Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “The more you know about the market, the more opportunities you create”

In today’s edition - This week brings key central bank decisions, with the Federal Reserve expected to cut rates and Japan’s recent hike causing market uncertainty. Goldman Sachs predicts U.S. home prices will rise 4.5% this year, led by growth in the Midwest and California. Mortgage rate locks on second homes dropped 13.1% year-over-year, while older condos in South Florida flood the market due to costly repairs. Multifamily development is booming, with 2 million units expected by 2028, and foreclosure filings declined 5.3% in August 2024, continuing a downward trend.

If you missed yesterday’s newsletter, click here

Mortgage & REITS

30-Yr Fixed RM | 6.12% | - 0.02% |

15-Yr Fixed RM | 5.63% | - 0.03% |

30-Yr Jumbo | 6.38% | - 0.02% |

7/6 SOFR ARM | 6.11% | - 0.01% |

30-Yr FHA | 5.66% | - 0.02% |

30-Yr VA | 5.68% | - 0.01% |

Average going rates as of Sep 16 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

This week is set to be pivotal for the global economy, with major shifts in central bank policies expected across key regions. The Federal Reserve's likely interest rate cut will be a significant event, as markets closely watch whether the Fed will opt for a quarter- or half-point reduction, which could set the tone for economic momentum. Simultaneously, the Bank of Japan's meeting will be critical after its recent rate hike, which sparked global market fluctuations.

Key Takeaways:

US Federal Reserve: Expected to cut rates, with traders speculating between a 25 or 50-basis point cut as the US economy shows signs of slowing.

Global Influence: Central banks in Brazil, South Africa, and the UK are set to adjust their policies in response to their own economic pressures, with potential interest rate hikes or reductions on the table.

Japan: The Bank of Japan's decision could affect global markets, especially after yen-centered carry trade disruptions following its July hike.

The global focus will also be on China, where deflation concerns have put pressure on its central bank to take decisive action. The decisions made by these major economies will have ripple effects across financial markets, impacting everything from currency valuations to inflation expectations worldwide.

🎢 Impact on Real Estate

✔️ Goldman Sachs Research

US House Prices Are Forecast To Rise More Than 4% Next Year

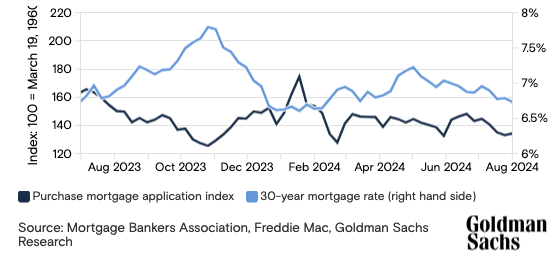

Rising Home Prices Despite Rate Cuts: Goldman Sachs forecasts a 4.5% increase in US home prices this year, as falling mortgage rates support buyer demand despite affordability challenges.

Regional Price Growth Hotspots: The Midwest, Northeast, and California are leading US home price growth, with San Jose expected to see up to 10% appreciation in 2024.

Affordability to Slowly Improve: Goldman Sachs predicts a gradual return to housing affordability over the next five years, driven by falling mortgage rates, steady income growth, and moderate home price gains.

🎙️ RE Spotlight

Mortgage Rate Locks on Second-Home Mortgages Fell 13.1%

Second-Home Market Declines Sharply: Mortgage-rate locks for second homes dropped 13.1% year-over-year in August, hitting their lowest since 2016, as rising home prices and interest rates dampen demand.

Higher Loan Fees Add Pressure: A government increase in loan fees, ranging from 1.125% to 3.875%, has made second-home purchases less appealing, contributing to a 59.2% drop in demand compared to pre-pandemic levels.

Seasonal Town Prices Still Rising: Despite the slowdown, second homes in seasonal towns saw a 4.1% price increase in August, with the typical home selling for $589,162, adding to the affordability challenges for buyers.

🏰 RE State Zone

Growing Glut of Older Condos Is Threatening the South Florida Housing Market. Here’s Why

Glut of Older Condos Flooding the Market: New Florida laws require owners in 30+ year-old condo buildings to complete costly repairs, creating a surge of discounted units in South Florida, but they’re struggling to sell.

Steep Assessments Hitting Owners Hard: Special assessments, often in six figures, are being levied on condo owners to cover deferred maintenance, forcing many to lower prices dramatically or face financial hardship.

Opportunities for Cash Buyers: Savvy investors with cash on hand may find bargains in well-located older condos, but must navigate high fees and potential construction delays, making thorough research essential.

“Our seller has to lower the price so much to make it enticing,” she continued. “It’s price cut after price cut after price cut, and everyone’s competing on who can cut the price faster.” Find Out More

🏕️ Niche-RE

Top 10 Markets for Multifamily Deliveries by 2028

With 2 million units expected to be completed across the U.S. from 2024 to 2028, multifamily development is peaking, the latest Yardi Matrix data shows. The supply surge is already in full swing, as these high-performing 10 cities had a combined 85,055 units come online in the first half of this year, about 20,000 more than they did during the first half of 2023.

Key Takeaways:

Total volume across the top-performing cities increased 32.8 percent year-over-year.

Sun Belt cities made up the bulk of this list, with eight entries.

Three Texas cities made the list with a combined 30,609 units completed.

Except for Miami, completions increased year-over-year for all cities on this list.

🚩 Foreclosure Activity

U.S. Foreclosure Activity Declines Both Monthly and Annually in August 2024

Foreclosures Continue to Decline: August 2024 saw 30,227 foreclosure filings across the U.S., marking a 5.3% month-over-month drop and an 11% decrease from last year, with lenders starting the foreclosure process on 20,747 properties.

Nevada and Florida Lead Foreclosure Rates: Nevada recorded the highest foreclosure rate with one in every 2,473 housing units receiving a filing, followed closely by Florida (one in every 2,605 units) and Illinois (one in every 2,837 units).

REO Completions Down 12%: Lenders repossessed 2,889 properties in August, down 12% from the previous month, with Pennsylvania, California, and Illinois leading in completed foreclosures.

🌍 Dwelling of the Day

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.