where real property meets real data, every day

Mortgage & REITS

30-Yr Fixed RM | 6.55% | + 0.01% |

15-Yr Fixed RM | 6.07% | 0.00% |

30-Yr FHA | 6.10% | + 0.01% |

30-Yr Jumbo | 6.73% | 0.00% |

7/6 SOFR ARM | 6.40% | + 0.01% |

30-Yr VA | 6.12% | + 0.02% |

Average going rates as of Aug 12 2024

S&P 500 | 5,374.00 | + 0.08% |

S&P REIT | 352.99 | - 0.98% |

FTSE NAREIT | 782.15 | - 0.72% |

Numbers as of Aug 12 2024 closing

New? Join our newsletter – no cost!

Economic Rundown

I’m an Economist: Here’s My Prediction for the Housing Market If Trump Wins the Election

The 2024 presidential race is a hot topic as Election Day approaches, with many Americans wondering how a second term under Donald Trump might impact the U.S. real estate landscape. Experts predict a Trump victory could lead to a surge in home sales and refinancing, driven by potential recommendations to lower interest rates.

Real Trends

Real Estate Value-Add Funds Rake in Fresh Capital, Institutional Money

Crow Holdings secured $3.7 billion and Pennybacker Capital closed a $1.6 billion fund for U.S. value-add real estate, backed by major institutions.

Revelop’s Swedish fund attracted SEK2.4 billion ($231 million), and a new value-add firm launched by former Patrizia directors highlights Europe's rising interest.

Value-add strategies make up 56% of investor preferences, with GRESB reporting a threefold increase in value-add fund participation from 2019 to 2023, reaching 537 funds.

Spotlight

Nominate a Healthcare Real Estate Expert, Influencers in Healthcare 2024 Recognition

Healthcare real estate benefits from a strong demand base and demographic trends that promise continued growth, even amid market shifts caused by interest rate hikes.

The healthcare real estate sector is complex, with changing regulations and new technologies constantly introducing fresh trends, requiring professionals with deep expertise.

Achieving success in healthcare real estate demands a high level of skill and nuanced understanding, making it crucial to identify and work with the best professionals and companies in the field.

Three Reasons We See a Potential Comeback in Commercial Real Estate

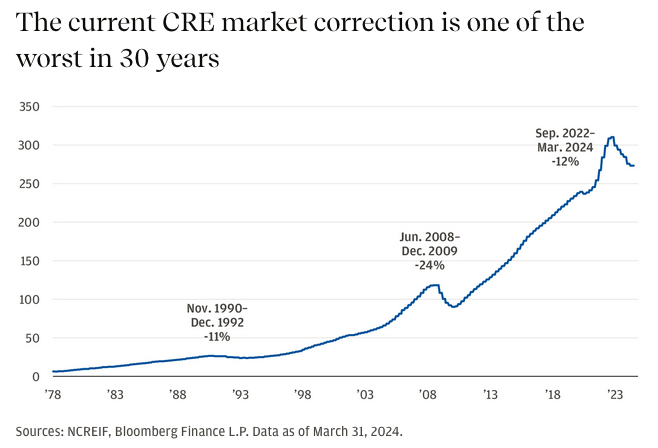

U.S. commercial real estate (CRE) prices have fallen 12% since their 2022 peak, with the current correction being one of the worst in 30 years. Despite the drop, cash flows remain robust, and cap rates have risen less than Treasury yields, suggesting potential for improved returns.

New CRE construction has decreased significantly—down 13% for residential and 75% for retail, industrial, and office sectors since 2022 peaks. With vacancies near a 25-year low and resilient cash flows, supply constraints could support future price stability and growth.

The CRE market shows significant variation by asset type and location. High-quality assets and certain regions, like Southern New Jersey, are performing well, while others, like Seattle, are struggling. Non-listed REITs are now aligned with market valuations, suggesting opportunities in both listed and non-listed markets.

Disability Income for Veterans will No Longer Disqualify Them from Rental Assistance

The Department of Veterans Affairs (VA) and HUD will now include veterans with disability compensation exceeding income limits for rental assistance under the HUD-VASH program. This change allows veterans who were previously disqualified due to high disability benefits to qualify for rental subsidies.

The income eligibility limit for HUD-VASH will increase from 50% to 80% of the area median income (AMI). For instance, 80% of the AMI in Los Angeles is $77,700 for a single-person household, compared to $46,800 in Jackson, MS.

HUD is allocating $20 million to assist disabled veterans with security deposits, enhance landlord recruitment, and provide mediation services. This funding aims to support veterans in securing rental housing and improving their overall housing stability.

State Zone

Dallas-Fort Worth Housing Market Shift from Dominated Seller Market

Explore how rising inventory levels and falling median home prices across Dallas-Fort Worth counties are creating opportunities for buyers after years of a seller-dominated market.

Discover the impact of buyer tactics, including offers below asking price and strategic concessions, on market dynamics and how this is influencing home pricing trends.

Learn how North Texas home builders are adapting to increased competition from the resale market, fluctuating interest rates, and the evolving needs of first-time home buyers.

More Stories

36-month trends include limited new construction starts, minimal new deliveries, increasing asking rental rates ($9.75 per square foot), and a persistent low vacancy rate (1.99%).

Section 8 housing voucher interest list applications now open in San Luis Obispo County

Chart-Tastic

US credit card serious delinquency rates jumped to 7% in Q2 2024, the highest level since 2011.

Interesting in Social

Dwelling’s in Market

Designed to Commune with Nature

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.