where real property meets real data, every day

Mortgage & REITS

30-Yr Fixed RM | 6.54% | - 0.09% |

15-Yr Fixed RM | 6.07% | - 0.08% |

30-Yr FHA | 6.09% | - 0.08% |

30-Yr Jumbo | 6.73% | - 0.02% |

7/6 SOFR ARM | 6.39% | - 0.09% |

30-Yr VA | 6.10% | - 0.10% |

Average going rates as of Aug 9th 2024

S&P 500 | 5,344.16 | + 0.47% |

S&P REIT | 356.47 | + 0.66% |

FTSE NAREIT | 787.82 | + 0.45% |

Numbers as of Aug 9th 2024 closing

New? Join our newsletter – no cost!

Economic Rundown

Customers Didn’t Stop Spending. Companies Stopped Serving

Consumers are shifting their spending patterns, with a 13% drop in Airbnb bookings and declining McDonald's sales signaling a move towards quality experiences. Meanwhile, Chipotle's sales have risen by 11%, highlighting the importance of value in today's economy.

Dining trends are changing as Texas Roadhouse sees a 14% increase in foot traffic, contrasting with declining fast-food sales. This shift in consumer behavior reflects broader economic changes.

Airbnb and Disney are struggling, with Airbnb's stock down over 13% and Disney's theme parks reporting unexpected weaknesses. In contrast, traditional hotels like Marriott are thriving, as consumer priorities shift in the travel and hospitality sectors.

Real Trends

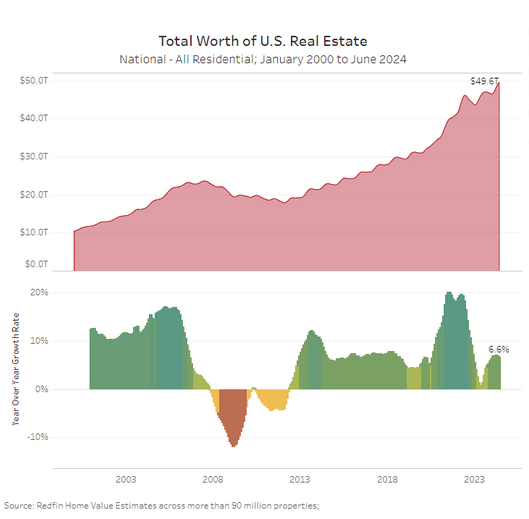

U.S. Housing Market Nears $50 Trillion in Value, Metros Doubles

Trillion-Dollar Metros Expand: The number of U.S. metro areas with over $1 trillion in total home value has doubled to eight in the past year, with Anaheim, Chicago, Phoenix, and Washington, DC joining the list.

Generational Shifts in Home Value: Millennials saw a significant 21.5% increase in the total value of homes they own, reaching $8.6 trillion, while the Silent Generation's home value decreased for the fifth consecutive quarter.

Rural and Asian Neighborhood Growth: Rural home values grew the fastest, increasing by 7% year-over-year, and majority Asian neighborhoods saw the largest spike in total home value, rising 9% to $1.4 trillion.

Asian neighborhoods experience largest increase in home value, Read More

Spotlight

Navigating Inflation As A Multifamily Real Estate Investor by Michael H. Zaransky

While overall inflation has moderated since its peak in June 2022, the shelter index remains stubbornly high, with a 5.2% increase year-over-year as of June 2023, contributing nearly 70% of the core inflation rise. This divergence highlights the ongoing pressure on housing costs, even as other sectors see relief.

Multifamily housing has proven to be a strong inflation hedge, with rents outpacing inflation by 40% from 1985 to 2001. The trend continues as rental demand rises due to high mortgage rates, driving up property values and rental income, making it a robust long-term investment.

Multifamily operators can navigate inflation by focusing on value-add strategies such as upgrading properties to meet premium demands. Despite rising costs for materials and insurance, maintaining high occupancy rates (over 94% as of May 2024) through strategic investments can bolster income and offset inflationary pressures.

“Michael found higher inflation and interest rates work in favor of multifamily” here’s why

Vacasa Lost 9% of Its Vacation Rentals in the Last Year

Vacasa's portfolio shrank by 9% year-over-year, managing 4,000 fewer homes as dissatisfaction with rates and communication pressures the company. This has contributed to a 37% drop in Vacasa's share price, highlighting significant challenges in the domestic vacation rental market.

Despite Vacasa's gross bookings per home outperforming industry averages, overall gross bookings fell 19% to $505 million in the second quarter, signaling ongoing difficulties. The company's revenue also dropped by 18% to $249 million, and its net loss widened to $13 million.

In response to declining performance, Vacasa has reorganized to enhance local decision-making and address owner concerns. The company secured $30 million in convertible notes and is exploring additional financing options, as it prepares for a challenging year with no expected profitability in 2024.

“These ongoing trends are continuing to put real pressure on our business” CEO

Best City in Every State To Get a Vacation Home for Under $300,000

Using numbers ("40 Surprising Cities", "Under $300K") to create specificity and set expectations.

Incorporating high-value keywords like "vacation home", "passive income", and "affordable" to improve search relevance.

Addressing key reader motivations: finding good deals ("Hidden Gems"), financial benefits ("Boost Your Wealth"), and lifestyle improvement ("Escape the Ordinary").

Creating a sense of discovery and exclusivity ("Surprising Cities", "Hidden Gems") to pique curiosity.

Highlighting multiple benefits (affordability, income potential, tax benefits, charming locations) to appeal to various reader interests.

Using action-oriented language ("Unlock", "Boost", "Discover", "Find") to encourage engagement.

State Zone

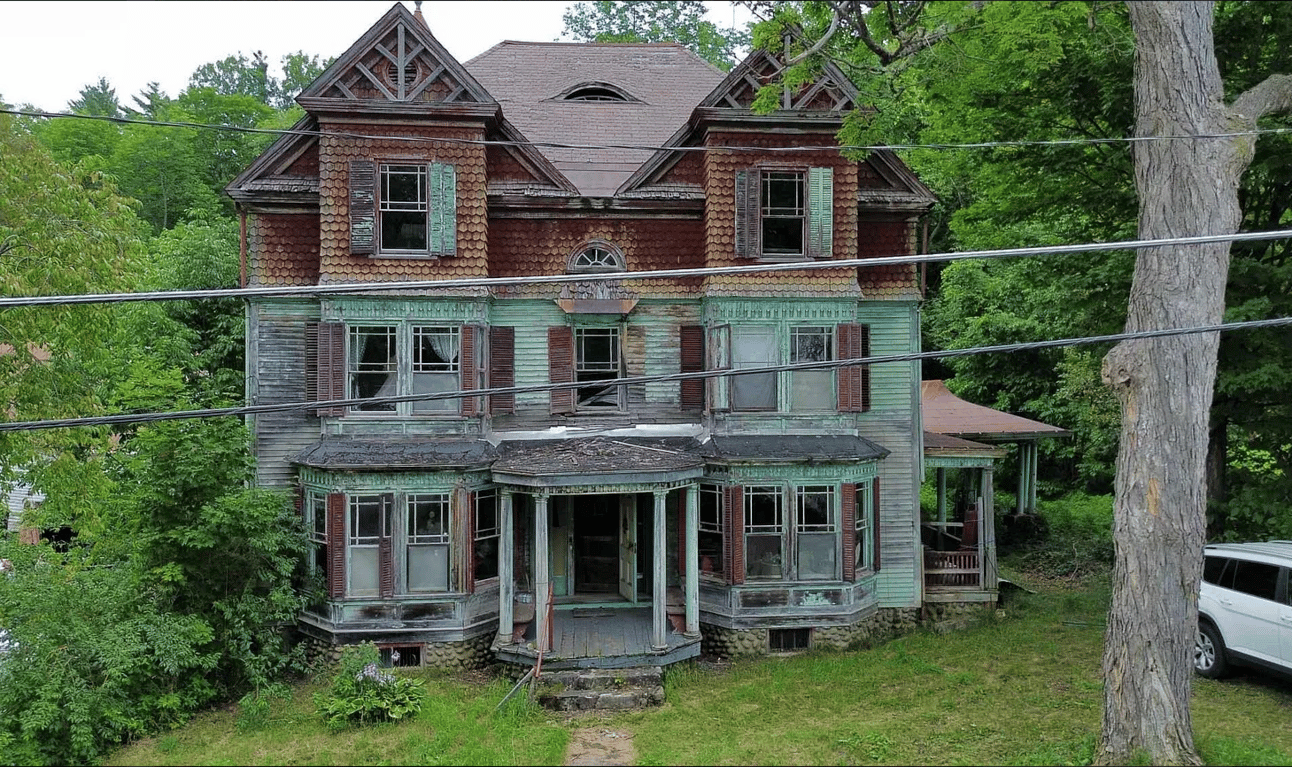

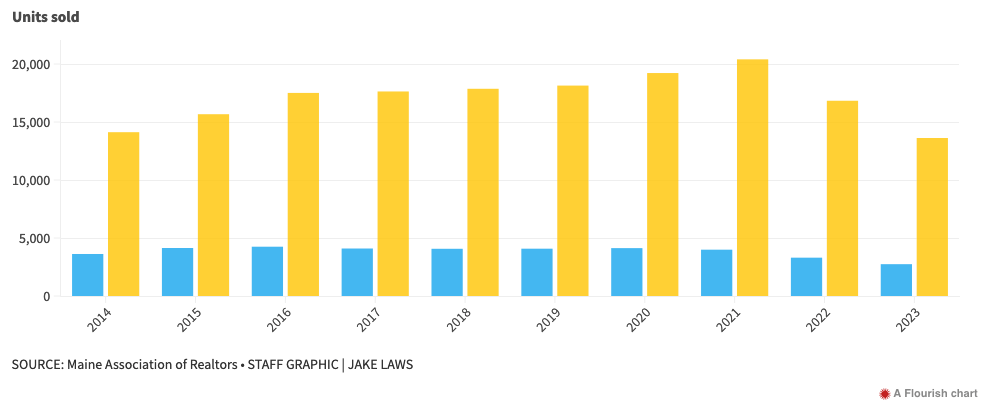

Maine Homeownership Out of Reach for an Entire Generation

Understanding the Surge in Home Prices

The housing market in Maine has seen an alarming increase, with home prices in Cumberland County rising by 63% in just five years, reaching a median of $531,000. This surge is a direct result of limited supply and high demand, making homeownership increasingly unattainable for many residents.NIMBY's Role in Maine's Housing Shortage

Local opposition to housing developments, known as NIMBY, has become a significant barrier to solving Maine’s housing crisis. Numerous projects across the state have been blocked, exacerbating a shortage of over 80,000 homes and leaving many families without affordable housing options.Addressing the Housing Shortage

Maine is at a critical juncture with the potential to add thousands of new housing units through legislation like L.D. 2003. However, resistance to change could deepen the housing crisis, forcing more working-class residents to leave the state in search of affordable living.

“The city caved to public pressure” Developer Loni Graiver Said.

More Stories

Alta North Central apartments in Phoenix sells for $79 million

10 Best Real Estate and Realty Stocks To Buy According to Hedge Funds

Chart-Tastic

Down 79%, This Growth Stock Could Double in the Housing Rebound

Dwelling’s in Market

And…that's a wrap on this edition!

Got questions or feedback? write to us [email protected] - we'd love to hear from you.