Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “In real estate, market shifts create opportunities—whether you're a buyer, seller, or investor, the key is knowing when to act.”

In today’s edition - The U.S. housing market is shifting as inventory hits a five-year high, giving buyers more choices while affordability remains a challenge with mortgage rates near 7%. Texas leads the nation in homebuilding, focusing on smaller, more affordable homes. REIT investments are gaining traction as traditional lenders pull back, and senior housing sees cautious optimism amid rate stabilization. Meanwhile, property taxes continue to rise, impacting homeownership costs in key states. Stay ahead with insights on market trends, investment strategies, and shifting real estate dynamics.

🔹 More inventory, lower mortgage rates—Is now the time to buy?

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.00% | + 0.01% |

15-Yr Fixed RM | 6.37% | - |

30-Yr Jumbo | 7.30% | - |

7/6 SOFR ARM | 6.75% | + 0.01% |

30-Yr FHA | 6.38% | + 0.01% |

30-Yr VA | 6.40% | + 0.01% |

Average going rates as of Feb 06 2025 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Stock Market Surge as Earnings Fuel Optimism - British pound sinks after Bank of England cuts rates

S&P 500 Near Record Highs – Strong corporate earnings lifted the S&P 500 (+0.4%) and Nasdaq (+0.5%), while the Dow (-0.3%) fell due to Honeywell’s planned breakup.

Luxury & Consumer Stocks Soar – Ralph Lauren (+9.7%), Tapestry (+12%), Hilton (+4.9%), and Yum Brands (+9.7%) surged as high-end consumers drive discretionary spending.

Tech & Commodities Struggle – Apple supplier Skyworks plunged 25%, gold dipped 0.5%, and Treasury yields edged up to 4.437% ahead of Friday’s key U.S. jobs report.

🎢 Impact on Real Estate

Homebuyers Gain Leverage as Listings Surge & Prices Slip

New Listings Jump 7.9% YoY – More sellers are entering the market, leading to the biggest inventory increase since last year, giving buyers more choices.

Homes Selling for 2% Below Asking Price – The typical home is seeing its biggest discount in nearly two years, but affordability remains a challenge with monthly housing payments up 8.3% YoY to $2,784.

5 Months of Supply Signals a Buyer’s Market Shift – Housing inventory is at a six-year high, and mortgage rates dipped below 7%, creating opportunities for buyers ready to act.

🎙️ RE Spotlight

Texas Housing Boom: Smaller, More Affordable Homes on the Rise

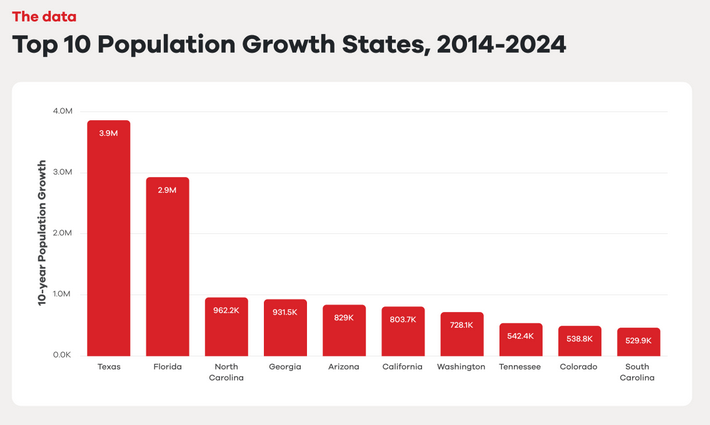

Texas Leads U.S. in Home building – Texas accounted for 15% of all new housing permits in 2024, well above its 9% share of the U.S. population. With over 200,000 new homes built, the state continues to address the ongoing housing shortage and rising demand.

Affordability Improves as Homes Shrink – The median size of new homes in Texas fell by 5.3% since 2020, outpacing the 3.6% decline nationwide. This shift has led to more homes priced below $350K, making homeownership accessible to more middle-income buyers.

Texas Home Prices Stay Below National Median – As of December 2024, the median home price in Texas was $360K, roughly $40K lower than the national median. The state also offers 17.6% lower price per square foot, reinforcing its position as a top destination for affordability-driven relocations.

70% of Single People Struggle to Afford Housing Payments, Compared to 52% of Married People

Singles Pay Thousands More in Rent – In Washington, D.C., a single renter pays $11,448 more per year than a couple splitting the rent. In Los Angeles, that gap rs to $14,880 annually.

70% of Singles Struggle With Housing Costs – Compared to 52% of married couples, single, divorced, or separated individuals are far more likely to sacrifice essentials like meals or take on side gigs to cover housing expenses.

Married Couples Have Financial Advantages – With dual incomes and tax benefits, 29% of married households earn $100K+, compared to just 7% of singles, making homeownership and affordability easier for couples.

🏰 RE State Zone

These 5 States Have the Highest Property Taxes in 2025

New Jersey Leads the Nation in Property Taxes – Homeowners in New Jersey pay the highest property tax rates in the U.S., with an average effective rate of 2.21%, significantly above the national average of 0.99%.

Texas Ranks in the Top 5 Despite No State Income Tax – While Texas doesn’t impose a state income tax, homeowners face an average property tax rate of 1.68%, making affordability a challenge for many buyers.

Property Taxes Are a Major Homeownership Cost – Property taxes contribute over 30% of local and state government revenue, funding schools, public safety, and infrastructure—key factors for buyers evaluating affordability.

🏕️ Niche-RE

Seniors Housing Market 2025 Update: Cautious Optimism Amid Market Shifts

Interest Rate Relief Offers New Capital Opportunities - After years of rising rates and financing challenges, declining interest rates in Q4 2024 are providing some relief, allowing banks and debt funds to reenter the seniors housing space selectively.

Existing Inventory Gains Support, But New Development Lags - With inventory growth at just ~1%, capital is focusing on stabilizing and repositioning existing assets, while new construction remains limited due to high costs and cautious lending.

Policy & Economic Uncertainty Still a Factor - While interest rate stability is welcome, fewer Fed cuts than expected and ongoing regulatory pressures mean investors must remain flexible in their financing strategies.

Bottom Line: Seniors housing capital markets are gradually improving, but selective lending and strategic partnerships will be key to navigating 2025.

Why REIT Investing is on the Rise in 2025

REITs Reclaim Buying Power Amid Market Shifts - After years of portfolio optimization, well-capitalized healthcare REITs are actively acquiring assets while traditional lenders remain cautious, capitalizing on a more favorable market.

Bank Lending Shortage Opens New REIT Investment Channels - With regional banks pulling back on commercial real estate lending, REITs are stepping in—not just as buyers but as lenders, offering high-yield debt and securing future acquisition opportunities.

Market Normalization Spurs Optimism for 2025 - As interest rates stabilize and inflation cools, publicly traded REITs are seeing improved equity costs and investor confidence, positioning them to exceed pre-pandemic investment volumes.

Bottom Line: The senior housing market is entering a new phase, with REITs leading the charge as key capital providers and investors in 2025’s evolving landscape.

🖼️ Chart-Tastic

Mapped: Energy Consumption Per Capita Around the World

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.