Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - Investing in real estate is investing in a life well lived

In today’s edition - I explore resilient consumer spending, led by upper-income households, amid economic strains. Real estate highlights include rising homebuyer demand despite mortgage hikes, a decline in jumbo loans, and tepid single-family rent growth. Houston’s multifamily market faces challenges, while Core Spaces plans to double its student housing portfolio to meet rising demand. Plus, discover insights into Latin America’s economic recovery and a unique property pick.

If you missed yesterday’s newsletter, click here

Rates & REITS

Mortgage | Current | 1 Day | 1 Week | 1 Month |

|---|---|---|---|---|

30-Yr Fixed | 6.90% | - 0.01% | + 0.22% | + 0.71% |

15-Yr Fixed | 6.37% | - 0.01% | + 0.30% | + 0.82% |

30-Yr FHA | 6.36% | - 0.02% | + 0.23% | + 0.60% |

30 Yr Jumbo | 7.00% | - | + 0.22% | + 0.60% |

7/6 SOFT ARM | 6.75% | - 0.02% | + 0.20% | + 0.58% |

30-Yr VA | 6.38% | - 0.02% | + 0.24% | + 0.61% |

Average going rates as of Oct 25 2024

S&P 500 | 5,808.12 | - 0.03% |

Crude Oil | 71.69 | + 2.14% |

Numbers as of Oct 25 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Despite economic pressures, American consumer spending has remained resilient, driven largely by higher-income households who have benefited from gains in home equity and stock market wealth. Here are some key takeaways:

Wealthier Consumer Spending Fuels Growth: Upper-income households, particularly those earning above $100,000, have been spending robustly due to strong stock market gains and elevated home values. This group has contributed significantly to retail and restaurant sales, sustaining U.S. economic growth even amid high interest rates and elevated inflation.

Strain on Lower-Income Households: In contrast, lower-income Americans have cut back on discretionary spending due to increased costs for essentials like housing and food. The share of spending on non-essential items for those earning less than $28,000 dropped by 2.5 percentage points from pre-pandemic levels, highlighting economic pressures on lower-income groups.

Mixed Economic Sentiment: While the broader economy shows signs of strength, disparities in spending power create a split in consumer sentiment. The high spending by wealthier households sustains growth, but rising debt delinquencies among lower-income groups could signal underlying stress that, while not derailing the economy, raises long-term questions about equitable growth.

🎢 Impact on Real Estate

U.S. Homebuying Resilience: Pending Sales and Demand Climb Amid Rising Mortgage Rates

Pending Sales See Largest Increase in Three Years: Pending home sales have surged 3.5% year-over-year, marking the highest uptick in three years and displaying notable resilience even as mortgage rates climb.

Early-Stage Homebuyer Interest Stays Strong: Redfin's Homebuyer Demand Index, reflecting tours and buying activity, has reached its peak since May and is up 3% year-over-year, suggesting robust demand despite economic uncertainties.

Market Activity Supported by Cash Buyers and Creative Financing: With mortgage payments at near-record highs, cash buyers and buyers leveraging adjustable-rate mortgages are helping to sustain sales while new listings post a modest 2.2% increase year-over-year.

🎙️ RE Spotlight

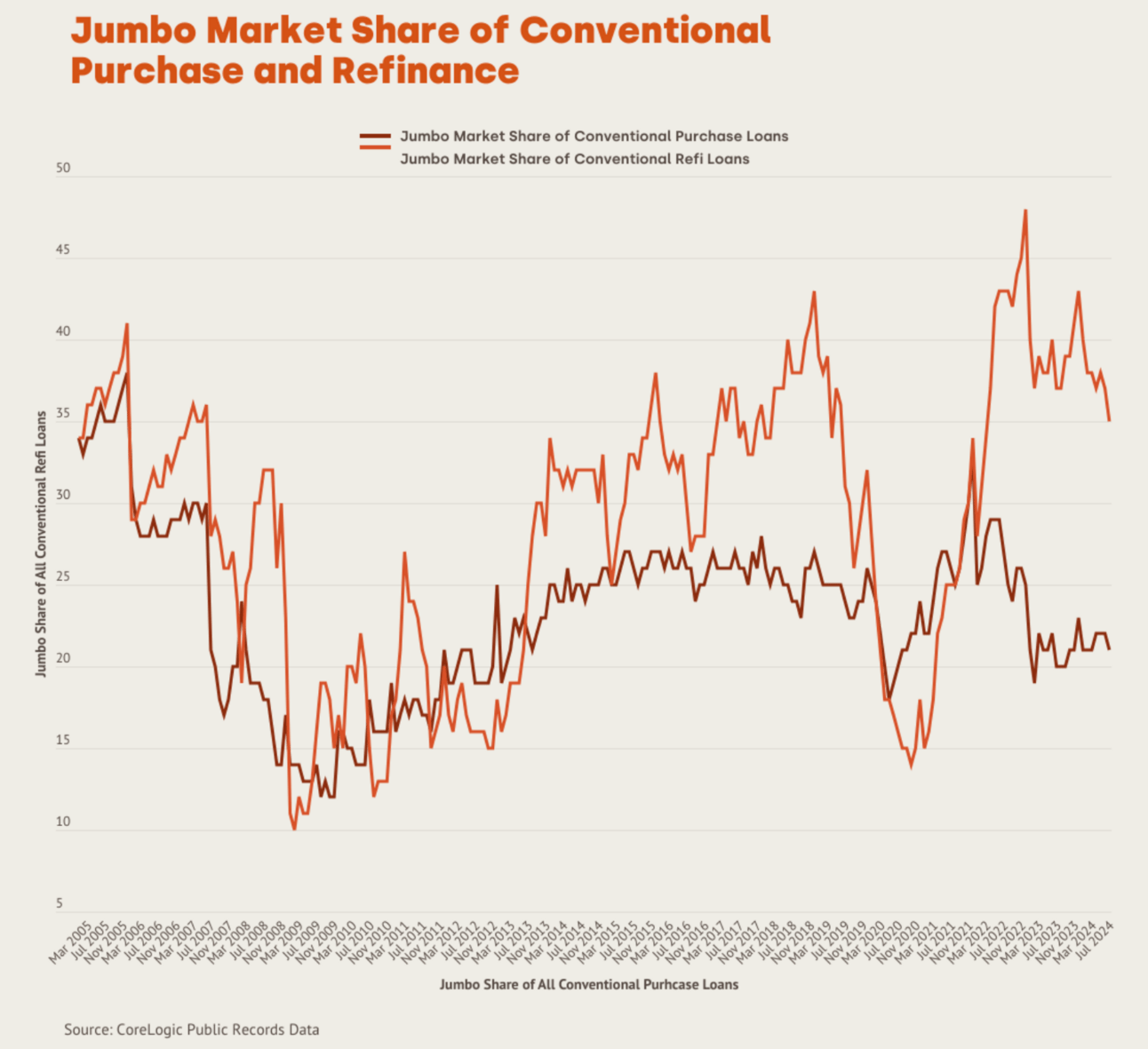

Decline in Jumbo Loan Originations as Rates Surge to Multi-Year Highs

Jumbo Loan Originations Hit Record Low: Between January and July 2024, jumbo loan originations dropped 56% from 2022 levels, marking the lowest volume since 2014 as higher rates and rising home prices dampen demand.

Interest Rates Push Jumbo Loans Over 6% for 10% of Borrowers: As of July 2024, 10% of outstanding jumbo loans hold interest rates above 6%, predominantly issued in recent years, making them prime candidates for refinancing should rates decrease.

Market Share Shifts as Refinance Activity Remains Low: Jumbo refinance loans, once surging post-pandemic, have now returned to pre-2020 market shares, while jumbo purchase loans have stabilized at 21% of the total mortgage market as of mid-2024.

Slow Growth in Single-Family Rents: August 2024 saw a minimal 2.4% annual rise in U.S. single-family rents, the lowest since late 2023. High-end rentals experienced the largest increase (2.9%), while low-end rents fell slightly by 0.2%.

Regional Trends in Rent Growth: Expensive coastal metros, like Seattle, led with 5.8% growth, while Texas markets such as Austin saw rents decline by 2.3%, showcasing regional variability in rental demand.

Deceleration Signals in Monthly Trends: Single-family rents decreased by 0.2% in August, bucking the typical monthly rise and suggesting further deceleration. Seven metros in CoreLogic’s top 20 saw annual gains of 4% or more, with several now exceeding $3,000 in median rent.

🏰 RE State Zone

Houston Multifamily Market Struggles: Occupancy Down, Incentives Ramp Up

Houston’s Multifamily Occupancy Drops Despite Class A Uptick: Class A occupancy has increased, but overall multifamily occupancy has declined, with Class A rents falling year-over-year. Relief could come in 2025 as new construction decreases and absorption balances demand.

Significant Concessions Offered Across Texas: Incentives like free rent and waived deposits now impact over 50% of Class A units in Houston, with similar trends across Texas metros — Austin (57%), Dallas/Fort Worth (39%), and San Antonio (46%).

Construction Slows as Absorption Lags: In the 12 months ending September 2024, Houston saw 26,377 new apartments but only absorbed 17,237 units, leading to reduced new construction with 16,537 units underway as of October.

🏕️ Niche-RE

Core Spaces Expands Student Housing: Doubling Beds in Key Markets

Core Spaces on Track to Double Student Housing Portfolio: With over 43,000 beds under development, Core Spaces is set to expand its student housing portfolio significantly, responding to surging demand in markets like Madison, Wisconsin, and Raleigh, North Carolina.

Enhanced Communal and Wellness Spaces Align with Student Needs: Shifting toward multifunctional amenities, Core Spaces designs prioritize flexible study and wellness areas, creating communal environments tailored to evolving student preferences for holistic living.

Madison Market Poised for Major Growth: Core’s development in Madison, totaling over 4,000 beds, reflects the city's need for high-quality student housing as UW-Madison enrollment rises, aiming to blend new builds into Madison’s unique culture.

🖼️ Chart-Tastic

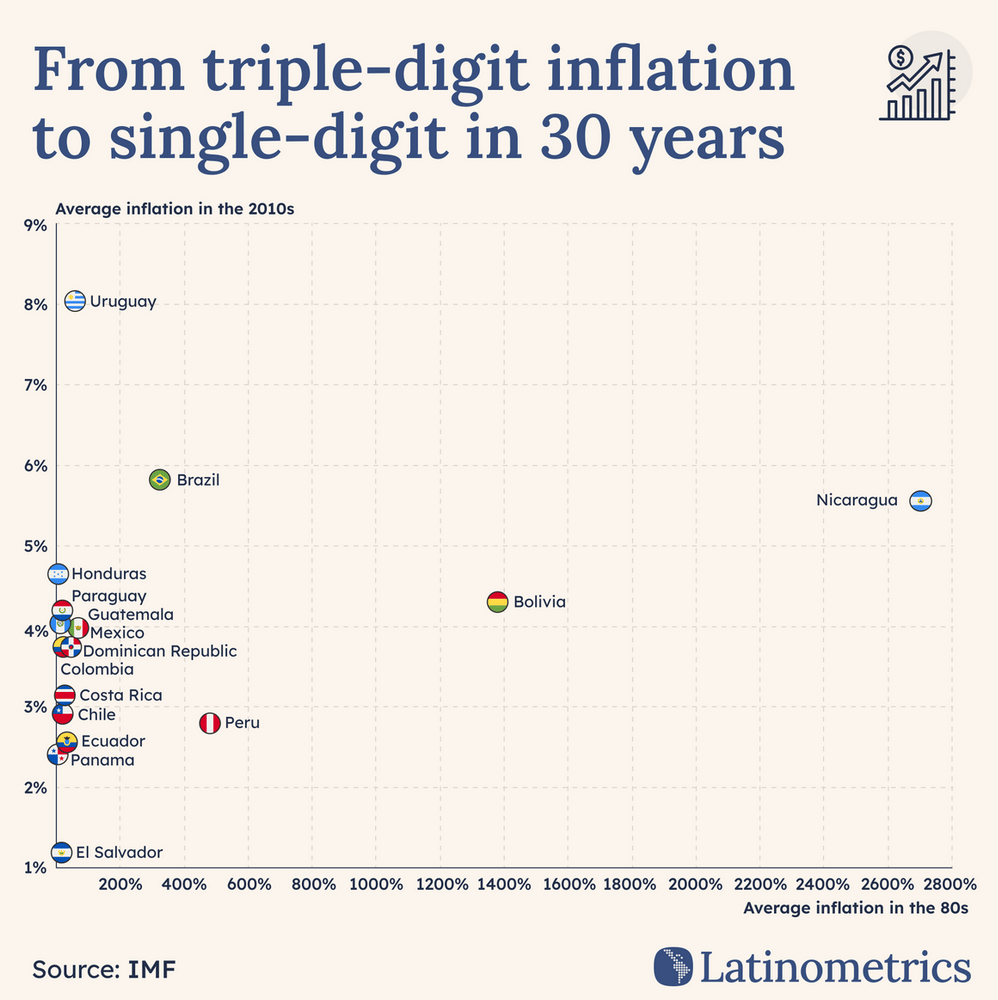

From Hyperinflation to Single-Digit Rates... Can Latin America's Economic Turnaround be a Model for Other Regions?

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.