Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Adapting to change is the cornerstone of resilience—whether in markets, real estate, or life, staying informed keeps you ahead”

In today’s edition - December brought pivotal shifts in consumer confidence, real estate regulations, and market dynamics. Consumer sentiment dipped to 104.7, while HUD unveiled stricter flood standards for 2025. Real estate listings rose 12% YoY, and Atlanta’s data center boom sparked housing debates. From luxury ski towns to America’s least safe cities, explore key market insights.

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.11% | - 0.01% |

15-Yr Fixed RM | 6.47% | - 0.01% |

30-Yr Jumbo | 7.33% | - |

7/6 SOFR ARM | 7.02% | - 0.02% |

30-Yr FHA | 6.45% | - 0.01% |

30-Yr VA | 6.46% | - 0.01% |

Average going rates as of Dec 27 2024

S&P 500 | 5,970.84 | - 1.11% |

Crude Oil | 70.26 | - 0.48% |

Dow 30 | 42,992.21 | - 0.77% |

10-Yr Bond | 4.6190 | + 0.87% |

Bitcoin USD (As of Dec 29) | 93,692.07 | - 1.24% |

Numbers as of Dec 27 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

US Consumer Confidence Dips in December Amid Economic and Policy Uncertainty

Consumer Confidence Slips to 104.7: December saw a sharp decline in consumer sentiment, falling from expectations of 113.2, with significant concerns about economic policies and tariffs shaping the outlook.

Tariffs Worry 46% of Respondents: Nearly half of surveyed consumers anticipate higher living costs due to tariffs, while only 21% see them boosting US jobs, reflecting mixed expectations about economic impacts.

Job Market Sentiment Improves: The share of consumers reporting "jobs are plentiful" rose to 37%, while those citing "jobs are hard to get" dropped to 14.8%, signaling continued strength in employment metrics.

Rising Treasury Yields and Elevated Valuations Raise 2025 Market Concerns

Santa Claus Rally Trends: The "Santa Claus Rally," a historically reliable seven-day period starting December 24, typically yields a 1.3% gain for the S&P 500. However, this year's 0.1% decline (as of Dec. 27) mirrors 2023's underperformance, suggesting caution for January, as markets with no rally in this period historically see 50% lower annual returns.

Interest Rates and Market Stress: The 10-year Treasury yield has climbed to 4.6%, its highest in seven months, driven by the Federal Reserve's stance on maintaining higher interest rates. Equity strategists like Michael Kantrowitz warn that rates above 4.5% create headwinds for stock performance, heightening the risk of corrections in early 2025.

Valuation and Sentiment Risks: The S&P 500 is entering 2025 with projected 15% earnings growth, supported by resilient economic performance. Yet, elevated valuations have pushed sentiment into "euphoria" territory, with the Levkovich Index at 0.62, well above the cautionary threshold of 0.38. This setup increases the likelihood of volatility spikes should unexpected catalysts disrupt the current bullish narrative.

🎢 Impact on Real Estate

HUD’s New Flood Risk Management Standard: Key Changes for Single-Family and Multifamily Properties in 2025

New Elevation Standards for Single-Family Homes: Starting Jan. 1, 2025, single-family homes in 100-year floodplains must be elevated 2 feet above base flood elevation to qualify for FHA mortgage insurance, ensuring stronger flood resilience.

Stricter Floodproofing for Multifamily Properties: HUD-assisted multifamily buildings face expanded floodplain boundaries and heightened floodproofing rules under the FFRMS, aligning with a climate-informed science approach (CISA).

Enhanced Notification Requirements: Owners and developers must inform residents of floodplain risks, while leases for HUD-insured rentals must include signed floodplain acknowledgments starting in 2025.

🎙️ RE Spotlight

Housing Supply Ends 2024 On the Rise, Up 12% Year Over Year

Active Listings Rise 12% YoY: Nationally, active home listings reached 954,703, marking a 12% year-over-year increase—the smallest rise since March—as more homes linger on the market.

Median Sale Price Climbs 6% YoY: The median home sale price hit $383,725 in December, driven by constrained new listings and persistent buyer demand in key metros like Philadelphia (+17.1%) and Milwaukee (+14.3%).

Pending Sales Dip by 3.4%: December recorded the first decline in pending sales in three months, reflecting holiday seasonality and cautious consumer sentiment amid rising mortgage rates.

The Data-Center Boom Eats Up a Lot of Land. Atlanta Says It’s Gone Too Far.

Atlanta's Data Center Surge: Data-center capacity in metro Atlanta grew 76% year-over-year in 2024, driven by tech giants like Meta, Google, and Microsoft, securing its spot as one of the fastest-growing markets nationwide.

Balancing Growth with Housing Needs: With a 100,000-unit housing shortfall, Atlanta lawmakers are limiting data-center developments near transit and the Beltline to prioritize people-centered urban planning.

Economic Impact Under Scrutiny: Data-center developments contribute significant tax revenues, yet Georgia Power faces an 80% surge in power demand projections by 2035, raising questions about sustainability and resource allocation.

🏰 RE State Zone

10 Least Safe Cities in America: Some Are Making a Comeback as Investor Markets

Memphis Tops the List for Unsafe Cities: With a safety score of just 34.81, Memphis struggles with high violent crime rates, pedestrian fatalities, and financial challenges, including low credit scores and high bankruptcy rates.

Affordability Amid Risks: Despite safety concerns, cities like Detroit (median home price $95,000) and Cleveland ($145,900) offer some of the most affordable housing options, attracting bargain hunters and investors alike.

Natural Disasters and Financial Strain: Southern cities like Fort Lauderdale and Baton Rouge face compounded risks, from hurricanes to financial instability, ranking them among the least safe despite strong law enforcement presence.

🏕️ Niche-RE

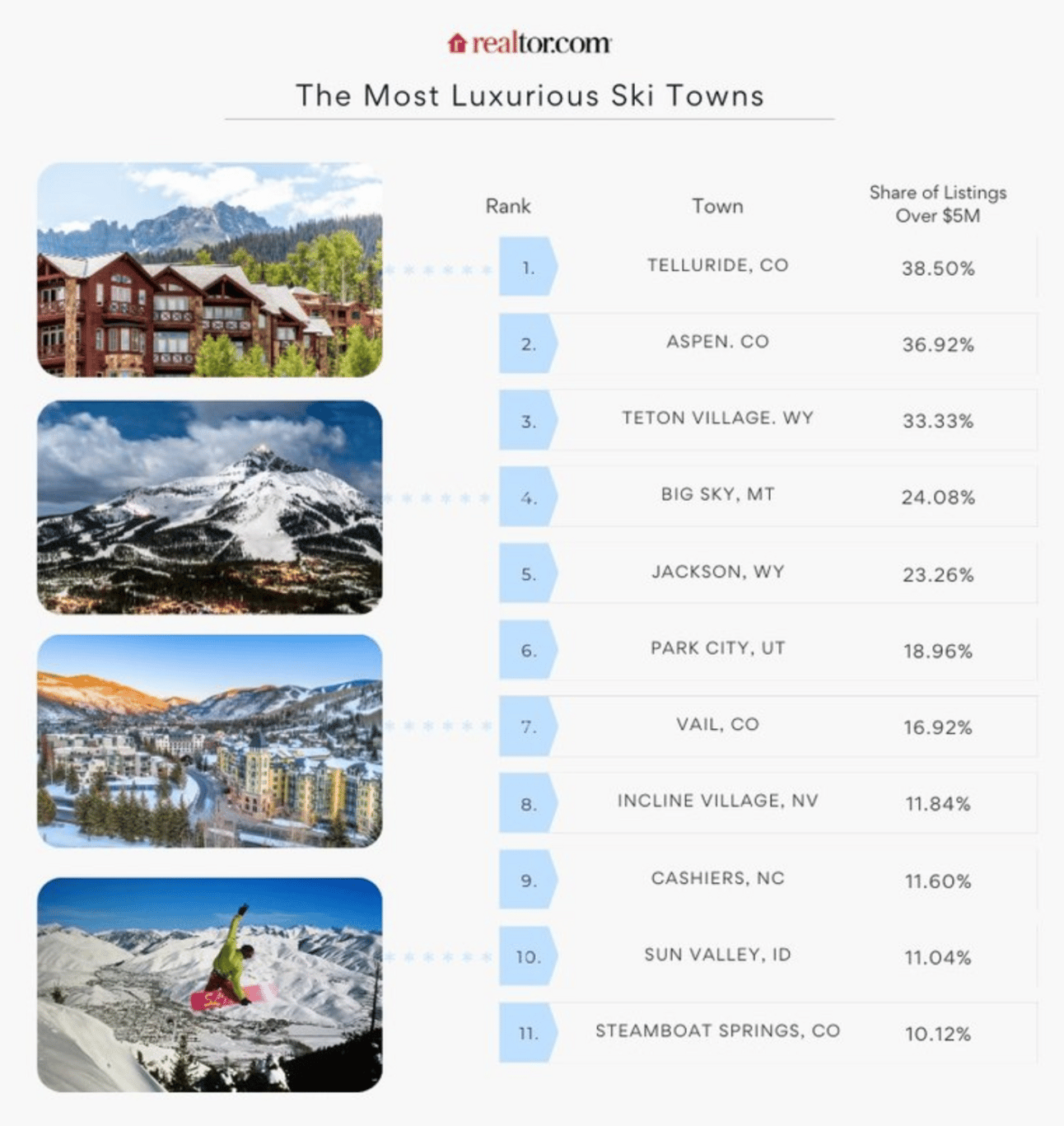

America’s Most Luxurious Ski Towns Revealed: The Priciest Winter Wonderlands Where Ultrawealthy Skiers Flock for Snow Season

Ski towns in the U.S. offer more than just slopes—they're the pinnacle of luxury living. Here's a snapshot of the top destinations where home prices soar, and exclusivity reigns:

With celebrity neighbors, breathtaking landscapes, and multimillion-dollar estates, these towns redefine alpine elegance. For those seeking luxury and adventure, these destinations deliver both in spades.

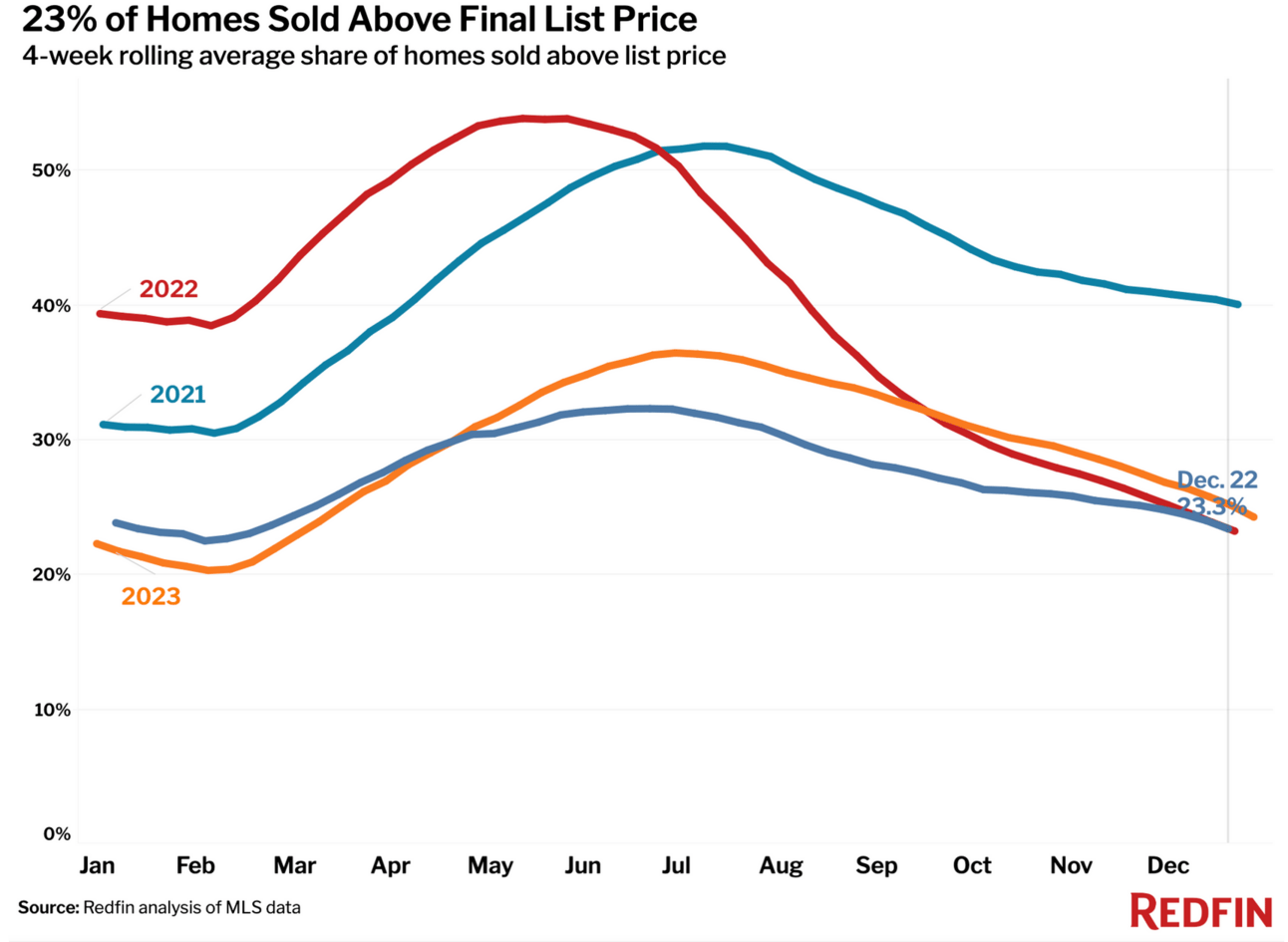

🖼️ Chart-Tastic

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.