Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “A home is where love resides, memories are created, and life unfolds”

In today’s edition - Gold prices dipped 0.3% to $2,650.10 as a stronger dollar and eased Fed rate cut bets impacted the market. Pending home sales stabilized after nine months of declines, while multifamily completions surged to a 50-year high. The DOJ-NAR commission lawsuit could trigger a major exodus of real estate agents, while homeownership remains unaffordable for many, with median home prices hitting $365,000. Arizona’s booming demand for data center sites signals a shift in land speculation, and fast-casual restaurants outshined QSRs, benefiting from the return-to-office trend.

If you missed yesterday’s newsletter, click here

Rates

30-Yr Fixed RM | 6.26% | + 0.01% |

15-Yr Fixed RM | 5.63% | + 0.01% |

30-Yr Jumbo | 6.43% | - |

7/6 SOFR ARM | 6.17% | + 0.02% |

30-Yr FHA | 5.78% | + 0.02% |

30-Yr VA | 5.79% | + 0.01% |

Average going rates as of Oct 3 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Gold Prices Dip as Stronger Dollar and Eased Fed Rate Cut Bets Loom

Gold prices declined by 0.3% to $2,650.10 per ounce as a stronger dollar and reduced expectations for a significant Federal Reserve rate cut weighed on the market. Traders are anticipating further clarity from the upcoming U.S. payrolls report.

The U.S. Federal Reserve's battle against inflation may limit interest rate cuts, with traders reducing bets on a 50-basis-point cut in November from 49% last week to 34%.

Silver fell 0.2% to $31.80, platinum dropped 1.2% to $990.65, and palladium slipped 1.9% to $996.02, reflecting broader caution in the precious metals market as geopolitical tensions and economic uncertainties continue.

🎢 Impact on Real Estate

September Was a Turning Point Pending Home Sales Flat After 9 Months of Declines

Pending U.S. home sales are flat from a year ago, marking the first non-decline since January. Sales rose in 27 of the top 50 U.S. metros, with Phoenix (+13%), San Jose (+12%), and Portland, OR (+10%) leading the charge, as homebuyers re-enter the market following last year's mortgage rate surge.

Mortgage rates dropped to their lowest level in two years, at 6.08%, reducing the typical homebuyer’s mortgage payment by 5.9% year-over-year. This marks the largest decline since May 2020, and housing costs are near their lowest since January 2024.

Homebuying demand surges as the market rebounds, with Redfin's Homebuyer Demand Index up 9% month over month and mortgage-purchase applications up 10%. Lower mortgage rates are bringing buyers back, encouraging both home sales and new listings, though many homeowners remain hesitant to sell their ultra-low rate properties.

🎙️ RE Spotlight

NAR-DOJ Commission Lawsuits to Trigger Mass Agent Exodus from the Industry

86% of agents believe changes to the commission structure following the DOJ's lawsuit against NAR will push many out of the industry. Sellers are no longer required to pay the buyer's agent commission, leaving buyers responsible for their agent's compensation—a shift that's sparking concerns across the real estate profession.

Nearly two-thirds (64%) of agents oppose the commission changes, with 48% feeling more pessimistic about their careers. Only 16% of agents view the settlement optimistically, while confusion dominates as the most common reaction to the changes in the industry.

Homeowners show strong support for the new structure, with 67% backing the changes, though most (79%) believe agent commissions should be disclosed upfront. Over half of buyers (59%) and homeowners (57%) also support government regulation of commission rates, reflecting broader demands for transparency in real estate transactions.

Home Ownership Slightly More Affordable Across U.S. in Third Quarter but Still Difficult for Average Workers

Median home prices hit $365,000 in Q3 2024, making homes less affordable in 99% of U.S. counties analyzed. Major home expenses consume 33.5% of average national wages, surpassing the preferred 28% guideline despite slight improvements in affordability due to falling mortgage rates.

Homeownership remains a financial stretch for average workers, as major expenses require 12 percentage points more of wages compared to 2021. Affordability is especially strained in populous counties like Los Angeles, Cook (Chicago), and Maricopa (Phoenix).

Affordability shows small signs of improvement, with ownership expenses down 3.3% from Q2 2024. However, wages still lag behind rising home prices in 71.1% of the 578 counties analyzed, leaving homeownership out of reach for many.

🏰 RE State Zone

Arizona Deal Latest Sign of Booming Demand for Sites to Power AI

Tract purchased a 2.1K-acre site in Buckeye, AZ, for $136M, signaling a shift in land speculation as AI and cloud computing spur the demand for sprawling data center campuses. The site is slated to support $20B worth of data center development over the next 15 years, positioning it as one of the largest data center complexes in the U.S.

Data center demand continues to surge, with the U.S. currently providing 6.7 gigawatts of capacity and an additional 4.5 gigawatts under construction, per CBRE. Tract’s strategy focuses on acquiring raw land and preparing it for data center developers in secondary markets, where land is more abundant.

Challenges remain for data center development, including community opposition, concerns over energy consumption, and the push for renewable energy solutions. Tract’s collaboration with Arizona Public Service highlights the critical role of energy providers in scaling data center infrastructure.

🏕️ Niche-RE

Fast-Casual Restaurants Outshine QSRs in 2024: Weekday Wins and Consumer Behavior Insights

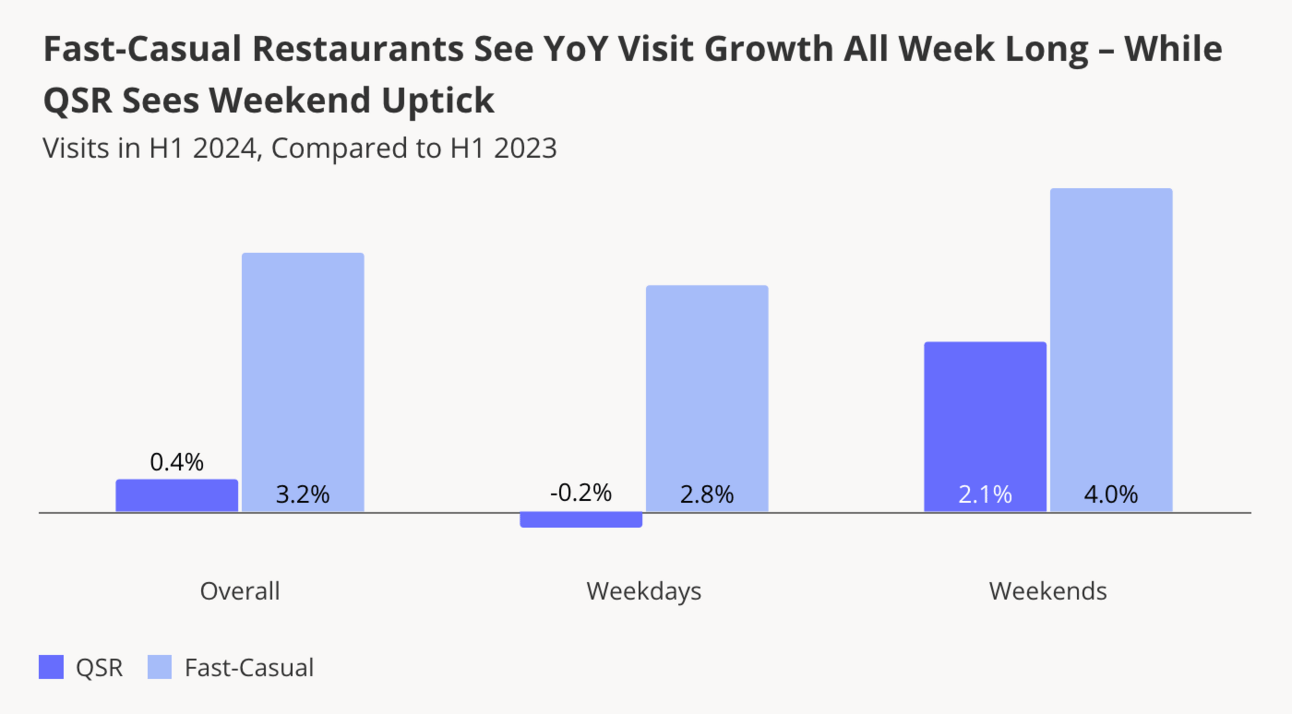

Fast-casual restaurants led with 3.2% year-over-year (YoY) visit growth in the first half (H1) of 2024, outperforming QSRs, which saw just 0.4% YoY growth. Rising QSR prices have narrowed the gap between fast food and premium offerings, driving more traffic to fast-casual chains.

Weekday visits to fast-casual restaurants surged by 2.8% YoY, while QSRs saw a slight weekday decline of -0.2% YoY. The return-to-office trend suggests that more affluent office workers are driving this weekday growth in fast-casual foot traffic.

QSRs attracted more local customers, with a higher percentage of visits from nearby Census Block Groups (CBGs), while fast-casual chains pulled in visitors from further away (2-30 miles)—potentially driven by commuters stopping by during lunch breaks or after work.

Takeaway:

Fast-casual restaurants have gained significant momentum in 2024, particularly on weekdays, as the return-to-office trend drives higher foot traffic among affluent consumers. These restaurants continue to attract customers from further distances, suggesting their appeal extends beyond local neighborhoods. Meanwhile, the shrinking price gap between QSRs and fast-casual chains has made the latter more attractive to budget-conscious consumers seeking a balance of quality and affordability. Both segments remain popular among households earning between $75K-$100K, highlighting their ability to capture key demographics.

🖼️ Chart-Tastic

No State Has an Adequate Supply of Affordable Rental Housing for the Lowest-Income Renters

🌍 Dwelling of the Day

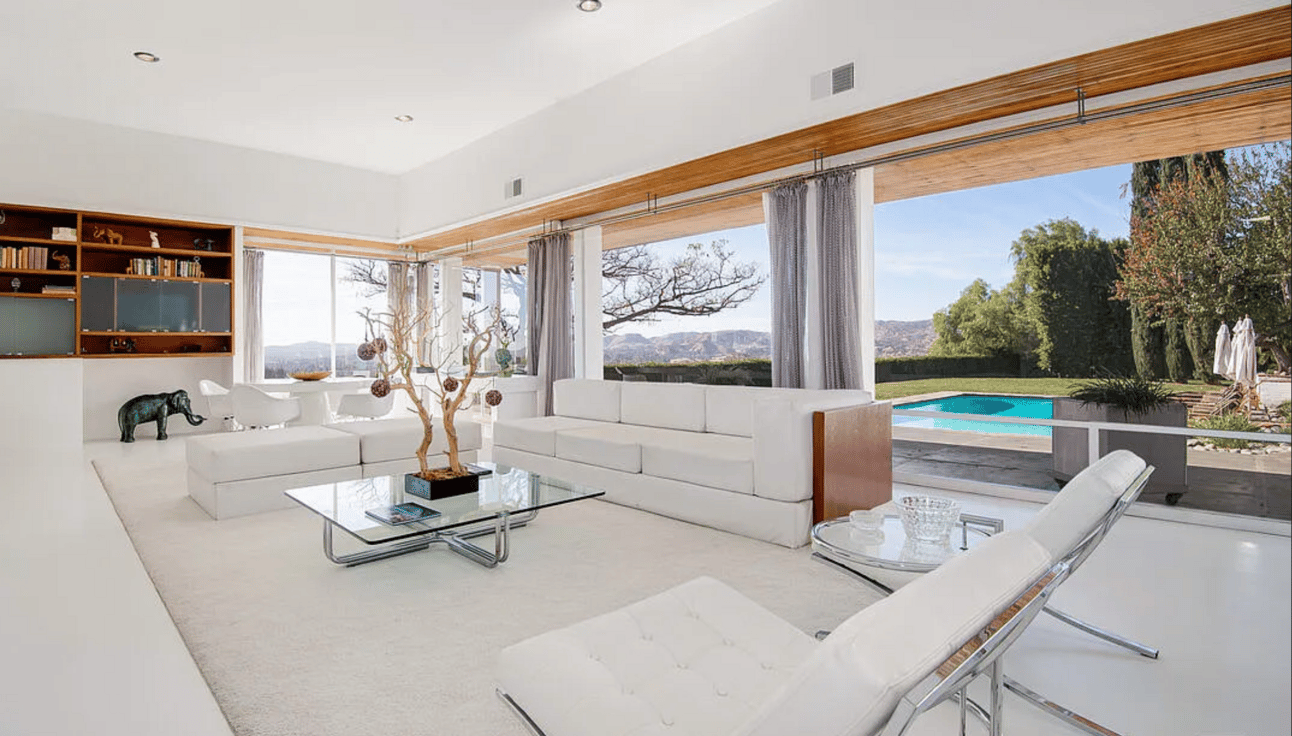

Listed for $8M, historically generated $750,000 - $1,200,000 annually with a "who's who" of Hollywood productions.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.