Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - A home is where you can be your truest self, the foundation of your life’s journey.

In today’s edition - We explore Walmart's Q3 sales surge and its reflection of consumer behavior, uncover the challenges facing the housing market amid high rates and natural disasters, and dive into the "Baby Chaser" migration trend reshaping U.S. cities. Stay informed with insights rooted in expertise, reliability, and market relevance

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.04% | - 0.04% |

15-Yr Fixed RM | 6.42% | - 0.03% |

30-Yr Jumbo | 7.23% | - 0.02% |

7/6 SOFR ARM | 7.04% | - 0.06% |

30-Yr FHA | 6.38% | - 0.02% |

30-Yr VA | 6.40% | - 0.02% |

Average going rates as of Nov 19th 2024

S&P 500 | 5,911.93 | + 0.31% |

Gold | 2,635.10 | + 0.78% |

10 Yr T-Note | 109.80 | + 0.16% |

Numbers as of Nov 19th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Walmart’s Holiday Momentum: Strong Sales Signal Consumer Trends

Sales Surge Amid Holiday Prep: Walmart’s U.S. sales grew by 5% in Q3 to $114.9B, with e-commerce sales jumping 22%. In-store, pickup, and delivery volumes all increased, reflecting consumer demand for both affordability and convenience.

Affluent Shoppers Drive Growth: Inflation-conscious higher-income customers continue to “trade down” to Walmart, boosting revenue. Targeted holiday pricing, such as toys under $25 and 3% cheaper Thanksgiving dinner essentials, is luring both core and new shoppers.

Cautious Retail Industry Outlook: While Walmart raised its annual forecast, analysts caution that broader retail success is uncertain. Inventory management remains tight, with Walmart reducing stock by 0.6% in Q3 while keeping shelves well-stocked for the critical shopping season.

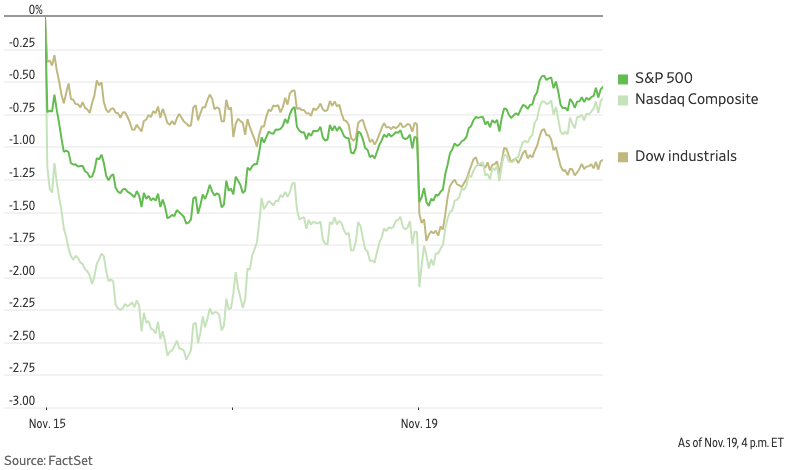

Markets at a Glance: Tech Gains, Geopolitical Tensions, and Housing Declines

Tech Stocks Propel Nasdaq: Nvidia surged 4.9% ahead of its earnings, lifting the Nasdaq by 1%. In contrast, the Dow dipped 0.3%, highlighting mixed market sentiment amid geopolitical and economic concerns.

Geopolitical Tensions Spark Safe-Haven Rally: European shares fell after Ukraine used U.S.-supplied missiles against Russia, prompting a response from President Putin. Investors turned to gold (+0.6%, $2,627.10/oz) and Treasurys (10-year yield down to 4.378%).

Housing Starts Tumble Amid Storms: U.S. housing starts dropped 3.1% in October, more than expected, with hurricanes playing a significant role in curbing construction activity.

🎢 Impact on Real Estate

Housing Starts Hit Recession Levels: High Rates Halt Millions of New Homes

Recession-Level Housing Activity: October 2024 saw housing starts at a seasonally adjusted annual rate of 1.311 million, down 4% YoY. Building permits also fell 7.7% YoY to 1.416 million, indicating waning confidence in new home construction.

Mortgage Rate Sensitivity: Builder activity improves when mortgage rates drop closer to 6% but stalls at rates between 6.75% and 7.5%. Meanwhile, 5-unit permits remain flatlined, signaling a downturn in multi-family construction.

Economic Realities vs. Builder Strategy: Despite high demand, builders hesitate to ramp up production as high borrowing costs and limited demand make expansion unprofitable, emphasizing the urgent need for sustained lower mortgage rates to revive growth.

🎙️ RE Spotlight

Big Cities Take Up Fight Against Algorithm-Based Rents

Algorithmic Rent Pricing Under Fire: Cities like San Francisco and Philadelphia have enacted laws to restrict rent-setting software, targeting its use of nonpublic landlord data. Over 13 U.S. states and cities are exploring similar legislation to combat rising rents and alleged antitrust violations by RealPage.

Federal Lawsuit Sparks Regulatory Action: The Justice Department's lawsuit accuses RealPage of illegal rent price coordination affecting 3 million apartments. While the case progresses, local governments are preemptively introducing measures to curb algorithmic influence in housing costs.

Industry Pushback Amid Supply Concerns: Real estate groups argue that rent software bans address symptoms, not root causes, of housing costs—highlighting the need for increased housing supply instead of penalizing tech innovations used by landlords.

Baby Chasers: How Grandchildren Are Driving America’s Migration Patterns

Southward Shift with Family Ties: Cities like Austin, Charleston, and Jacksonville lead the "Baby Chaser Index," reflecting a trend where older Americans relocate to be closer to grandchildren. This shift, fueled by rising childcare costs (+6.4% in 2 years), is reshaping housing markets, with age-restricted developments thriving.

Economic and Emotional Drivers: Decades of wealth accumulation through rising stock prices and home values allow retirees to sell mortgage-free homes and relocate without financial strain. For families, nearby grandparents reduce childcare and eldercare expenses, especially as working moms of toddlers rose to 66% in 2022, up from 58% three decades ago.

Cultural and Market Impacts: In cities like Georgetown, Texas, booming retiree populations contribute to soaring home sales and triple-A bond ratings. Age-restricted communities are expanding within master-planned developments, catering to a growing demographic prioritizing proximity to family.

🏰 RE State Zone

Home Sales Sink Across Florida Amid Hurricane Recovery, Surging HOA and Insurance Costs

1. Pending Sales Decline Sharply in Florida

Fort Lauderdale: -15.2% YoY

Miami: -14% YoY

West Palm Beach: -13.8% YoY

Jacksonville: -9.5% YoY

Tampa: -7.2% YoY

Nationally, pending sales rose 4.7% during the same period.

2. Hurricanes and Rising Costs Pressure Buyers

Hurricanes Helene and Milton disrupted the market, compounding challenges from escalating insurance premiums, HOA fees, and climate risk.

Condo markets are particularly hard-hit due to special assessments after Surfside regulations, with some units sitting on the market for over a year.

3. Signs of Recovery Post-Storms

Tampa’s pending sales plunged 32.2% during peak hurricane impacts but have since moderated to -7.2% YoY.

Orlando has also seen improvements, with declines narrowing from -14.1% to -5.1% YoY.

🏕️ Niche-RE

Dallas Office Sales Pick Up the Pace.

1. Investment Activity Stays Robust

Dallas office investments reached $1.1 billion by Q3 2024, ranking 4th nationally behind Manhattan, D.C., and the Bay Area.

Properties traded at an average of $128 per square foot, below the $171 national average but steady compared to prior quarters.

2. Construction Pipeline Expands

About 4 million square feet of office space is under construction, 1.4% of total stock, above the 1.0% national rate.

Major developments include NexPoint's Texas Research Quarter, set to deliver 4+ million square feet of life science facilities in Plano.

3. Rising Vacancy and Office Conversions

Dallas' office vacancy rate climbed to 22.9% in September, up 390 basis points YoY, exceeding the 19.5% national average.

Investors increasingly explore office-to-residential conversions amid fluctuating sector metrics, leveraging tools like the Conversion Feasibility Index.

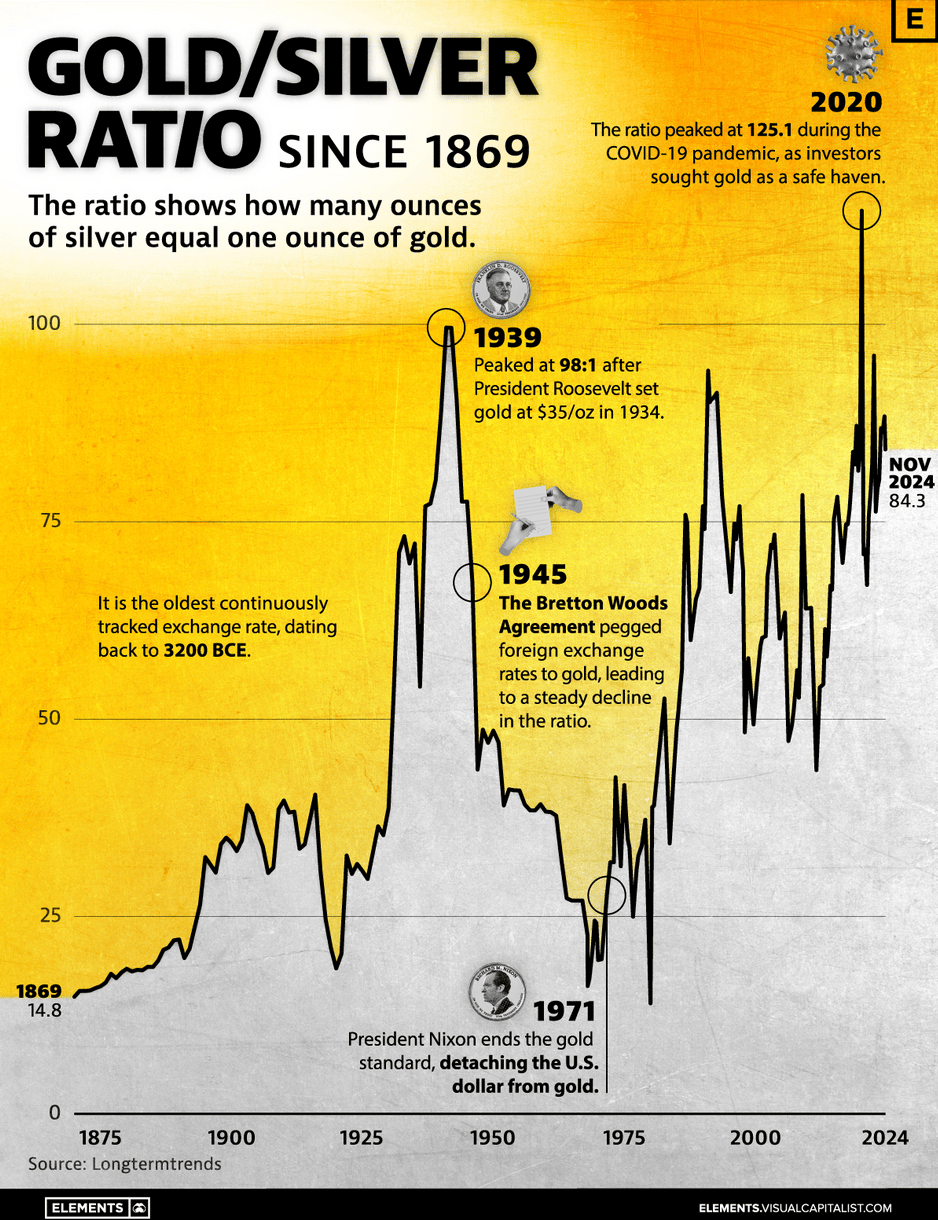

🖼️ Chart-Tastic

🌍 Dwelling of the Day

Timeless elegance - when modern comfort meets classic charm. MUST SEE TO BELIEVE & BUY if qualified for it in Shelley, Idaho.

10Bed 7Bath, 12,475sqft

Built 1983 on a 1.56 Acre lot

Asking $1.2M. Link to Listing

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.