. By the end of 2024, median home prices hit $418,000, nearly doubling since 2014. Meanwhile, total wage growth over the same period lagged behind.

Mortgage vs. Rent Disparity: In 2010, mortgage payments were just 18% higher than average asking rents. By 2024, monthly mortgage payments ($3,525) soared to 91% above asking rents ($1,850), driven by rising home prices and elevated interest rates. This sharp rise underscores the financial strain on homebuyers compared to renters.

Renting Stabilizes as an Affordable Option: The rent-to-income ratio ended 2024 at 22.5%, close to pre-pandemic levels, thanks to stagnant rent growth and steady wage increases. With housing shortages and high mortgage rates, renting has become a more viable and accessible option for many households.

As mortgage payments climb and housing affordability shrinks, renting offers financial relief for those locked out of homeownership.

U.S. Home Prices Grew 0.6% in January

Month-Over-Month Home Price Growth Hits 0.6%: January marked the fastest monthly home price growth (0.6%) since November 2023, slightly above the 0.5% pace of the prior three months. However, price growth may slow soon due to rising inventory and longer market times.

Slowest Year-Over-Year Price Growth Since August 2023: On an annual basis, home prices rose 5.4%, indicating a significant slowdown in price appreciation compared to previous months.

Regional Price Shifts: While Tampa led the largest price declines (-1.6%), cities like Pittsburgh (+3%), Nassau County, NY (+2.8%), and Philadelphia (+2.6%) saw the strongest month-over-month gains.

With homes selling at the biggest discounts in two years, market conditions may signal further cooling ahead.

🏰 RE State Zone

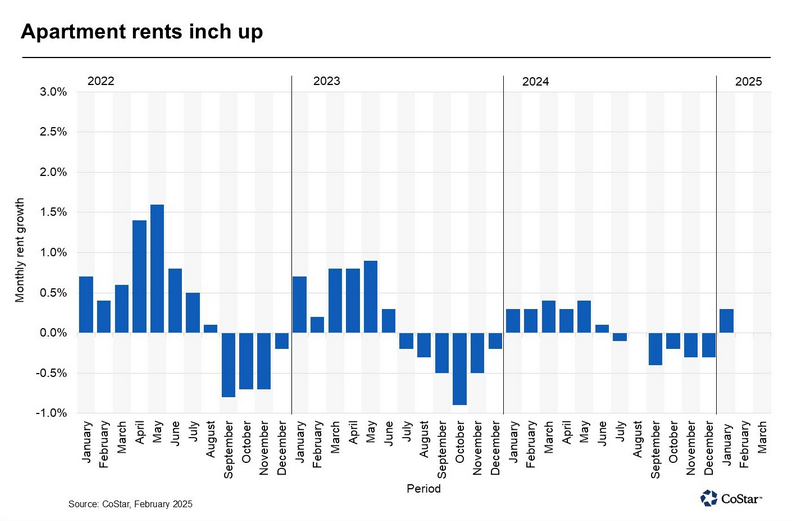

Apartment rent growth reverses course in San Diego, Average asking rate in January exceeded $2,500 per month

🏕️ Niche-RE

Lodgify Accelerates Its Vacation Rental Management Platform with Tech Innovation

Strategic SaaS Leadership: Shaun Shirazian, former Chief Product Officer at Pipedrive, brings over 15 years of SaaS and technology experience to Lodgify. He will focus on expanding market reach and enhancing product offerings to meet the evolving needs of vacation rental hosts.

Global Expansion Milestone: Lodgify’s platform, used by hosts in over 100 countries, continues to empower small and mid-sized vacation rental owners with property management tools that streamline operations and boost bookings.

Vacation Rental Innovation: Lodgify’s centralized system supports over 330 employees worldwide and synchronizes listings across major OTAs like Airbnb and Booking.com, driving increased visibility and occupancy for independent hosts.

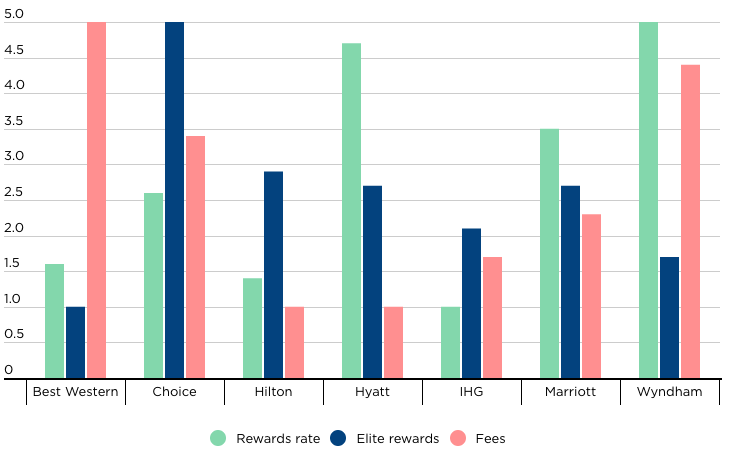

Hotels Embrace Home Rental-Style Stays as Wyndham Tops 2025 Loyalty Rankings

Hotels Adopt Home Rental Vibes: Hyatt, Hilton, and Marriott are offering home-style properties with kitchens, laundry rooms, and multiple master bedrooms to cater to group travelers frustrated with hidden fees from vacation rental platforms.

Wyndham Takes the Crown: Wyndham Hotels & Resorts ranked as the best hotel brand of 2025, with an 11.75% rewards return on cash stays and low fees, beating out Choice Hotels and Hyatt.

Travel Tip: Hilton and IHG fell to the bottom of the rankings due to high fees and low rewards. Consider Wyndham for better point value and fewer hidden costs.

Book smarter this year with top hotel programs that maximize comfort and savings. The Best Hotel Brands of 2025

🖼️ Chart-Tastic

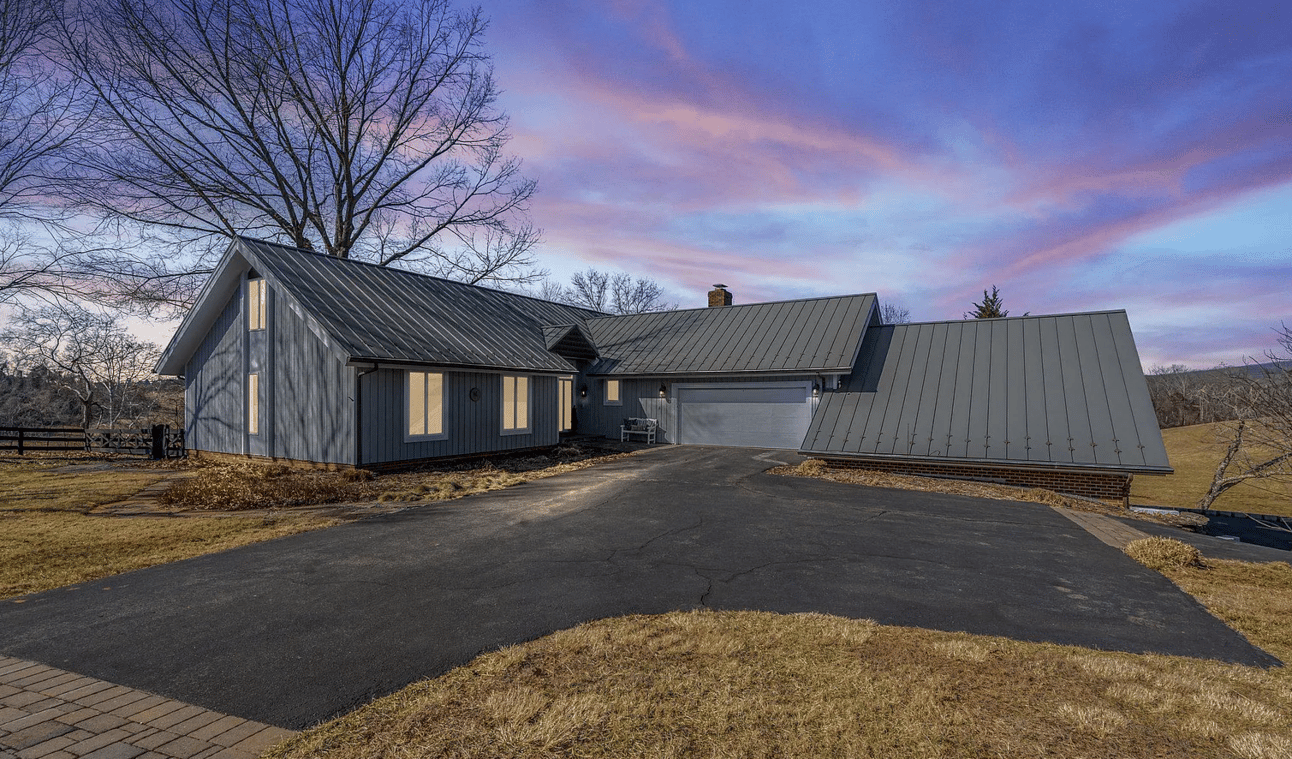

🌍 Dwelling of the Day

Custom-built home will not disappoint!

Asking $895K, 4Bed 4Bath 4,481 sqft

Warrenton, VA 20186

Listed by: Patti Brown & Co-Listing Agent: Layne M Jensen CENTURY 21 New Millennium,

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.