Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Understanding market shifts today paves the way for smarter real estate investments tomorrow”.

In today’s edition - we examine Fannie Mae’s updated projections for GDP growth, mortgage rates, and housing market trends. "In an ever-evolving market, staying informed about economic shifts and market dynamics is key to making smart real estate decisions." We also explore the surge in manufactured home prices, rising homeowner equity, and global real estate investment opportunities. Plus, discover senior housing solutions and how auction pricing trends are signaling a market shift. Stay ahead with the latest market insights.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.80% | + 0.02% |

15-Yr Fixed RM | 6.05% | - 0.04% |

30-Yr Jumbo | 7.03% | - 0.01% |

7/6 SOFR ARM | 6.65% | + 0.01% |

30-Yr FHA | 6.16% | - 0.03% |

30-Yr VA | 6.18% | - 0.02% |

Average going rates as of Dec 12 2024

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Fannie Mae’s Economic Developments - GDP Growth, Inflation Trends, and Market InsightsInsights 2024 - 2026

Economic Outlook: Moderate Growth Ahead

GDP Growth: 2024 and 2025 projections revised slightly upward to 2.4% and 2.1%, with 2026 forecast at 2.2%. Consumption growth is decelerating but remains steady.

Labor Market: October saw a slowdown in job growth due to strikes and hurricanes, but broader indicators suggest stable conditions near full employment.

Inflation & Interest Rates: Mixed Signals

Inflation: Core CPI readings remain sticky at 3.3% YOY in October. Energy prices are expected to keep topline inflation below core levels until 2026, when oil prices stabilize.

Mortgage Rates: Projections increased; 2024 rates are expected to average 6.7%, with slight easing to 6.4% in 2025.

Housing Market Trends

Existing Home Sales: Downgraded to 4.01M units for 2024, near a 30-year low, but projected recovery to 4.89M in 2026 as lock-in effects ease.

New Home Sales: Growth expected, rising to 784,000 units by 2026, supported by rate buydowns and limited inventory in existing homes.

Home Prices: National prices forecasted to rise 5.8% in 2024 and 3.6% in 2025, reflecting tight inventory and demand.

Mortgage Outlook

Originators: Total single-family mortgage originations revised downward to $1.64T for 2024, with gradual recovery to $2.4T by 2026.

Refinancing: Activity remains muted, with 2024 volumes forecasted at $351B, rebounding to $705B in 2026 as rates decline.

Key Takeaways

2024 Economy: Modest growth but higher interest rates and sticky inflation shape the outlook.

Housing Trends: Affordability pressures persist; recovery anticipated post-2025.

Policy Watch: Uncertainty following the November election could influence fiscal and trade dynamics.

Takeaway: Modest growth, tight housing supply, and elevated mortgage rates define the near-term outlook, with gradual recovery expected post-2025.

🎢 Impact on Real Estate

Manufactured Home Prices Soar 60% Amid Housing Affordability Crisis:

Manufactured Homes Surge in Value: Between 2018 and 2023, prices for manufactured homes skyrocketed by 58.34%, outpacing the 37.66% rise in site-built single-family homes, according to LendingTree's analysis of HUD and Census Bureau data.

Affordability Gap Persists: Despite price growth, the average manufactured home costs $124,300, offering a significantly lower-cost alternative to site-built homes, which average $409,872—a difference of $285,572.

Regional Price Variations: Manufactured homes command the highest prices in Washington ($164,100), California ($154,500), and Arizona ($148,800)—states facing some of the largest single-family housing supply shortfalls.

🎙️ RE Spotlight

Homebuying Demand Sitting Near Highest Level Since Early Spring As Mortgage Rates Fall

Mortgage Rates Decline, Boosting Affordability: The average mortgage rate dipped to 6.69%, down from a recent high of 6.84%, lowering the typical U.S. homebuyer’s monthly payment to $2,527, its lowest in over two months.

Demand Indicators Show Strong Momentum: Redfin’s Homebuyer Demand Index rose 8% YoY, nearing its highest point since April. Mortgage-purchase applications jumped 20% month-over-month, and pending home sales increased 4.1% YoY during early December.

Buyers and Sellers Adjust to Market Stability: With the presidential election behind and high rates becoming the norm, both buyers and sellers are re-engaging. New listings increased 7.9% YoY, the highest growth since June, as sellers aim to capitalize on improving demand.

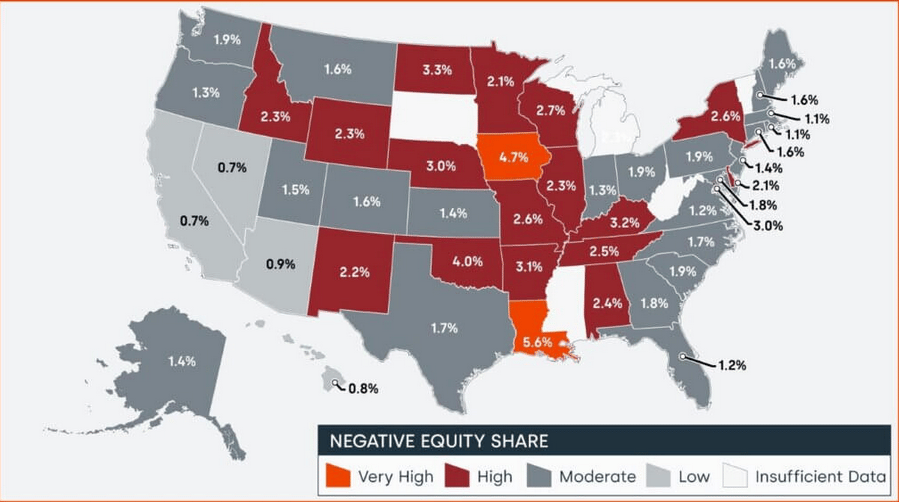

Negative Equity Rising for Homeowners as Equity Growth Slows in Q3 2024

Homeowner Equity Growth: U.S. homeowners with mortgages saw a total equity increase of $425 billion (2.5% year-over-year) in Q3 2024, bringing total homeowner equity to over $17.5 trillion—highlighting a strong, but slowing, trend in equity accumulation.

Regional Variations in Equity Gains: Homeowners in the Northeast, particularly in New Jersey and Rhode Island, experienced the largest equity gains of $43K on average, driven by home price increases of 8.1% and 7.5%, respectively, in the past year.

Rising Negative Equity: Despite overall equity growth, negative equity rose by 3.5% in Q3 2024, affecting nearly 1 million homes, though this was a 3% decrease from the previous year, with the aggregate value of negative equity reaching $324 billion.

🏰 Beyond America

Top 10 Surprising Countries To Get a Golden Visa Through Real Estate Investment

Golden Visas: A Global Investment Trend: Many countries offer golden visa programs, allowing foreign investors to gain residency by purchasing property. Popular destinations like Panama and Malta offer real estate investment minimums starting at just $300,000, making this a more affordable option than buying comparable property in the U.S.

Countries with Attractive Real Estate Investment Opportunities: From coastal properties in Panama to historical apartments in Malta, golden visas often provide access to high-demand rental markets, boosting both long-term capital appreciation and income potential. For example, Malta's real estate market has thrived due to robust demand from locals and international buyers, while St. Kitts and Nevis offers visa-free travel to over 150 countries.

Growing Global Demand for Residency by Investment: The appeal of a real estate-backed golden visa is gaining traction. In regions like Mauritius and Cambodia, lower investment thresholds (from $100,000) combined with strong economic growth make these countries compelling options for investors seeking residency and long-term financial returns in emerging markets.

🏕️ Niche-RE

Housing Solutions for Seniors: Bridging Affordability, Care, and Generational Needs

Dual Burden of Housing and Care: Nearly 70% of adults 65+ will need long-term care, but only 24% can afford both housing and care costs, with median LTC expenses reaching $67,000/year—far exceeding the median senior income of $40,000/year (Harvard Study).

Shared Housing Provides Financial Relief: 23% of seniors live in shared housing, saving guests $500–$700/month on average. These arrangements, often intergenerational, help mitigate cost burdens, particularly for seniors of color and those with disabilities.

Generational Ties Shape Housing Choices: Older adults are moving closer to their adult children, prioritizing accessibility and receiving more caregiving support. This trend underscores the need for diverse, senior-friendly housing in urban areas.

Distressed Auction Pricing Signals Slower Home Price Growth in 2025

Declining Auction Reserves Point to Market Shift: Over the past six months, reserve-to-value ratios at REO auctions fell by 2 percentage points, while foreclosure credit bid-to-value ratios dropped 3 percentage points. Historical trends suggest these declines often precede slowing or negative home price appreciation, as seen in 2023's 5-month price drop.

Broader Economic Indicators Add Pressure: Active housing inventory surged 29% YoY in October 2024, with cities like Seattle (+60%) and Denver (+59%) seeing the largest increases. Meanwhile, mortgage rates remain high at around 7%, with no immediate Federal Reserve rate cuts expected, sustaining affordability challenges.

Institutional Sellers as Leading Indicators: Institutional auction sellers adjust pricing faster than retail counterparts, reflecting real-time market conditions. Distressed buyers, often local developers, rely on accurate pricing forecasts for short-term retail resale success, making auction trends a key predictive tool.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

Thornhill Manor, one of Winchester’s most notable historic fixtures

Built 1787

Location - Winchester, Virginia

Asking $1.6M

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.