Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Every house has a soul, and every buyer has a heartbeat that matches it.

In today’s edition - The U.S. labor market showed strength with 8 million job openings, despite a historic East Coast port strike. In real estate, housing turnover hit a 30-year low, with only 2.5% of homes changing hands in 2024, largely due to the "lock-in effect" of low mortgage rates. Baby boomers, who own 38% of U.S. homes, are reluctant to sell, tightening supply. However, multifamily completions surged to a 50-year high in August. Virginia Beach stands out with 95.3% occupancy and 3% annual rent growth, outperforming national averages.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.20% | - 0.04% |

15-Yr Fixed RM | 5.55% | - 0.06% |

30-Yr Jumbo | 6.40% | - 0.03% |

7/6 SOFR ARM | 6.16% | + 0.01% |

30-Yr FHA | 5.75% | - 0.05% |

30-Yr VA | 5.77% | - 0.04 |

Average going rates as of Oct 1 2024

S&P 500 | 5,754.75 | - 0.09% |

Bitcoin USD | 60,763.13 | - 3.80% |

Numbers as of Oct 1 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

U.S. Labor Market Shows Strength Amid Rising Job Openings and Major Port Disruptions

U.S. job openings rose to 8 million in August 2024, defying expectations of stability as employers in construction and government sectors sought more workers. Despite layoffs falling, the labor market has cooled, with job quitting at its lowest since 2020.

East Coast ports shut down in a historic strike, affecting 45,000 workers and 36 ports. With wage disputes unresolved and negotiations stalling, U.S. maritime trade faces severe disruption, threatening peak-season imports and exports.

The Fed's cautious rate cuts reflect resilience in the U.S. economy, as inflation has fallen to 2.5%, but hiring momentum has weakened. September jobs report expected to show 143,000 new jobs, keeping the unemployment rate at 4.2%.

Manufacturing remains in contraction, with September’s ISM Manufacturing PMI at 47.2, below the forecasted 47.5. Economist Tim Fiore notes production stability, but warns of potential disruptions from the East Coast port strike and Boeing strike in October.

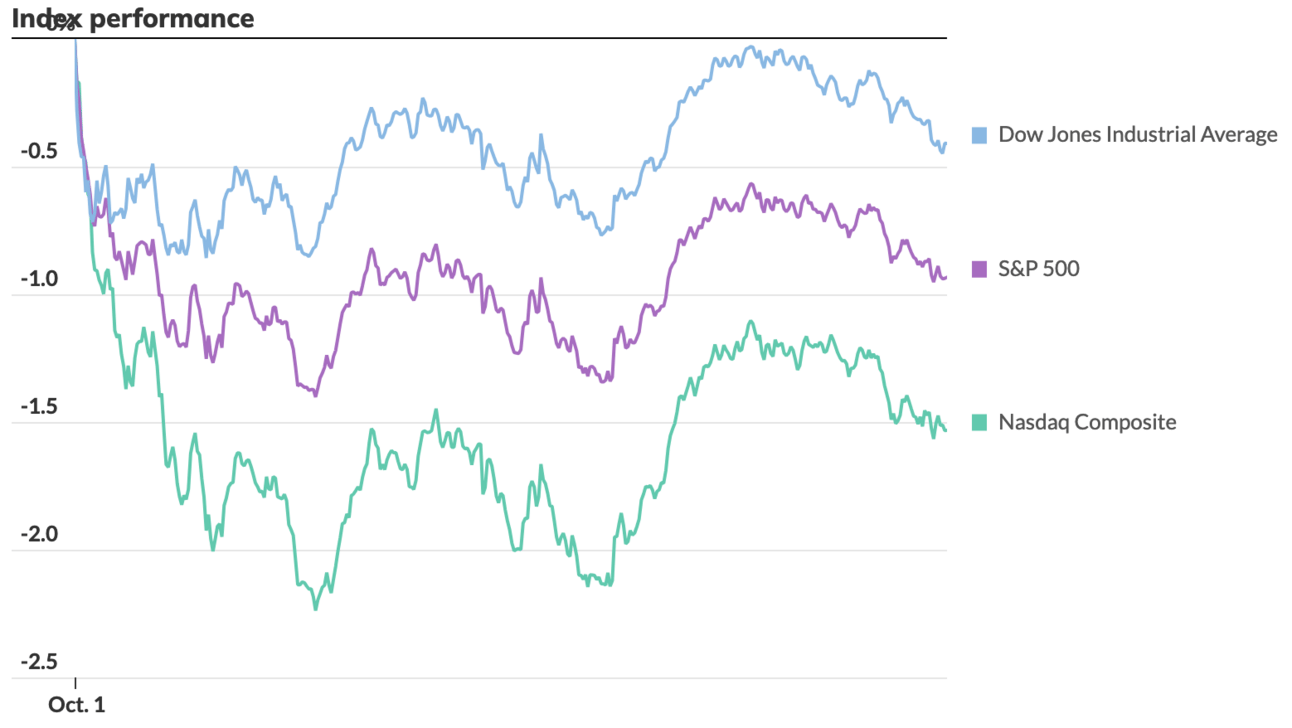

Stock Market: Dow ends lower as S&P 500, Nasdaq suffer worst day in nearly a month after Iran launches missile attack on Israel

🎢 Impact on Real Estate

Just 2.5% of U.S. Homes Changed Hands This Year, The Lowest Rate in Decades

Housing turnover in 2024 hit a 30-year low, with 37.5% fewer homes sold compared to the peak of the pandemic buying frenzy in 2021, according to Redfin. Elevated mortgage rates and rising home prices are key factors in this sharp decline.

Home sales remain constrained by the "lock-in effect," as over 75% of U.S. homeowners have secured mortgage rates under 5%, compared to the 2024 peak of 7.52%. This phenomenon discourages homeowners from selling and buying new homes at higher rates.

Phoenix and Newark, NJ lead in housing turnover, with Phoenix seeing 38 out of every 1,000 homes sold in 2024, followed closely by Newark at 37. In contrast, urban areas experienced lower turnover rates, driven by economic and political uncertainty.

🎙️ RE Spotlight

Boomers Hold the Key to the Housing Market as Supply Stays Tight

Over half of baby boomers (54%) plan to stay in their homes for life, further restricting the already tight housing supply, according to a recent Clever Real Estate survey. Boomers, who own 38% of U.S. homes, are holding onto properties, despite many expecting to profit $100,000 or more from selling.

Boomers’ reluctance to sell may amplify the housing market supply crisis, where available homes remain well below the balanced six-month supply economists recommend. As of July 2024, the market had a four-month supply, despite a 20% increase from last year, says the National Association of Realtors®.

First-time homebuyers face a steeper challenge than their boomer predecessors, with high prices, elevated mortgage rates, and tight inventory making it harder for younger generations to afford homes. Meanwhile, 42% of boomers believe today’s young buyers have it easier, despite vastly different market conditions.

🏰 RE State Zone

Virginia Beach Outperforms Most Large Apartment Markets

Virginia Beach’s apartment market ranks among the top in the U.S., with 95.3% occupancy as of August 2024, the eighth-tightest among the 50 largest markets. With modest inventory growth of 1.5% and high demand, the market saw significant absorption of 1,636 units in the past year.

Rental rates in Virginia Beach increased by 3% year-over-year in 2024, outperforming the U.S. average of 0.4%. Class A and C units led the way with 3.4% growth, while Class B units saw a more moderate increase of 2.4%. The region has maintained a decade-long streak without annual rent cuts.

Economic stability supports apartment demand, with Virginia Beach’s unemployment rate at 3.5%, tied for fifth-lowest among major U.S. markets. The area’s military presence and strong defense industry contribute roughly $26 billion annually to the local economy, providing a stable base for continued growth.

🏕️ Niche-RE

Multifamily Completions Reach 50-Year High

Multifamily completions hit a 50-year high in August 2024, totaling 740,000 units—up 36.5% from July and 79.2% from last year, according to the U.S. Census Bureau and HUD. However, multifamily starts fell 6% to 333,000 units, while under-construction units also dropped to 850,000.

Annualized multifamily permitting jumped 8.4% from July but was down 17% year-over-year at 451,000 units, signaling that multifamily construction is slowing. The West saw the steepest decline in permits (42%), while the South remained stable with a minor 1.4% drop.

Single-family housing starts are on the rise, with a 15.8% increase in August, reversing previous declines. The trend is expected to continue as interest and mortgage rates ease, pushing single-family completions to 1.029 million units, up 8.4% from last year.

Construction

Building Healthier Homes: Prioritizing Indoor Air Quality for Thriving Families

Indoor air quality can be up to five times more polluted than outdoor air, according to the EPA, leading to an estimated 3.8 million premature deaths annually from household air pollution, as reported by the World Health Organization. This highlights the urgent need for healthier homes.

Childhood asthma is the leading cause of chronic disease-related school absenteeism, resulting in over 10 million missed school days each year. By addressing indoor air quality, we can significantly reduce asthma and allergy triggers from the start of construction.

Choosing low-VOC materials and CERTIFIED asthma & allergy friendly® products is essential for improving indoor air quality. Knauf’s Performance+™ insulation not only meets these standards but is also formaldehyde-free and resistant to mold, creating safer, healthier living spaces for families.

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.