Happy Friday, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

Quote of the day - “Your first step to financial freedom is owning a piece of the earth”.

If you missed yesterday’s newsletter, click here

Going Rates

30-Yr Fixed RM | 6.41% | + 0.04% |

15-Yr Fixed RM | 5.95% | + 0.03% |

30-Yr Jumbo | 6.62% | + 0.02% |

7/6 SOFR ARM | 6.29% | - 0.01% |

30-Yr FHA | 5.80% | + 0.05% |

30-Yr VA | 5.82% | + 0.08% |

Average going rates as of Aug 29 2024 |

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

U.S. Economic Growth Accelerates in Q2: Key Indicators Show Resilience Amid Labor Market Cooling

The U.S. economy shows signs of steady growth despite a cooling labor market, with consumer spending driving a stronger-than-expected 3.0% GDP increase in Q2. Corporate profits have rebounded, supporting business investment and quelling recession fears. While the labor market softens, re-employment opportunities are becoming scarcer, reflecting cautious optimism in the economic outlook. The Federal Reserve is expected to start cutting interest rates, but a 50 basis point reduction remains unlikely as inflation moderates and consumer confidence stabilizes.

Key Indicators:

Consumer Confidence: Strong consumer spending continues to drive economic growth, with GDP up 3.0% in Q2, highlighting resilient consumer confidence despite rising costs.

Business Investment: Corporate profits surged in Q2, supporting business investment and reducing the likelihood of significant layoffs, helping maintain economic stability.

Stock Market Trends: Major stock indices experienced mixed performance as markets react to economic data and corporate earnings, with the S&P 500 and Nasdaq 100 slightly down ahead of key reports.

Labor Market: Initial jobless claims fell slightly, signaling a cautious slowdown in hiring, while re-employment opportunities decline, indicating a more competitive job market.

🎢 Impact on Real Estate

Home Buyers Must Meet $80,000 to Afford U.S. Starter Home

Middle-Income Squeeze: The annual income required to afford a median-priced starter home has surged to $79,252, up 4.4% year-over-year, making homeownership increasingly out of reach for families earning below the median U.S. income.

California's Affordability Gap: In Los Angeles and Anaheim, families need to earn over $184,000—double the local median income—to afford a starter home, highlighting the severe affordability crisis in California's largest metros.

Rising Demand, Limited Supply: Despite a 20% increase in starter home listings nationwide, fierce competition has driven pending sales up 10% year-over-year, pushing prices to a record high of $250,000 in July 2024.

🎙️ RE Spotlight

SINK (Single Income No Kids) Women Are Buying Homes in Droves

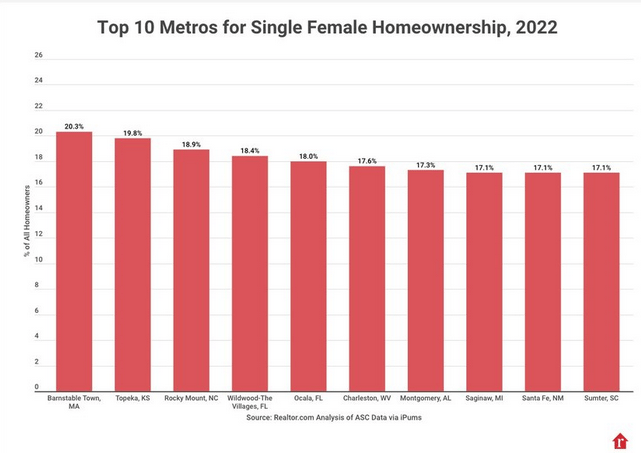

Rising Trend: Single Income, No Kids (SINKs) are increasingly becoming a significant demographic in the real estate market, with single women accounting for 19% of all home buyers in 2023, according to the National Association of Realtors.

Key Markets: SINK homeowners often gravitate towards smaller, more affordable markets; in 2022, 8 of the top 10 metros for single female homeownership had lower median home prices than the national average, including Barnstable Town, MA, and Topeka, KS.

Unique Challenges: While SINKs enjoy the freedom of solo decision-making, they face challenges such as ensuring affordability on a single income and managing home maintenance without a support system. Despite these hurdles, many SINKs, like Kristi Eaton in Tulsa, OK, are thrilled with their decision to buy solo.

🤷♀️ Home Insurance Hike

Allstate's 34% Premium Hike Amid California's Homeowners Insurance Crisis

Significant Rate Hike: Allstate, California's sixth-largest homeowners insurer, has received approval to increase premiums by an average of 34% starting in November 2024, impacting over 350,000 policyholders. This is the largest insurance rate increase in the state this year, surpassing a pending 30% increase from State Farm.

Crisis Context: The rate hike is part of a broader insurance crisis in California, driven by rising home values, increased repair costs, and more severe weather conditions. Many insurers, including Allstate, have reduced their presence in the market, citing the growing severity of wildfires and associated risks.

Consumer Impact: The rate increase includes discounts for homeowners who mitigate wildfire risks on their properties. However, with ongoing market instability, Insurance Commissioner Ricardo Lara is working on executive actions to stabilize the market, which may influence future insurance availability and pricing in California.

🏰 RE State Zone

Florida's Affordable Housing Crisis: Rising Costs, Migration, and Innovative Solutions.

Severe Affordability Gap: Florida has only 25 affordable rental homes available per 100 extremely low-income renters, with 82% of these renters being severely cost-burdened, the second highest in the nation .

Skyrocketing Home Prices: In May 2024, Florida home prices rose by 3.1% year-over-year, with cities like Sarasota and Orlando seeing increases of 9.4% and 8.5%, respectively .

Rising Insurance Costs: Hurricane Ian's $112 billion damages in 2022 exacerbated insurance costs, forcing affordable housing operators to pay higher deductibles and self-insure properties, impacting affordability .

🏕️ Niche-RE Trend

Luxury Hotel Residences: Ultimate Blend of Opulent Living and Long-Term Convenience

Global Surge in Luxury Living: Luxury hotel residences are becoming a global phenomenon, offering opulent living spaces in prime locations like New York, Miami, and Bali, catering to the affluent who seek both exclusivity and convenience.

Rising Demand for Permanent Luxury: As of 2024, there has been a 20% increase in demand for luxury hotel-branded residences, driven by wealthy individuals who desire the five-star hotel experience as a permanent lifestyle.

Exclusive Amenities and Services: Residents enjoy bespoke services such as 24/7 concierge, private pools, and access to world-renowned restaurants, transforming the concept of luxury living by blurring the lines between vacation and home.

👾 Prop Tech vs Justice

DOJ Sues RealPage: Antitrust Violations in Rental Pricing Algorithm Exposed

DOJ Antitrust Lawsuit: The U.S. Justice Department, alongside Attorneys General from eight states, has filed an antitrust lawsuit against RealPage Inc., accusing it of using its pricing algorithm to unlawfully coordinate rental prices among competing landlords, violating Sections 1 and 2 of the Sherman Act.

Market Impact: RealPage holds approximately 80% market share in commercial revenue management software, with its alleged practices leading to increased rental prices and reduced competition in the multifamily housing market, negatively impacting millions of renters across the U.S.

Legal and Ethical Concerns: The lawsuit highlights internal RealPage communications that reveal the company's intention to maximize rent prices and avoid market competition, actions that the DOJ claims are detrimental to fair pricing and consumer welfare.

🖼️ Chart-Tastic

Number of new house sales in United States from 2000 to 2023 by financing.

Statista

🤪 Fun for the Road

Real estate is serious business, but that doesn’t mean we can’t have some fun along the way! Let’s celebrate the wins and enjoy a little humor!

Here is One - What did the real estate agent say to the house after a bad day? "You need to lighten up, you're bringing down the whole neighborhood!"

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.