Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “A good real estate deal feels like finding treasure.”

In today’s edition - Mixed market sentiment dominates as the S&P 500 and Dow continue to dip ahead of the August jobs report. In real estate, migration patterns show a historic low in short-distance moves, while long-distance relocations rise. Housing payments hit their lowest level since January, yet pending sales remain sluggish. Universities face overcrowded dorms, while commercial real estate braces for a $1.5 trillion debt maturity crisis by 2026.

If you missed yesterday’s newsletter, click here

Going Rates

30-Yr Fixed RM | 6.35% | - 0.03% |

15-Yr Fixed RM | 5.85% | - 0.05% |

30-Yr Jumbo | 6.55% | - 0.02% |

7/6 SOFR ARM | 6.21% | - 0.04% |

30-Yr FHA | 5.72% | - 0.04% |

30-Yr VA | 5.75% | - 0.03% |

Average going rates as of Sep 5 2024 |

New? Join our newsletter – no cost!

🏛️ Friday’s Market Sentiment

Mixed Market Sentiment: All Eyes on Jobs Data and Tech Giant

September Struggles Continue: The S&P 500 and Dow closed lower for the third day, reflecting investor caution ahead of the highly anticipated August jobs report. Economists predict that this data could either confirm a "soft landing" or signal a broader economic slowdown.

Tech Stocks to the Rescue: Despite broader market declines, the Magnificent Seven tech stocks have kept the Nasdaq afloat. As Tesla and Amazon rallied, these mega-cap stocks provided a bright spot, underscoring the ongoing reliance on tech to stabilize market sentiment.

Markets on Edge: With mixed economic indicators—disappointing payroll figures but lower jobless claims—investors are on alert. Friday's Labor Department report is expected to be a pivotal moment, influencing whether stocks continue their downward trend or rebound.

🎢 Impact on Real Estate

2022 Study - Americans’ Migration Patterns: Longer-Distance on Rise and Short-Distance Hits Historic Lows.

Historic Low in Short-Distance Moves: Census data from 2021-22 shows that residential moves within the same county hit a 75-year low, with only 4.6% of Americans moving locally. Housing-related factors, like finding cheaper or larger homes, drove the decline.

Rise in Long-Distance Migration: While overall migration rates are historically low, longer-distance moves across counties and states have increased slightly. Pandemic-induced remote work and job flexibility continue to fuel migration to states like Texas and Florida.

Young Adults Driving Migration Shifts: Americans aged 25-34, historically the most mobile group, saw an uptick in cross-state moves in 2021-22, signaling a potential recovery in migration rates as this demographic seeks jobs and housing in new regions.

🎙️ RE Stats

Housing Payments Have Dropped to Their Lowest Level Since January.

Mortgage Rates Hit Lowest Level in 18 Months: Weekly average mortgage rates have dropped to their lowest in over a year, pushing the median U.S. housing payment down to $2,534—$300 below the April peak—offering homebuyers some relief despite near-record high home-sale prices.

Home Sales Still Stalled Amid Market Hesitation: Pending home sales dropped 8.4% year over year, as many potential buyers are delaying purchases. Factors include anticipated Federal Reserve interest rate cuts, uncertainties around new NAR rules on agent fees, and the upcoming presidential election.

Homebuyer Demand Signals an Uptick: Despite buyer caution, mortgage-purchase applications rose 3% week over week, and Redfin’s Homebuyer Demand Index increased by 4% month over month, reflecting growing interest as buyers tour homes in preparation for potential purchases.

Lower mortgage payments ease the pressure, but buyers remain cautious amid market uncertainty.

🎓 Campus Housing

Colleges Face Growing Challenges with Overcrowded Dorms.

Overcrowded Dorms & Makeshift Solutions: Universities like Webster and the University of Maine are converting lounges and kitchens into dorm rooms to accommodate enrollment surges, often squeezing three students into rooms meant for two.

Housing Waitlists Grow: At institutions such as Cal State Monterey Bay and the University of Utah, students remain on housing waitlists even days before classes, signaling ongoing challenges in forecasting housing demand.

Incentives for Off-Campus Living: To alleviate on-campus overcrowding, universities including UIUC and LSU are offering financial incentives worth thousands to students who opt to live off-campus or in nearby hotels.

🏕️ Niche-RE

Landlords Face $1.5T Maturity Wall Before 2026

CRE Debt Maturity Crisis Looms: With $1.5 trillion in commercial real estate debt due by the end of 2025, the industry faces significant challenges. JLL estimates that $375 billion of that amount may struggle to refinance, setting the stage for potential disruptions.

Pandemic Aftermath & Economic Shifts: The pandemic's monetary policies led to unprecedented liquidity and stimulus, but they also fueled inflation. The Federal Reserve's rapid interest rate hikes, while necessary to combat inflation, have sharply increased borrowing costs, catching many CRE borrowers off guard.

Impact on Property Valuations: The sudden shift from ultra-low to higher borrowing rates has led to reduced transaction activity and falling property valuations. With refinancing becoming more difficult, the commercial real estate sector faces an uncertain future.

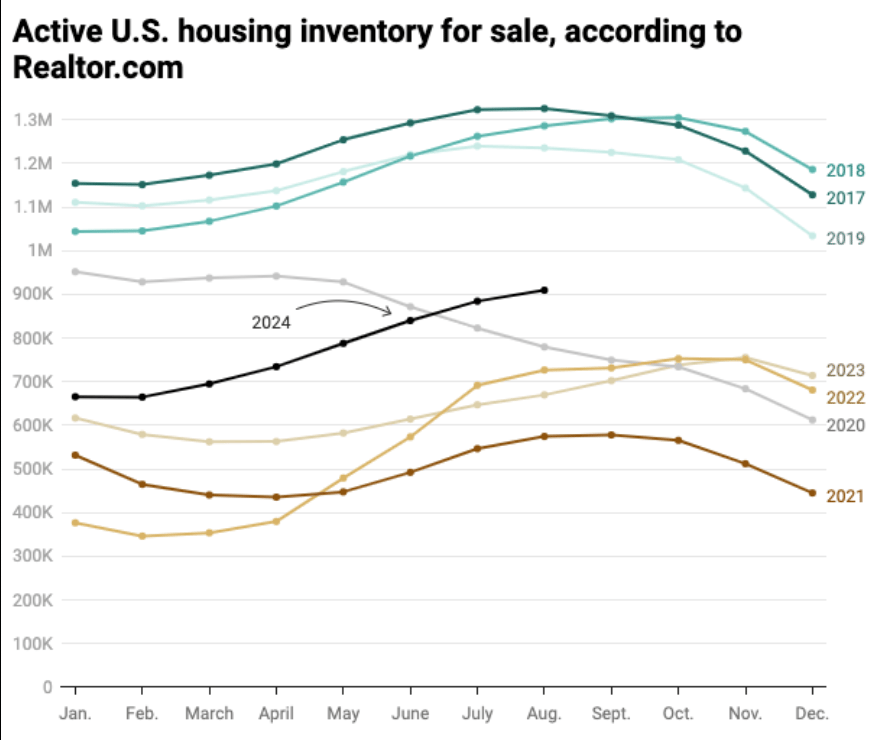

🖼️ Chart-Tastic

👾 Interesting in Social

Want to know what it means being a realtor or real estate agent mean? Realtors are sharing their thoughts here.

🤪 Fun for the Road

Real estate is serious business, but that doesn’t mean we can’t have some fun along the way! Let’s celebrate the wins and enjoy a little humor!

Here is One -

"When the inspection reveals a 'slight' issue:

Client: 'How bad can it be?'

Inspector: 'You ever seen Jumanji?'"

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.