Where real property meets real data, every day

🗞️ In This Edition

Power of 3% down mortgages

iGeneration is redefining housing

Real Estate resilience

Thriving luxury market

NAR report home sales declined

and more stories

Plus - 5 DIY ways to transform your patio into a summer escape

📈 Market Numbers

S&P 500 | 5,486.25 | + 0.26% |

Dow 30 | 40,203 | + 0.23% |

Bitcoin USD | 65,427.00 | - 0.87% |

S&P REIT | 346.61 | - 1.76% |

FTSE NAREIT | 764.05 | - 1.53% |

30-Yr Fixed RM | 6.77% | - 0.12% |

15-Yr Fixed RM | 6.05% | - 0.12% |

Numbers as of July 24 2024 closing

New? Join our newsletter – no cost!

🔍 Spotlight

Unlock Homeownership Through The Power Of 3% Down Mortgages

Low Down Payment Options: Several programs, including Conventional 97, Fannie Mae's HomeReady, Freddie Mac's Home Possible, and HomeOne, allow qualified buyers to purchase a home with only 3% down. This can significantly reduce the upfront costs of homeownership. For example, on a $300,000 home, your down payment would be just $9,000 instead of the traditional 20% ($60,000).

First-Time Buyer Focus: Most of these programs are designed for first-time homebuyers or those who haven't owned a home in the past three years. They often include income limits (typically 80% of the area median income) and may require completion of a homeownership education course. Credit score requirements vary but generally start at 620 for Conventional 97 and HomeReady, and 660 for Home Possible.

Trade-Offs to Consider: While these programs make homeownership more accessible, they typically require private mortgage insurance (PMI) until you reach 20% equity in your home. PMI can range from 0.58% to 1.86% of your loan amount annually, depending on your credit score and loan-to-value ratio. This adds to your monthly payments but can be removed once you cross the 20% threshold.

Beyond 3% Options: For those who don't qualify for these specific programs, other low down payment options exist, such as FHA loans (3.5% down with a credit score of 580 or higher) and VA or USDA loans (potentially 0% down for eligible borrowers). FHA loans have more lenient credit requirements but come with mandatory mortgage insurance for the life of the loan in most cases.

Remember, while these programs can make homeownership more attainable, it's crucial to carefully consider your financial situation and long-term goals before committing to a mortgage. For instance, on a $300,000 home with a 3% down payment and a 30-year fixed rate of 6.5%, your monthly payment (excluding taxes and insurance) would be about $1,816. Always shop around and compare offers from multiple lenders to find the best fit for your needs.

How the iGeneration Is Redefining Home Sweet Home

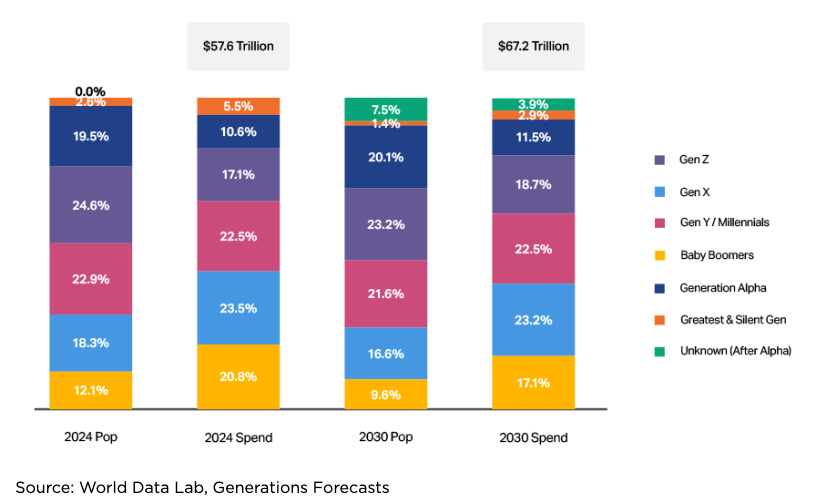

Shifting Priorities: Gen Z is showing less immediate interest in traditional homeownership, focusing instead on career fulfillment and experiences. According to NeilsenIQ, this generation is more likely to prioritize travel and meaningful work over buying homes and starting families. This shift could lead to delayed entry into the real estate market for many Gen Z individuals.

Unconventional Ownership Models: When Gen Z does enter the housing market, they're likely to embrace alternative approaches. A striking 70% of Gen Z respondents in a JW Surety Bonds survey were open to co-purchasing a home with a friend. Additionally, over half view "house hacking" (renting out portions of their living space) favorably, according to Zillow. These trends could reshape how homes are bought, sold, and utilized.

Unique Home Features: Gen Z homebuyers are expected to prioritize sustainability and functionality over size. Omer Reiner, president of FL Cash Home Buyers, LLC, notes that features like solar panels, sustainable water systems, and multi-purpose spaces are likely to be in high demand. This could influence future home designs and renovations to cater to these preferences.

Market Impact Still Unfolding: While Gen Z made up only 4% of homebuyers in 2022 according to NAR, it's important to note that many in this generation are still too young to consider homeownership. Sam Morgan of Engel & Volkers Atlanta suggests that the real question isn't whether Gen Z will become homeowners, but rather what type of homes and lifestyles they'll seek as they mature.

Real Estate Resilience In 2024's Choppy Waters

Market Fundamentals: Unlike 2008's artificial bubble, today's high prices stem from genuine supply constraints and strong demand. The median existing-home sales price hit $419,300 in May 2024, up 54% since 2019. Stricter lending standards and greater homeowner equity provide a more stable foundation, with only 2.7% of mortgages "seriously underwater" compared to 26% in 2008.

Agent Attrition: Just as in 2008, we're seeing a decline in real estate agent numbers. NAR membership has dropped by over 100,000 since 2022, with predictions suggesting up to 80% of agents could exit the industry. This attrition can create opportunities for committed professionals to capture market share.

Diversification is Key: With home sales slowing and mortgage rates around 7.5%, savvy agents are expanding into rentals. About 38% of U.S. households now rent, offering a growing market segment. Embracing rental services can provide stability and lead generation during slower sales periods.

Relationship Focus: In challenging times, your network becomes your net worth. Nurturing relationships with clients, lenders, and industry professionals isn't just about immediate transactions—it's about building a resilient business for the long term.

Luxury Homes Thrive Amidst Market Challenges

Overall Decline in Sales: New home sales fell slightly, and transactions for previously owned properties dropped for the fourth straight month. Existing-home sales reached a seasonally adjusted annual rate of 3.89 million, down 5.4% from May and 5.4% from June 2023, marking the lowest level in 13 years.

Luxury Market Resilience: Homes priced over $1 million were the only category to see a sales increase in June. 45% of high-end buyers paid all cash, the largest share in at least a decade.

Rising Home Prices: The median sales price for existing homes hit a record $426,900 in June, up 4.1% from the previous year, with prices rising across all U.S. regions.

Mortgage Rate Impact: The 30-year fixed mortgage rate averaged 6.92% in June, more than double the rates from late 2019 to early 2022. High mortgage rates continue to deter buyers who need financing.

Builder Challenges: Homebuilders, such as David Weekley Homes, struggle to produce affordable homes under $400,000 due to rising costs of land, labor, and materials. Despite this, Toll Brothers Inc. saw stronger-than-expected orders, with shares rising approximately 170% since the start of 2023.

NAR Report Home Sales Declined While Prices Reached New Highs

According to the National Association of Realtors® (NAR), existing-home sales fell by 5.4% from May, hitting a seasonally adjusted annual rate of 3.89 million in June. This figure marks a 5.4% decrease from June 2023, reaching the lowest level in 13 years. In contrast, the median sales price for existing homes hit a record $426,900, up 4.1% from last year, with prices rising across all U.S. regions.

NAR Chief Economist Lawrence Yun noted the repetitive nature of the market, with low sales, high prices, and steady mortgage rates. However, there is a glimmer of hope for buyers as the market shows signs of shifting from a seller's market. Homes are staying on the market longer, and the number of multiple offers is decreasing, indicating a potential transition towards a buyer’s market.

In June, the inventory of unsold existing homes rose by 3.1% from May, totaling 1.32 million, equivalent to a 4.1-month supply at the current sales pace—the highest level since May 2020. Yet, it remains below the six-month supply considered balanced.

Mortgage rates averaged 6.92% in June, more than double the rates from three years ago. Although rates have slightly decreased to 6.77%, they are expected to cool further as the Federal Reserve is likely to cut its benchmark rate.

The only category with an increase in sales was homes priced above $1 million, rising 4% from a year ago. In contrast, sales for homes below $100,000 plummeted by 27%, and sales for homes in the $100,000 to $250,000 range dropped by 18%.

Regional highlights:

Northeast: Sales decreased by 2.1% from May, with a median price of $521,500, up 9.7% from last year.

Midwest: Sales fell by 8% from May, with a median price of $327,100, up 5.5% year-over-year.

South: Sales dropped by 5.9% from May, with a median price of $373,000, up 1.7% from last year.

West: Sales declined by 2.6% from May, with a median price of $629,800, up 3.5% year-over-year.

Despite the rise in listings, Yun emphasized that these are primarily healthy listings, not distressed sales, driven by factors such as job changes and downsizing for retirement.

Not Seeing Us in Your Inbox? Check your spam folder and mark us as 'not spam' to ensure you receive our latest real estate updates and opportunities.

👉 More Stories

Record gains and growing pains in Calgary, as Montreal sales renew; Vancouver and Toronto luxury markets calm with market and population shifts

Atlanta’s real estate market is rebounding after a significant slowdown. The first half of 2024 indicates a market transitioning from the challenges posed by soaring interest rates and limited inventory.

CoStar Group, a leading real estate data provider based in DC, has lowered its annual revenue forecast due to the financial strain imposed by high interest rates.

The Crown Estate delivers a record £1.1 billion net revenue profit for the public finances

Abu Dhabi’s biggest property developer plans to invest $490 million in neighboring Dubai, expanding its footprint in one of the hottest commercial real estate markets globally.

The latest figures from China’s National Bureau of Statistics point to significant improvement in the real estate market in June. F

⚡ Inspiration

5 DIY Ways to Transform Your Patio Into a Summer Escape

1. Create a Cozy Seating Area:

Tip: Upcycle old furniture with fresh cushions and throws. Arrange a mix of lounge chairs, a bench, and a stylish table to create an inviting space.

Why It Works: A comfortable seating area encourages relaxation and enjoyment of summer evenings.

2. Add Ambient Lighting:

Tip: Hang string lights or lanterns for a warm, inviting glow. Use mason jars or repurpose old bottles to create custom lanterns.

Why It Works: Soft lighting creates a magical atmosphere, perfect for evening gatherings.

3 . Install a Shade Solution:

Tip: Craft a pergola using wood or metal piping, or hang outdoor curtains to create a shaded retreat. Use fabric that is weather-resistant.

Why It Works: Shade provides relief from the sun and adds an element of privacy.

4. Incorporate Greenery:

Tip: Build or buy planter boxes to add flowers, herbs, or small shrubs. Arrange potted plants around your patio for a lush look.

Why It Works: Greenery brings a refreshing, natural element to your outdoor space.

5. Create an Outdoor Rug:

Tip: Paint an old rug or fabric with weather-resistant paint to make a custom outdoor rug. Choose patterns and colors that complement your patio decor.

Why It Works: An outdoor rug defines the space and adds a touch of comfort underfoot.

🛠️ Toolkit

For Buyers:

Get Creative with Financing: With mortgage rates high, now's the time to explore all your options. Talk to your lender about creative financing solutions or wait for rates to drop if you can.

Time Your Moves: Keep an eye on the Fed. Lower rates might be just around the corner, so stay patient and be ready to pounce when the time is right!

Explore New Horizons: Looking for a deal? Check out neighborhoods further from the city center where prices might be more wallet-friendly.

For Sellers:

Price to Entice: Make your home irresistible by pricing it just right. Check out similar homes in your area to make sure you're competitive.

Show Off Your Best: Highlight what makes your home unique—whether it's a fabulous backyard, a newly renovated kitchen, or quirky charm. Great photos and fun descriptions will catch buyers' eyes!

Stay Chill and Flexible: The market’s a bit slow, so be prepared for your home to take a little longer to sell. Stay flexible with your timing and consider sweetening the deal to make buyers fall in love.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.