where real property meets real data, every day

In This Edition

Fed signals first rate cuts

Changes to VA loans

AMH build-to-rent strategy

Economy is likely in a recession

and more inside

Regional: Agents demanding $25,000 flat fee

Mortgage & REITS

30-Yr Fixed RM | 6.78% | - 0.02 |

15-Yr Fixed RM | 6.29% | - 0.01% |

30-Yr FHA | 6.37% | - 0.03% |

30-Yr Jumbo | 6.95% | - 0.04% |

7/6 SOFR ARM | 6.43% | - 0.02% |

30-Yr VA | 6.39% | + 0.13% |

Average going rates as of July 31 2024

S&P 500 | 5,522.30 | + 1.58% |

S&P REIT | 351.16 | - 0.52% |

FTSE NAREIT | 778.71 | - 0.50% |

Numbers as of July 31 2024 closing

New? Join our newsletter – no cost!

Key Trends

Steady Interest Rates - but Signals First Cut in September more info

Anticipate Lower Mortgage Rates: A potential Fed rate cut this fall could significantly lower mortgage rates, currently averaging 6.78% for 30-year fixed loans, making homeownership more affordable for buyers.

Surge in Housing Listings Expected: As rates fall, more homeowners may list their properties, easing the housing shortage. With 87% of outstanding mortgage loans at sub-6% rates, a decrease could unlock more market inventory.

Expert Insights on Economic Shifts: Realtor.com® Chief Economist Danielle Hale explains how recent inflation and job growth data suggest a possible policy change. Annual inflation is now at 3%, above the Fed's 2% target, but softening economic conditions could lead to lower rates.

Happening Now

VA Home Loan Change Will Help Vets in realtor words

Historically, the Department of Veteran Affairs exempted qualified veterans utilizing their VA-guaranteed home loan benefit from being able to pay certain fees in a transaction. One of those fees was compensation to their real estate agent,” Bartshe said.

Starting August 10, veterans using VA-guaranteed home loans can now pay reasonable real estate fees, ensuring they get the representation they need for their largest purchase.

This policy adjustment helps veteran buyers compete more effectively in the housing market, removing the disadvantage they previously faced due to fee restrictions. This change opens up more home inventory options, providing veterans the same opportunities as civilian buyers.

AMH's Build-to-Rent Strategy - Transforming Housing with 20,000 New Rentals read more

AMH turned a $102,600 investment into a $425,500 asset and revolutionized their strategy with a cutting-edge build-to-rent approach. Discover the transformation of 8025 Peaceful Woods St. and explore how AMH’s new focus on building entire rental communities is changing the real estate landscape.

AMH's shift from buying individual homes to constructing entire communities is reshaping the housing market. With 10,000 build-to-rent homes already in their portfolio and another 10,000 in development, they’re providing affordable living options for families and addressing America's housing shortage.

With a portfolio of 59,343 single-family rentals and 10,000 more in development, AMH's innovative in-house home building division is meeting the growing demand for rental homes. Their strategy, from quality control and scalability to long-term community planning, is positioning AMH as a leader in the rental housing market

Please Note: We send our editions on most week days at 8am ET,if you don’t see us in your inbox,please check your spam and move to primary.

Regional Zone - Dallas

Buyer Agents Demanding 3% Commission or $25,000 Flat Fee full story here

Howard a tech worker encountered buyer agents demanding up to $25,000 in fees for a buyer’s agent — something he never had to deal with when buying his first house in 2017. One agent even wanted him to sign a contract committing to a 3% commission.

Things are about to get even more crazy for home buyers everywhere. Starting Aug. 17, buyers will have to sign contracts with real estate agents before even viewing a house. Plus, the commission a buyer’s agent gets will no longer be listed on the Multiple Listing Service.

“In the short term, there will be as much confusion … among agents as among buyers,” said Steve Broebeck, a senior fellow at the Consumer Federation of America. But he added that in the long run, the changes should “save consumers tens of billions a year in lower commissions.”

Special Topic

Q2 Rental Housing, more stats here

National vacancy rates in the second quarter 2024 were 6.6 percent for rental housing and 0.9 percent for homeowner housing.

The rental vacancy rate was higher than the rate in the second quarter 2023 (6.3 percent) and virtually the same as the rate in the first quarter 2024 (6.6 percent).

The homeownership rate of 65.6 percent was not statistically different from the rate in the second quarter 2023 (65.9 percent)

Economic Indicator

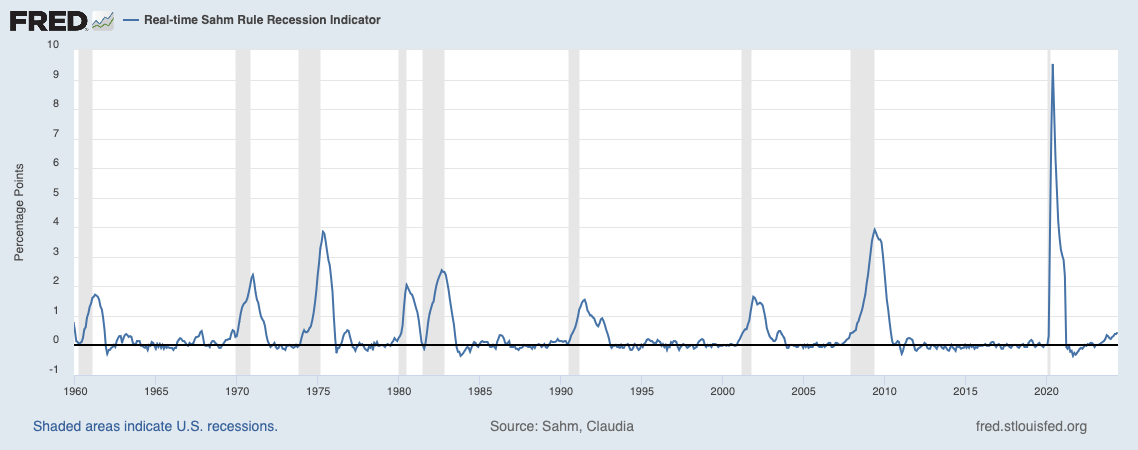

According to the Sahm Rule, the economy is likely in a recession when there is a 0.5 percentage point increase in the three-month average unemployment rate over the prior 12 months. As of June, that difference stood at 0.43 percentage point. continue here

Dwelling’s on Market

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.