Mortgage & REITS

30-Yr Fixed RM | 6.44% | - 0.04% |

15-Yr Fixed RM | 5.97% | - 0.03% |

30-Yr FHA | 5.90% | - 0.04% |

30-Yr Jumbo | 6.66% | - 0.02% |

7/6 SOFR ARM | 6.32% | - 0.06% |

30-Yr VA | 5.92% | - 0.03% |

Average going rates as of Aug 25th 2024

S&P 500 | 5,634.61 | + 1.15% |

S&P REIT | 370.04 | + 1.71% |

FTSE NAREIT | 816.75 | + 1.96% |

Numbers as of Aug 25th 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic Rundown

Weekend Fed's Strategic Review - Key Insights from Jackson Hole

Bottom Line:

Fed's Rate-Cutting Signal: With inflation near the Fed's 2% target, interest rates are expected to begin decreasing in September, impacting market expectations and future economic strategies.

Scenario Analysis Emphasis: Fed officials, including Governor Lisa Cook, advocate for scenario analysis to improve forecasting amid labor market uncertainties, enhancing communication with the public.

Long-Term Rate Debate: Policymakers are considering whether structural shifts like AI investment and globalization will lead to higher average rates or if demographic trends will keep rates low, influencing future monetary policy decisions.

🎢 Stock Health

Nvidia Earnings - A Key Test for the S&P 500 Amid High Market Expectations

Nvidia's Impact on S&P 500: Nvidia’s stock, up 150% YTD, has driven about 25% of the S&P 500’s 17% gain in 2024, making its upcoming earnings report a critical event for market sentiment.

High Valuations Raise Stakes: Nvidia trades at 37 times forward earnings, well above its 20-year average of 29 times, highlighting the market's high expectations and the potential for volatility.

September Market Volatility: Historically, the S&P 500 has seen an average decline of 0.78% in September since WWII, making Nvidia’s earnings and guidance pivotal as investors navigate this typically turbulent period.

🎙️ RE Spotlight

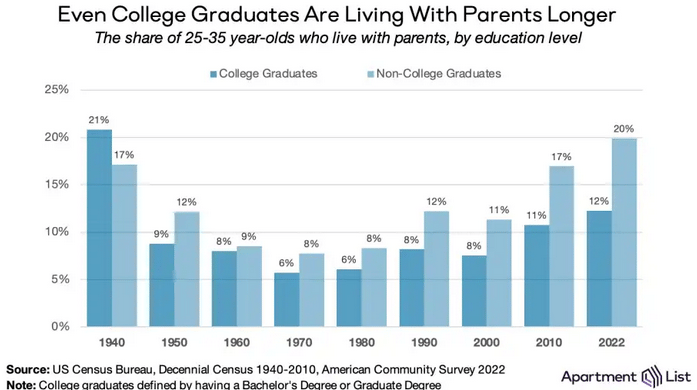

National Trend - More Young Adults Now Live With their Parents than at Any Point Since 1940

Bottom Line:

Sharp Increase in Young Adults Living with Parents: In 2022, 17% of 25 to 35-year-olds lived at home, the highest rate since 1940, reflecting a growing trend fueled by housing affordability challenges.

Income Decline and Rent Surge: The median income for young adults living at home dropped 10% since 2000, while only 18% can afford local rent, down from 60% in 1960, highlighting the financial pressure driving this trend.

Widespread Impact Across Education Levels: The share of college-educated young adults living with parents doubled to 12% in 2022, showing that rising student debt and housing costs affect even the highly educated.

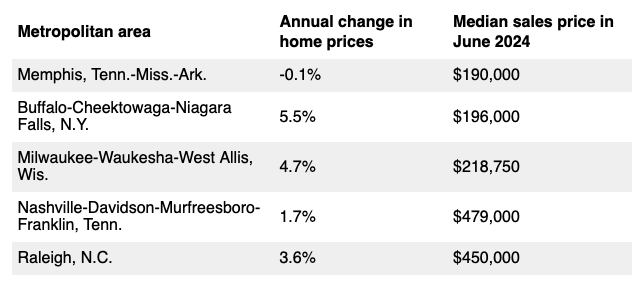

Homes Are Most Overvalued in These 5 Metro Areas - “Signs of Early Correction”

Bottom Line:

89% of Major US Metros Overvalued: As of Q1 2024, homes in 89% of major US metropolitan areas were overvalued, with a national overvaluation rate of 11.5%, signaling potential price corrections ahead.

26% of Listings See Price Cuts: In July 2024, over 26% of homes listed on Zillow had price reductions, indicating growing pressure on sellers as home buyers hesitate amid high prices and mortgage rates.

Memphis Sees a 0.1% Price Dip: While the Memphis area saw a slight 0.1% annual decline in home prices in June 2024, the median sale price remains strong at $190,000, reflecting a mixed market response across regions.

🏰 RE State Zone

It’s Time For An Overhaul - Rockland’s Plan for Modernizing Infrastructure and Ensuring Sustainability

Bottom Line:

Critical Infrastructure Upgrades: Rockland County's aging infrastructure, dating back to the mid-20th century, urgently requires comprehensive assessments and strategic investments to modernize roads, bridges, water systems, and public buildings, ensuring they meet current safety and efficiency standards.

Sustainable and Resilient Design: Incorporating sustainability and resilience into infrastructure projects is vital for Rockland's future. By integrating renewable energy sources and designing for environmental challenges, the county can reduce long-term costs and improve residents' quality of life.

Community Engagement and Funding Strategies: Successful modernization efforts will depend on leveraging state and federal funding, exploring public-private partnerships, and maintaining transparent community involvement to build trust and prioritize critical projects effectively.

🏕️ Niche-RE

Wellness Real Estate - New Challenges and Opportunities in Hospitality Finance

Bottom Line:

Accelerating Growth in Wellness Real Estate: The wellness real estate market is rapidly expanding, challenging traditional valuation methods and financial practices. New CAP rate and WACC considerations are needed to accurately assess these assets, which have distinct property features and sustainability requirements.

Impact on Hospitality Financing: The rise of wellness-centered hotels and resorts is reshaping the hospitality sector. Smaller and independent developers face challenges in securing financing as traditional frameworks often undervalue these assets' unique market performance and income expectations.

Shifting Market Dynamics: Global hospitality is experiencing a significant shift with technological advancements and climate concerns driving changes in design, construction, and operational standards. This transformation requires a modern approach to valuation and a deeper understanding of new asset classes emerging within the sector.

👉 More Stories

Applications are being accepted for Ventura Springs, an affordable housing complex in east Ventura that prioritizes homeless and low-income veterans.

🖼️ Chart-Tastic

👾 Interesting in Social

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.