Where real property meets real data, every day

🗞️ In This Edition

Rise of $1 Dollar starter homes

Sellers Q2 profit margins hold steady

iBuyers effect on racial bias

Buyer’s hesitate despite falling rates

Plus: Functional and Attractive Home Decor Is Doable?

📈 Market Numbers

S&P 500 | 5,399.22 | - 0.51% |

Dow 30 | 39,935.07 | + 0.20% |

Bitcoin USD | 65,707.60 | + 0.56% |

S&P REIT | 343.26 | - 0.97% |

FTSE NAREIT | 758.54 | - 0.72% |

30-Yr Fixed RM | 6.78% | + 0.01% |

15-Yr Fixed RM | 6.07% | + 0.02% |

Numbers as of July 25th 2024 closing

New? Join our newsletter – no cost!

🤌🏻 Real Trends

The Rise of $1 Dollar Starter Homes in 237 Cities

Escalating Starter Home Prices: In over 200 U.S. cities, the typical starter home now costs $1 million or more. This significant increase from just 84 cities five years ago reflects a severe housing shortage that has driven prices to new heights across the country.

Nationwide Trends: The average starter home in the U.S. is valued at $196,611, a price that remains affordable for median-income households. However, starter home values have surged by 54.1% over the past five years, outpacing the 49.1% increase seen for the average U.S. home. This rise has contributed to the delay in first-time home purchases, with the median age of first-time buyers now at 35.

Geographic Concentration: California leads the nation with 117 cities where the typical starter home costs $1 million or more. Other states with high counts include New York (31 cities), New Jersey (21), Florida (11), and Massachusetts (11). The New York City metro area, encompassing parts of New Jersey and Pennsylvania, tops the list of metropolitan areas with 48 cities featuring million-dollar starter homes.

Market Dynamics and Future Outlook: The housing market may be approaching a more balanced state. Increased housing inventory, driven by easing rate locks and ongoing construction, is giving buyers more options and negotiating power. Record-high price cuts indicate a potential shift in favor of buyers.

🔍 Spotlight

Home Sellers Q2 Profit Margins Hold Steady Amid Price Surge

Profit Margins Steady Despite Price Surge: Home sellers enjoyed a 55.8% profit margin on typical sales in Q2 2024, a slight increase from Q1 but still below last year's figures. This steadiness came even as median home prices hit a new high of $365,000.

Regional Variations in Profit Margins: Profit margins varied widely across the U.S., with significant declines in high-value markets like Hilo, HI, and San Antonio, TX, while areas like Syracuse, NY, and Rockford, IL saw substantial increases.

Raw Profits Near Record Highs: Sellers' raw profits rose to an average of $130,712, approaching the peak levels seen in 2022. This increase was driven by a robust Spring buying season and limited housing supply.

Cash Sales and Institutional Investments: Cash sales accounted for 39.1% of all transactions, slightly down from Q1 but up from last year. Institutional investor activity also dipped, reflecting cautious investment strategies amid fluctuating market conditions.

iBuyers Effect on Racial Bias Home Appraisals in One Major City

Equalizing Home Prices: In Charlotte, NC, where iBuyers like Opendoor and Offerpad hold a significant market share, researchers found that these companies paid more equal prices to Black and white homeowners. iBuyers offered Black homeowners an average of $4,376 more than traditional buyers, reducing the racial price gap significantly.

Preference for Institutional Buyers: The study revealed that iBuyers are more likely to sell homes to institutions rather than individual buyers. This trend is troubling as institutional buyers, such as large rental companies, are often associated with higher eviction rates and rent gouging.

Detailed Data Analysis: By analyzing 50,000 property transactions from 2018 to 2023 in Mecklenburg County, researchers discovered that white-owned homes sold to private buyers for $36,051 more than Black-owned homes. When sold to iBuyers, this difference shrank to $4,436, indicating a more balanced approach by iBuyers.

Future Research Directions: The researchers plan to expand their study to other regions with significant iBuyer activity, such as Maricopa County, AZ, and Orange County, FL. They aim to understand the broader impact of iBuyers on the housing market and racial equity by interviewing homeowners about their experiences with these companies.

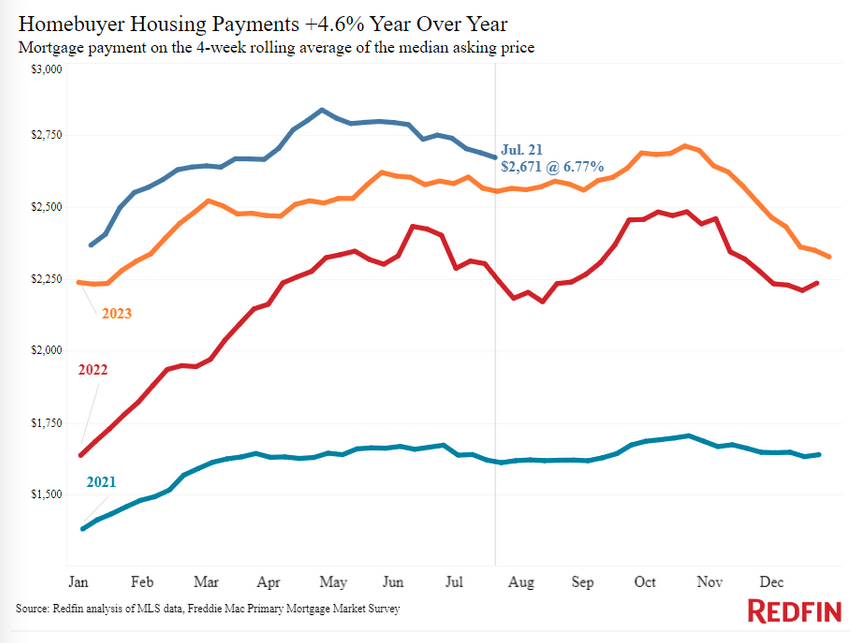

Homebuyer’s Hesitate Despite Falling Mortgage Rates in 4 Months

Declining Monthly Payments: The typical U.S. homebuyer’s monthly payment dropped to $2,671 during the four weeks ending July 21, the lowest level in four months. This decrease is driven by falling mortgage rates, with the average 30-year fixed rate declining to 6.77%, its lowest since March.

High Sale Prices: Despite lower mortgage rates, home-sale prices remain near record highs, keeping many potential buyers on the sidelines. The median sale price was $395,500, just $1,000 below the all-time high set earlier in July.

Increased Inventory: New listings have risen by 6.1% year over year, providing more options for buyers. Additionally, more homes are staying on the market longer, giving buyers better negotiation opportunities.

Political and Economic Uncertainty: Some buyers are delaying purchases due to concerns over political and economic instability. According to Redfin agents, many house hunters prefer to wait until after the upcoming presidential election, hoping for a more stable market.

Federal Land Sales Is Not the Housing Fix in Nevada

Federal Land Transfer Proposals: Recent initiatives, including the Republican Party platform and Sen. Mike Lee's HOUSES Act, aim to open federal lands for residential development. This could potentially increase housing supply in land-constrained Western states, where federal government owns up to 86.5% of some states' land area (Nevada).

Affordability Concerns: Critics argue that without specific affordability mandates, these proposals may lead to more market-rate sprawl rather than addressing the core issue of affordable housing. The Las Vegas area's experience with the Southern Nevada Public Land Management Act (SNPLMA) has led to the transfer of about 30,000 acres since 1998, but only 30 acres have been used explicitly for affordable housing.

Water Scarcity Challenge: In water-stressed regions like Las Vegas, large-scale development on former federal lands raises concerns about sustainability. Gov. Joe Lombardo's proposal for 335,000 new homes could consume an additional 43.5 billion gallons of water annually, based on current average household consumption of 130,000 gallons per year.

Balancing Act: The BLM's recent approach of selling land at below-market value specifically for affordable housing development presents a potential model for responsible public land transfer. A recent 20-acre sale in Las Vegas targets housing for those making less than 80% of the region's median income, addressing housing needs while considering environmental and resource constraints.

Not Seeing Us in Your Inbox? Check your spam folder and mark us as 'not spam' to ensure you receive our latest real estate updates and opportunities.

🛠️ Toolkit

Functional and Attractive Home Decor Is Doable: Here's How

Embrace Multi-Functional Furniture: Invest in pieces that serve multiple purposes, such as a sofa bed, a storage ottoman, or a dining table with extendable leaves. These items save space and add versatility to your home.

Utilize Vertical Space: Make use of your walls by adding shelves, hooks, and cabinets. Vertical storage helps keep your floors clear, making your home look more spacious and organized.

Choose Dual-Purpose Decor: Look for decor items that are both beautiful and functional. For instance, decorative baskets can be used for storage, and stylish trays can organize and display items on coffee tables or countertops.

Opt for Timeless Design: Select decor and furniture pieces with timeless appeal to ensure they stay in style and remain functional for years. Neutral colors, classic patterns, and high-quality materials can help achieve a lasting look.

Incorporate Smart Storage Solutions: Use furniture with built-in storage, such as beds with drawers underneath or coffee tables with hidden compartments. These smart solutions help maintain a clutter-free environment without sacrificing style.

Layer Your Lighting: Combine different types of lighting, including ambient, task, and accent lighting, to create a warm and inviting atmosphere. Use stylish fixtures like pendant lights, floor lamps, and wall sconces to enhance your decor while providing practical illumination.

Personalize with Accessories: Add personal touches with accessories like throw pillows, blankets, and artwork. Choose items that reflect your style and personality, and rotate them seasonally to keep your decor fresh and exciting.

📸 Dwelling’s

J. Long Custom Homes said their clients’ 6,700-square-foot luxury beach mansion on Figure Eight Island near Wilmington, North Carolina just sold for $13.9 million.

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.