Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Behind every front door is a life waiting to be lived.

In today’s edition - we explore the contrasting economic views of Trump and Musk, from crypto collaborations to trade and energy policies. We also highlight bullish trends for Thanksgiving week in the stock market, the latest mortgage rate forecast, and Zillow’s new BuyAbility tool to help buyers with affordability. As remote work migration reshapes housing demand, we review top cities leading multi-family housing developments. Stay informed with the latest insights and trends to make smarter real estate and financial decisions.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.03% | - 0.01% |

15-Yr Fixed RM | 6.40% | - 0.01% |

30-Yr Jumbo | 7.22% | - |

7/6 SOFR ARM | 7.04% | - 0.01% |

30-Yr FHA | 6.45% | - |

30-Yr VA | 6.47% | + 0.02% |

Average going rates as of Nov 22 2024

S&P 500 | 5,969.34 | + 0.35% |

Gold | 2,718.20 | + 1.62% |

Bitcoin USD | 96,263.30 | - 2.39% |

Numbers as of Nov 22 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

From tariffs to crypto, how Trump and Musk's economic views compare

Crypto Collaboration Sparks Controversy: Elon Musk's ties to Dogecoin (DOGE) could bring financial gains as the Department of Government Efficiency—dubbed "DOGE"—takes shape under Trump's leadership. Both Trump and Musk support cryptocurrency growth, reflecting a shared economic agenda rooted in decentralization.

Tensions Over Trade and Tariffs: Trump’s high-tariff policies aim to boost U.S. manufacturing but risk raising consumer prices. Musk has voiced support for lower tariffs, aligning with global trade liberalization, creating potential policy clashes in the new administration.

Energy Debate Intensifies: Musk advocates for renewable energy and nuclear power, while Trump leans heavily on fossil fuels, favoring economic growth over environmental concerns. This divide underscores differing visions on addressing climate change and energy innovation.

US Stock Market Thanksgiving Week Outlook: Bullish Trends Expected Despite Holiday-Shortened Trading Week

Bullish Sentiment Fueled by Seasonality and Strong Fundamentals: Last week, the Dow Jones gained 1.99%, the S&P 500 surged 1.62%, and the Nasdaq Composite rose 1.53%, reflecting robust market momentum. Thanksgiving week is historically bullish, aligning with November’s positive seasonality.

Key Economic Data to Watch: Anticipate market-shaping reports like PCE Prices, the Federal Reserve’s preferred inflation gauge, and the S&P Case-Shiller Home Price Index on Wednesday. A hotter-than-expected PCE could challenge bullish trends by influencing treasury yields.

Holiday-Shortened Trading with Limited Earnings Spotlight: Markets will close on November 28, Thanksgiving Day, impacting trading volume. Earnings from high-profile tech firms, including Dell (DELL), CrowdStrike (CRWD), and Workday (WDAY), will keep investors attentive amid lighter corporate calendars.

Nate Peterson Director of Derivatives Analysis at Charles Schwab in his note said, “ A stronger Dollar is generally bullish for U.S Stocks, though if the velocity of the move is too swift it can create near-term market volatility. Taking everything into consideration, bullish seasonality, bullish technical’s, a strong fundamentals backdrop and a friendly Fed leave me in the bullish camp for Thanksgiving week.”

🎢 Impact on Real Estate

Mortgage rate forecast for 2025

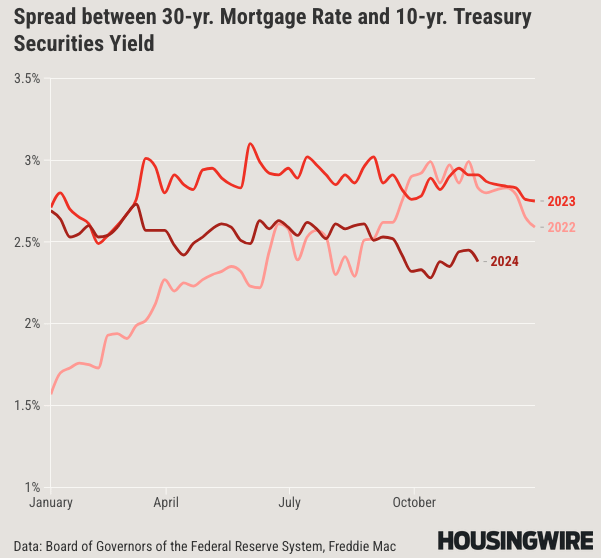

Mortgage Rates Remain Elevated: HousingWire forecasts a 30-year fixed mortgage rate range of 5.75%–7.25% for 2025, with limited prospects for significant declines. Stability in bond markets and easing spreads may allow rates to touch the lower end of the range, but affordability challenges persist.

10-Year Treasury Yields as a Guide: Expected to range between 3.4% and 4.5%, the 10-year yield plays a crucial role in mortgage rate trends. Economic outperformance or inflationary pressures could push yields—and mortgage rates—higher.

The Spread's Role: A shrinking spread, down from 291 bps in 2023 to 238 bps in 2024, offers a glimmer of hope. A further reduction to 225 bps could bring mortgage rates closer to the 5.75% range, under favorable economic conditions.

🎙️ RE Spotlight

New Zillow Home Loans tool addresses home buyers biggest concern: affordability

Real-Time, Personalized Affordability: BuyAbility, exclusive to Zillow, calculates a buyer’s home price and monthly payment affordability using real-time mortgage rates, credit score, income, and budget. It dynamically updates to keep buyers informed of their financial standing.

Bridging Mortgage Rates and Buying Power: A change in rates dramatically impacts affordability. For instance, a 1% rate drop (from 7% to 6%) increases a median-income buyer's budget by $40,000—from $380,000 to $420,000.

Streamlined Decision-Making: Integrated into Zillow’s home search, BuyAbility lets buyers instantly identify homes that match their budget, eliminating guesswork and enhancing confidence in the decision-making process.

The rise of work-from-home migration has changed the real estate market

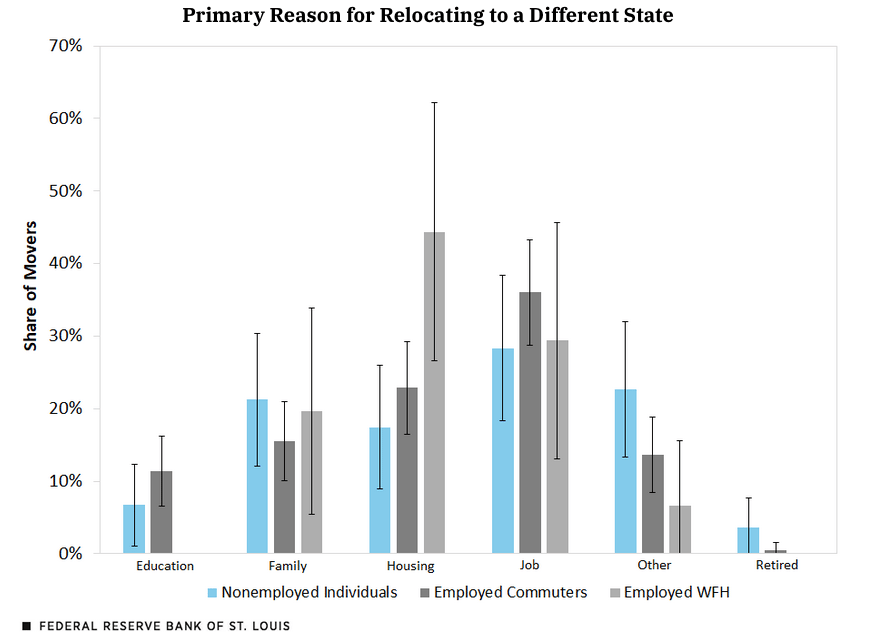

Remote Work Driving Migration: Interstate migration surged post-pandemic, with the share of remote workers tripling from 5% in 2019 to 15% in 2022. Remote workers were 50% more likely to move between states than commuters, and WFH accounted for 57% of the migration increase during this period.

Shifting Motivations:

Remote workers prioritize housing (44%) over jobs (29%) when relocating, emphasizing affordability and quality of life.

Commuters still move for jobs (36%), aligning with historical trends, while family and housing rank lower in priority.

Economic Sorting: This shift signals a reorganization of the U.S. population. Remote workers are clustering in areas with affordable housing, while commuters gravitate toward higher-wage job hubs, potentially altering regional economic landscapes.

🏕️ Niche-RE

Top U.S. Cities Leading Multi-Family Housing Development

As the housing shortage persists, multi-family construction is a critical solution for increasing supply and improving affordability. Here's how major U.S. cities rank in building density-friendly developments:

New York-Newark-Jersey City, NY-NJ-PA

Share of new multi-family units: 81.4%

New multi-family units authorized: 51,296

Leading the pack with unparalleled multi-family housing investments.

Miami-Fort Lauderdale-Pompano Beach, FL

Share of new multi-family units: 74.1%

New multi-family units authorized: 15,808

Transforming South Florida with extensive new developments.

San Diego-Chula Vista-Carlsbad, CA

Share of new multi-family units: 73.4%

New multi-family units authorized: 8,420

Focused on expanding coastal urban density.

Boston-Cambridge-Newton, MA-NH

Share of new multi-family units: 68.6%

New multi-family units authorized: 7,426

Addressing high demand in the Northeast.

Hartford-East Hartford-Middletown, CT

Share of new multi-family units: 68.3%

New multi-family units authorized: 1,444

Small but significant strides in affordable housing.

Why This Matters

Efficiency: Multi-family homes are cost-effective and faster to build than single-family homes.

Density: Supports urban housing demands without expanding land use.

Affordability: Key to alleviating the housing crisis, especially in high-demand metro areas.

With cities like New York and Miami taking the lead, these developments showcase the growing role of multi-family housing in reshaping urban living.

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.