- Dwelling's Digest

- Posts

- Rents Surged 31.8%

Rents Surged 31.8%

Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Success in real estate starts when you believe in yourself.”

In today’s edition - August's CPI rose 0.2%, driven by a 0.5% increase in shelter costs and a 0.8% decline in energy prices. Pending home sales dropped 5.5% in July, hitting a record low. The rental market cooled with slower rent growth and more concessions, as income needed for typical rents surged 31.8% since pre-pandemic levels. Luxury home sales are up 66%, led by Dubai, Palm Beach, and Miami. High-value commercial real estate faces significant pressure, with declines in office and multifamily sectors amid ongoing economic uncertainty.

If you missed yesterday’s newsletter, click here

Mortgage & REITS

30-Yr Fixed RM | 6.11% | - 0.11% |

15-Yr Fixed RM | 5.62% | - |

30-Yr Jumbo | 6.37% | - 0.08% |

7/6 SOFR ARM | 6.13% | - 0.02% |

30-Yr FHA | 5.65% | - 0.05% |

30-Yr VA | 5.67% | - 0.05% |

Average going rates as of Sep 11 2024

S&P 500 | 5,554.13 | + 1.07% |

Dow Jones | 40,906.00 | - |

Bitcoin USD | 57,754.96 | + 0.93% |

Numbers as of Sep 11 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

The Consumer Price Index (CPI) report for August 2024 highlights a 0.2% increase in the CPI for All Urban Consumers (CPI-U), consistent with July's rise. Over the past 12 months, the CPI-U increased by 2.5% before seasonal adjustment. The primary contributor to this increase was a 0.5% rise in shelter costs. Meanwhile, food prices increased by 0.1%, and energy costs fell by 0.8% during the month.

Key Takeaways:

Shelter: Up 0.5% in August, contributing significantly to overall CPI growth.

Food: Slight rise of 0.1%, with food away from home up by 0.3%.

Energy: Declined by 0.8%, driven by falling gasoline prices, down 0.6%.

Over the past year, shelter costs have increased 5.2%, while energy prices have decreased 4.0%. The 12-month inflation rate for the CPI excluding food and energy stands at 3.2%.

Stock Market Reaction: Amid the inflation data release, stock markets remain focused on the Federal Reserve’s upcoming decisions. While inflation has cooled, the persistent rise in shelter costs and core inflation may keep the Fed cautious. The S&P 500 and Nasdaq Composite experienced moderate declines this week as investors digest inflation reports and energy price volatility, which could influence corporate earnings.

Energy Sector Stocks: Despite a drop in gasoline prices, energy stocks remain mixed. Oil companies are navigating a delicate balance as crude oil prices remain volatile, with supply concerns from OPEC and demand fluctuations in China.

🎢 Impact on Real Estate

U.S. Home Sales Recovery Did Not Occur This Summary as Expected, Says NAR

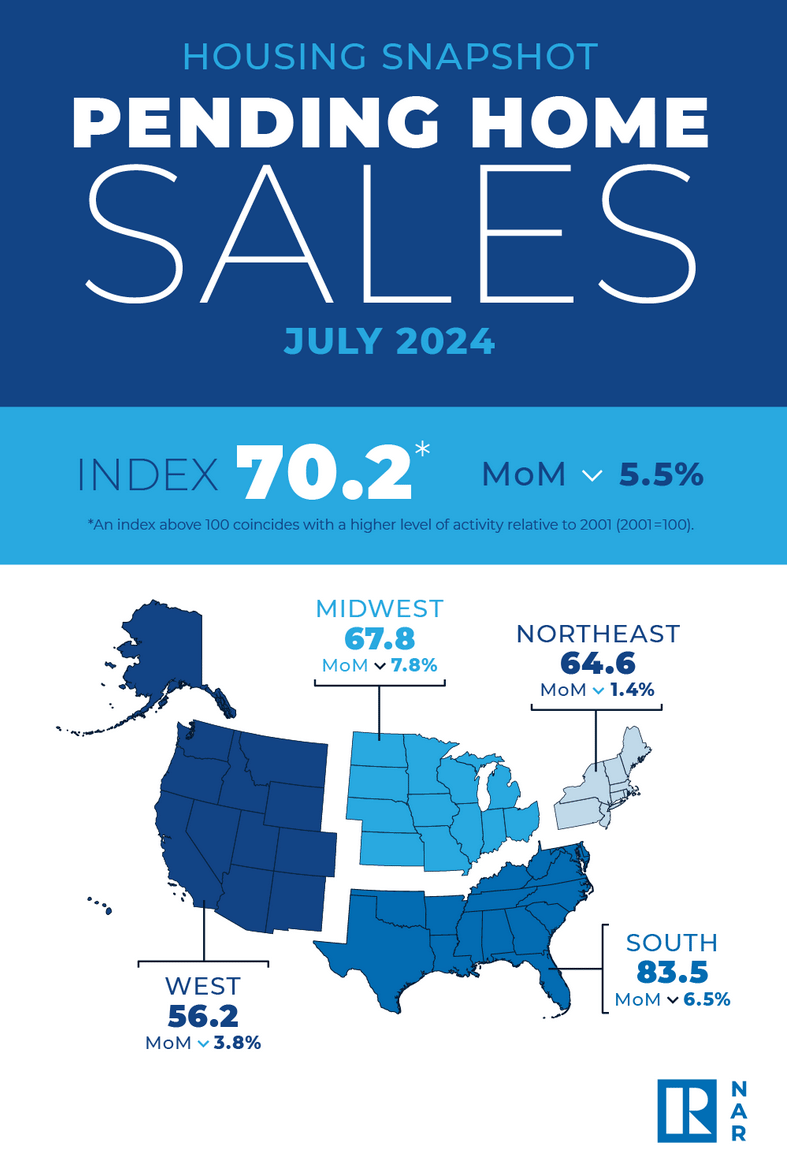

National Decline: In July 2024, pending home sales fell by 5.5%, marking a significant dip across all four U.S. regions. The Pending Home Sales Index (PHSI) dropped to 70.2, the lowest level since its inception in 2001. On a year-over-year basis, pending transactions declined by 8.5%.

NAR Chief Economist Lawrence Yun pointed out that while job growth and increased inventory are positives, affordability concerns and election uncertainty hindered a sales recovery in midsummer.

🎙️ RE Spotlight

🎯 Rental Market Report

Rental demand softens into summer as more apartments are completed

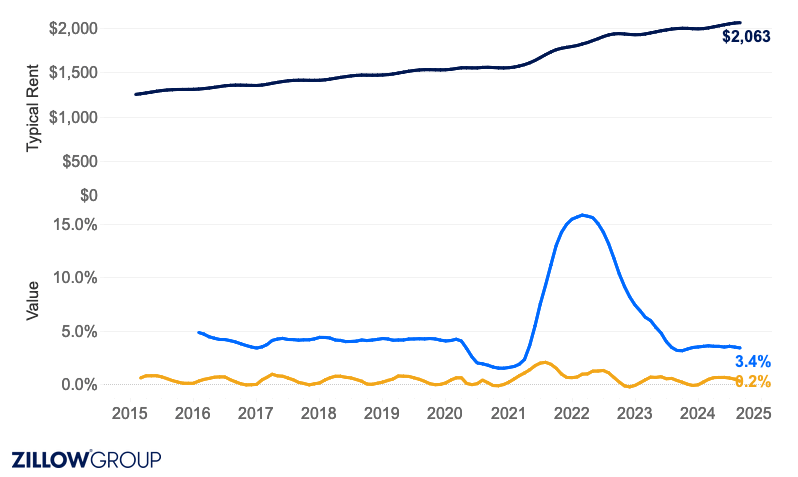

Cooling Rental Market: Rental demand softened in August as new multi-family units hit the market, leading to slower rent growth and increased concessions. Monthly rents rose by just 0.2% to $2,063, reflecting a cooling trend from previous years.

Increased Rental Concessions: More than a third of rental listings offered incentives like free rent or parking in August, the highest share since March 2021. This rise in concessions highlights the ongoing affordability challenges in the rental market.

Affordability Struggles Persist: The income needed to afford typical U.S. rents has surged 31.8% since pre-pandemic levels, reaching $82,514. Despite cooling rent growth, affordability remains a major hurdle for renters across the country.

❓ Do You Know

Why Are There Fewer Entry-Level Homes in America?

Zoning Laws Favor Larger Homes: Local regulations often impose minimum size requirements, pushing builders to construct bigger homes.

Economies of Scale: Building larger homes reduces the cost per square foot, benefiting builders with higher profit margins and offering homebuyers more space for their money.

Market Preferences: Many Americans associate larger homes with status and wealth, influencing the demand for bigger properties. Additionally, entry-level homebuilders struggled after the 2008 housing crash, reducing the availability of smaller homes.

🏰 RE State Zone

Dubai, Palm Beach and Miami Lead World's Super Luxury Home Sales

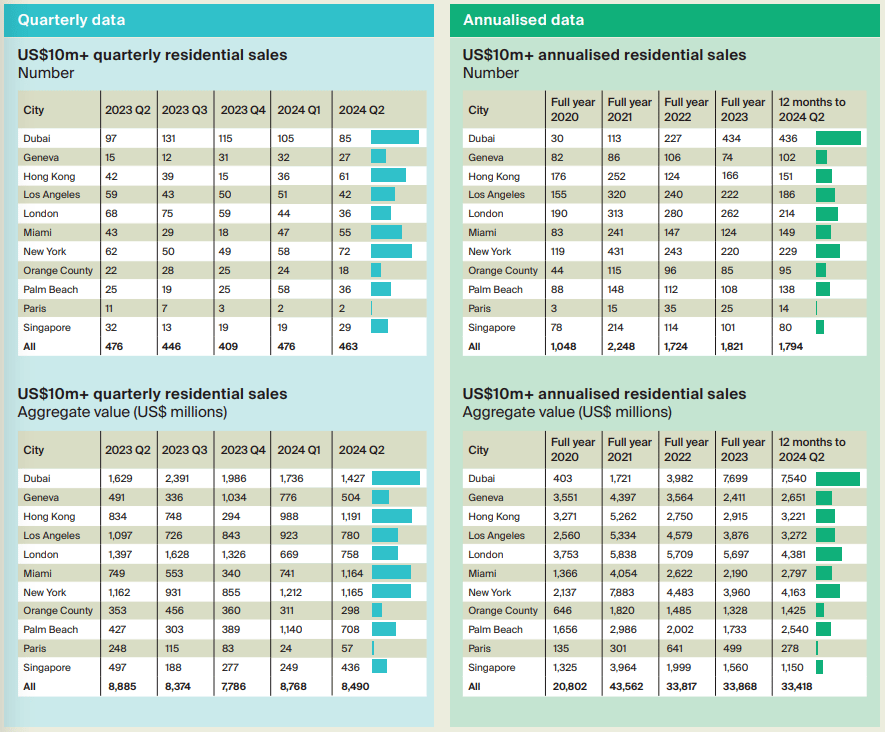

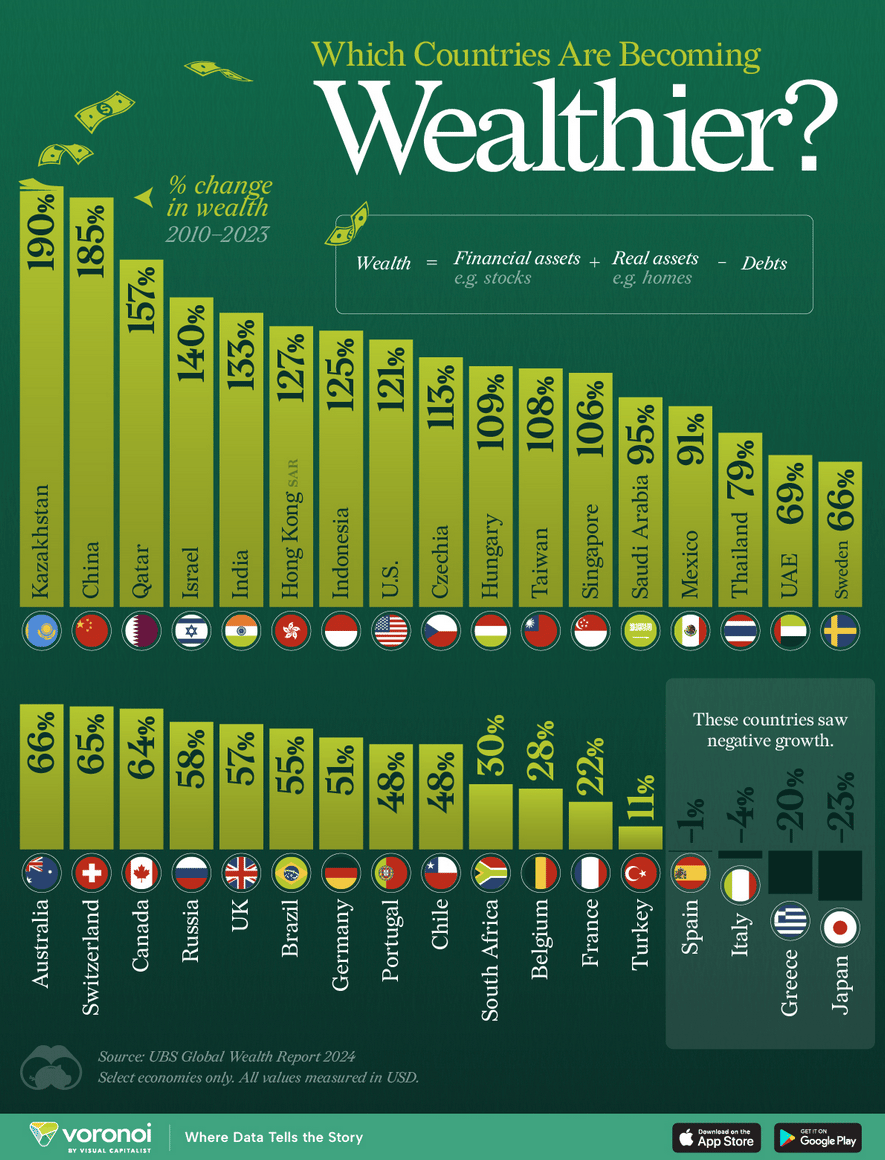

Rising Super Prime Sales: 463 properties valued at $10M+ were sold in the 3 months to June 2024, up 66% from pre-pandemic levels, reflecting robust growth driven by wealth creation.

Market Leaders: Dubai, with 85 sales, leads globally, followed by New York (72) and Hong Kong (61), showing renewed demand from ultra-high-net-worth buyers.

Stable Sales Values: The super-prime market hit $33.4B in the year to June 2024, steadying after the pandemic boom, with key markets like Palm Beach, Miami, and Geneva seeing strong growth.

Luxury markets thrive as wealth creation fuels $33B in high-end property sales.

🏕️ Niche-RE

Q2 2024 CRE Market: High-Value Properties Under Pressure Amid Stability

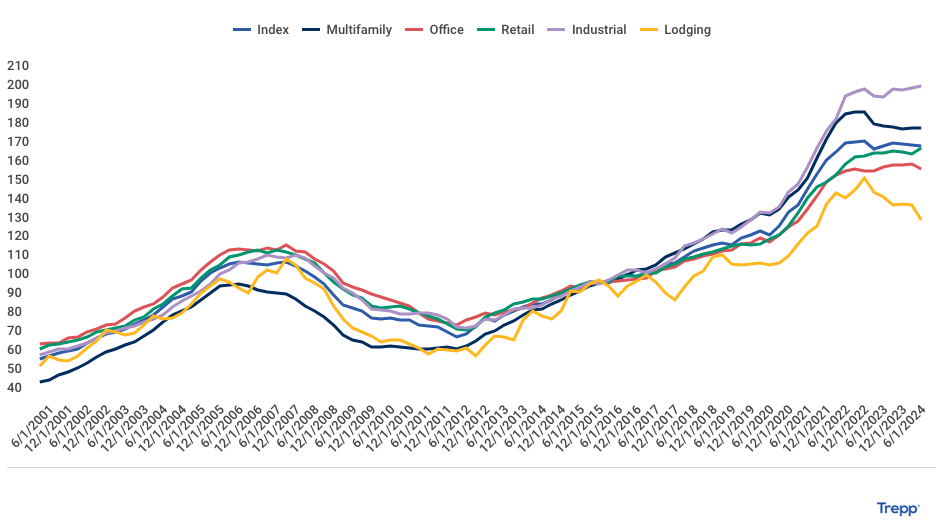

CRE Pricing Overview: The Trepp Property Price Index (TPPI) reveals stability with the equally weighted (EW) index down just 0.24% in Q2 2024. However, the value weighted (VW) index shows a sharp 4.21% decline year-over-year, with high-value properties facing a 12.77% drop since June 2022. Office and multifamily assets are under the most stress, often selling at discounted prices.

Multifamily Sector: The VW index for multifamily properties dropped by 13.16% since June 2022, as interest rate hikes and changing urban demographics continue to hit larger, high-value assets hardest.

Office Sector: Office properties saw a 24.49% VW index drop since June 2022, while the EW index stayed relatively stable, reflecting major challenges for larger office spaces in the post-pandemic, remote-work environment.

Stock Market Impact on CRE:

Economic Uncertainty: Rising interest rates and stock market volatility are squeezing CRE valuations, especially high-end properties, as borrowers face higher costs.

Market Sentiment: With tighter financial conditions, capital-intensive CRE sectors are feeling the pressure, and investor confidence may continue to weaken as 2024 progresses.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.

Reply