Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - I explore the latest in Cyber Monday shopping trends, breaking records with a 7.3% spending surge. Plus, we delve into real estate dynamics as mortgage activity climbs, and top metros show significant growth. Discover insights into luxury markets in Washington D.C., where the return of high-profile buyers is creating a buzz. As rental markets cool, we forecast a shift in affordability for 2025.

Quote of the day - "The real estate market’s shifting landscape reminds us that opportunity lies in the unknown, and success comes to those who adapt to change."

Stay ahead with key insights and market movements!

If you missed yesterday’s newsletter, click here

Coming soon: A 2-part in-depth series on the “U.S. Credit Report, exploring the impact of mortgages, personal loans, and auto loans”. Mark your calendars for December 8th and 15th!

Rates & REITS

30-Yr Fixed RM | 6.85% | - 0.01% |

15-Yr Fixed RM | 6.05% | - 0.01% |

30-Yr Jumbo | 7.02% | - 0.02% |

7/6 SOFR ARM | 6.75% | - 0.04% |

30-Yr FHA | 6.18% | - 0.02% |

30-Yr VA | 6.20% | - 0.01% |

Average going rates as of Dec 3 2024

S&P 500 | 6,049.88 | + 0.05% |

Crude Oil | 69.98 | + 2.76% |

Bitcoin USD | 96.044.77 | + 0.50% |

Numbers as of Dec 3 2024 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Cyber Monday Hits $13.3 Billion in Sales: A 7.3% Surge

Spending Soars + Mobile Shopping Dominates

Consumers shattered expectations, spending $13.3B (+7.3% YoY). Mobile shopping took the lead, driving 57% of sales with $7.6B.

🧸 Top-Selling Categories:

Toys: +680%

Appliances: +464%

Electronics: +452%

AI and Influencers: The Game Changers

Generative AI chatbots surged 1,950% in traffic, while influencers converted shoppers at 6x the rate of general social media, accounting for 20.3% of revenue.

S&P 500 will hit 6,666 in 2025 with large-cap value stocks leading the way: BofA

🎢 Impact on Real Estate

Top 10 U.S. Metros with Purchase Mortgage Originations on the Rise

Mortgage Activity Climbs Amid Diverse Lending Trends

Q3 2024 mortgage originations hit $550 billion, up 2.9% QoQ and 6.6% YoY, driven by 6.9% growth in refinancing and 2.3% rise in home-equity loans. However, purchase loans dipped 1.7%.

Metro Markets Show Dynamic Growth

Lending surged in 60.4% of metros with data, including Anchorage, AK (+78.6%) and Yuma, AZ (+33.3%). Trenton, NJ saw a notable +20.5% increase in lending activity.

Top 10 Metros Leading Purchase Mortgage Growth

Urban Honolulu, HI led the way with an 82.1% yearly increase, reaching 3,130 loans in Q3 2024. Orlando-Kissimmee-Sanford, FL followed at +49.3%, with 8,266 loans issued.

🎙️ RE Spotlight

Through October 2024 With Forecasts Through October 2025

Current month-over-month and year-over year U.S. home price growth and projections through October 2025

Forecast indicates that home prices will drop by -0.03% from October 2024 to November 2024 and increase by 2.4% on a year-over-year basis from October 2024 to October 2025.

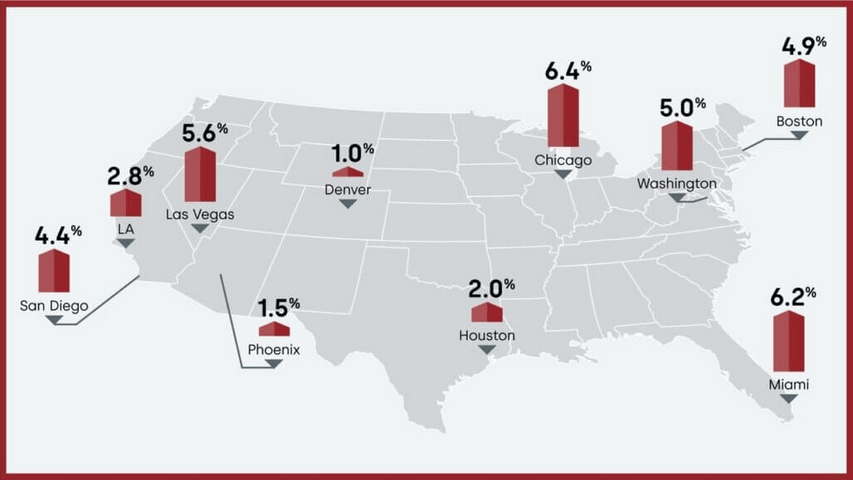

Year-over-year home price changes by select metro areas

Below is a look at home price changes in 10 select large U.S. metros in August, with Chicago posting the highest gain at 6.4% year over year.

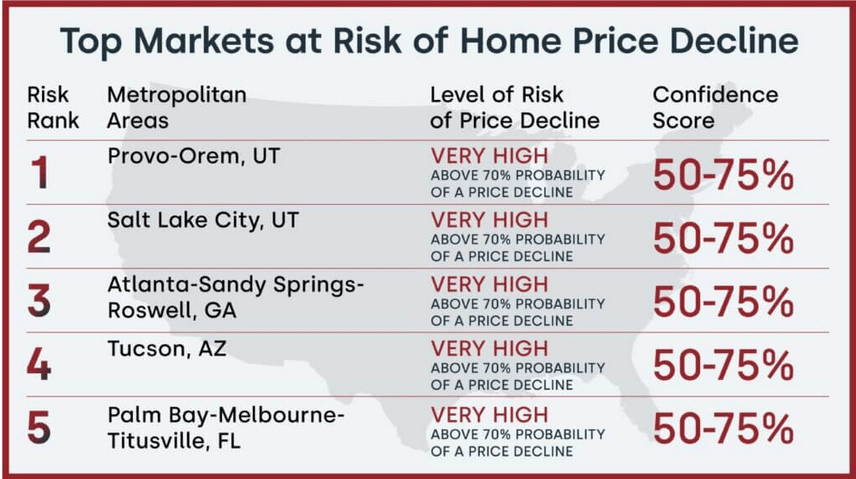

Top five U.S. markets at risk of annual price declines

Markets to Watch: Top Markets at Risk of Home Price Decline

🏰 RE State Zone

DC's High-End Real Estate Braces for Trump-Era Resurgence

As Donald Trump prepares to return to the White House, Washington, D.C.’s luxury real estate market is poised for a revival, with elite neighborhoods like Kalorama and Massachusetts Heights attracting high-profile buyers.

1. Luxury Surge in 2024

Wealthy Buyers Incoming: Power players, including multimillionaires and billionaires, are expected to flood the market, seeking properties priced between $5 million to $15 million.

Kalorama Dominance: Known for its palatial estates, Kalorama is the top choice for Trump’s circle, with previous buyers like Wilbur Ross ($12M) and Steve Mnuchin ($12.58M).

2. Broader Market Impacts

Layoff Concerns: Planned federal workforce cuts could destabilize the middle and upper-middle-class housing market, driving potential sell-offs.

Georgetown Exclusion: Despite its charm, Georgetown’s liberal reputation and older homes make it less appealing for Trump’s team.

3. Speculation vs. Investment

Skepticism Remains: Some brokers doubt deep investment in the capital, citing Trump’s and allies’ ties to Florida and New York. Even Elon Musk, a close ally, is unlikely to make a splash, as he prefers minimal real estate.

Luxury brokers anticipate a fast-paced start to 2024, but mixed signals from federal plans and buyer intentions keep D.C.’s market outlook cautiously optimistic.

🏕️ Niche-RE

December 2024 National Rent Report Highlights

1. Seasonal Dips and Year-Over-Year Trends

Monthly Drop: National median rent fell by 0.8% in November, reaching $1,382.

Annual Change: Rents are down 0.6% year-over-year, marking nearly 18 months of negative annual rent growth.

Supply and Demand Dynamics: A record-high vacancy rate of 6.8% is being driven by the largest apartment supply surge in 50 years, with over 800,000 units still under construction.

2. Regional Variations

Declining Rents in the Sun Belt: Cities like Austin (-6.9%), Raleigh (-4.1%), and Jacksonville (-3.5%) are experiencing the steepest annual rent declines, influenced by rapid multifamily development.

Modest Growth Elsewhere: Midwest and Northeast cities, including Hartford and Cleveland, report small but positive annual rent growth, primarily due to limited new supply.

Largest Monthly Rent Drops: November saw rents fall in 88 of the 100 largest cities, signaling widespread seasonal declines.

3. Broader Economic Impact

Impact on Inflation: Rent inflation continues to ease, with the shelter component of CPI declining. This cooling trend influenced the Federal Reserve’s decision to cut interest rates in September 2024, with further cuts anticipated.

Market Outlook: With new supply outpacing demand, rents are likely to remain soft into 2025, particularly in overbuilt regions like the Sun Belt.

This report underscores the rental market’s ongoing transition, shaped by a supply boom and shifting demand patterns, signaling a potential affordability recalibration for renters across the U.S.

🖼️ Chart-Tastic

🌍 Dwelling of the Day

Modern Masterpiece | $40M

7 Beds | 9 Baths | 12,586 sqft

This architectural gem in Sea Island, GA, is the epitome of luxury living.

💬 What’s Your Take?

Is this home accurately priced in today’s market?

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.