Good morning, Dwellers! Welcome to another edition of Dwellings Digest, a realtor and investor driven newsletter simplifying real estate, exploring the economy-stock-real estate link, adding a fun twist with niche topics and more. Enjoy!

In today’s edition - Clemson University fuels South Carolina’s economy with a $6.4B impact, while the U.S. housing market sees rising inventory and slowing sales. Mortgage rates dip but remain near 7%, keeping affordability a challenge. New Jersey’s housing inventory jumps 53%, giving buyers more options. AI regulation in real estate is under debate, shaping the future of property valuations and lending. Meanwhile, luxury co-ownership in Los Cabos is reshaping vacation home investments. Stay ahead with key real estate trends, policy updates, and market insights.

🔹 More inventory, shifting regulations—how will real estate evolve in 2025?

If you missed yesterday’s newsletter, click here

Rates & REITS

30-Yr Fixed RM | 7.03% | + 0.03% |

15-Yr Fixed RM | 6.42% | + 0.05% |

30-Yr Jumbo | 7.31% | + 0.01% |

7/6 SOFR ARM | 6.81% | + 0.06% |

30-Yr FHA | 6.39% | + 0.01% |

30-Yr VA | 6.41% | + 0.01% |

Average going rates as of Feb 7 2025

S&P 500 | 6,025.99 | - 0.95% |

Dow 30 | 44,303.40 | - 0.99% |

Gold | 2,886.10 | - 0.05% |

Numbers as of Feb 7 2025 closing

New? Join our newsletter – no cost!

🏛️ Economic & Market Sentiment

Clemson University Spurs $6.4 Billion Economic Boom in South Carolina, Fuels Innovation & Job Growth

Economic Engine: Clemson University drives a statewide economic impact of $6.4 billion in South Carolina—generating $35 in output for every dollar invested, supporting 37,100 jobs, and contributing $114.4 million in annual state tax revenue.

Innovation Leader: With over $334 million in research and development expenditures for FY ending June 30, 2024, Clemson has doubled its research activity since 2013—resulting in 79 new patent applications, 218 invention disclosures, and the formation of 10 startup businesses.

Alumni Impact: A strong talent pipeline is evident as 58% of Clemson alumni remain in the state, with 97% finding employment or pursuing further education within six months of graduation, and median 10-year earnings reaching around $72,000, outperforming many peer institutions.

“Since Clemson’s doors opened in 1889, our University has strived to provide high-quality education and impactful research to the citizens of the state of South Carolina, and our land-grant mission also drives us to improve the lives and economic prosperity of our state. Through our combined efforts in all 46 counties across the state, Clemson is elevating South Carolina to new heights.”

President Jim Clements

🎢 Impact on Real Estate

Weekly Housing Market Update: Big Moves in Texas and Hope for Homeowners

Mortgage Rates Dip, But Affordability Remains a Hurdle: Despite falling for a third straight week, mortgage rates still hover near 7%, limiting affordability for many buyers. Lower 10-year Treasury yields signal potential relief ahead, but high borrowing costs continue to price out first-time buyers and move-up buyers alike.

Homeownership Slips for Younger Buyers Due to Market Pressures: The homeownership rate for those under 35 has dropped to pre-pandemic levels, even as overall rates remain high. Decade-long housing shortages, record-high prices, and stagnant wage growth relative to home costs are creating a tough environment for first-time buyers.

Texas Leads in Housing & Economic Growth Amid Affordability Crisis: Realtor.com’s move to Austin highlights Texas’ economic strength, with affordable housing, a strong job market, and a business-friendly climate drawing companies and residents alike. Texas accounted for 15% of all U.S. housing permits in 2024, proving that states prioritizing housing development are better positioned to attract new homebuyers and businesses.

🎙️ RE Spotlight

The Top 10 Metros With the Largest Home Price Increases

Home Prices Climbing Nationwide: 89% of U.S. metros saw home price increases in Q4 2024, with the national median single-family home price rising 4.8% YoY to $410,000—a 50% jump since 2019.

Midwest & South Lead Price Growth: Affordable metros saw the sharpest spikes, with Jackson, MS (+28.7%), Peoria, IL (+19.6%), and Chattanooga, TN (+18.2%) leading the charge due to low inventory and high demand.

Affordability Pressures Persist: While mortgage payments dropped slightly (-1.7%), high prices and 7% mortgage rates continue to challenge buyers, though 11% of U.S. metros saw price declines, offering some relief.

Overall Housing Sentiment Ticks Higher Despite Consumers’ Growing Affordability Concerns

Homebuyer Sentiment Rises Slightly, But Affordability Remains a Challenge:

The Fannie Mae Home Purchase Sentiment Index (HPSI) rose to 73.4 in January, up 2.7 points year-over-year. However, 78% of consumers still believe it’s a bad time to buy a home, signaling continued affordability concerns despite a marginal rise in optimism.More Consumers Expect Home & Rent Prices to Increase:

43% of respondents predict home prices will rise in the next 12 months, while 65% expect higher rents. This aligns with market forecasts, which anticipate 2-2.5% rent growth in 2025, further straining affordability for renters and potential buyers alike.Mortgage Rate Optimism Fades as Market Adjusts Expectations:

The share of consumers expecting mortgage rates to drop in the next 12 months fell 13 percentage points to 35%, while 32% now expect rates to rise. With rates still near 7%, homebuyers face continued affordability hurdles, and expectations of only modest rate declines in 2025 (to around 6.5%) suggest little near-term relief.

🏰 RE State Zone

NJ housing inventory spiked by 53% from the end of 2024.

Surge in New Listings: New Jersey saw 6,444 new home listings in January, marking a 52.99% increase from December 2024 and a 5.85% rise year-over-year. Every county experienced gains in new listings from December, with Morris County leading North Jersey at 21.26% YoY growth.

Price & Market Activity Trends: The statewide median listing price hit $535,000, reflecting a 1.91% annual increase but a slight 1.37% dip from December. Homes spent an average of 58 days on the market, up 2.68% YoY, indicating a slight cooling trend despite rising inventory.

Regional Housing Performance: In North Jersey, Bergen County’s median listing price remained stable at $785,250, while Essex saw the largest price jump at 11.67% YoY. Passaic homes sold 21.53% faster than last year, signaling strong buyer demand in the region.

Market Outlook: With rising inventory and stabilizing prices, New Jersey’s housing market is becoming more competitive for buyers, while sellers may need to adjust pricing strategies to attract offers.

🏕️ Niche-RE

Will Congress Regulate AI’s Rapid Growth in Real Estate?

AI Regulation Under the Trump Administration: Expect a deregulation and innovation-first approach, with potential rollbacks of Biden-era AI policies. Industry engagement will be key, as agencies will likely seek input before setting new rules.

AI in Property & Mortgage Markets: AI is already optimizing underwriting and risk assessment, but bias concerns remain a major focus. If properly leveraged, AI could increase mortgage fairness, but unchecked algorithms could exacerbate disparities.

Who Regulates AI?: There likely won’t be a single AI oversight body. Instead, individual agencies will shape AI rules tailored to their industries—financial services, housing, military, and healthcare all taking different regulatory approaches.

The Future of AI & Housing Policy: With AI playing a growing role in climate risk assessment, fraud detection, and property valuations, regulations could emerge around data privacy, demographic fairness, and model transparency.

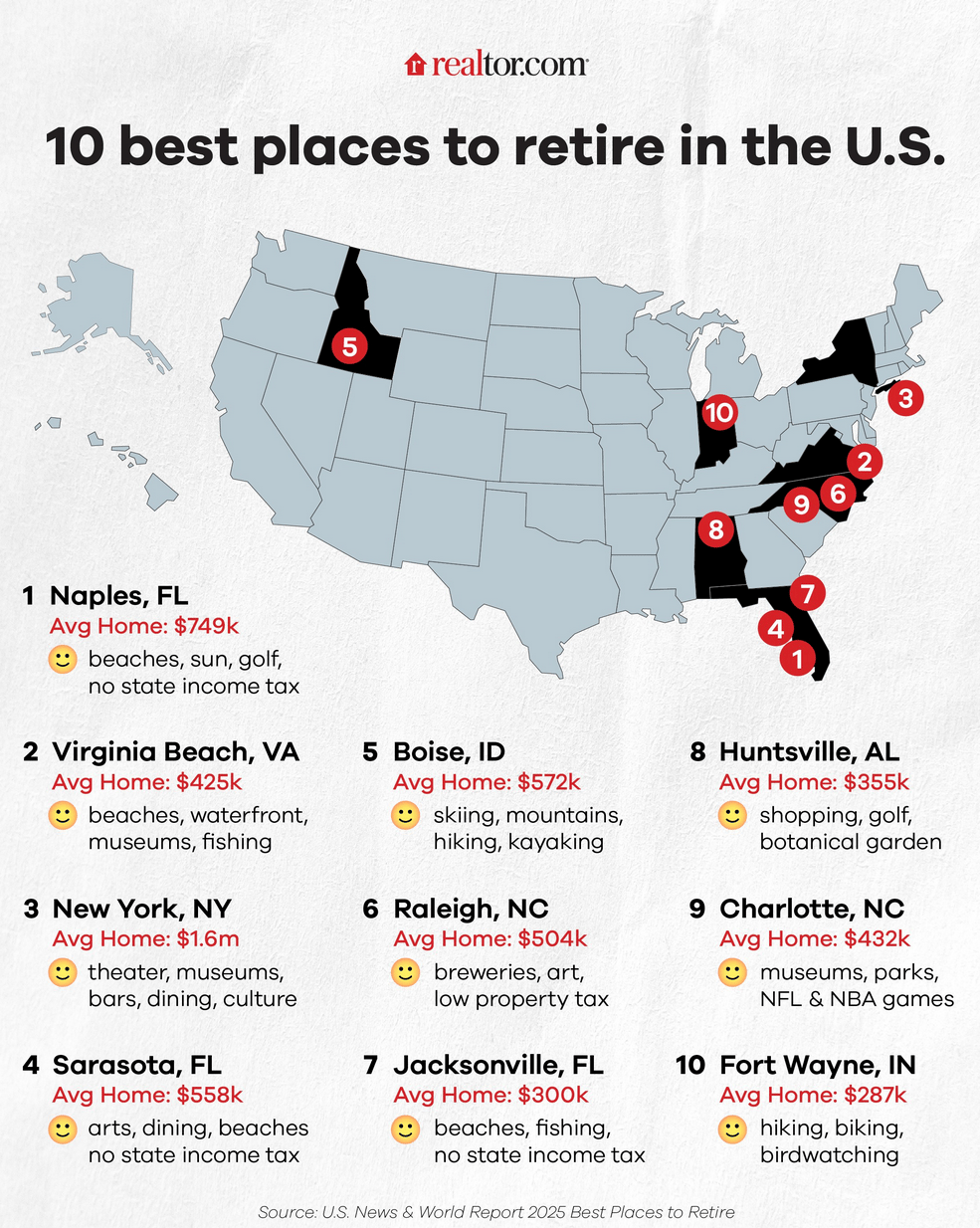

🖼️ Chart-Tastic

👾 Interesting in Social

🌍 Dwelling of the Day

Bugatti, The #1 Brand For Exotics. 3.5 Acres Estate Is The Bugatti Of Luxury Real Estate For The Ultimate Car Enthusiast. Built 2023, 35,000 Total Sqft, 19,000 Sqft Living Space. 6 Bedrooms 11 Baths 16,500 Sq Ft Luxury 95+Car Indoor Car Salon, Glass Elevator To Underground Garage. 5000 Sq Ft Hobby Workshop. Glass Elevator, Wine Room.

Asking C$14,399,000, 4490 Henderson Rd, Milton, Ontario L9E 0K1

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.