Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Strategic investments today shape the resilient markets of tomorrow.

In today’s edition - we explore President Trump’s calls for lower oil prices and interest rates, pushing the Dow higher. Real estate sees cash sales surging to 38.9% and institutional investing declining. Despite record home prices, profits are shrinking across U.S. markets. We also dive into ROI trends, with top metros like San Jose seeing strong returns. Plus, discover the latest real estate opportunities, including fire-resilient homes and new development projects in Chicago and Miami. Stay informed with expert insights on how these shifts impact real estate investments and market dynamics in 2025.

If you missed yesterday’s newsletter, click here

Mortgage Rates

30-Yr Fixed RM | 7.08% | - |

15-Yr Fixed RM | 6.50% | - 0.01% |

30-Yr Jumbo | 7.35% | - |

7/6 SOFR ARM | 6.95% | + 0.03% |

30-Yr FHA | 6.48% | + 0.03% |

30-Yr VA | 6.49% | + 0.02% |

Average going rates as of Jan 23 2025 |

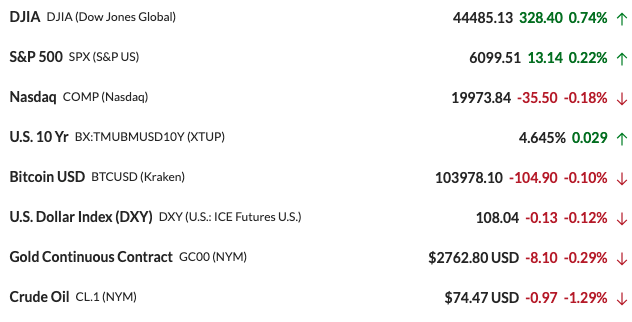

Stock Market: Dow up, S&P 500 on track for record close after Trump demands lower interest rates and oil prices; Nasdaq lower

Call for Lower Interest Rates and Oil Prices

President Trump urged OPEC to lower oil prices, tying them to his demand for a global drop in interest rates. He emphasized that declining oil prices should justify immediate rate cuts in the U.S. and globally.

Market Response

Oil Futures: Turned lower following Trump's remarks.

Treasury Yields: The 2-year yield, sensitive to Fed policy, dropped, while longer-term yields remained elevated.

Stocks: The Dow Jones rose 267 points (+0.6%), and the S&P 500 edged up 0.1%, nearing a record close last seen on December 6.

Muted Market Reaction

Analysts noted that Trump's comments didn’t reveal new strategies but revived familiar themes from his first term, such as tensions with the Federal Reserve.

Concerns linger about the possibility of sweeping, universal tariffs, which the market has yet to fully price in.

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

US President Trump threatens tariffs at 2025 Davos World Economic Forum

United States President Donald Trump has delivered the first international speech of his second term, appearing via livestream before the World Economic Forum in Davos, Switzerland.

1. "America First" Economic Vision - Trump reiterated his "carrot-and-stick" approach to global business leaders, inviting them to manufacture in the U.S. with promises of low taxes and deregulation. However, he warned of tariffs on foreign companies and goods, with a strong emphasis on reducing trade deficits.

2. Tensions with the European Union - The president criticized the EU for its treatment of U.S. businesses, particularly in cases involving tech companies like Apple and Google. He argued that European value-added taxes and trade barriers were unfair, likening them to indirect tariffs.

3. Aggressive Stance Toward Canada - Trump raised the idea of Canada becoming the "51st state" as a solution to trade disputes, threatening tariffs as leverage. His remarks hinted at broader territorial ambitions, including Greenland and the Panama Canal.

4. Focus on Ukraine Conflict and Oil Prices - Trump blamed high energy prices for prolonging the Russia-Ukraine war, suggesting that lowering oil costs could expedite peace. He also teased potential negotiations with Russia on nuclear disarmament, citing past conversations with Vladimir Putin.

5. Mocking Climate Policies - The president took aim at environmental initiatives, withdrawing from the Paris Agreement again and mocking the Green New Deal. He emphasized expanding U.S. fossil fuel production and criticized climate warnings as overblown, despite growing evidence of climate-related disasters.

🎢 Impact on Real Estate

Home Selling Profits Slide Again in 2024 Across U.S. Despite Continued Price Gains

Typical home sale profits reached $122,500, with a 53.8% ROI, but margins dropped for the second consecutive year, down from 56.9% in 2023.

The median home price rose by 5% to a record $350,000, yet ROI trends highlighted increasing purchase costs impacting returns.

Regional Highlights and Market Variations

Top ROI Metros: San Jose, CA (105.8%), Knoxville, TN (94.3%), and Ocala, FL (87.1%) led the nation in returns.

Median Price Leaders: Evansville, IN (+13.4%), Augusta, GA (+13.2%), and Albany, NY (+12.3%) recorded the highest annual price gains.

Declining Markets: Birmingham, AL (-8.3%), Ocala, FL (-5.9%), and Fort Myers, FL (-4.3%) saw the steepest price drops.

Cash Purchases Surge and Institutional Investing Declines

Cash sales accounted for 38.9% of all transactions, the highest level since 2013. Top cash-sale markets included Myrtle Beach, SC (61.3%) and Naples, FL (61.2%).

Institutional investor purchases continued declining, dropping to 6.3% of sales, led by Memphis, TN (15.1%) and Huntsville, AL (12.5%).

Foreclosure Sales and Tenure Trends

Lender-purchased foreclosures remained minimal at 1.4% of sales, near historic lows.

Average homeownership tenure reached 8.18 years, the longest since 2000.

🎙️ RE Spotlight

Fire-Resilient Homes: The New Standard for Southern California's Wildfire-Prone Future

Surviving the Flames: A Pacific Palisades home designed by architect Greg Chasen remained standing after wildfires destroyed surrounding structures, thanks to fire-resistant design features like a metal roof, tempered glass, and Class A wood decking. (Source: Bloomberg CityLab Housing)

Critical Fire-Resilient Strategies: Homes built to modern fire codes, like those in Los Angeles, are 50% more likely to withstand wildfires, with features such as concrete garden walls, heat-treated wood, and sparing vegetation playing a key role. (Metrics: Modern fire code impact analysis)

Urgency for Policy Overhauls: Wildfires have consumed over 12,000 structures in LA, prompting architects and lawmakers to push for fire-resilient designs and stricter building codes in the wildland-urban interface to protect vulnerable communities. (Source: Local Government Reports)

🏰 RE State Zone

Chicago's Largest Vacant Land Portfolio for Sale: 812 Lots Across South and West Sides

Massive Opportunity in South & West Chicago: A portfolio of 812 vacant lots, valued at $22.4M, is up for sale as part of a bankruptcy settlement. The properties span residential, commercial, and industrial zones, with some larger assemblages in high-potential areas like Lake and State Streets.

Transformative Investments in Underserved Areas: Spurred by major projects like the $7B United Center development and the Obama Presidential Center, these neighborhoods are seeing their biggest revitalization efforts in decades.

Bid Deadline Set for March 7: Developers eyeing the lots could benefit from new Red Line extensions and city-backed affordable housing initiatives, with multi-property deals expected over single-buyer acquisitions.

🏕️ Niche-RE

Adam Neumann's Flow buys one of Miami's last large development sites

$70.5M Deal for Rare Miami Land: Flow, backed by a $350M Andreessen Horowitz investment, acquired 16 acres in El Portal—double the $35M stalking-horse bid—paving the way for thousands of residential units.

One of Miami's Last Large Development Sites: At $4.4M per acre, the 8500 Biscayne Blvd. purchase highlights scarce opportunities east of I-95, where deals over 10 acres are rare.

Transforming Miami’s Biscayne Corridor: This mixed-use project joins Flow's other properties, such as Miami Worldcenter, cementing Neumann's strategy of high-growth, high-density investments in South Florida.

U.S. Hotel Development Booms: Dallas Pipeline Tops 200 Projects, Southern Markets Dominate Future Growth

Dallas Leads the Pack: With a record-breaking 204 hotel projects and 23,669 rooms, Dallas dominates the U.S. construction pipeline, followed by Atlanta with 168 projects (19,431 rooms) and Nashville with 130 projects (17,029 rooms).

Pipeline Growth Soars: The U.S. hotel construction pipeline boasts 459 new project announcements in Q4 2024, with 46% concentrated in the top 50 markets. Dallas again leads with 20 new projects (2,061 rooms), showcasing robust demand.

Expansive Renovations: Nationwide, 1,997 hotel renovation and conversion projects are in progress, adding 255,816 rooms. Washington DC leads with 34 projects (5,204 rooms), while Chicago contributes 31 projects (7,514 rooms).

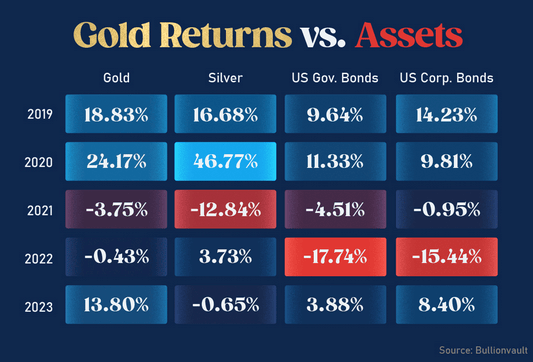

🖼️ Chart-Tastic

🌍 Dwelling of the Day

A basement surprise I have never seen before, well built house in Concord, CA 94519

Must See…

Listing Courtesy of: Albert Bernardo

Coldwell Banker DRE: 01356674

MLS# 41081662 & 41081664

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.