Happy Monday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Property isn’t just land; it’s the foundation of your future

In today’s edition - Consumer sentiment dips as inflation concerns persist, though sentiment remains stronger than a year ago. Wall Street debates the next phase of the bull market, driven by AI growth and resilient stocks. Real estate sees vacant homes rising, yet supply remains tight. The South and West struggle in housing market rankings, while young Americans prioritize reproductive rights in relocation decisions. In New Jersey, municipalities challenge affordable housing laws, and the U.S. office market tightens amid leasing gains and supply constraints. Home Depot adapts to post-pandemic shifts, subleasing warehouse space as renovation demand eases.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.64% | + 0.02% |

15-Yr Fixed RM | 6.10% | - 0.06% |

30-Yr Jumbo | 6.75% | - |

7/6 SOFR ARM | 6.55% | - 0.01% |

30-Yr FHA | 6.12% | - |

30-Yr VA | 6.13% | - 0.02% |

Average going rates as of Oct 12 2024

S&P 500 | 5,815.03 | + 0.61% |

Gold | 2,674.20 | + 1.32% |

Numbers as of Oct 12 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Consumer Sentiment Inches Down Amid Continued Frustration Over High Prices

Consumer sentiment dips: The University of Michigan’s consumer sentiment index dropped 1.7% in early October to 68.9, falling short of the forecasted 70.8, reflecting ongoing consumer concerns over high prices.

Inflation expectations rise: The survey revealed that consumers expect price increases to climb for the first time in five months, despite recent signs of inflation easing, per the Consumer Price Index (CPI).

Resilient outlook: Despite frustrations over inflation, consumer sentiment is still 8% higher than a year ago and nearly 40% stronger than its June 2022 low, with long-run business conditions improving to a six-month high.

The Bull Market is 2 Years Old. Here's Where Wall Street Thinks Stocks Go Next.

S&P 500 up over 60% in two years: Driven by AI euphoria and a resilient U.S. economy, the S&P 500 has surged, with strategists forecasting further growth into 2025, despite concerns over high valuations.

AI’s expanding influence: The AI boom, initially led by tech giants, is expected to broaden, driving profitability and earnings growth across various sectors over the next 2-5 years.

Valuation risks loom: Analysts caution that stretched valuations resemble past market bubbles, but no clear downside catalyst, such as rising interest rates or unemployment, is in sight for now.

🎢 Impact on Real Estate

Despite Housing Shortage, America Has 5.6 Million Vacant Homes—What Gives?

Vacant homes don’t equal housing surplus: Although there are 5.6 million vacant homes in the U.S., most are either rental units, vacation homes, or held for personal reasons, not dilapidated properties ready to hit the market.

Top vacancy drivers: The most common reasons for vacancies are properties being offered for rent (23.49% in New Orleans), seasonal use (50.44% in Miami), and personal reasons, such as owners waiting to decide on selling or renting.

Vacancy rates vs. supply issues: While rental vacancy rates sit at 6.6%, homeowner vacancy rates remain low at 0.9%. For-sale inventory remains more than 20% below pre-pandemic levels, meaning the housing supply remains tight despite high vacancy numbers.

🎙️ RE Spotlight

Why the South and West Can’t Seem To Crack the List of America’s Hottest Housing Markets

Midwest and Northeast dominate: Markets like Manchester, NH, and Rockford, IL, are seeing intense buyer interest, while the South and West are cooling due to increased supply and high home prices, respectively.

High views, fast sales: Homes in Manchester are snapped up in about 25 days, with listings receiving 3.4 times more views than the national average, driven by low inventory and high demand.

Affordability matters: Cities like Rockford, IL, offer bargain homes, with median prices around $223,000, making them appealing to buyers navigating rising mortgage rates.

Young Americans and Homebuyers Prioritize Access to Abortion and IVF

Abortion access drives relocation for some: 7% of Gen Zers and 5% of millennials who plan to move soon are motivated by wanting to live in a place where abortion is legal.

Generational divide on abortion: 59% of millennials and over half of Gen Zers and Gen Xers prefer to live where abortion is legal, while baby boomers are the least concerned (50%).

IVF access equally important: Roughly two-thirds of millennials and Gen Zers want to live in places where IVF and fertility treatments are easily accessible, reflecting the increasing importance of reproductive health services in housing decisions.

🏰 RE State Zone

21 New Jersey Municipalities Challenge Affordable Housing Law in Amended Lawsuit

Expanded lawsuit: A total of 21 municipalities, led by Montvale Mayor Mike Ghassali, have joined a legal challenge against New Jersey’s affordable housing law, citing concerns over state overreach.

Law standardizes housing obligations: The law, signed by Governor Phil Murphy in March, requires municipalities to meet affordable housing targets while offering protections against anti-housing lawsuits.

Legal battle over local control: The lawsuit claims the law exceeds constitutional requirements under the Mount Laurel Doctrine, particularly criticizing the exemption of 62 urban municipalities from housing obligations.

🏕️ Niche-RE

US Office Market Tightens as Leasing Activity Grows and Supply Shrinks in 5 Years

Leasing gains momentum: Q3 leasing activity hit 50.4 million square feet, with gateway and secondary markets leading the charge—growing by 2.5% and 4.6% respectively—while tertiary markets saw an 18.7% decline.

Supply crunch drives availability down: For the first time in over five years, U.S. office availability decreased as new supply dwindled and over 30 million square feet were removed, primarily due to office-to-residential conversions.

Downsizing stabilizes: Tenant comfort with existing office space has slowed the downsizing trend, helping to balance the tightening market and boost leasing growth.

Home Depot’s Post-Pandemic Shift: Subleasing Warehouses as Renovation Demand Eases

Sales peak and retreat: Home Depot saw pandemic-driven sales surge from $132.1 billion in 2021 to $157.4 billion in 2023 before dipping slightly to $152.7 billion in 2024 as renovation demand cooled.

Subleasing 4.7 million sq ft of warehouse space: Home Depot is subleasing warehouses in key locations like New Jersey and Arizona, a move prompted by reduced inventory needs and shifts in supply chain dynamics.

Market shift: Low existing home sales and higher interest rates have dampened the home improvement boom, prompting Home Depot to recalibrate its operations.

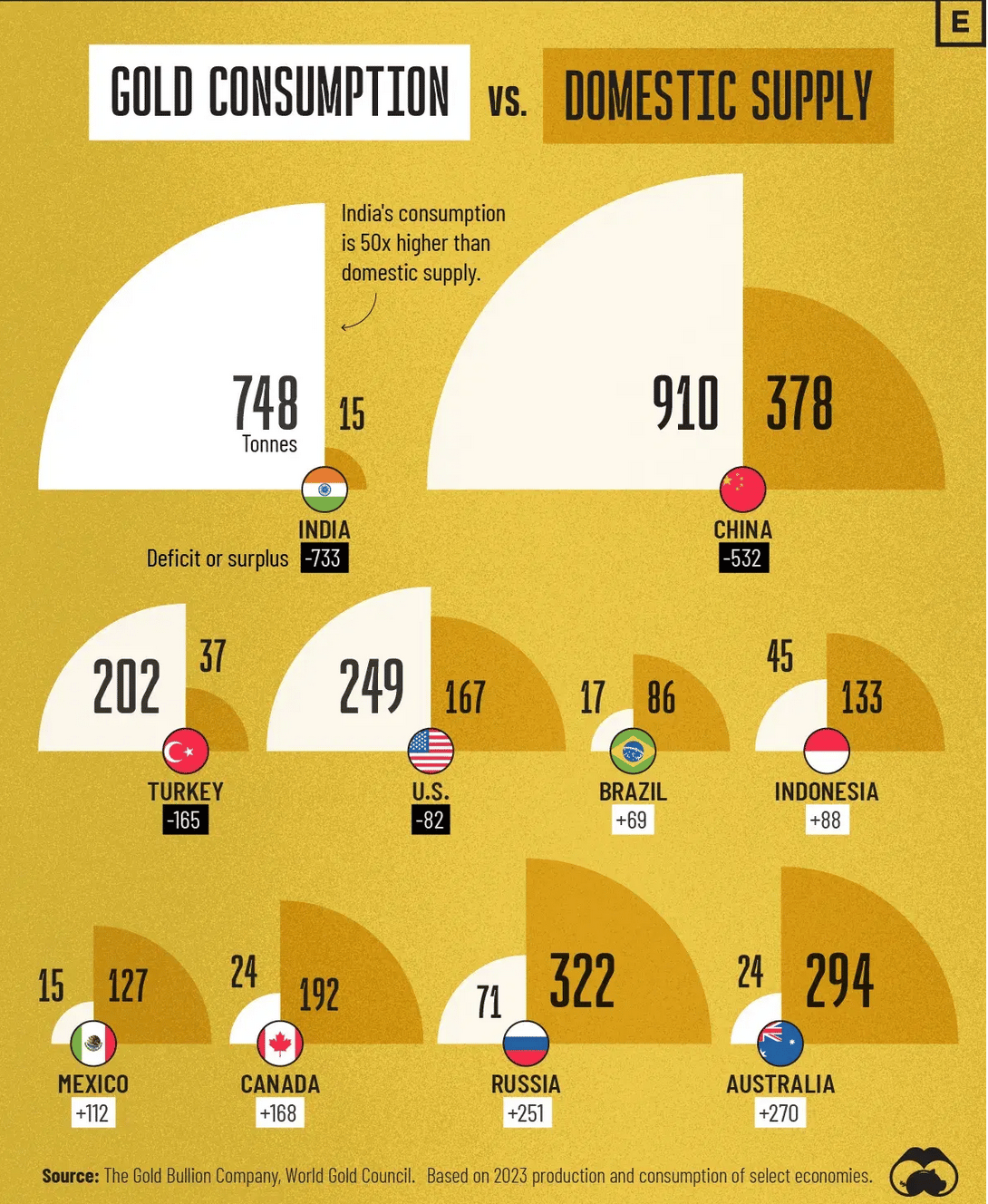

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.