Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Success in real estate comes from the courage to pursue opportunities”

In today’s edition - U.S. retail sales rose 0.1% in August, beating expectations, driven by a 1.4% rebound in online sales. The Atlanta Fed raised its Q3 GDP growth estimate to 3%, signaling strong economic momentum. Mortgage applications surged 14.2%, fueled by a rate drop to 6.15%. Gen Z faces affordability challenges, with median salaries supporting homes far below current prices, but creative strategies like down payment assistance and roommates can help. Meanwhile, 92.8% of student housing beds are pre-leased, with Southern universities leading rent growth over 20%.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 6.11% | - 0.01% |

15-Yr Fixed RM | 5.63% | - |

30-Yr Jumbo | 6.38% | - |

7/6 SOFR ARM | 6.12% | + 0.01% |

30-Yr FHA | 5.65% | - 0.01% |

30-Yr VA | 5.66% | - 0.02% |

Average going rates as of Sep 18 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

US economy on solid ground as retail sales surprise on the upside

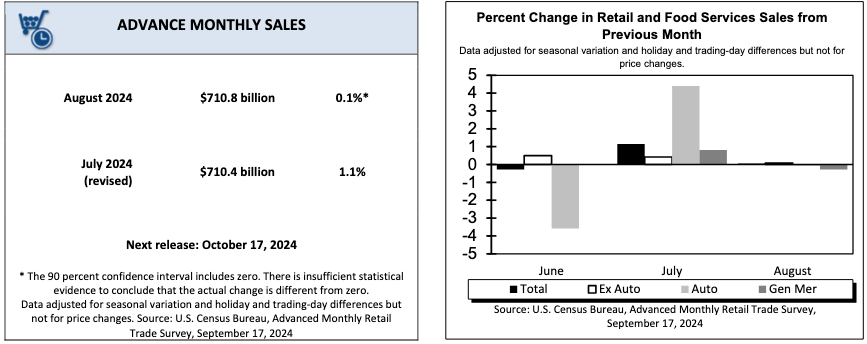

Retail Sales Beat Expectations: U.S. retail sales increased 0.1% in August 2024, defying forecasts of a decline, bolstered by a 1.4% rebound in online sales and offsetting weaker auto dealership receipts.

Economic Growth on Track: The Atlanta Fed raised its Q3 GDP growth estimate to 3.0%, reflecting robust consumer spending, while core retail sales (excluding autos, gas, and food services) rose 0.3%.

Fed Rate Cut Uncertainty: Strong retail sales and a low unemployment rate have led to a reduced probability of a 50-basis-point rate cut by the Federal Reserve, with markets now favoring a smaller 25-basis-point reduction.

Retail sales edge up 0.1% in August as strong online purchases offset auto dealership declines. Read More From Reuters

🎢 Impact on Real Estate

Mortgage Applications Surge 14.2% From One Week Earlier

Mortgage Application Spike: Mortgage applications jumped by 14.2% last week, with refinance applications up 24%, as the 30-year fixed mortgage rate dropped to 6.15%, the lowest since September 2022.

Refinancing Boom: Refinancing activity soared, making up 51.2% of total applications, a dramatic increase from 46.7% the previous week, fueled by lower rates and the fastest refinancing pace since 2022.

Improving Affordability: Purchase applications rose 5%, driven by improving affordability from declining rates and slower home-price growth, bringing overall purchase activity near year-ago levels.

🎙️ RE Spotlight

Can Gen Z Afford Homes? Creative Strategies for Navigating the Housing Market

Affordability Challenge: Gen Z’s median salary of $35,050 only supports a home worth up to $64,878, far below even the lowest U.S. average single-family home value in West Virginia, priced at $169,488.

Boosting Buying Power: To maximize home affordability, Gen Z should focus on reducing debt, increasing savings for a larger down payment, and exploring state/local down payment assistance programs.

Roommate Strategy: Sharing housing with roommates to lower rent costs can help young adults save more toward a down payment, providing a long-term path to homeownership.

Student Housing Pre-Leasing Ends Strong, Southern Universities Lead in Rent Growth

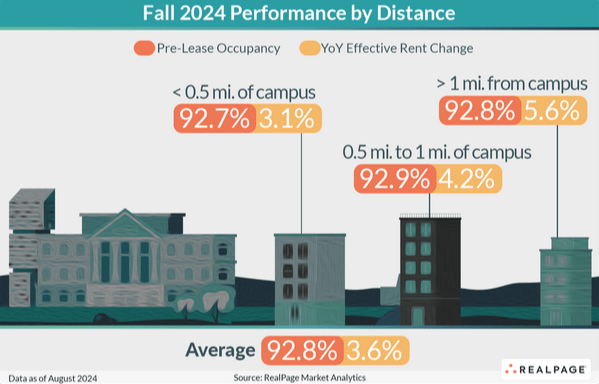

Pre-Leasing Wraps Up at 92.8%: As of August, 92.8% of student housing beds across 175 core universities were leased for Fall 2024, a slight dip from previous years but still significantly above pre-COVID norms.

Southern Schools Dominate Rent Growth: Universities in the South, such as the University of Mississippi and University of Tennessee, led the nation with student housing rent growth rates above 20%, with the Carolinas also showing tight occupancy.

Strong End-of-Season Push: August saw a notable last-minute leasing surge, with 4.4% of beds leased between July and August, exceeding typical August pre-lease momentum.

🏕️ Niche-RE

Do Appraisers Have What It Takes to Value Short-Term Rentals?

Short-term rental valuation challenges: 82% of 13 million sq ft leased in Q2 2024 was green-certified, up 24% YoY across top 6 Indian cities

Appraisal complexities: Short-term rentals require analysis of business factors beyond traditional real estate value, including occupancy rates, host ratings, and local regulations

Lending risks and trends: Lenders face challenges with using traditional forms like the 1007 for STRs; industry moving towards separating real estate value from income potential analysis

Uncover the unique challenges and evolving trends in valuing Airbnb and VRBO properties for mortgages and investment - A Conversation With Shawn Telford

CRE Market Stability: 55% of Investors Report Stable Real Estate Values

Steady Values Amid Volatility: According to a Matthews Real Estate sentiment survey, 55% of investors report stable real estate values through the first half of the year, signaling resilience despite broader market fluctuations.

Rents Hold Steady: 46% of investors have seen rents remain unchanged, with 30% reporting increases, indicating a balanced outlook, although Sunbelt region construction is pushing vacancies up.

Class A Construction Impact: While Class A developments in the Sunbelt region have driven average rents higher, vacancy rates have risen, complicating market performance predictions for the rest of the year.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

Former Milwaukee Electric Railway and Light Co substation transformed to beautiful artists Loft!

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.