I'mGood morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Opportunities abound in markets adapting to new conditions.”

In today’s edition - The Federal Reserve is expected to lower interest rates in December, signaling a shift toward more gradual easing in 2025. While inflation remains persistent, the economic outlook is shifting, and real estate dynamics are evolving. In this issue, we explore the impact of rising loan limits, trends in affordability, and where homebuyers can find the most starter homes in 2025. With mortgage rate forecasts and market adjustments, it's clear: change is coming. Get ready for what's ahead in the housing market.

Don’t miss the final part of our in-depth analysis on credit trends, published yesterday! Read it now for key insights

If you missed yesterday’s newsletter, click here

Rates & Markets

30-Yr Fixed RM | 6.95% | + 0.08% |

15-Yr Fixed RM | 6.23% | + 0.09% |

30-Yr Jumbo | 7.16% | + 0.06% |

7/6 SOFR ARM | 6.83% | + 0.15% |

30-Yr FHA | 6.32% | + 0.07% |

30-Yr VA | 6.33% | + 0.07% |

Average going rates as of Dec 13th 2024

S&P 500 | 6,051.09% | - |

Bitcoin USD (As of Dec 15th 2024) | 106,560.21 | + 3.90% |

10-Yr Bond | 4.3990 | + 1.73% |

Numbers as of Dec 13th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

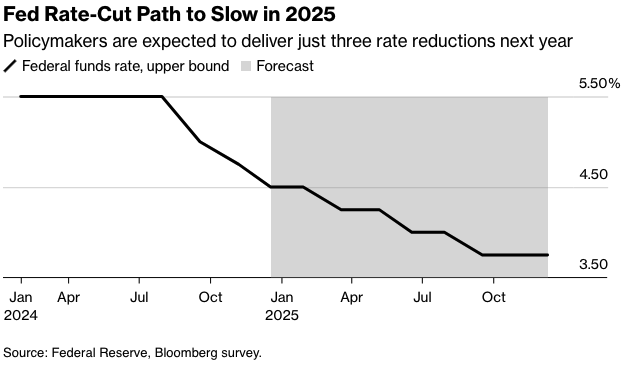

Fed to Cut Once More Before Slowing Pace in 2025, Economists Say - Bloomberg

Third Rate Cut Expected This Month: The Federal Reserve is poised to lower the benchmark rate to a range of 4.25%-4.50% during its December meeting, marking a 1% reduction since September 2024.

2025 Outlook Adjusted: Economists now predict just three rate cuts next year, reflecting inflation concerns and steady economic growth. This is a notable slowdown compared to earlier expectations for more aggressive easing.

Inflation Remains Persistent: Core inflation holds at 3.3% year-over-year, highlighting challenges in achieving the Fed’s 2% target. Economists project policymakers will revise neutral interest rates to 3% by 2025.

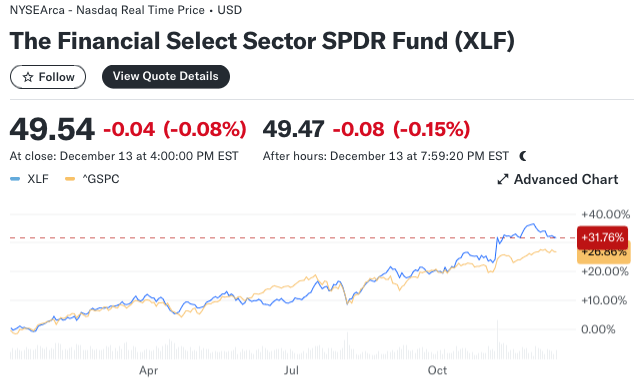

Why Wall Street says bank stocks are a top play for 2025 - Yahoo

Financial Sector Surges Post-Election: The Financial Select Sector SPDR Fund (XLF) has climbed nearly 7% since November 5, outperforming the S&P 500 as optimism around deregulation and lower rates gains momentum.

IPO Activity Rebounds: U.S. IPOs jumped 35% in 2024, with 158 debuts marking a recovery from 2023. Bullish outlooks for 2025 predict even greater public debut activity amid a favorable economic environment.

$7 Trillion in Cash Ready for Markets: Analysts project a shift of $7 trillion from money market funds into equities, with financials benefiting most from renewed confidence in investment banking and strategic transactions.

🎢 Impact on Real Estate

Renters Are Less Likely Than Homeowners to Feel a Sense of Belonging in Their Neighborhood - Redfin

A Sense of Belonging: Nearly two-thirds of homeowners (64%) feel a connection to their neighborhood, compared to just 47% of renters—a clear disparity reflecting the transient nature of renting.

Common Ground Lacking: While 59% of homeowners share commonalities with their neighbors, only 39% of renters feel the same, hinting at different social dynamics between the two groups.

Avoidance Trends: Renters are more likely to avoid interactions with neighbors, with 42% steering clear of neighborly ties compared to 33% of homeowners, underscoring the impact of stability on community engagement.

🎙️ RE Spotlight

Conventional loan limits rise to $806,500 - themortgagereports

Loan Limits Rise with Home Prices: Starting January 1, 2025, conforming loan limits increase to $806,500 for standard one-unit homes and up to $1,209,750 in high-cost areas—a 5.2% boost reflecting rising home values.

More Flexibility for Multi-Unit Buyers: Multi-unit properties see higher limits, with 2-unit homes capped at $1,032,650 in standard areas and $1,548,975 in high-cost regions.

Access to More Financing: Elevated limits allow borrowers to access larger conventional loans, reducing the need for jumbo loans and expanding homeownership opportunities.

Find Your Regions Conforming Loan Limit Values Map - fhfa.gov

Veterans United Foresees 2025 Housing Market Recovery, With a Few Caveats - Housingwire

Mortgage Rate Adjustments: Mortgage rates in 2025 are expected to average 6.5%, gradually decreasing to 6.3% after the anticipated 75-basis point Federal Reserve rate cut, although external economic factors may slow the rate of change.

Home Price Growth: Home prices are forecasted to increase by 3.2% to a national average of $424,977, with a slight slowdown in price appreciation, but affordability will continue to challenge buyers.

Affordability Issues Persist: Fewer housing starts and rising construction costs will keep affordability a major hurdle, despite government-backed loan options and creative financing solutions for first-time buyers and moderate-income buyers.

🏰 RE State Zone

Boston Surprisingly Has an Abundance of Starter Homes Under $550K—Along With These Markets- Realtor.com

Boston's Starter Home Surprise: While Boston's median list price is a steep $949,000, 41% of homes are valued under $550,000, above the national average (38.9%). Stabilizing mortgage rates may unlock more inventory, making it a promising market for first-time buyers.

Affordable Standouts: Cities like Indianapolis ($260K median) and Hartford ($249.9K median) shine with starter home shares of over 40%, backed by affordability, job growth, and a lower percentage of locked-in homeowners.

Growth Markets: Charlotte (43.5%) and Greenville (42.2%) boast robust job growth and migration rates, with nearly half of their housing stock catering to first-time buyers—a perfect blend of opportunity and affordability.

🏕️ Niche-RE

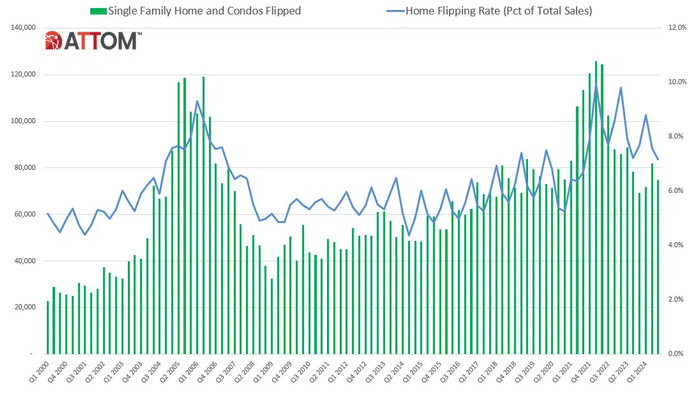

Home Flipping Declines and Investor Profits Stumble Across U.S. During Third Quarter of 2024 - Attom

Flipping Activity Declines: Home flips represented 7.2% of all U.S. home sales in Q3 2024, down slightly from 7.6% in Q2, showing seasonal fluctuations in real estate market activity.

Profit Margins Fall: Investors saw a 28.7% average gross profit on flips, a decrease from 31.2% in Q2, with some metro areas, like Salisbury, MD, experiencing drops of up to 68%.

Cash Flipping Dominates: 64.1% of home flips were all-cash transactions, reflecting the continued preference for cash financing amid tight market conditions and rising renovation costs.

Expert Insight: “Persistently high interest rates and inflation-driven renovation costs are squeezing margins for flippers, despite a tight housing market," said Rob Barber, CEO of ATTOM.

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.