- Dwelling's Digest

- Posts

- Reports Inside - Student Housing Trend and Top opportunity zones in 2024.

Reports Inside - Student Housing Trend and Top opportunity zones in 2024.

Feds Official Rate Cuts, Stock Slip Ahead of Powell Speech. Student Housing. 62% doubled in opportunity zones. Manhattan Secures $75M Historic Office to Multifamily conversion. Kimco Realty REIT.

Mortgage & REITS

30-Yr Fixed RM | 6.48% | + 0.02% |

15-Yr Fixed RM | 6.00% | + 0.02% |

30-Yr FHA | 5.94% | + 0.04% |

30-Yr Jumbo | 6.68% | + 0.01% |

7/6 SOFR ARM | 6.38% | - 0.01% |

30-Yr VA | 5.95% | + 0.03% |

Average going rates as of Aug 22 2024

S&P 500 | 5,570.64 | - 0.89% |

S&P REIT | 363.82 | + 0.48% |

FTSE NAREIT | 801.08 | + 0.41% |

Numbers as of Aug 22 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic Rundown

Fed Officials Signal Support for Interest Rate Cuts as Inflation Cools

Interest Rate Cuts Expected: Federal Reserve policymakers are aligning in favor of reducing interest rates, with cuts anticipated at the upcoming September meeting as inflation shows significant improvement.

Methodical Easing Advocated: Philadelphia Fed President Patrick Harker and Boston Fed President Susan Collins support a gradual and cautious approach to lowering rates to sustain economic health.

Labor Market Concerns: Despite the momentum towards rate cuts, Kansas City Fed President Jeff Schmid emphasizes the need to closely monitor labor market data before making decisive moves.

"For me, barring any surprise in the data we'll get between now and then, I think we need to start this process” of lowering rates, Philadephia Fed Bank President Patrick Harker said in an interview with Reuters. “I think a slow, methodical approach down is the right way to go.”

🎢 Stock Health

Stocks Slip Ahead of Powell's Speech Amid Interest Rate Speculation

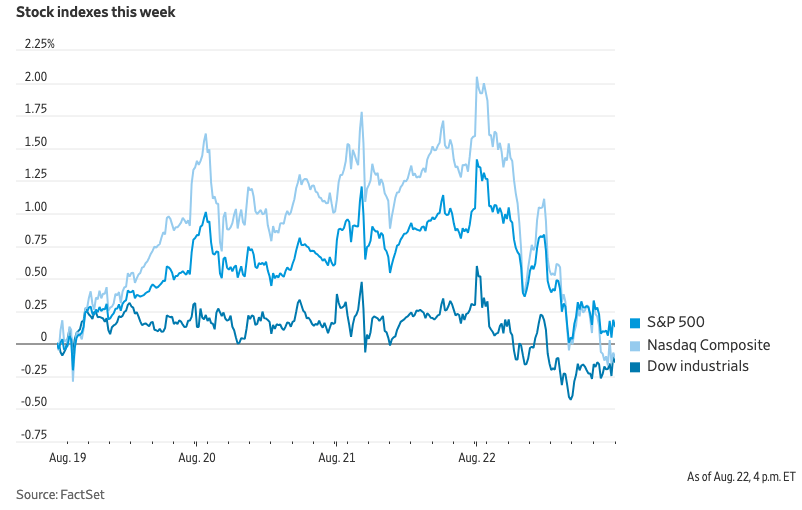

Stock Market Dips: The S&P 500 fell 0.9%, the Nasdaq Composite dropped 1.7%, and the Dow lost 178 points as investors await insights from Fed Chair Jerome Powell on interest rate cuts.

Labor Market Softens: Initial jobless claims rose to 232,000, slightly above expectations, signaling potential weaknesses in the labor market that could influence the Fed's rate decisions.

Housing Market Struggles: Sales of previously owned homes increased in July but remained historically low, highlighting the ongoing affordability challenges due to near-record-high prices.

🎙️ RE Spotlight

Reported: 62% of Opportunity Zones See Home Prices Doubled in Q2 2024

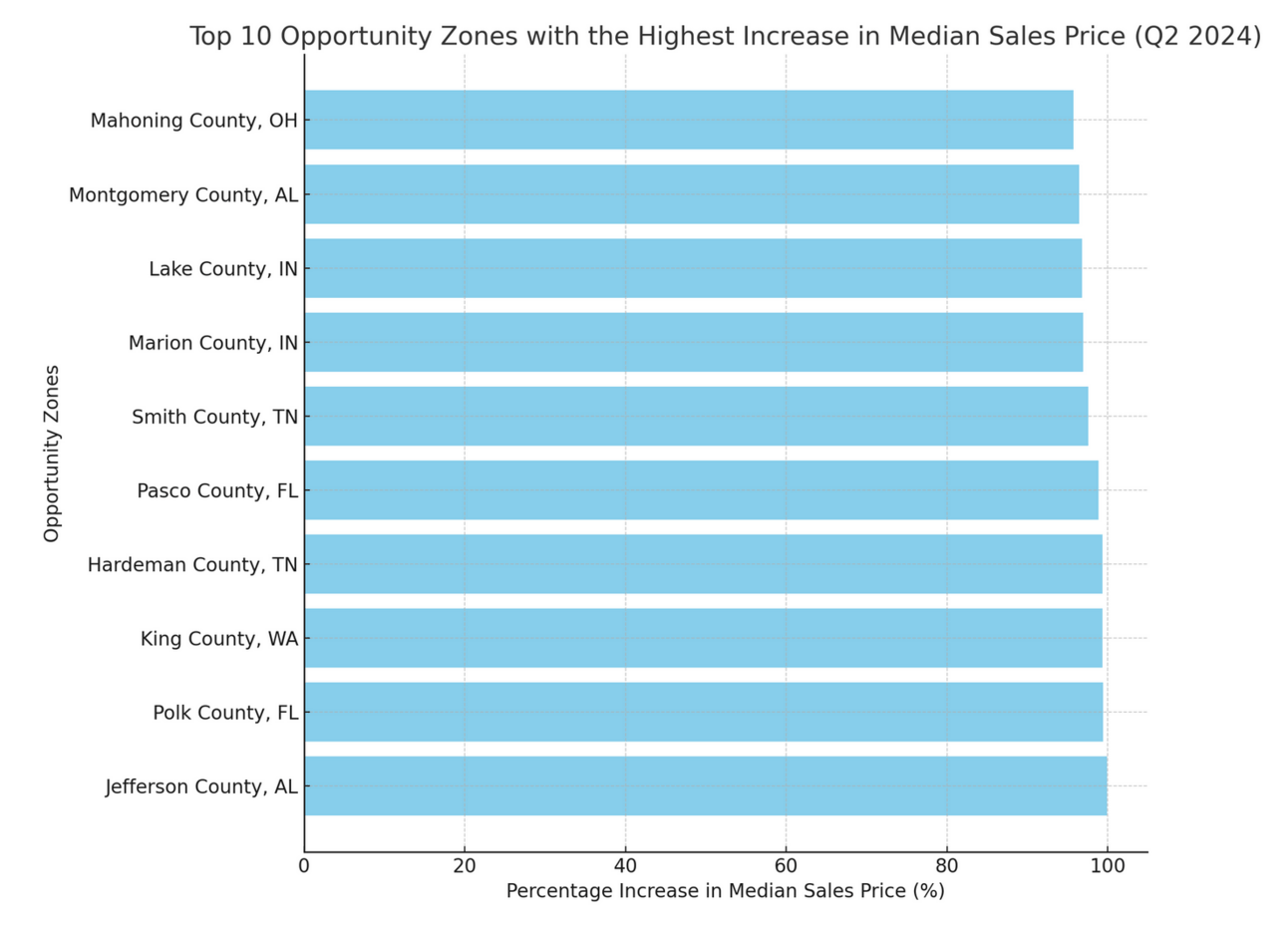

National Trends Reflected in Opportunity Zones: In Q2 2024, 61% of Opportunity Zones across the U.S. saw median home prices rise from the previous quarter, continuing a trend where home values in these areas mirror broader national patterns.

Significant Growth in Affordable Zones: Nearly 29% of Opportunity Zones reported median home prices below $150,000, highlighting affordability, though this percentage has decreased from 34% a year earlier.

Top 10 Zones with Surging Prices: Notable spikes include Jefferson County, AL (99.95% increase to $59,985) and King County, WA (99.39% increase to $650,000), showcasing zones with nearly doubled median prices in just one quarter.

Reported: Student Housing Pre-leasing Lags in 2024 but Remains Above Historical Norms

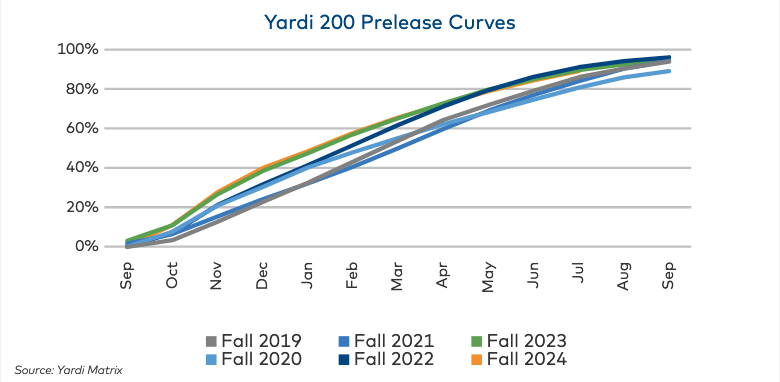

Preleasing Decline: National student housing preleasing reached 89.2% in July 2024, down 5% from the 94.6% occupancy rate in July 2023, indicating a slight market softening.

Varied Performance: Despite the overall dip, 41 schools exceeded their 2023 occupancy levels, with 18 of them rising above last year's sub-90% occupancy rates.

Market Resilience: Yardi Matrix highlights that while student housing performance in 2024 didn't match previous highs, it remains stronger than historical norms, reflecting ongoing demand stability.

🏰 RE State Zone

Manhattan Property Secures $75M Loan for Historic Office-to-Multifamily Conversion

Historic Conversion: The $75 million loan will transform 219 East 42nd Street, a former Pfizer headquarters, from a nine-story office building into one of NYC's largest multifamily spaces.

Major Real Estate Collaboration: The project is spearheaded by Metro Loft Management and David Werner Real Estate Investments, showcasing a significant joint venture in Manhattan's real estate landscape.

Northwind Group's Role: The senior mortgage acquisition predevelopment loan, provided by Northwind Group, marks a pivotal investment in what is set to be the largest conversion project in NYC history.

🏕️ Niche-RE

Gain from Ulta's Growth by Investing in Kimco Realty's High-Yield Dividends REIT’S

Indirect Exposure to Ulta: By investing in Kimco Realty Corp., shareholders can benefit from Ulta Beauty's success, as Ulta is one of Kimco's top 20 tenants, contributing 0.8% to its annual base rent.

Consistent Dividend Growth: Kimco Realty offers a solid 4.3% dividend yield, with a track record of increasing annual payouts, including a recent 4.3% hike and special dividends, making it a reliable income stream for investors.

Strong Portfolio Performance: With ownership interests in 567 properties and a commitment to an 80% dividend payout ratio, Kimco continues to enhance investor returns by expanding its real estate portfolio and increasing rental income.

👉 More Stories

Wells Fargo-Trimont Deal should work out well for everyone. Even the industry might be thankful in the final view.

Phoenix Lands Latest Multibillion-Dollar Data Center, Novva Data Centers plans to build a 300 MW campus on 160 acres in Mesa, Arizona.

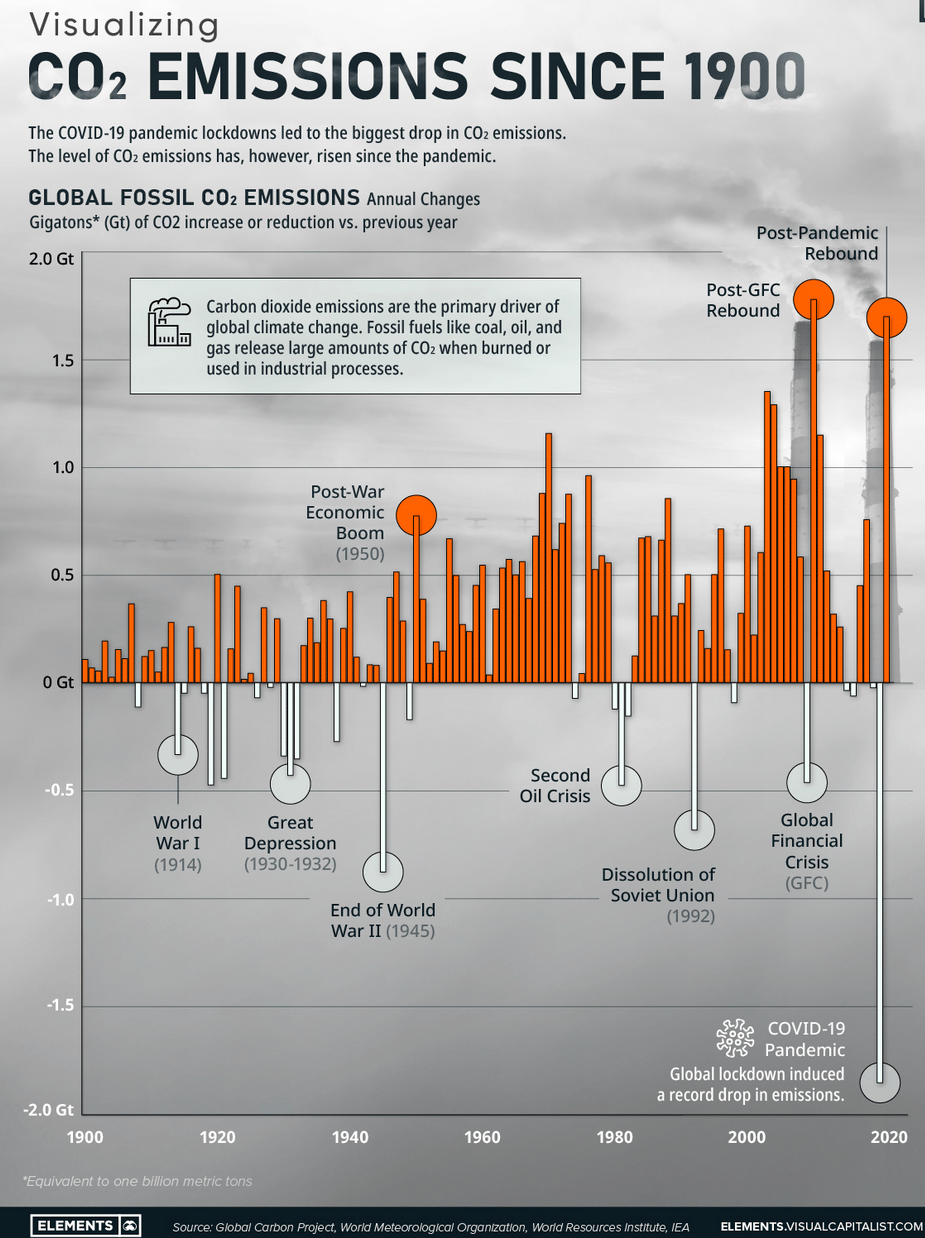

🖼️ Chart-Tastic

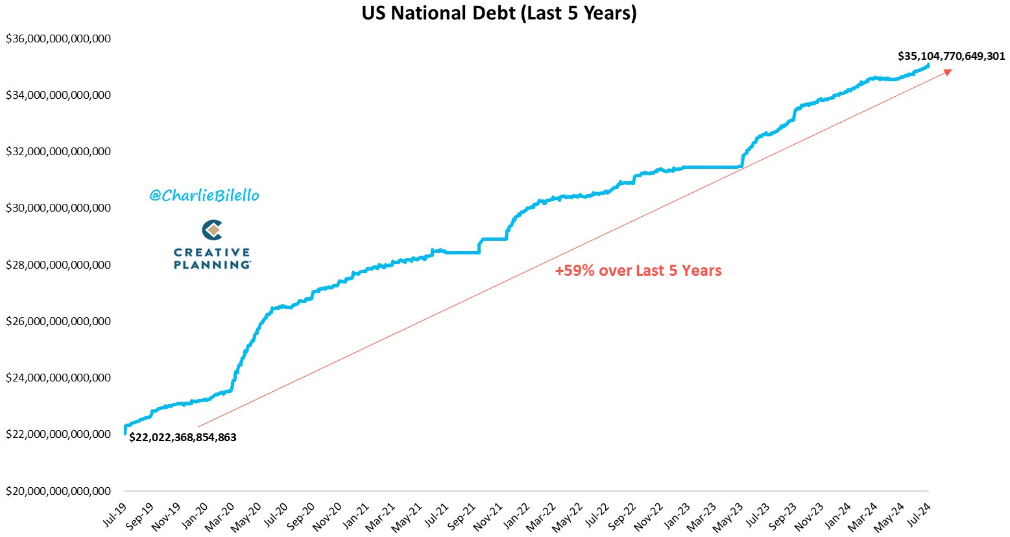

US National Debt has moved from $22 trillion to $35 trillion over the past 5 years, a 59% increase.

👾 Interesting in Social

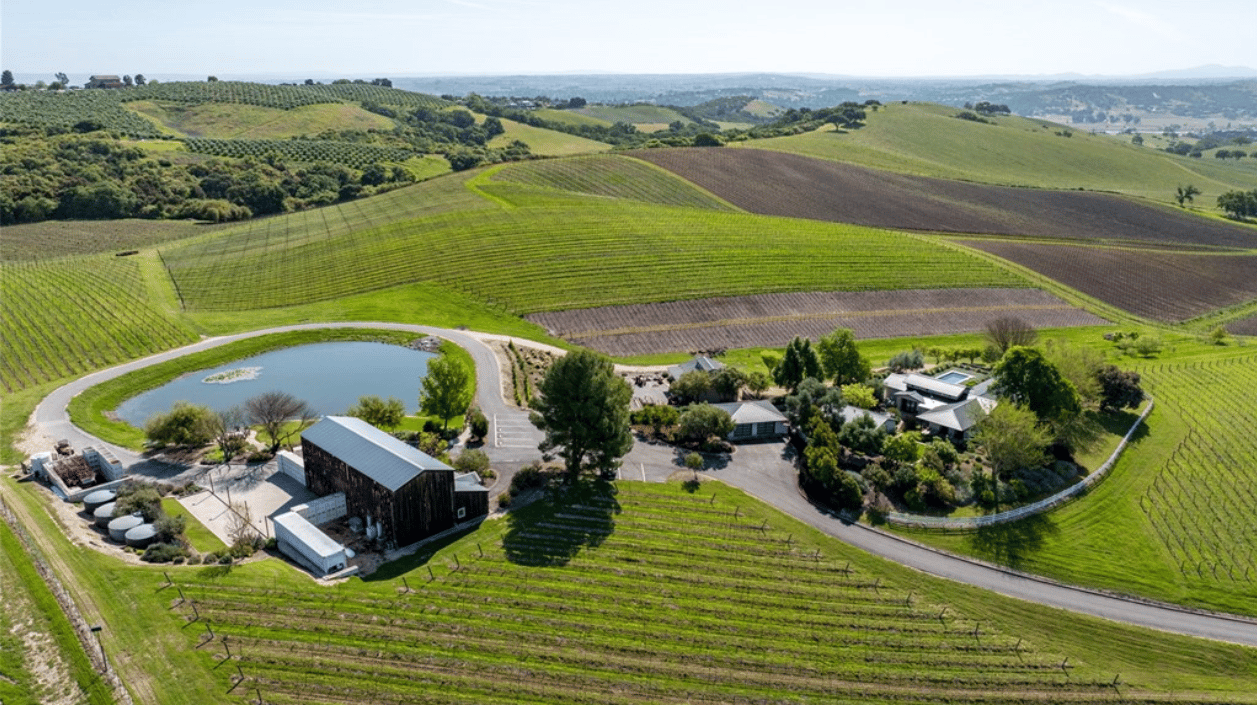

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.

Reply