Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Real estate isn't just about buying and selling; it's about finding opportunity in the shifting tides of the market

In today’s edition - The U.S. housing market is experiencing slower sales and longer listing times, signaling a shift toward a buyer's market. With mortgage rates hovering near 7%, buyers may find better opportunities as inventory increases and price growth slows. Cities like Miami, Denver, and Kansas City offer potential value, while emerging markets in Southern Indiana show strong rental growth. New developments, such as Fairly’s vacation rental model in Holly Ridge and Sandow Lakes' industrial hub in Texas, highlight innovative shifts in real estate and manufacturing.

If you missed yesterday’s newsletter, click here

Mortgage Rates

30-Yr Fixed RM | 7.05% | - 0.01% |

15-Yr Fixed RM | 6.47% | - 0.01% |

30-Yr Jumbo | 7.33% | - 0.02% |

7/6 SOFR ARM | 6.87% | - 0.02% |

30-Yr FHA | 6.45% | - 0.01% |

30-Yr VA | 6.46% | - 0.01% |

Average going rates as of Jan 30 2025 |

New? Join our newsletter – no cost!

🎢 Impact on Real Estate

U.S. Housing Market Sees Slowest Sales Since 2020—What Buyers Need to Know

Homes Are Sitting on the Market Longer, Signaling Less Competition:

The typical home took 54 days to go under contract, the slowest pace since March 2020 and a full week longer than a year ago. In contrast, homes sold in just 35 days during the pandemic boom in early 2022. This trend suggests a shift toward a buyer’s market, where those who can afford to purchase may have more negotiating power.Housing Inventory at a Five-Year High, but Costs Are Keeping Buyers on the Sidelines: The market now has 5.2 months of supply, the highest level since early 2019, meaning more homes are available for buyers. However, pending home sales dropped 9.4% year-over-year, the biggest decline since September 2023, largely due to affordability concerns. Extreme weather conditions—including snowstorms, freezing temperatures, and wildfires—are also delaying buyer activity in several regions.

Affordability Remains a Major Hurdle, With Mortgage Rates Near 7%:

With home prices up 4.8% year-over-year, the median monthly housing payment now sits at $2,753, just shy of the all-time high seen in April 2024. Many prospective buyers have been waiting for rates or prices to fall, but sellers aren’t slashing prices, and mortgage rates aren’t expected to drop significantly in the short term. Some buyers are beginning to realize that waiting may not lead to better deals, prompting them to act now if they can afford it.

Our Take: While high mortgage rates and home prices are limiting affordability, those who can buy may find less competition and more inventory to choose from. The market is shifting, but drastic price cuts remain unlikely. #RealEstateTrends #HousingMarket2025

Mortgage Rates Dip Slightly to 6.95% After DeepSeek Drove Sell-Off in Tech Stocks

Mortgage Rates Stay Near 7% as Markets React to Tech Sell-Off - The average 30-year fixed mortgage rate dipped slightly to 6.95%, driven by bond market movements after a tech stock sell-off. The Fed’s rate pause had little impact, and inflation concerns may limit future declines.

Home Prices See 35th Consecutive Week of Flat or Falling Growth - While median home prices are down 0.5% YoY, price per square foot rose 1.3%, signaling a shift toward smaller, more affordable homes. Buyers may find better deals as affordability improves.

New Listings Surge 9.3%, Inventory Up 26.1% - More homes are hitting the market, breaking the “lock-in” effect of high mortgage rates. Time on the market is rising, giving buyers more options and negotiation power.

Our Take: Mortgage rates remain elevated, but rising inventory and slower price growth could make homebuying more accessible.

🎙️ RE Spotlight

5 Cities Where Homes Will Be Total Steals in Two Years - GoBankingRates

Miami Leads in Price Declines as Condo Market Surges - Miami's median home price dropped 11.2% YOY, driven by a flood of new condo listings that now make up two-thirds of the market, creating affordability opportunities for buyers.

Denver & Seattle See Unexpected Price Corrections - Denver’s home prices slid 6.3% YOY to $639K, while Seattle’s dipped 5.5% YOY to $770K, as high interest rates push buyers to the suburbs, creating buyer-friendly deals in the urban core.

Midwest & South Markets Show Value Opportunities - Kansas City (4.9% YOY drop) and Oklahoma City (4.3% YOY drop) are seeing home prices decline, but list prices remain stable, meaning sellers are adjusting to match buyer demand rather than market depreciation.

🏰 RE State Zone

Fairly Launches in Holly Ridge: A Game-Changer for Vacation Rentals

A New Era in Vacation Rentals - Fairly, founded by Vacasa’s Eric Breon, is launching in Holly Ridge with a local-first approach, prioritizing fair pay for housekeepers and partnerships with real estate agents.

Revenue Sharing Puts More Money in Local Hands - Unlike traditional property managers, Fairly shares 50% of its fees—25% to housekeepers and 25% to real estate agents, ensuring higher earnings for local professionals.

A Smarter, Fairer Way to Rent Vacation Homes - With no excessive guest fees and direct local support, Fairly aims to create a sustainable, community-driven vacation rental model while boosting local economies.

Our Take: As vacation rentals evolve, Fairly is setting a new standard by prioritizing local professionals and fair wages, making it a win-win for property owners, guests, and communities. #VacationRentals #RealEstate #FairPay

🏕️ Niche-RE

$67.15M sale and $42.68M financing secured for luxury multi-housing community in Southern Indiana

Lakeside Gardens Sells for $67.15M Amid Strong Rental Growth - The 360-home luxury apartment community in Jeffersonville, IN, part of the Louisville MSA, attracted a seven-year Fannie Mae loan for $42.68M, showcasing investor confidence in the region.

Louisville: #1 U.S. Market for Year-Over-Year Rent Growth - The area's high occupancy rate (95%) and economic expansion, driven by River Ridge Commerce Center’s 12,000+ jobs, continue to fuel rental demand and investor interest.

Premium Location and Single-Family Features Drive Value - Built in 2022, Lakeside Gardens offers spacious units (avg. 1,244 sq. ft.), luxury amenities, and a fast-growing suburban lifestyle, enhancing its long-term investment potential.

Our Take JLL’s successful deal reflects Louisville’s booming rental market, making Southern Indiana an emerging hotspot for real estate investors. #RealEstateInvesting #MultifamilyHousing

Next American manufacturing renaissance headed for the heart of the Texas Triangle

Sandow Lakes Unveils 35M Sq. Ft. Advanced Manufacturing Hub - The 50-square-mile site, formerly home to the world’s largest aluminum smelter, is now Texas’ only true megasite, featuring abundant power, water, rail, and natural gas for industrial and logistics operations.

Strategic Location Fuels Economic Growth & Innovation - Located 20 minutes from Samsung's new chip plant in Taylor and 45 minutes from Tesla Giga Texas, the site provides unmatched access to Austin, Dallas, Houston, and San Antonio, making it ideal for reshoring U.S. manufacturing.

Sustainable, Future-Ready Infrastructure for Global Manufacturers - Designed for carbon net-zero operations, Sandow Lakes will feature microgrid solar power, rainwater harvesting, LED lighting, and private rail intermodal transport, setting a new benchmark for clean energy manufacturing.

Our Take: The Advanced Manufacturing Logistix Campus at Sandow Lakes is set to reshape U.S. industrial growth, attracting global manufacturers and logistics leaders to Texas’ thriving economy. #Manufacturing #IndustrialRealEstate #TexasGrowth

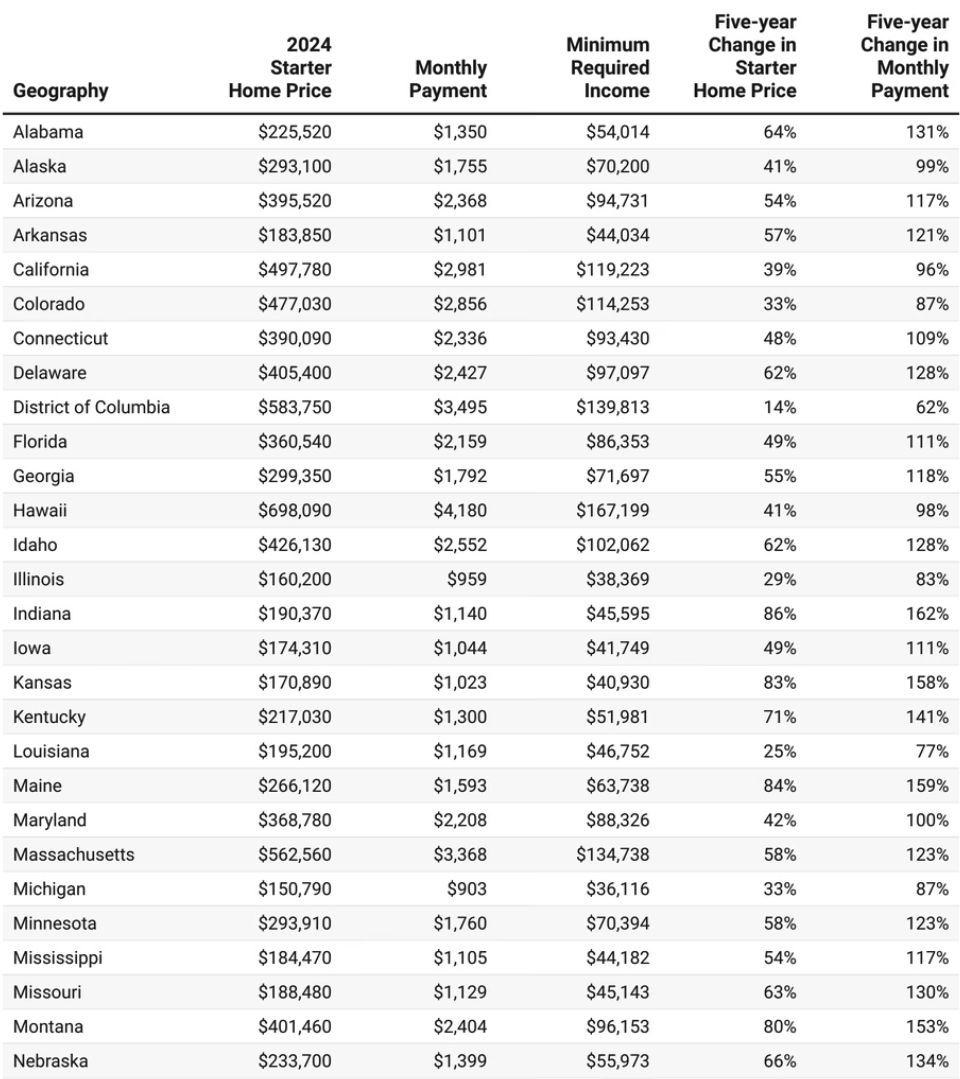

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.