Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Real estate is no longer just about location—it’s about resilience.”

In today’s edition - This edition dives into key market trends for 2025, including slower Fed rate cuts, volatile stock projections, and the growing impact of climate risks on housing. Discover the top real estate markets poised for growth and how evolving investor sentiment shapes opportunities ahead. With insights on stabilizing mortgage rates, rising natural disaster costs, and economic forecasts, this newsletter equips you to navigate the year ahead.

If you missed yesterday’s newsletter, click here

Rates

30-Yr Fixed RM | 7.24% | + 0.09% |

15-Yr Fixed RM | 6.53% | + 0.02% |

30-Yr Jumbo | 7.42% | + 0.04% |

7/6 SOFR ARM | 7.10% | + 0.11% |

30-Yr FHA | 6.55% | + 0.07% |

30-Yr VA | 6.57% | + 0.07% |

Average going rates as of Jan 10 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Wall Street veteran fund manager unveils market forecast for 2025

Slower Fed Rate Cuts in 2024: Contrary to expectations of six rate cuts, the Fed reduced rates only three times last year, starting in September. Inflation remains above the 2% target, with headline inflation at 2.7% and core inflation at 3.3% as of late 2024.

2025 Economic Outlook: Bob Doll predicts economic growth will slow, with unemployment staying between 4.0%-5.0%. Inflation will remain sticky above target, limiting the Fed to just one expected rate cut in 2025.

Market Projections for 2025:

S&P 500 Earnings: Growth will fall short of the consensus 14% increase, though all sectors will post positive EPS.

Volatility and Corrections: The VIX is expected to rise, with a 10% stock correction likely as P/E ratios compress.

Sector Performance: Financials, energy, and staples will outperform healthcare, technology, and industrials.

🎢 Impact on Real Estate

Los Angeles fires expose inflated US home prices

Rising Natural Disaster Costs: The recent Los Angeles wildfires have caused an estimated $50 billion in damage, highlighting how severe disasters can reshape the housing market. Insurers are retreating, and coverage costs are skyrocketing, with some areas seeing premium increases of 34% or more.

Impact on Property Values: As insurance premiums double or become unavailable, home values in high-risk areas plummet. For example, Pacific Palisades median sale prices dropped 16% after insurers like State Farm canceled policies.

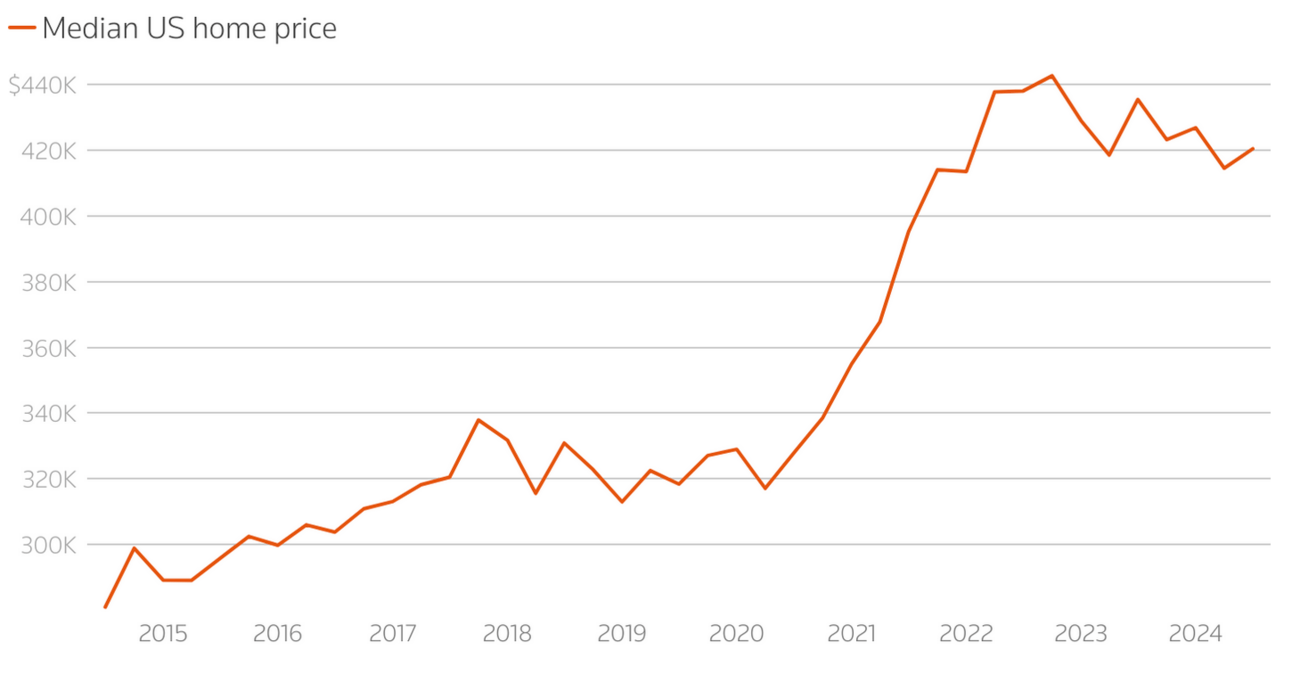

Broader Housing Market Risks: With median home prices up 50% nationwide over the last decade, stronger hurricanes, floods, and wildfires threaten to destabilize the broader housing market, potentially reducing property values in disaster-prone areas.

Our Take:

The devastating Los Angeles wildfires underscore a looming nationwide housing market challenge: the growing impact of climate change. As natural disasters intensify, insurers retreat, driving up premiums and eroding property values. This is not just a California problem—rising climate risks are set to reshape housing markets across the U.S. It’s a wake-up call for homeowners, investors, and policymakers to address the economic implications of a warming planet.

🎙️ RE Spotlight

Housing Hot Spots for 2025: Top Markets Amid Stabilizing Rates

Mortgage Rates & Affordability: The National Association of REALTORS® predicts mortgage rates to stabilize near 6% in 2025, allowing 6.2 million households to afford median-priced homes. This marks a return to broader market activity, especially as rates drop below 6.5%.

Inventory & Construction Growth: Housing inventory is set to improve with new construction projects pushing starts toward the historical annual average of 1.5 million units. However, inventory will still fall short of pre-pandemic levels, maintaining some pressure on buyers.

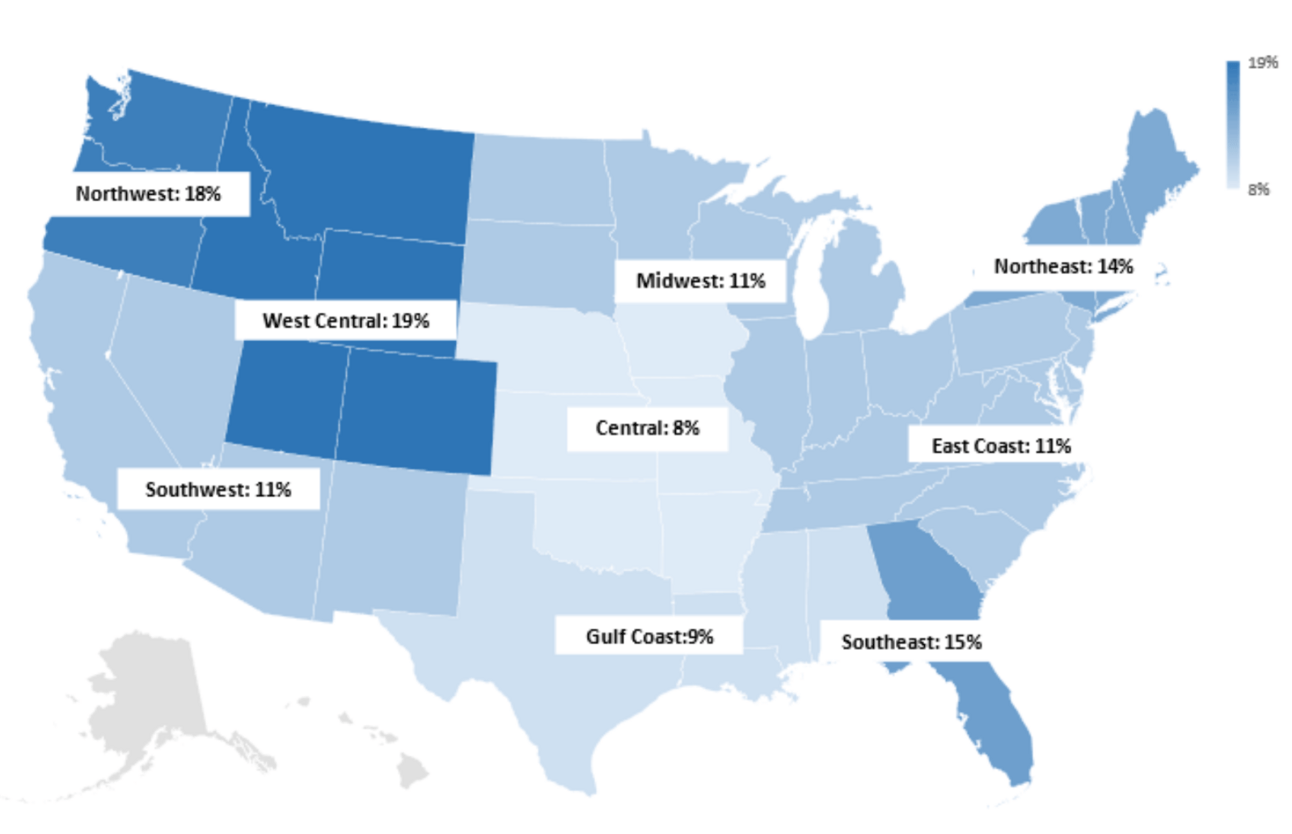

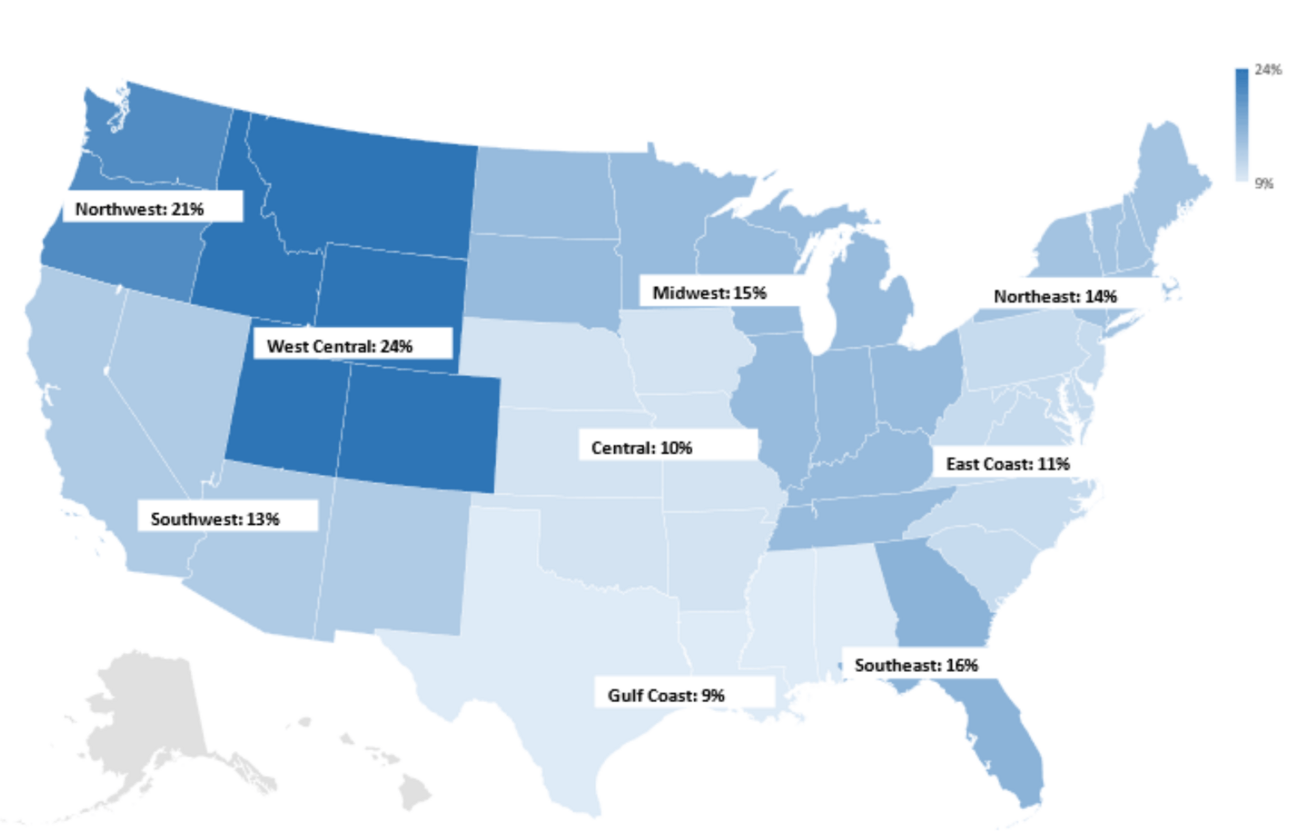

Regional Housing Hotspots: Key factors such as faster job growth, higher net migration, and more starter-home availability will drive local market strength in 2025. Areas with fewer “locked-in” homeowners and more Millennials reaching homebuying age are expected to see heightened activity.

🏕️ Niche-RE

Real estate investors face a daunting winter storm

Investor Sentiment Hits a Low: The Investor Sentiment Index fell 27 points to 97, its lowest level in a year. Only 35% of investors believe the market is better than a year ago, compared to 68% in fall 2024.

Challenges Impacting Confidence: Financing costs, inventory shortages, rising home prices, and insurance costs dominate investor concerns. Nearly 70% cite insurance costs as a factor in decisions, with 53% reporting deals fell through due to this.

Short-Term vs. Long-Term Outlook: Fix-and-flip investors are more optimistic, with 48% expecting market improvement in the next six months, compared to 33% of rental property investors. Despite challenges, 55% of all respondents predict home prices will continue to rise.

Our Take:

The Winter 2024 Investor Sentiment Survey reflects a cautious real estate investment landscape. Long-term rental investors express significant concerns, citing high financing and insurance costs, while short-term flippers remain relatively upbeat. Political uncertainty and economic challenges are also shaping the outlook. However, a majority of investors anticipate continued home price growth, signaling resilience amid the uncertainty.

🖼️ Chart-Tastic

Fire/Lightning (Large Loss) Insights: 12-Month Trend

Wind/Hail (Exterior/Roof) Insights: 12-Month Trend

Water (Interior Reconstruction) Insights: 12-Month Trend

Water Mitigation (Drying) Insights: 12-Month Trend

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.