Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - Jobless claims fall, but economic uncertainty looms with federal spending cuts and trade tensions. Meanwhile, mortgage rates see a slight uptick to 6.65%, spurring buyer interest despite rising home prices and price reductions. The market is becoming more balanced, with inventory growth and longer days on market. As affluent renters surge in Sun Belt cities, luxury renting gains popularity as a financial strategy.

"In today’s shifting market, adaptability and strategic buying are key to navigating the evolving housing landscape."

If you missed yesterday’s newsletter, click here

Mortgage & Stocks

30-Yr Fixed RM | 6.78% | -0.04% |

15-Yr Fixed RM | 6.23% | -0.01% |

30-Yr Jumbo | 7.00% | - |

7/6 SOFR ARM | 6.45% | +0.01% |

30-Yr FHA | 6.22% | - |

30-Yr VA | 6.24% | - |

Average going rates as of Mar 13 2025

S&P 500 | 5,521.52 | -1.39% |

Dow30 | 40,813.57 | -1.30% |

Bitcoin USD | 80,986.92 | -3.12% |

Numbers as of Mar 13 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

U.S. Jobless Claims Drop, but Economic Risks Loom

Unemployment Claims Fall Slightly – Initial jobless claims declined by 2,000 to 220,000 for the week ending March 8, signaling continued labor market resilience. However, economists had forecast 225,000 claims, highlighting minor deviations in expectations.

Federal Spending Cuts & Trade Uncertainty Add Pressure – Ongoing government budget reductions and escalating trade tensions pose risks to job stability, particularly in sectors reliant on federal contracts. Business confidence is wavering, with hiring plans slowing due to policy uncertainty.

Fed Holds Rates Steady, Eyes June Cuts – The Federal Reserve is expected to maintain interest rates at 4.25%-4.50% next week, following 100 basis points in cuts since September. Markets anticipate further easing by June as economic headwinds mount.

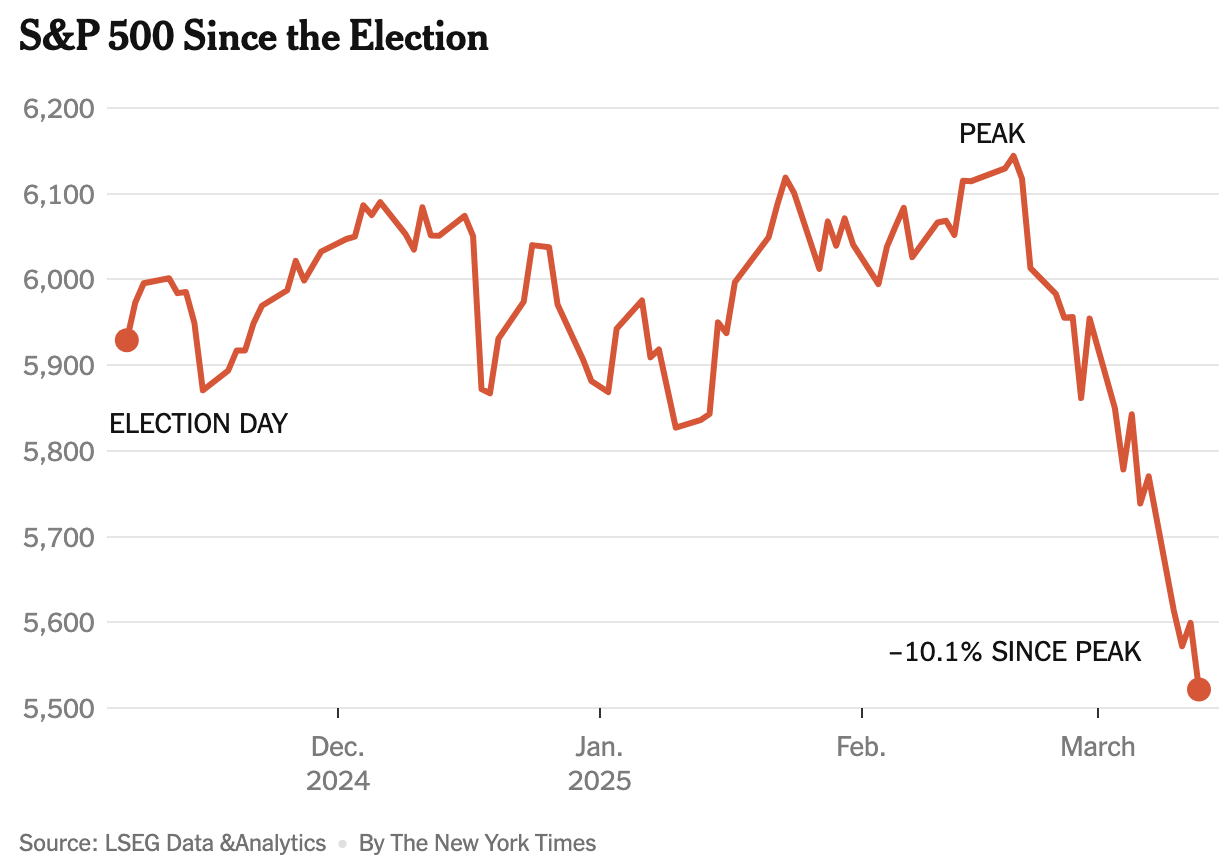

Stocks Tumble Into Correction as Investors Sour on Trump

S&P 500 Enters Correction Territory – The index fell 10.1% from its recent peak, marking its 11th correction since 2008. The Nasdaq is down 14%, while the Russell 2000 has dropped 18%, nearing bear market levels.

Trade War & Policy Shifts Shake Investor Confidence – 200% tariffs on European wine and retaliatory EU tariffs on U.S. goods add uncertainty. Businesses are pulling back on hiring and investment amid unpredictable policy shifts.

Market Volatility vs. Economic Signals – Despite lower-than-expected jobless claims and positive CPI data, investor sentiment remains weak. Concerns over inflation, government firings, and trade policies continue to weigh on the market.

The S&P 500 is now more than 10 percent below its last record high — a line in the sand for investors worried about a sell-off gathering steam.

🎢 Impact on Real Estate

More People Are House Hunting and Applying For Mortgages as Rates Decline

Mortgage Rate Drop Spurs Buyer Interest – Home tours and mortgage applications are up, with Google searches for “homes for sale” rising 10% YoY. Redfin’s Homebuyer Demand Index also hit its highest level since early 2025.

Pending Sales Still Struggling – Despite increased house hunting, pending home sales fell 6.1% YoY, signaling that buyers remain hesitant due to economic uncertainty, job security concerns, and recession fears.

Spring Listings on the Rise – New home listings increased 3.1% YoY, and sellers may continue listing as buyer demand picks up, though affordability challenges persist.

🎙️ RE Spotlight

The Rise of Wealthy Renters in the U.S since Pandemic

Affluent Renters Surge in Sun Belt Cities – Wealthy renters have grown in 35 of the 50 largest U.S. metros since 2019, with Raleigh (+7.7%) and Orlando (+10.8%) leading the trend. Rising homebuying costs and lifestyle flexibility are driving high-income households to rent.

Homeownership Costs Outpace Rent Growth – In cities like Tampa, where home prices soared +67.4% since 2019, the income needed to buy a home has jumped +63.1%, making renting a more attractive option—even for the affluent. Nationally, home affordability has dropped by 36.9%, while rents have risen 28.1%.

Luxury Renting as a Status Symbol – In high-cost metros like San Jose (11%), San Francisco (10.4%), and New York (10.3%), affluent individuals rent not out of necessity but by choice, saving for dream homes or maintaining financial flexibility.

Mortgage Rates Rise Today as Trump’s Tariff Threats Drive Economic Uncertainty

Mortgage Rates Edge Up Slightly – The 30-year fixed mortgage rate rose to 6.65% this week, breaking a seven-week decline but staying in a narrow range after peaking above 7% in January. Homebuyers are responding as purchase applications rose 5% YoY due to improving inventory.

Price Reductions Signal a Market Shift – The share of homes with price reductions increased 0.8 percentage points YoY, while median list prices fell 0.2%, marking the 41st straight week of flat or declining prices—a sign of a more balanced market.

Inventory Growth Gives Buyers More Choices – Newly listed homes rose 8.3% YoY, while total active inventory surged 27.8%, extending a 70-week trend. However, slower buyer activity means homes are sitting on the market 4 days longer than last year.

🏰 RE State Zone

Major Cities Are Growing and Reversing the Pandemic Exodus Trend—Here’s Why

Metro Areas See Stronger Growth – U.S. metro populations grew by 3.2 million (+1.1%) from 2023 to 2024, outpacing the 0.9% growth in 2022-2023. Cities like NYC, Houston, Dallas, and Miami saw the largest influx of new residents, driven primarily by international migration.

Immigration Fuels Urban Expansion – The U.S. Census Bureau reports that international migration is now the dominant factor in metro area growth, offsetting domestic outmigration trends. Birth rates continue contributing, but immigration plays a bigger role in population recovery.

Return-to-Office Drives Relocations – Economic hubs are attracting movers again as companies scale back remote work. Many professionals are returning to cities for job stability, reversing the pandemic-driven suburban migration.

🏕️ Niche-RE

VM Realty Expands Partnership with Xeal to Deploy EV Chargers Across 20+ Midwest Multifamily Properties

Scaling EV Charging for Future-Ready Living – JVM Realty is expanding its partnership with Xeal’s 100% uptime smart EV charging, deploying 20+ new sites across Illinois, Indiana, Kansas, Missouri, and Wisconsin to support the region’s 188,700+ registered EVs and growing demand for sustainable amenities.

Multifamily Market Remains Strong – The Chicago apartment market saw a 2.7% YoY rent increase in Q1 2024, with 5.6% vacancy rates, while cities like Indianapolis, Milwaukee, Kansas City, and St. Louis continue to experience multifamily growth fueled by population shifts and rising demand.

Tech-Forward Investments Drive Resident Satisfaction – JVM Realty’s focus on smart access, managed Wi-Fi, and EV charging enhances resident retention and leasing velocity, ensuring its portfolio remains competitive in an evolving market.

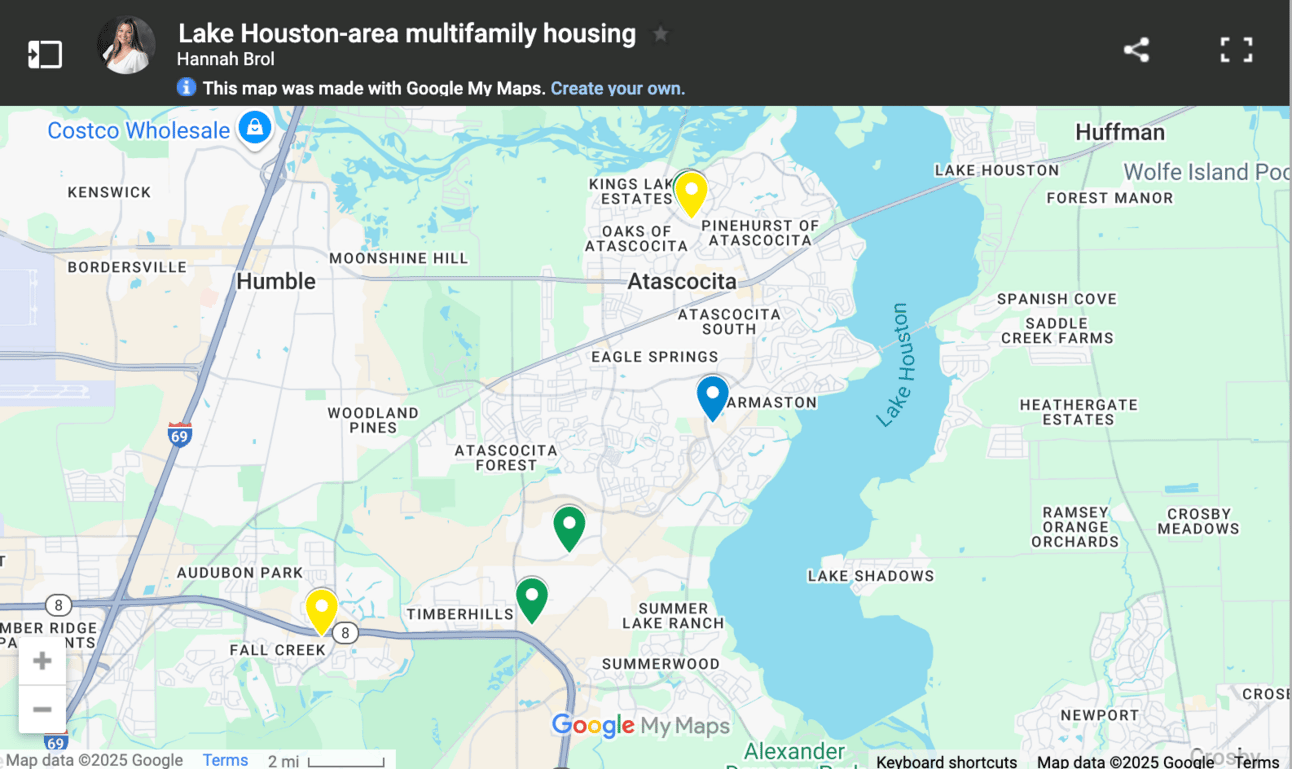

More than 1,800 multifamily housing units under construction, proposed for Lake Houston area

New Supply on the Horizon – 1,840 multifamily units are under construction or proposed in Lake Houston, with 538 units actively being built and 1,302 units planned.

Market Snapshot – The Lake Houston Kingwood submarket includes 79 properties with 19,063 units, averaging $1,369 monthly rent at $1.42 per sq. ft. Occupancy hit a 2-year high of 91.4% in Feb. 2025, up from 87.3% in Feb. 2024.

Key Developments – 703 units opened in the past year, while major projects like The Oaks (357 units) and The Residences at Kingwood East (181 units) are set for 2025 move-ins.

🖼️ Chart-Tastic

👾 Interesting in Social

🌍 Dwelling of the Day

Inside a Hoarder House Listed for $600,000: An ‘Investor’s Dream,’ Seller Claims

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.