Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “You don’t just buy real estate; you invest in a better future”.

In today’s edition - The U.S. economy defied expectations with 3.0% GDP growth in Q2 2024, driven by strong consumer spending and business investments. Mortgage demand surged 68%, while Redfin’s Homebuyer Demand Index hit a four-month high. Apartment rents dropped 6.2% amid a construction boom. Over 55.5% of new home listings in August came with major climate risks, affecting affordability. Miami tops UBS’s Global Real Estate Bubble Index, signaling price risks. Non-QM loans now make up 5% of the mortgage market, reflecting rising demand from creditworthy borrowers with flexible documentation.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.21% | + 0.02% |

15-Yr Fixed RM | 5.58% | + 0.03% |

30-Yr Jumbo | 6.41% | + 0.01% |

7/6 SOFR ARM | 6.14% | - 0.03% |

30-Yr FHA | 5.80% | + 0.04% |

30-Yr VA | 5.82% | + 0.05% |

Average going rates as of Sep 26 2024

S&P 500 | 5,745.37 | + 0.40% |

Oil | 67.41 | - 3.27% |

BTCUSD | 64,757.01 | + 2.09% |

Numbers as of Sep 26 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

BEA's Annual Revision Shows U.S. Economy Outpacing Expectations with 3.0% GDP Growth in Q2

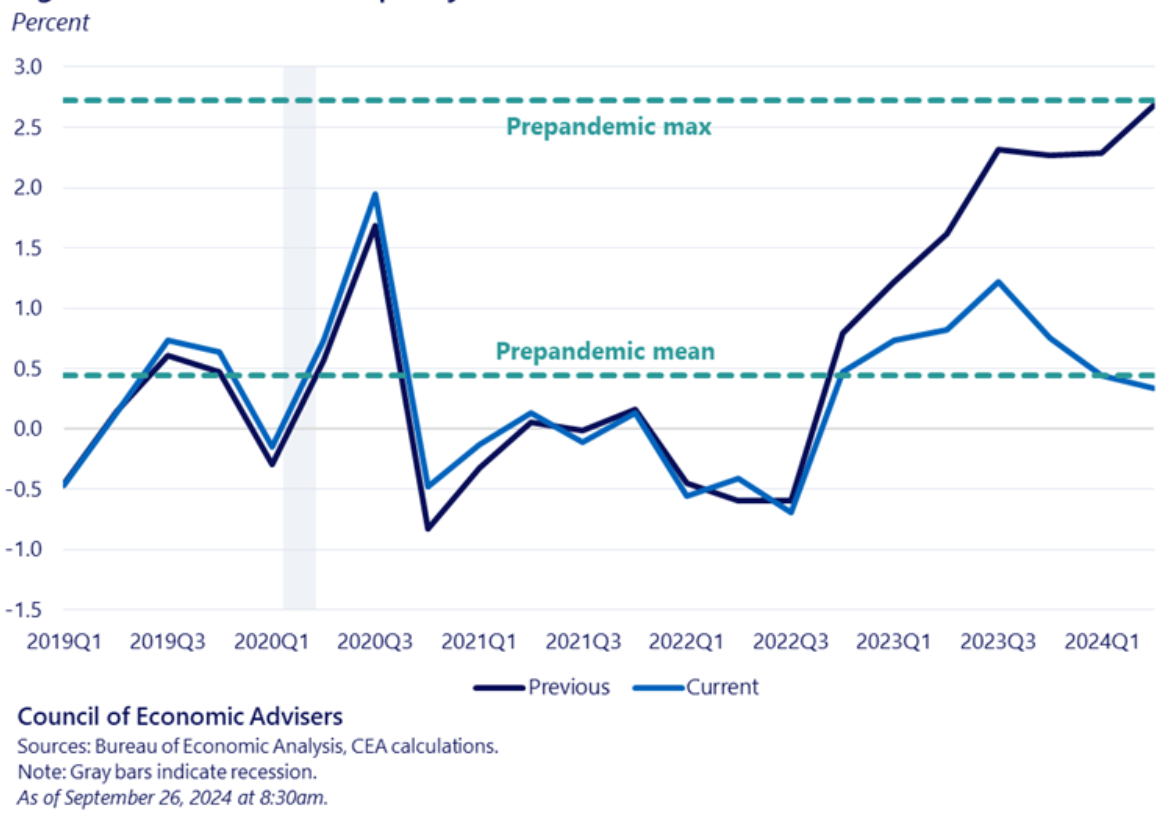

Q2 GDP Growth Surges to 3.0%: The updated BEA report for Q2 2024 reveals 3.0% GDP growth, fueled by strong consumer spending and business investment, reflecting a robust U.S. economic performance.

Upward Revisions in Income & Savings: Real disposable personal income grew faster than previously estimated, increasing by $3,700 per capita since 2019, while the savings rate rose to 5.2% in Q2 2024, easing concerns about financial strain.

Real GDI Growth Outpaces GDP: Gross domestic income (GDI) was revised up to a 3.8% cumulative growth through Q2 2024, narrowing the statistical discrepancy between GDI and GDP, signaling stronger-than-anticipated economic fundamentals.

🎢 Impact on Real Estate

Buyers Are Coming Back: Mortgage Demand Shoots Up, Home Tours Hit Highest Level Since May

Mortgage Rate Locks Surge 68%: Following the Fed's rate cut, mortgage-rate locks jumped by 68% compared to the previous month, signaling a strong uptick in homebuying activity, according to Optimal Blue.

Redfin's Demand Index Hits 4-Month High: Redfin's Homebuyer Demand Index surged to its highest level since May, reflecting improved housing market activity with a 1% annual increase—the first in nearly a year.

Affordability Improves as Payments Drop: Median monthly housing payments decreased by 4.4% year over year, marking the largest decline in over four years, driven by lower mortgage rates and increased affordability.

🎙️ RE Spotlight

Asking Rents for New Apartments Drop 6% to Lowest Level Since 2022, as Finished Buildings Soar

Asking Rents Drop 6.2%: The average asking rent for newly built apartments fell to $1,746 in Q2, marking a 6.2% year-over-year decline—the second-steepest drop in five years.

One-Bedroom Apartments See 9% Decline: One-bedroom apartments experienced the largest drop, with rents decreasing by 9% to $1,566, while two-bedroom rents fell 4.5% to $1,934.

Construction Boom Impact: New apartment completions surged 18.7% in Q1 2024, leading to increased competition among property owners and contributing to lower rents, especially in high-growth markets like Austin and Nashville.

Over Half of New Home Listings in August Come with Major Climate Risks

Rising Climate Risk in Home Listings: Over 55.5% of new home listings in August were at major risk of extreme heat, with 33% facing major wind risk. In comparison, wildfire, flood, and air quality risks were lower but still significant.

Regional Differences in Climate Risk: New Orleans led with 76.8% of new listings at major flood risk, while Riverside topped wildfire risk at 70%. Midwest cities like Cleveland and Columbus had the lowest climate risks, with fewer than 10% of listings affected.

Climate Risk Impact on Affordability: As climate risks rise, home insurance costs become a critical factor in affordability. Wildfire, flood, and wind risks may increase insurance premiums, making it harder for buyers to afford homes in high-risk areas.

🏰 RE State Zone

Miami Tops Global List as Most Overvalued Housing Market in UBS Real Estate Bubble Index

Miami Leads Global Housing Bubble Risk: Miami's housing market faces the highest bubble risk, with prices almost 50% higher than pre-pandemic levels, despite cooling due to rising mortgage rates, according to UBS’s Global Real Estate Bubble Index.

Market Imbalances Amid Growing Supply: A surge in high-end home listings, coupled with sharply rising insurance costs and concerns over sea-level rise, puts the future of Miami's property values in question, signaling potential price erosion.

Global Bubble Risks Shifting: While bubble risks have generally decreased for cities globally, Tokyo, Zurich, and several U.S. cities like Los Angeles and Toronto still face elevated risks, highlighting regional market differences in 2024.

🏕️ Niche-RE

Non-QM Mortgages in 2024: High Credit Scores & Lower Risks Amid Flexible Documentation

High Credit Scores, Low Risk: Non-QM borrowers in 2024 boast an average credit score of 776, reflecting strong creditworthiness compared to government loan borrowers averaging 699, despite using flexible documentation.

Flexible but Stable DTI Ratios: While 26% of non-QM loans have debt-to-income (DTI) ratios above 43%, today's non-QM loans have 75% loan-to-value (LTV) ratios, the same as QM loans, ensuring more stability than in the pre-recession period.

Smaller Market Share, Rising Demand: Non-QM loans account for 5% of the mortgage market in 2024, nearly double from 2020, serving creditworthy borrowers with unique income streams, such as gig economy workers and investors.

Non-QM loans rise to 5% of the mortgage market with improved borrower profiles and safer underwriting.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.