Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “From rising rental demand to sustainable building policies, today’s trends remind us: adaptability shapes opportunity in real estate and beyond”

In today’s edition - Explore December’s dip in consumer confidence, why renting outpaces owning as mortgage costs surge 35%, and the $520M Miami waterfront deal transforming the financial district. From Virginia’s green building policies to small investors reshaping housing, this edition dives into key trends shaping the market.

If you missed yesterday’s newsletter, click here

Rates

30-Yr Fixed RM | 7.10% | + 0.03% |

15-Yr Fixed RM | 6.49% | + 0.02% |

30-Yr Jumbo | 7.34% | + 0.04% |

7/6 SOFR ARM | 7.04% | + 0.05% |

30-Yr FHA | 6.42% | + 0.03% |

30-Yr VA | 6.45% | + 0.04% |

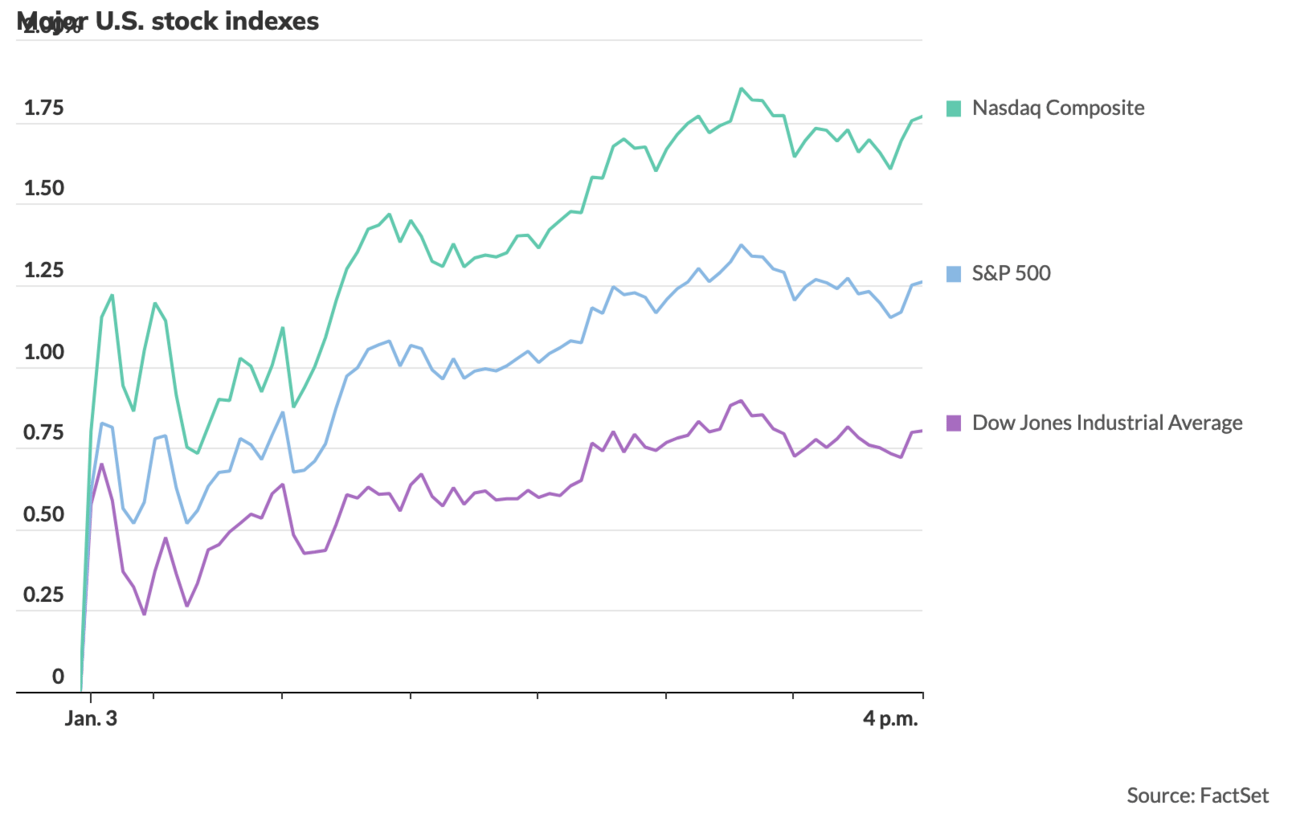

Average going rates as of Jan 3rd 2025 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

🎢 Impact on Real Estate

Why More Americans are Opting for Rental Properties Over Homeownership

Mortgage Payments Outpace Rents: Average monthly mortgage payments, including taxes, are now 35% higher than apartment rents, a gap driven by a 75% surge in costs since late 2019.

Multifamily Rents Rising: CBRE forecasts 3.1% annual rent growth through 2029, outpacing pre-pandemic levels and narrowing the homeownership premium to 32% by 2025.

Market Hotspots: Austin and Los Angeles face the steepest cost-to-buy premiums, with homeownership at 2.5x rental costs, while Phoenix, Salt Lake City, and Nashville are expected to see the most significant cost-gap compression.

🎙️ RE Spotlight

Americans Are Moving Back To Cities. - Top Factors Influencing U.S. Migration

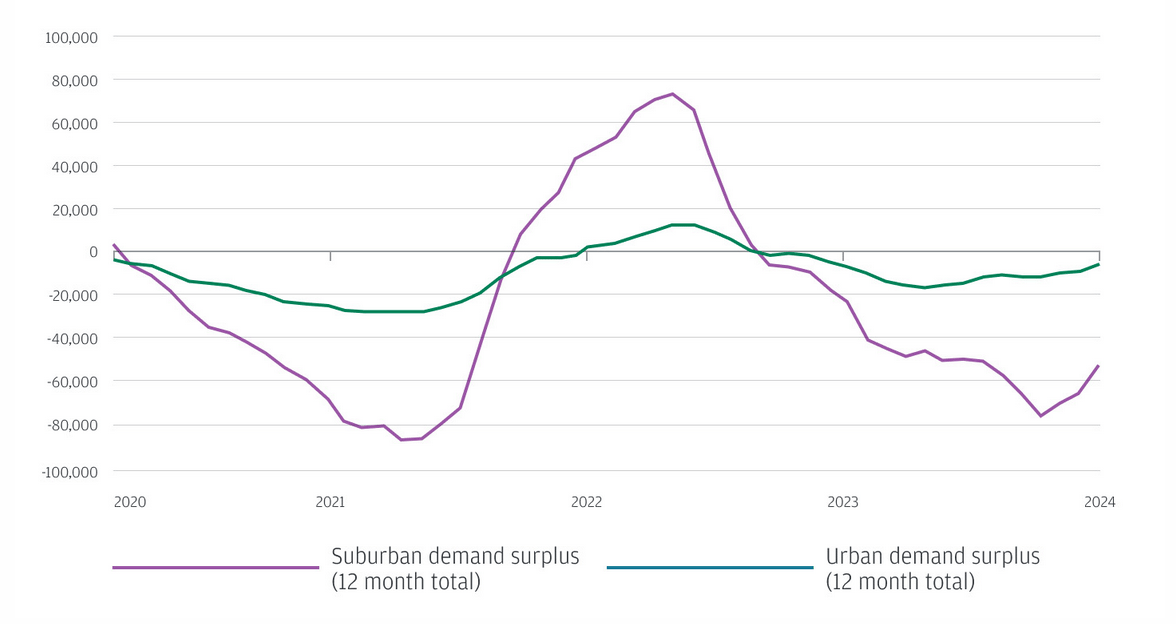

Urban-to-Suburban Migration Normalizes: After the pandemic-driven migration shake-up, patterns have largely returned to pre-2020 norms, with downtown living regaining traction in major metros while suburban markets stabilize.

Emerging Migration Drivers: Economic opportunities, affordable housing, and climate resilience are driving population growth in cities like Nashville, Austin, and Boise, as smaller metros and their suburbs continue to attract new residents.

Lifestyle Shifts Shape Trends: Young professionals are rediscovering urban cores for hybrid work convenience, while families and retirees favor affordable suburban options or Sun Belt locales like Florida and the Carolinas.

🏰 RE State Zone

Virginia Leads the Way: High-Performance Building Policies Drive Sustainability

Fairfax's Green Building Ambitions: The draft policy for Fairfax requires public buildings to achieve LEED Gold and private buildings LEED Silver, with tax incentives for higher certifications, fostering zero-emission and sustainable construction.

Richmond's RVAgreen 2050 Plan: Richmond mandates LEED Silver certification for city projects over 10,000 sq. ft., integrating credits for electric vehicles, renewable energy, and water efficiency to align with its climate goals.

Arlington’s Decarbonization Focus: Arlington’s updated Green Building Incentive Policy offers $0.50–$0.75 per sq. ft. for energy-efficient renovations and $1,500–$2,500 per unit for adaptive reuse projects meeting LEED and energy reduction benchmarks.

Miami developers start new year with record $520 million deal for rare property

Record-Breaking Waterfront Deal: A 4.25-acre site at 1001 and 1111 Brickell Bay Drive is under contract for $520M, marking Miami's priciest commercial land transaction and setting the stage for transformative development.

Luxury Condos in Miami's Supertall District: Developers plan to build ultra-luxury condominiums in Miami's only neighborhood zoned for 3M+ sq. ft. and 984+ ft. towers, leveraging prime waterfront access.

Booming Financial District: The Brickell area sees a surge in projects, including Santander Bank's 41-story tower, Citadel's future HQ, and Oak Row Equities' 1M+ sq. ft. Wynwood Plaza.

🏕️ Niche-RE

FHFA Raises 2025 Multifamily Loan Caps to $73B for Fannie Mae and Freddie Mac

Significant Cap Increase: The Federal Housing Finance Agency (FHFA) elevated Fannie Mae and Freddie Mac’s multifamily loan purchase caps to $73 billion each in 2025, a 4% rise from 2024, signaling enhanced liquidity and stronger financing activity in the multifamily market.

Support for Affordable Housing: Maintaining a 50% mission-driven business requirement and preserving workforce housing exemptions, the FHFA ensures continued robust financing availability for affordable and workforce-oriented multifamily projects, reinforcing the commitment to equitable housing.

Positive Market Outlook: With total multifamily financing projected to reach $365 billion in 2025, up 20% from 2024’s forecast of $297 billion, the increased caps reflect FHFA’s confidence in a resilient multifamily sector and provide a stable foundation for property investors and developers.

Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

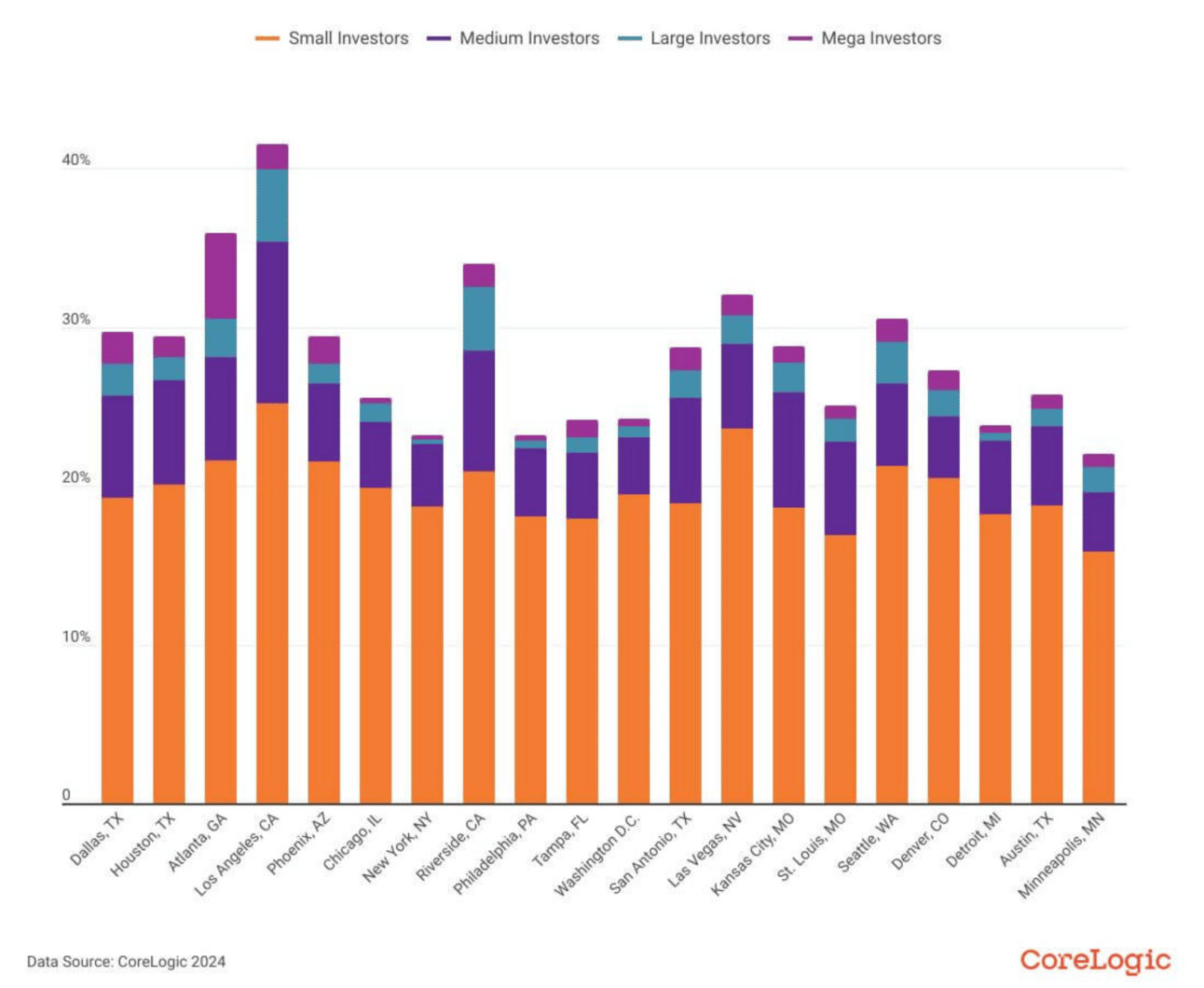

Small Investors Lead the Market: 60% of investor purchases in Q3 2024 were made by small-scale investors owning fewer than 10 properties, compared to only 2% by mega-investors in top markets like Los Angeles.

Declining Investor Activity: Investor purchases dropped to an average of 85,000 monthly in Q3 2024, down from 140,000 in 2021, reflecting high mortgage rates and elevated home prices.

Regional Shifts in Focus: While investor share declined in states like Idaho (-5.7%) and Maryland (-5.1%), markets like South Dakota and Oregon saw modest gains, driven by localized demand and price trends.

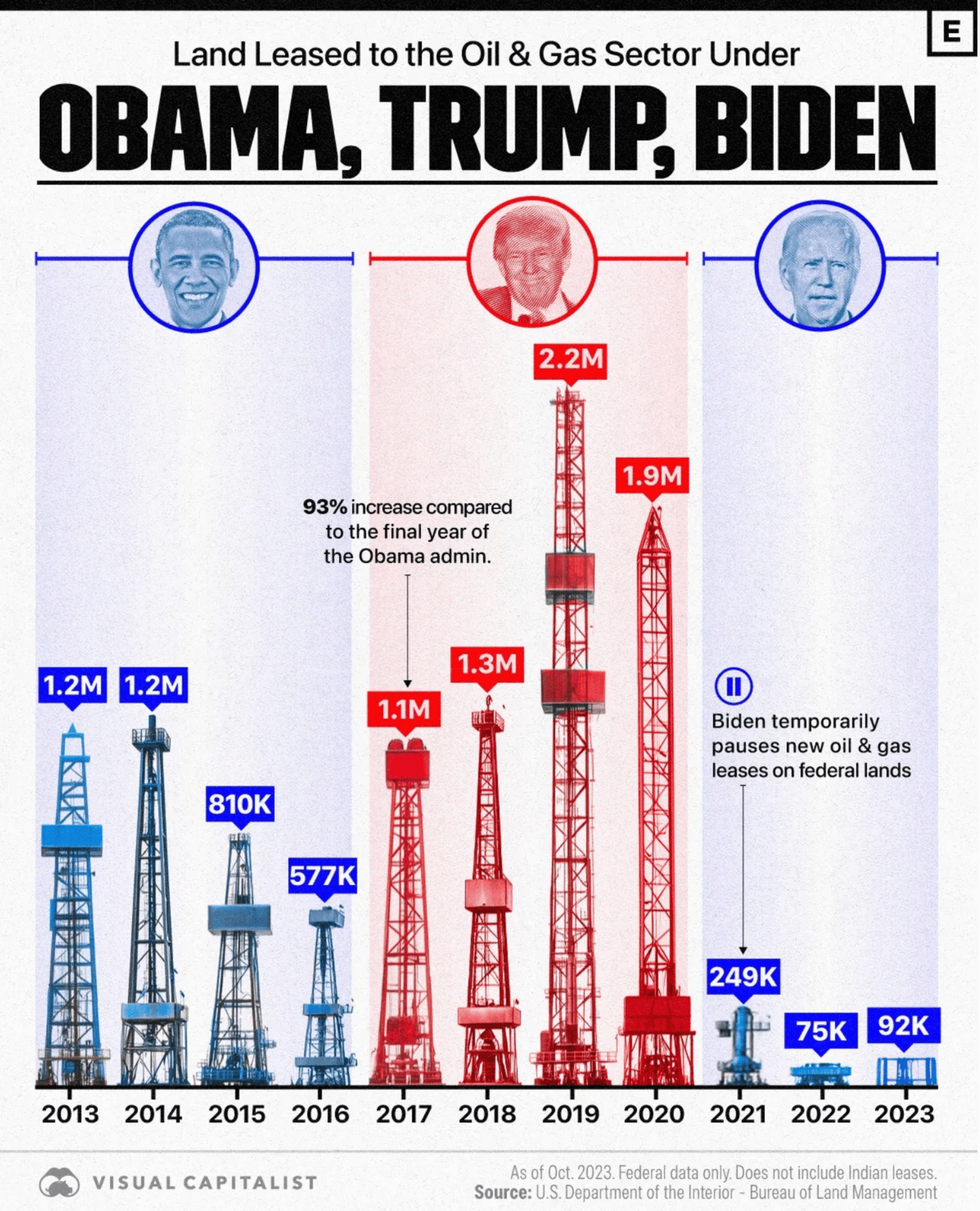

🖼️ Chart-Tastic

👾 Interesting in Social

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.