Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Real estate is more than a transaction—it's the gateway to a new chapter

In today’s edition - The U.S. labor market remains resilient, with rising labor costs keeping inflation in focus. Mortgage rates hit a four-month high, impacting home affordability and pushing existing home sales to historic lows. The U.K. housing crisis sees a growing demand for co-living, gaining attention from institutional investors as a solution for single renters. In the U.S. multifamily sector, national rent growth slows while vacancy rates hold steady. Q4 2024 shows a decrease in zombie foreclosures, with Florida and New York topping the list for abandoned pre-foreclosure homes. By 2025, multifamily vacancy rates should stabilize, with projected national rent growth reaching 3.1%, driven by robust demand in the Southwest and Northeast.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.98% | - 0.15% |

15-Yr Fixed RM | 6.45% | - 0.10% |

30-Yr Jumbo | 7.20% | - 0.05% |

7/6 SOFR ARM | 6.95% | - 0.05% |

30-Yr FHA | 6.48% | - 0.14% |

30-Yr VA | 6.50% | - 0.14% |

Average going rates as of Nov 7th 2024

S&P 500 | 5,973.10 | + 0.74% |

10 Yr T-Note | 110.20 | + 0.01% |

BTCUSD | 75,930.52 | + 0.25% |

Numbers as of Nov 7th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

U.S Economy Report - Labor Market Holds Steady Amid Rate Cuts and Inflation Concerns

Rising Labor Costs Keep Inflation in Focus: The Labor Department’s Q3 report showed a 1.9% rise in unit labor costs, up from 2.4% in Q2, suggesting wage pressures continue despite slowing job growth. Labor costs have risen by 3.4% over the past year, posing challenges to the Fed’s 2% inflation goal as the Fed cuts rates further to stimulate the economy.

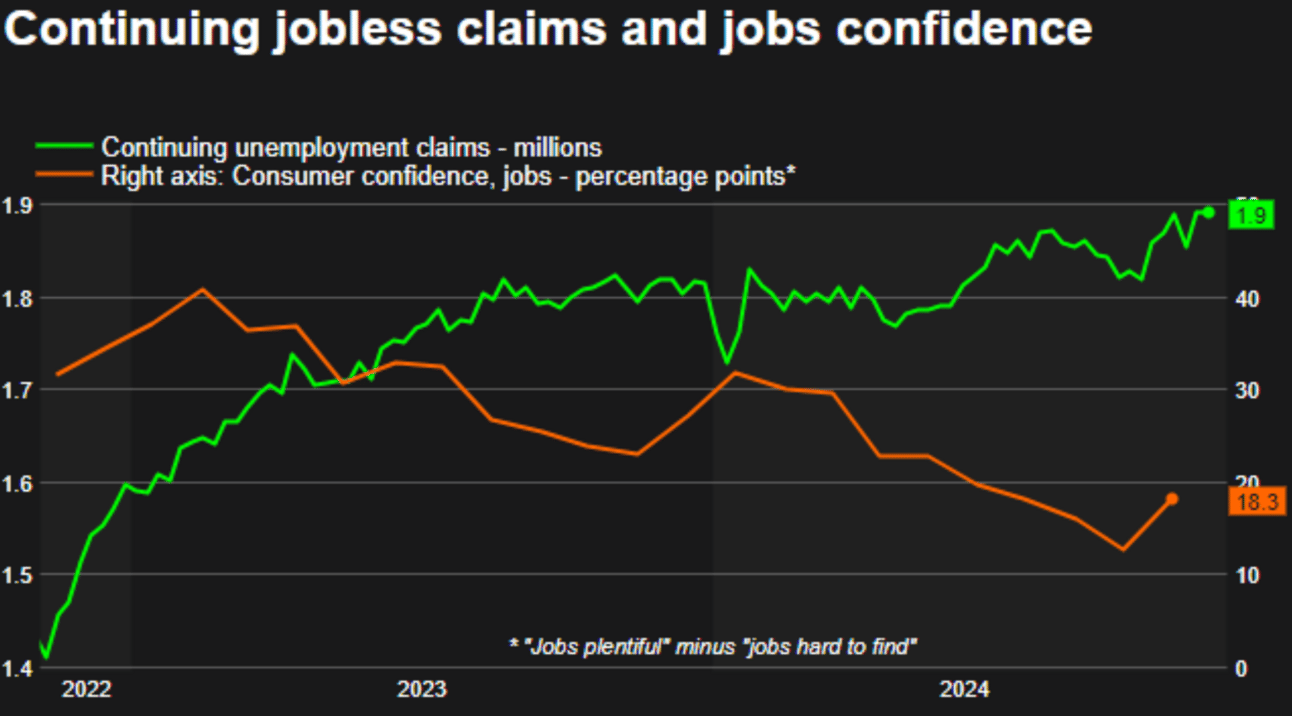

Employment Growth Slows Amid Disruptions: Weekly jobless claims rose by 3,000 to 221,000, with nonfarm payrolls growing by just 12,000 jobs in October due to hurricanes and strikes, such as Boeing’s recent work stoppage. Despite a slight uptick in continued claims, economists expect a rebound in November as disruptions ease.

Productivity Growth Eases Inflationary Pressures: Nonfarm productivity increased by 2.2% in Q3, showing a rise in output per worker and reflecting business investments in technology, particularly AI. Over the long term, rising productivity is expected to help balance wage growth, providing a key offset to inflation concerns.

🎢 Impact on Real Estate

Mortgage Rates Hit Four-Month High, Impacting Home Sales and Affordability as Inflation Concerns Grow

Mortgage Rates Climb Amid Economic Uncertainty: The 30-year fixed-rate mortgage reached 6.79% this week, marking the highest level since July and reflecting a six-week streak of rate increases. Rates could rise further if proposed economic policies under the Trump administration push inflation higher.

Supply Shortages and Rate Locks Limit Market Activity: With rates averaging below 4% for many homeowners, the “rate lock” effect continues to limit housing supply. Elevated prices and rising rates have led to a 14-year low in existing home sales, exacerbating affordability challenges for buyers who delayed purchasing until after the election.

Inflation Expectations Shape Economic Outlook: Anticipated policies, including potential tariffs and tax cuts, could drive inflation and put pressure on the Federal Reserve, limiting its ability to reduce rates. The average monthly mortgage payment on a $400,000 home has risen by $200 since September, highlighting affordability concerns as rates climb.

🎙️ RE Spotlight

Co-Living as a Solution for UK’s Housing Crisis: Filling the Gap for Single Renters

Rising Demand for Single-Occupancy Spaces: The UK’s housing crisis is impacting single renters significantly, as traditional private rental sector (PRS) options are dwindling. Co-living addresses this gap by providing tailored living spaces with private rooms and shared, well-designed communal areas that foster social connection and ease loneliness, which is more prevalent among renters (40%) than the general population (29%).

Location and Design Drive Success: Strategic location and thoughtful design are crucial for co-living success. Centrally-located schemes near urban centers and transport links meet the high demand in employment hubs, leading to rapid occupancy rates, as seen in DTZI’s Folk Co-living schemes, which stabilized within just three months of launch.

Institutional Investment on the Rise: Co-living’s fundamentals are capturing the attention of UK institutional investors. Currently led by forward funding in London and emerging regional cities, co-living may follow the growth trajectory of Purpose-Built Student Accommodation (PBSA) and solidify its place as a core investment within the Living sector.

U.S. Multifamily Market: Trends in Rent Growth, Occupancy, and Regional Divergences for 2024

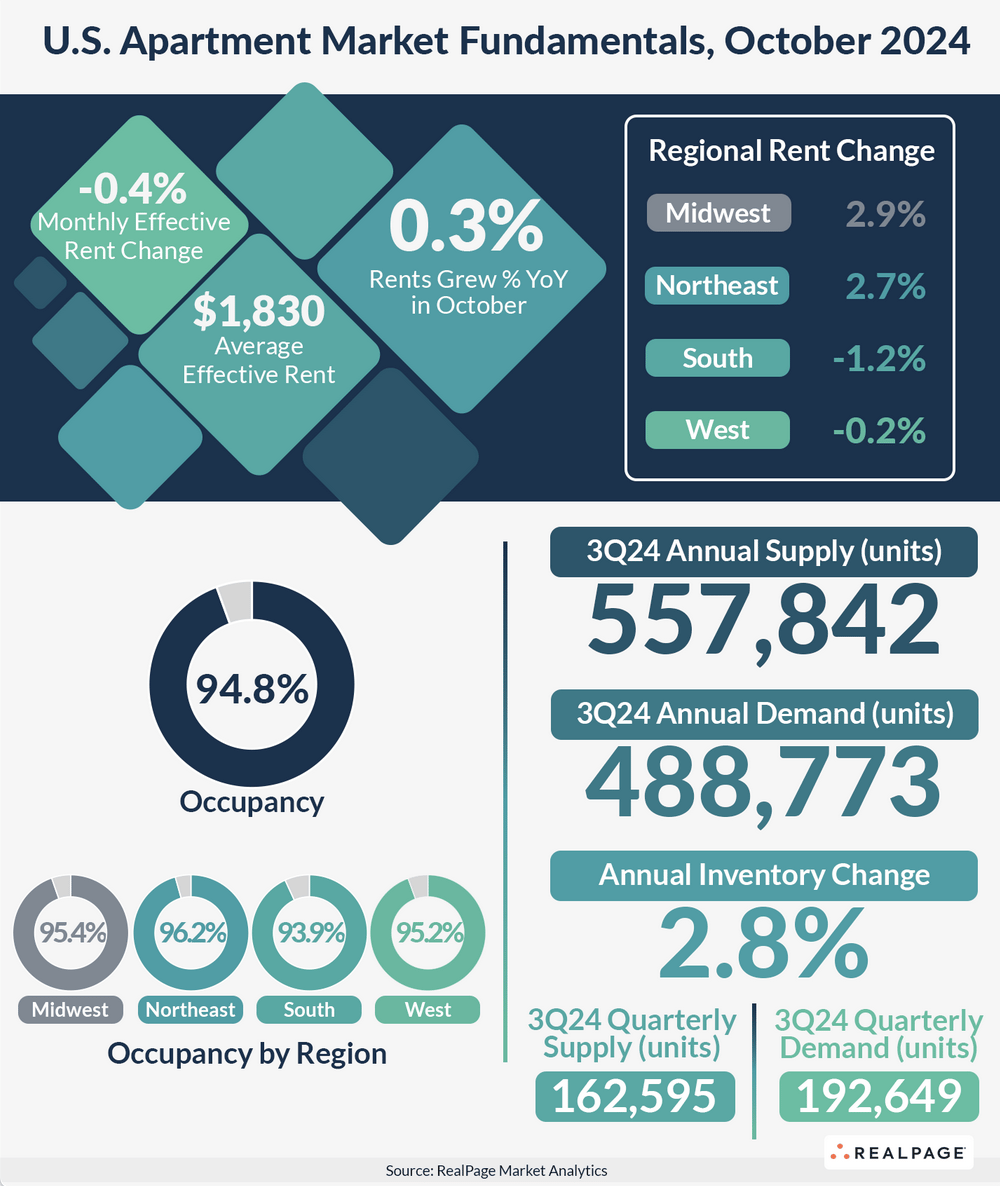

National Rent Growth and Seasonal Declines: Effective rents for professionally managed apartments increased just 0.3% year-over-year as of October 2024, marking over a year of mild rent growth. This includes a seasonal monthly dip of 0.4% in October, as operators typically cut rents during slower leasing months to maintain occupancy, which remains stable at 94.8% nationally.

Regional Highlights and Disparities: The Northeast boasts the highest occupancy (96.2%), while the South has the lowest (93.9%) due to high supply. Midwest cities, especially Detroit (+4.1% annual rent growth), outpace the national average, driven by limited new supply. Conversely, high-supply Southern markets, such as Austin (-8.1%) and Phoenix (-4.5%), face notable rent cuts as inventory exceeds demand.

Recovery in the West: Post-pandemic challenges are fading for West Coast markets like San Jose, Seattle, and San Francisco, which posted modest rent growth (1.2%-1.5%) due to balanced supply and demand dynamics. Yet, high-supply inner West markets, including Denver and Salt Lake City, continue to see significant rent reductions.

🏰 RE State Zone

Top 10 U.S. Metro Areas with Highest Zombie Foreclosures in Q4 2024

Stable Vacancy Rates with Slight Decline in Zombie Foreclosures: In Q4 2024, 1.4 million U.S. homes were vacant, making up 1.3% of total housing. Zombie foreclosures—a subset where homes are abandoned during pre-foreclosure—saw a 20.2% year-over-year decrease, with about 7,100 homes classified as such, marking one of the lowest levels in five years.

Leading Zombie Foreclosure Metros: Miami-Fort Lauderdale-West Palm Beach, FL leads with 772 zombie foreclosures, followed by New York-Newark-Jersey City, NY-NJ-PA (754), and Chicago-Naperville-Elgin, IL-IN-WI (483). Florida has significant entries in the top 10, highlighting a persistent challenge in certain high-traffic markets.

Significant Reductions in Select States: States like Connecticut, Iowa, North Carolina, New Mexico, and Oklahoma showed the highest percentage declines in zombie foreclosures since last year, with decreases up to 87%. This trend underscores positive market adjustments and reduced distressed inventory in these areas.

🏕️ Niche-RE

Multifamily Market in 2025: Vacancy Drops and Rent Growth Resurges as Supply Peaks

Stabilizing Vacancy Rates: After two years of record-breaking multifamily construction, the U.S. is set for a cooling period. As construction slows over the next 12-18 months, vacancy rates are expected to stabilize, paving the way for rental rates to increase to around 3% annually in 2025 and 2026.

Regional Rent Growth Leaders: Moody's forecasts the Southwest to lead rent growth with a 3.4% increase in 2025, followed by the Northeast at 3.3%. The Midwest will maintain solid growth at 3.0%, while the South Atlantic and the West are expected to trail with rates of 2.9% and 2.2%, respectively.

National Outlook: With an anticipated overall U.S. rent growth of 3.1%, these projections highlight significant regional opportunities for investors as multifamily markets balance new supply with demand.

🖼️ Chart-Tastic

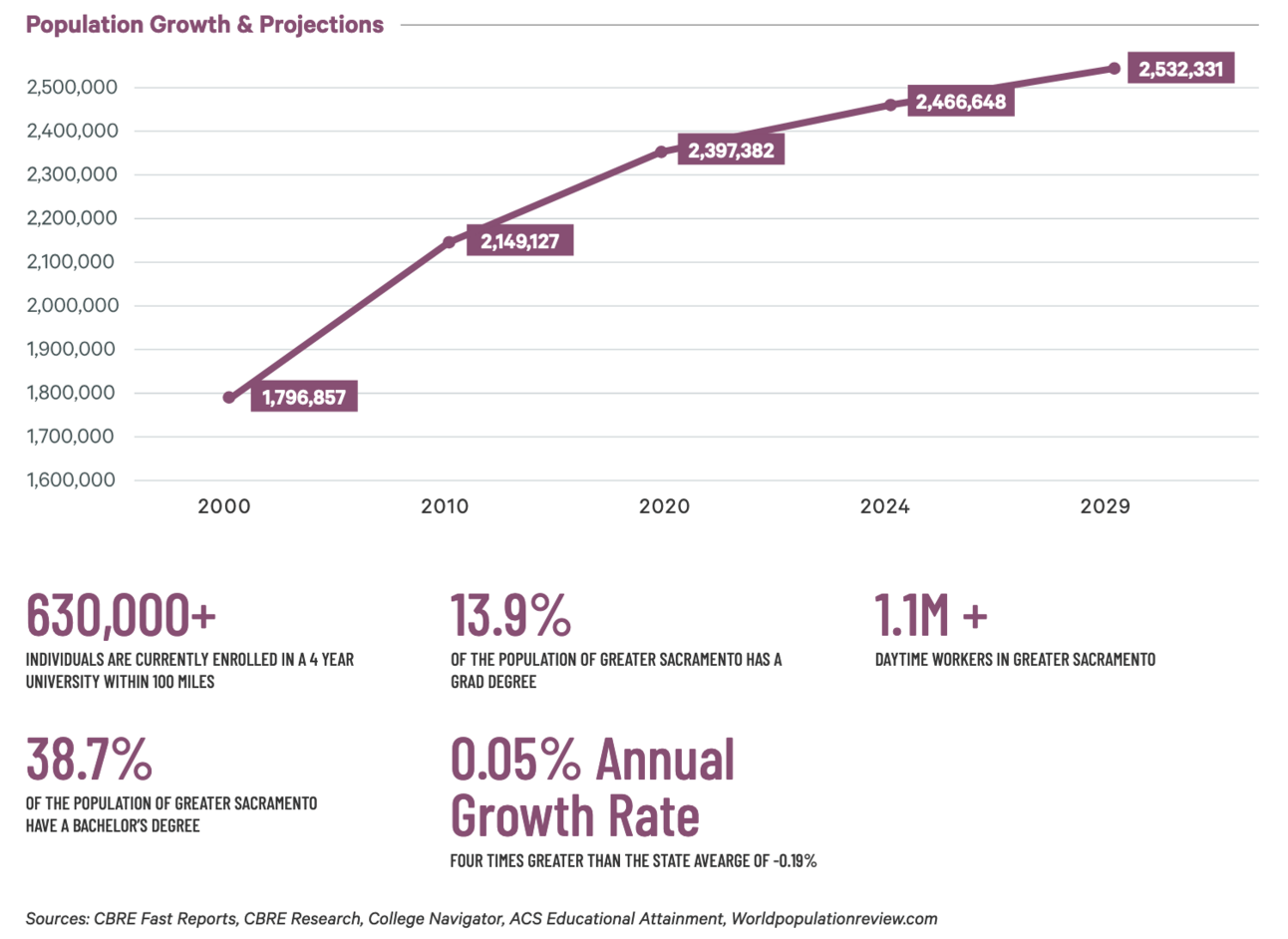

SACRAMENTO Population Growth & Projections

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.