where real property meets real data, every day

In This Edition

Sustainability and Climate Risk Mitigation

Don’t Wait To Invest In Rental Properties

Luxury Home Values Surpass Typical Homes

10 Housing Predictions for 2025

Regional: Phoenix is Best Market for New College Graduates

Economic: U.S. Economic Slowdown

New? Join our newsletter – no cost!

Mortgage & REITS

30-Yr Fixed RM | 6.34% | - 0.06% |

15-Yr Fixed RM | 5.88% | - 0.01% |

30-Yr FHA | 5.75% | - 0.35% |

30-Yr Jumbo | 6.61% | - 0.07% |

7/6 SOFR ARM | 5.95% | - 0.30% |

30-Yr VA | 5.79% | - 0.33% |

Average going rates as of Aug 5th 2024

S&P 500 | 5,186.33 | - 3.00% |

S&P REIT | 344.05 | - 2.84% |

FTSE NAREIT | 766.32 | - 2.95% |

Numbers as of Aug 5th 2024 closing

Key Trends

Institutional investors in commercial real estate are prioritizing sustainability and climate risk mitigation. Full Report

Sustainability and Market Demand:

Decarbonizing Portfolios: Investors are focusing on reducing their carbon footprint and adapting to climate risks due to regulatory pressures and tenant demands for sustainable spaces.

Economic Benefits: Sustainable assets command an average 7.1% premium in the U.S., enhancing marketability and providing competitive advantages.

Climate Risk Management:

Transition and Physical Risks: Addressing regulatory compliance, mitigating risks from transitioning to a low-carbon economy, and managing the physical impacts of climate change like flooding and extreme weather.

Data-Driven Decisions: Effective data management is crucial for assessing risks, guiding investments, and ensuring compliance with regulations such as the SEC’s pending climate disclosure rules.

Financing and Insurance:

Accessing Capital: Utilizing green finance opportunities, such as the Greenhouse Gas Reduction Fund, and exploring incentives like grants and tax credits to fund sustainability projects.

Insurance Strategies: Implementing risk mitigation measures to lower insurance premiums and evaluating alternative risk transfer strategies to manage rising insurance costs.

Happening Now

Why You Don’t Want To Wait To Invest In Rental Properties. Read More

Invest Now in Rental Properties: High demand from millennials and Gen Zers makes rental properties a solid investment despite high mortgage rates. RentCafe reports that Gen Zers earn more but prefer renting. The average monthly rent for single-family rentals is $1,361 (RentRedi), and real estate investing is accessible with strategies like house hacking and leveraging loans.

Maximize Your Investment: Utilize first-time buyer programs, renovate spaces for rental, and choose properties in desirable locations with good amenities. Calculate potential ROI and stay updated on market trends. Sacrifices like living in and renovating properties can lead to significant gains, as Suzanne Moore’s experience shows. Investing now can build long-term wealth and financial security. more stats inside

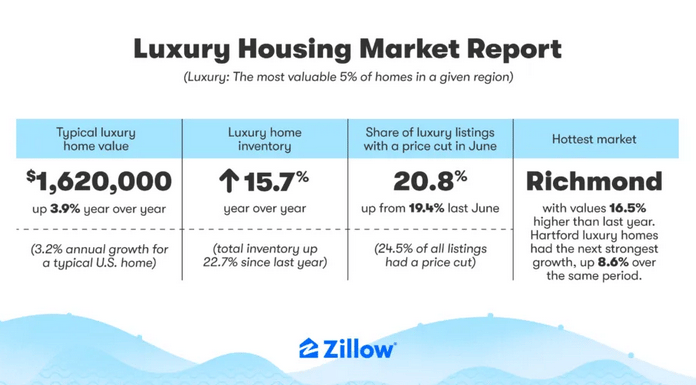

Luxury Home Values Surpass Typical Homes: For five consecutive months, luxury home values have outpaced typical home values. Defined as the top 5% most valuable homes in a region, luxury homes saw a 3.9% annual growth, compared to 3.2% for typical homes. Since January 2024, luxury homes have consistently grown faster. Higher mortgage rates affect luxury buyers less, with many able to pay cash.

Inventory and Market Trends: Luxury home inventory is up 15.7% year over year but remains 46.9% below pre-pandemic levels. In June, 20.8% of luxury listings had price cuts, compared to 24.5% for all homes. The typical luxury home value nationwide is about $1,620,000. Richmond leads with a 16.5% annual increase in luxury home values, while Austin saw a 1.5% decline.

Regional Zone - Phoenix, Arizona

Phoenix is Named the Best Market for New College Graduates. Link to Best Market

Phoenix has established itself as a thriving hub for the class of 2024, offering abundant job opportunities and a sizable population of similarly aged individuals. Phoenix claimed a top spot primarily due to its booming job market, ranking as the second-strongest among the markets analyzed by Zillow.

Phoenix also ranked in the top 10 for the share of rental listings on Zillow that offer concessions, such as a free month of rent or free parking (50.5%). Those factors helped Phoenix overcome only middling affordability. A new grad can anticipate spending about 34.5% of their starting salary on a typical rental, which ranks outside of the top 60.

Special Topic

10 Early Housing Market Predictions for 2025, By Expert Realtors

Stabilization and Modest Growth: Experts predict the real estate market will stabilize by 2025 with slower, sustainable price growth. Nationally, prices are expected to remain flat or increase modestly, following a 50% rise over the past five years.

Mortgage Rates and Affordability: Mortgage rates are anticipated to stabilize or slightly decrease, remaining in the mid to high single digits. However, affordability challenges will persist due to high home prices and living costs. Housing inventory will stay tight, but new housing starts are expected to help alleviate the supply shortage. The rental market will remain strong, with potential for mildly lower average rents due to higher supply.

Generational Shifts and Technology: Millennials and Gen Z will drive demand for walkable neighborhoods and smaller homes, while baby boomers downsizing could increase inventory. Technological advancements, such as AI-powered tools and virtual tours, will enhance efficiency and transparency in real estate transactions.

Inflation and Market Resilience: While inflation may decrease gradually, impacting mortgage affordability, the market will face tests from ongoing affordability concerns and inventory constraints. Nonetheless, innovations and generational shifts promise to reshape the industry, leading to a more balanced market with better affordability.

Economic Indicator - U.S. Economic Slowdown

The service sector rebounded in July, with the ISM services index rising to 51.4% from June's 48.8%, signaling economic expansion.

Significant improvements were observed in new orders, production, and employment, with the respective indices rising to 52.4%, 54.5%, and 51.1%. Continue Reading

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.